It is certain that with the expansion of stablecoins and cryptocurrencies, crypto payments are no longer a dream.

Author: Pink Brains

Compiled by: Deep Tide TechFlow

Cryptocurrency cards have evolved from simple cashback tools to comprehensive new banking services. The best crypto cards now allow you to earn yields, borrow against your assets, and spend directly from DeFi (decentralized finance) without relying on centralized intermediaries. However, different crypto cards vary greatly in user experience.

Here is a comparison list of the top crypto cards and new banks for 2025 based on custody models, usability, reward mechanisms, and real-world practicality.

1. EtherFi Card

EtherFi's Cash Card is redefining the standards for crypto cards. Instead of selling your ETH (Ethereum), it allows you to borrow stablecoins against your ETH collateral for spending—meaning your assets can still earn yields while being used. This card is completely non-custodial, directly integrating with your DeFi wallet, and supports Apple Pay and Google Pay.

The EtherFi Cash Card is divided into different tiers based on user loyalty levels:

Core Tier: Suitable for everyday users. Users receive 1 free physical card and 3 virtual cards, with an annual fee of 0.01 ETH and a daily spending limit of $20,000.

Luxe Tier: Suitable for users needing more cards and higher spending limits. Users receive 2 free physical cards and 10 virtual cards, with an annual fee of 0.1 ETH and a daily spending limit of $150,000.

Pinnacle Tier: Targeted at crypto industry users, with an additional opportunity for a free conference participation once a year. Users receive 5 free physical cards and unlimited virtual cards, with an annual fee of 1 ETH and a daily spending limit of $1,000,000.

VIP Tier: Invitation-only, with most benefits similar to Pinnacle, but includes investment opportunities with Ether.fi Ventures.

Since its launch just four months ago, EtherFi Cash has processed over 1 million transactions, totaling $82.6 million, with an average transaction amount of $82.60.

Advantages:

Borrowing against ETH for spending without selling assets

Up to 3% cashback (promotional cashback can occasionally reach 20%)

Foreign exchange fees around 1%, low travel costs

Integrated UltraYield stablecoin yield vault for earnings

Non-custodial model, directly connects to your DeFi wallet

Disadvantages:

Limited regional availability (the U.S. market is still partially rolling out)

Borrowing carries liquidation risks; collateral may be forcibly liquidated if its value declines

Cashback promotions are temporary or based on user tiers

No traditional bank protections, such as FDIC insurance

2. Payy Card

Payy is a newer cryptocurrency card and wallet combination focused on privacy protection and stablecoin spending. It offers a self-custodial Visa card, allowing users to spend USDC (USD stablecoin) through its unique zk technology-supported "Payy Network," designed to obscure the links between on-chain identities, wallets, and card transactions. Interestingly, this physical card lights up when making payments—yes, it really lights up! The team also stated they are developing a points/reward program and broader fiat exchange channels.

Advantages:

Privacy First: Your transactions and wallet balances are not publicly traceable through a zero-knowledge system.

Non-Custodial: Users have complete control over their funds in the Payy Wallet.

Unique Physical Card Experience: The glowing physical card provides a "cool" factor, contrasting sharply with most crypto cards.

Low Fee Structure: According to official documentation, there are often no transaction or top-up fees.

Disadvantages:

Limited Rewards/Cashback: The current reward mechanism is unclear, and more rewards will come with the upcoming "points program."

Still in Early Stages: Fiat exchange, global availability, and full card benefits are still being gradually rolled out.

Not Fully Featured: Compared to complete crypto new banks, it does not yet offer lending, yield earning, or comprehensive banking services.

Typical Issues of Non-Traditional Cards: There are regulatory/licensing risks, and standard bank protections may not apply.

3. Gnosis Pay

Gnosis Pay, also known as Gnosis Card, is one of the few truly self-custodial cryptocurrency cards on the market. Instead of storing funds with a service provider, this card connects directly to the Gnosis Safe wallet on the Gnosis Chain, with the card serving merely as a Visa interface for cryptocurrencies.

Users can directly spend stablecoins like USDC or EURc without first converting to fiat, and most transactions incur no foreign exchange fees. Cashback rates range from 1% to 5%, depending on the user's asset holdings and loyalty tier, issued in $GNO.

Advantages:

Fully Self-Custodial: Funds remain in your wallet, not on a third-party platform.

Up to 5% $GNO Cashback: Available for active users and NFT holders.

Low or Zero Foreign Exchange Fees: Usable at millions of Visa merchants.

Direct Spending of Stablecoins: No need to "withdraw" before spending.

Disadvantages:

Requires Bridging to Gnosis Chain: Adds complexity to setup.

Cashback Levels Depend on $GNO Holdings: Base rewards are limited.

Managing Safe Wallet Requires Some Technical Knowledge.

Card Availability is Limited: Currently not launched in the U.S. market.

4. Bybit Card

Bybit Card is an ideal choice for active traders and users of the Bybit ecosystem. Through the Visa card, users can directly spend cryptocurrencies while earning tiered cashback, seamlessly connecting with Bybit Pay. The latest update integrates the two services into a unified rewards system, meaning every transaction—whether completed through the wallet or card—helps you level up and unlock higher rewards.

Advantages:

Up to 10% Cashback: Available for high-tier users, with some limited-time promotions offering up to 20%.

10% Cashback with Selected Partners: Including Netflix, ChatGPT, Spotify, Amazon Prime, and Trading View.

Automatic Savings Feature: Bybit Card users can earn interest on their assets through flexible savings, unlocking and spending at any time.

$100 Free Monthly ATM Withdrawal Limit.

Supports Multiple Payment Methods: Compatible with Apple Pay, Google Pay, and Samsung Pay.

No Annual Fee (in most regions) and competitive foreign exchange rates (around 0.5%–1%).

Integrated with Bybit Pay: Unified rewards system for quick user level upgrades.

Widely Accepted Globally, Easy Setup for Existing Bybit Users.

Disadvantages:

Cashback is Tiered and Conditional: Base rewards are relatively low.

Cryptocurrency Conversion Fee of 0.9%, plus spot trading fees.

High Cashback Promotions are Often Temporary or Region-Specific.

Available Only to Users in Australia and the European Economic Area (EEA).

5. Tria

Tria is a "borderless Web3 new bank" dedicated to making the experience of spending and saving cryptocurrencies as smooth as modern banking applications. Users can recharge with over 1,000 tokens, trade and earn yields directly within the app, and use the card in over 150 countries.

With its BestPath engine, Tria automatically handles gas fees and cross-chain routing, relieving users from worrying about bridging or paying gas fees with different tokens.

By the end of 2025, Tria completed $12 million in funding to drive its global expansion, gradually becoming a strong competitor in the self-custodial new banking space.

Advantages:

Globally Applicable: Supports over 1,000 crypto assets.

Up to 6% Cashback: Available for active users.

No Interest on Spending, Simple Registration Process.

Gas Fee-Free Cross-Chain User Experience: Powered by the BestPath engine.

Early User Airdrop Potential.

Disadvantages:

Non-USD Transactions May Incur Up to 3% Foreign Exchange Fees.

Cashback tiers and promotional activities may adjust over time.

Some features are still being gradually rolled out: such as multi-chain credit and advanced reward mechanisms.

Card delivery and customer support vary by region.

6. KAST Card

KAST is an elegantly designed lifestyle card that supports cryptocurrencies and has a strong connection to Solana. Users can recharge stablecoins (like USDC or USDT) and receive a virtual card within minutes, usable globally through Apple Pay or Google Pay.

Advantages:

Quick Setup: Supports both physical and virtual card options.

Multi-Chain Token Support: Including USDC, USDT, and USDe, compatible with various blockchain networks.

Mobile Payment Integration: Supports Apple Pay and Google Pay.

Globally Applicable: Covers over 150 countries (excluding India and China due to regulatory restrictions).

No Daily Transaction Limits: Daily ATM withdrawal limit of up to $20,000.

SOL Staking Integration: Earn up to 21% annual percentage yield (APY) through KAST validators, with no commission and 100% MEV rewards.

KAST Points Program: Earn points on every transaction for future airdrops and rewards.

Disadvantages:

- Points Are Not Direct Cashback: Their value depends on future airdrops.

Standard KAST Card:

Standard Version (K Card): Free, 4% rewards on all spending in 2025, and earn KAST points by staking SOL.

Premium Version (X Card): $1,000 annual fee, 8% rewards, double KAST points for staking SOL, and comes with a high-end metal card.

Limited Edition (Founder's Edition): One-time payment of $5,000, 8% rewards, VIP concierge service, double KAST points for staking SOL, with no subsequent fees.

Solana Exclusive Card (Enhanced SOL Staking Benefits):

Solana Standard Card: Free, 4% rewards on all spending, earn KAST points by staking SOL, and receive 3.5%-7% APY.

Solana Illuma (Premium Card): $1,000 annual fee, 8% rewards on all spending, double KAST points for staking SOL, and receive 7%-14% APY.

Solana Gold (Gold Card): $10,000 annual fee, 12% rewards on all spending, VIP concierge service, triple KAST points for staking SOL, and receive 14%-21% APY.

Solana Solid Gold (Pure Gold Card): Invitation-only, most benefits are similar to Solana Gold.

7. MetaMask Card

The MetaMask Card is still in the early promotion stage but stands out due to its fully self-custodial nature. This card connects directly to your MetaMask wallet, allowing users to spend cryptocurrencies directly from their wallet address while always retaining control over their private keys before payment.

The card operates on the Linea network, supporting tokens including USDC, aUSDC, USDT, and WETH. It has currently launched in select regions, including Europe, the UK, and parts of Latin America, with plans for a global rollout in the future.

Cardholders can choose between the following two card options:

Virtual Card: A virtual-only card, free to use, allowing users to earn 1% USDC crypto cashback on all eligible transactions. The single transaction limit is $10,000, with a daily limit of $15,000.

Metal Card: A high-end physical metal card offering exclusive benefits, such as 3% cashback on the first $10,000 spent each year (then 1%), higher spending and ATM withdrawal limits, and exclusive rights and privileges. The single transaction limit is $20,000, with a daily limit of $30,000.

Advantages:

Supports Multiple Tokens: Globally supports six tokens—USDC, USDT, wETH, EURe, GBPe, and aUSDC. For U.S. users, only USDC and aUSDC are supported.

Cashback: 1% cashback on all spending with the virtual card; 3% cashback on the first $10,000 spent each year with the metal card, then 1%.

Free ATM Withdrawals: Up to $1,200 per month, with a 2% fee on amounts exceeding this.

Seamless Integration: Deeply integrated with the MetaMask app and Linea Layer 2 blockchain.

Globally Applicable: Operates through the Mastercard network, ensuring smooth regional experiences.

Spending Rewards: Spending on Linea can enjoy Linea Boosted Yield (based on Aave's yield) and Linea Coinmunity Cashback.

Mobile Payment Integration: Supports Apple Pay and Google Pay.

Disadvantages:

Still in Pilot Phase: Limited regional coverage, with users in other regions needing to wait in line.

Cashback and Reward Details Are Unclear: Application rules are not consistent enough.

Wallet Management Required: Including gas fees and token conversion operations.

Limited Fiat Functionality: Compared to more banking-style crypto cards, there is less fiat convenience.

Applicable Regions: Currently supports Argentina, Brazil, Colombia, Mexico, Europe (excluding Czech Republic, Estonia, Latvia, and Lithuania), and the UK. In the U.S., the early testing phase has ended, but a new round of releases is still pending on the waitlist.

8. Bleap

Bleap is designed for users who want to spend cryptocurrencies simply. It operates on the Mastercard network, offering a fixed 2% USDC cashback, with no foreign exchange fees or hidden charges. Users can set up a virtual card in minutes, connect it to Apple Pay or Google Pay, and use it like a regular debit card in Europe.

Advantages:

Simple Cashback Mechanism: Enjoy 2% USDC cashback on all spending.

High-Yield DeFi Products: Access to the best DeFi products on the market, with digital dollars (USD), pounds (GBP), and euros (EUR) earning up to 20% annual yield.

Free ATM Withdrawals: Free withdrawals of about $400 per month.

No Foreign Exchange or Conversion Fees: No extra charges for spending abroad.

Quick Setup: Easy to get started, seamlessly integrates with mobile wallets.

Compatible with Mobile Payments: Supports Apple Pay and Google Pay.

Disadvantages:

Limited to European Regions.

Limited Cashback Amount: Compared to high-yield cards, cashback is relatively modest.

No Bank-Level Deposit Protection: Operates through electronic money service providers.

Limited Functionality: Few additional features beyond payments.

Additional Features (like high-yield vaults): Exist but have limited appeal for everyday spending users.

9. Avici

Avici is building what it calls an "internet-native neobank," aiming to bridge the gap between fiat and cryptocurrencies while ensuring users have complete control over their funds. Users can deposit USDC into smart contracts, instantly receive a Visa card, and spend globally.

The card supports Apple Pay and Google Pay, offering both virtual and physical card options, with no hidden fees or foreign exchange fees. Additionally, Avici provides virtual dollar (USD) and euro (EUR) accounts, making it easy for users to transfer funds between traditional banking systems and cryptocurrencies.

Advantages:

Directly Spend Cryptocurrency: Can be used directly at millions of Visa merchants worldwide.

No Foreign Exchange Markup or Hidden Fees.

Quick Setup: Supports Apple Pay and Google Pay.

Fund Security: Funds are locked in the user's own smart contract, not in a custodial account.

Ecosystem Expansion: Upcoming features include lending, fiat gateways, and privacy tools.

Virtual Bank Accounts: Provides USD and EUR accounts, supporting fiat deposits that are automatically converted to stablecoins in the wallet.

Disadvantages:

The rewards and cashback mechanisms have not been clearly defined.

Some features (like credit limits) are still under development.

Regional support and delivery may vary.

Managing smart contracts may be challenging for beginners.

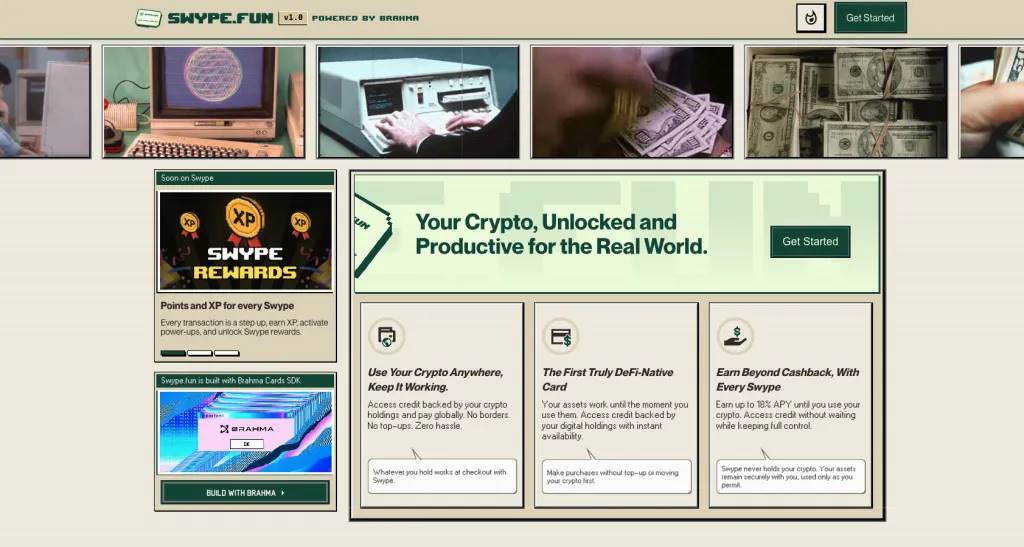

10. Swype by BrahmaFi

Swype is the first DeFi-native payment card launched by BrahmaFi, designed for everyday cryptocurrency users, allowing your assets to continuously generate returns. There is no need to convert or deposit stablecoins; you can spend directly based on on-chain collateral. It connects your wallet to lending protocols like Aave or Euler, allowing you to lend or spend while maintaining your crypto asset investments. Users can choose "Borrow Mode," where the system borrows USDC for each transaction, or "Spend Mode," using stablecoins that have already generated returns.

Advantages:

Spend Without Selling Crypto Assets: Keep assets in DeFi and continue generating returns.

Globally Applicable: Operates through the Visa network, supporting Apple Pay and Google Pay.

Based on Ethereum Layer 2: Runs on Ethereum Layer 2 networks like Base and HyperEVM.

Advanced Automation Features: Each transaction can trigger automatic yield or dollar-cost averaging logic.

Disadvantages:

Fees: Approximately 0.5% execution fee per transaction, with a 1% foreign exchange fee for non-USD payments.

Lending Risks: Borrowing against collateral carries liquidation risks.

Not Suitable for Beginners: Requires a certain understanding of DeFi.

Still Gradually Rolling Out: There are regional and protocol limitations.

Summary

Cryptocurrency payment cards have come a long way from the early "load and use" model. Today, you can spend yield-generating ETH, borrow against on-chain positions, or earn cashback on coffee without leaving your wallet.

Each option caters to different user groups: EtherFi and BrahmaFi target deep DeFi users, Tria occupies a middle ground, while Bleap seeks simplicity and convenience. One thing is certain: as stablecoins and cryptocurrencies expand, crypto payments are no longer a dream but are gradually becoming a part of everyday life.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。