The $2.67-$2.69 zone now stands as critical overhead supply. Meanwhile support in the $2.580 area and the 200-day EMA near ~$2.61 are acting as anchors.

News Background

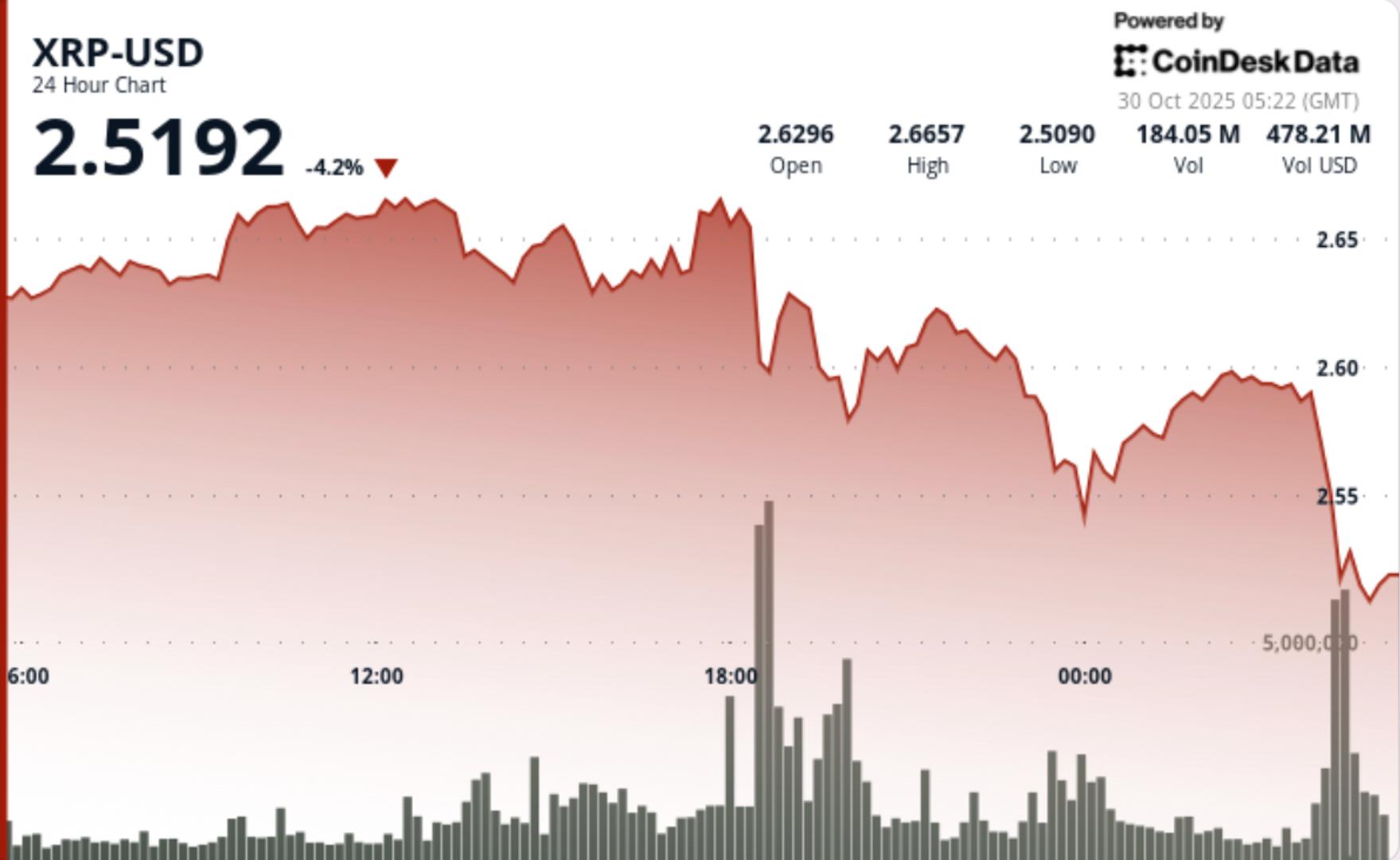

- XRP slid from $2.63 to $2.59 after a failed breakout above the $2.67 zone, with trading volume spiking to roughly 392.6 million tokens—about 658% above its recent average—during the rejection.

- This move coincides with elevated open interest in XRP futures near early-2025 highs (~$2.9 billion).

- Meanwhile, on-chain data suggest major wallets are offloading large amounts of XRP, raising profit-taking concerns even amid broader institutional interest.

Price Action Summary

- Over the 24-hour window, XRP moved from ~$2.63 to ~$2.59 while carving out a $0.12 trading band. The decisive cap occurred at ~$2.67 resistance, where volume exploded and price faltered.

- A late-session drop from ~$2.590 to ~$2.579 around 04:04-04:05 UTC occurred on ~2.18 million token volume—≈355% above the hourly average—before briefly freezing trading between 04:08-04:10 at near-zero volume.

- The breakdown breached the support cluster near $2.580, establishing fresh lower-lows beneath prior consolidation levels.

Technical Analysis

- The rejection at resistance affirms the short-term bearish pivot: while long-term structure still shows accumulation, the immediate risk has shifted back to the downside.

- Futures open interest remains elevated, but whale wallet sell-off data suggest distribution—not accumulation—is currently dominant.

- RSI/MACD momentum indicators show divergence (higher highs on price, lower highs on momentum), further warning of potential correction.

What Traders Should Know

- Traders should treat current levels as a high-risk / high-reward pivot zone. A bounce from $2.58–$2.60 on renewed volume could reset momentum and aim toward $2.70–$3.00.

- But a clear break below $2.58 would open downside toward ~$2.53 and perhaps $2.50, especially if whale outflows continue and open interest drops.

- Monitoring large wallet flows, futures OI dynamics and volume spikes will be key to judge whether this is just consolidation or the start of a deeper correction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。