Original Title: "The Federal Reserve Takes Action: Continues to Cut Interest Rates by 25 Basis Points + Ends Balance Sheet Reduction in December, Two Voting Members Oppose the Rate Decision"

Original Author: Li Dan, Wall Street Insights

Key Points:

· The Federal Reserve has cut interest rates by 25 basis points for the second consecutive time, in line with market expectations.

· The balance sheet reduction by the Federal Reserve, which lasted for three and a half years, has come to an end, with a decision to replace maturing MBS holdings with short-term government bonds starting in December.

· Among the two FOMC voting members who opposed the rate decision, the newly appointed governor Milan, handpicked by Trump, advocated for a 50 basis point cut, while Kansas City Fed President Schmid supported maintaining the current rate.

· The statement reiterated that "given the balance of risks has shifted," the decision to cut rates was made, replacing "recent" data indicators with "available" ones, and newly pointed out that recent labor market indicators align with trends before the government shutdown, stating that the risk of job losses "has increased in recent months."

· "New Federal Reserve News Agency": The Fed continues to work to prevent the recent trend of slowing employment from worsening, but the lack of economic data makes the future direction of interest rates uncertain.

As expected by the market, the Federal Reserve continued its rate-cutting actions and decided to abandon quantitative tightening (QT), ending the balance sheet reduction plan a month later.

On Wednesday, October 29, Eastern Time, the Federal Reserve announced after the FOMC meeting that it would lower the target range for the federal funds rate from 4.00% to 4.25% to 3.75% to 4.00%, a decrease of 25 basis points. This marks the first time in a year that the Fed has cut rates in consecutive FOMC meetings after the first rate cut earlier this year.

This rate cut decision was fully anticipated by investors. By the close of trading on Tuesday, CME tools indicated that the futures market expected a 99.9% probability of a 25 basis point rate cut this week, with a 91% probability of another 25 basis point cut at the next meeting in December. This shows that the market has almost completely absorbed the expectation of three rate cuts this year. The rate outlook published after the last FOMC meeting in September indicated that most Fed policymakers expected the number of rate cuts this year to increase from two in June to three.

As in the previous two meetings, the Fed's decision-making body did not reach a consensus on the rate action this time. Including the newly appointed governor Milan, who was "handpicked" by President Trump, two FOMC members voted against the decision to cut rates by 25 basis points, reflecting ongoing divisions within the Fed. Unlike before, this time there were disagreements on both the magnitude of the rate cut and whether to continue taking action.

The Federal Reserve announced the end of the balance sheet reduction (QT) starting in December, which was not unexpected. Two weeks ago, Fed Chair Powell hinted at stopping the balance sheet reduction, stating that bank reserves remain ample and may approach the level needed to stop the reduction in the coming months. This week, Wall Street Insights mentioned that most major Wall Street banks, including Goldman Sachs and JPMorgan, expected the Fed to announce the end of the balance sheet reduction due to recent signs of liquidity tightening in the money market.

After the announcement of this decision, Nick Timiraos, a senior Fed reporter known as the "New Federal Reserve News Agency," wrote:

"The Fed has cut rates by 25 basis points again, but the lack of (economic) data makes the future direction uncertain."

"The Fed has cut rates in two consecutive meetings, continuing to work to prevent the recent trend of slowing employment from worsening. In the effort to unwind the Fed's aggressive rate hikes, the easiest part may have already been completed, and Fed officials are discussing the next steps for the magnitude of the rate cut. This tricky task has become more complicated due to the lack of data caused by the government shutdown."

End of Balance Sheet Reduction After Three and a Half Years, Short-Term Government Bonds Replace Maturing MBS Holdings

The main difference in this meeting's decision statement compared to the last one is the adjustment regarding the balance sheet reduction.

The statement no longer reiterates that the Federal Reserve will continue to reduce its holdings of U.S. Treasury securities, agency debt, and agency mortgage-backed securities (MBS), but instead clearly states:

"The (FOMC) committee has decided to end the reduction of its total securities holdings on December 1."

This means that the Fed's balance sheet reduction will come to an end after three and a half years.

The Federal Reserve began the balance sheet reduction on June 1, 2022, and last June first began to slow the pace of the reduction, lowering the maximum monthly reduction of U.S. Treasury securities from $35 billion to $25 billion. In April of this year, it further slowed the pace, reducing the monthly cap for Treasury securities to $5 billion while maintaining the $35 billion monthly redemption cap for agency debt and agency MBS.

The monetary policy decision announcement released by the Federal Reserve this Wednesday indicates:

For U.S. Treasury securities maturing in October and November, the Fed will extend the portion of principal payments exceeding the monthly cap of $5 billion through auction, and starting December 1, will extend the principal of all Treasury securities held through auction.

For agency debt and agency MBS holdings maturing in October and November, the Fed will extend the portion of principal payments exceeding the monthly cap of $35 billion, and starting December 1, will reinvest all agency securities principal payments into Treasury bills.

This means that after stopping the balance sheet reduction plan in December, the Fed's MBS redemption principal will be reinvested into short-term U.S. Treasury bonds, replacing maturing MBS holdings with short-term government bonds.

Regarding the decision on the balance sheet reduction, Timiraos pointed out that Fed officials have long indicated that they would stop the reduction once signs of banks holding excess cash in the overnight lending market are no longer evident, and these signals have become increasingly clear over the past week. The Fed will replace maturing bond holdings with short-term government bonds starting in December.

Voting Member Milan Insists on a 50 Basis Point Rate Cut, Schmid Supports Maintaining Current Rate

The second major difference in this Federal Reserve decision statement is the FOMC voting results. The number of dissenting votes this time is one more than the last time, matching the count from the meeting at the end of July.

The voting results show that Powell and ten other voting members supported another 25 basis point rate cut. Among the two dissenters, interim Fed governor Milan, who took office before the September FOMC meeting, maintained the aggressive rate cut stance from the last meeting, still hoping for a 50 basis point cut. Kansas City Fed President Schmid opposed the decision because he supported keeping rates unchanged.

This is in stark contrast to the voting situation at the end of July's FOMC meeting, where two members voted against the decision to pause rate cuts. The two dissenters—Fed Governor Waller and Trump-nominated Vice Chair for Supervision Bowman—both favored a 25 basis point cut at that time.

Bob Michele, the global fixed income head at JPMorgan Asset Management, commented that Powell is losing control over the Federal Reserve. A "persuasive" leader is needed to head the Fed. Trump may have to place U.S. Treasury Secretary Mnuchin into the Fed to promote his own views on interest rate policy.

Recent Labor Market Indicators Align with Trends Before Government Shutdown, Employment Downside Risks "Increased in Recent Months"

The differences in this Federal Reserve decision compared to the last one are also reflected in the description of the economic situation. The relevant adjustments mainly reflect the impact of the ongoing government shutdown since October, which has delayed the release of various economic data.

The last statement reiterated at the beginning that "recent indicators show that economic growth has moderated in the first half of the year," while this time it replaced "recent" with "available," stating:

"Available indicators show that the pace of economic activity has moderated."

The last statement noted, "Employment growth has slowed, the unemployment rate has risen slightly but remains low. Inflation has increased and remains somewhat elevated." This time, the statement added a time frame for labor market and inflation trends, and newly pointed out that recent labor market indicators align with trends reflected in data released before the government shutdown. The statement read:

"Employment growth has slowed this year, the unemployment rate has risen slightly but remains low as of August; more recent indicators are also consistent with these trends. Inflation has risen since the beginning of the year and remains somewhat elevated."

The newly added statements are consistent with Powell's remarks two weeks ago. He stated at that time: "Based on the data we have, it is fair to say that since our September meeting four weeks ago, the employment and inflation outlooks have not changed much."

Like the last statement, this one also indicates that the decision to cut rates was made "given that the balance of risks has shifted."

This statement reiterates that the FOMC is focused on the two-sided risks it faces in achieving its dual mandate of maximum employment and price stability, and largely follows the last statement's new assessment of increased downside risks to employment, with the only difference being the addition of a time frame for this risk change.

This statement no longer states that the FOMC "judges that downside risks to employment have increased," but rather states that "the (FOMC) committee is concerned about the risks it faces in achieving its dual mandate and judges that downside risks to employment have increased in recent months."

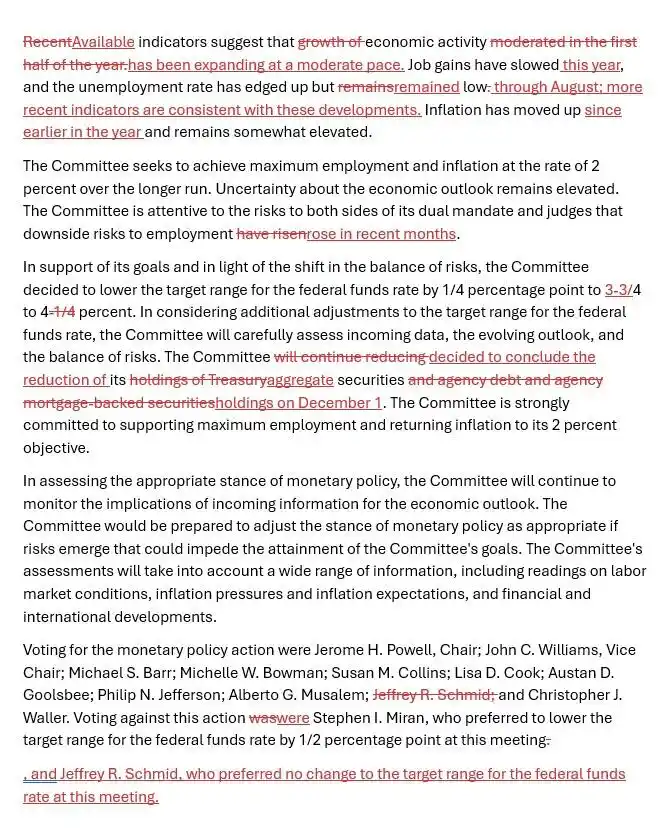

The following red text highlights the deletions and additions in this decision statement compared to the last one.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。