Yesterday we mentioned that the market is in a narrow range and we need to continue waiting. Today we see that the market continues to narrow, but we also observe that the conditions for a trend change are present, meaning it is logical for the market to suddenly make a move. However, we are more inclined to believe that it will take a few more days before the market starts to move.

From the MACD perspective, the energy bars continue to rise, but the volume has clearly weakened. Both the fast line and the slow line are moving upwards, which overall favors the bulls.

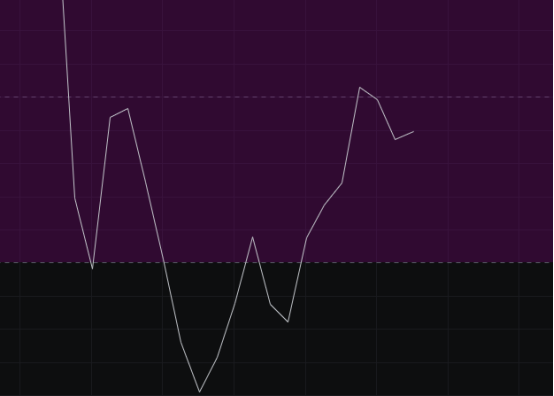

From the CCI perspective, after two consecutive days of bearish closes, the CCI that once stood above the zero line has now fallen below it. Here we consider that it has not managed to stay above. Since the market has not been able to hold at critical levels, whether it can maintain a bullish trend going forward is questionable.

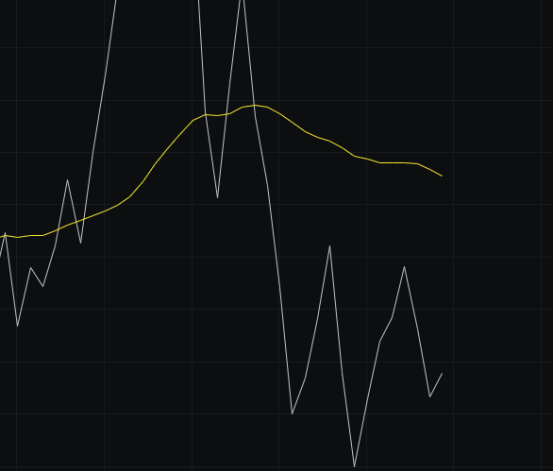

From the OBV perspective, the outflow of volume has been significant over the past two days, while today's upward volume is not large. Overall, the outflow is greater than the inflow, and the slow line continues to trend downwards, indicating a bearish trend in the OBV.

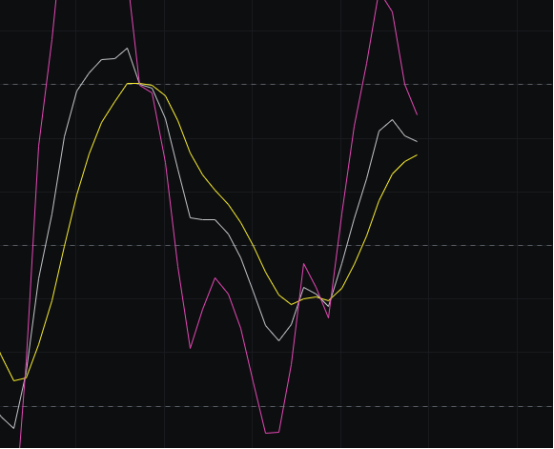

From the KDJ perspective, after a peak, the KDJ has started to turn down, indicating that it seems unable to stay above 80. If it cannot stay above 80, there will not be a good upward movement. Although it has turned down, it does not necessarily mean the market will drop immediately; there is also a possibility of moving sideways.

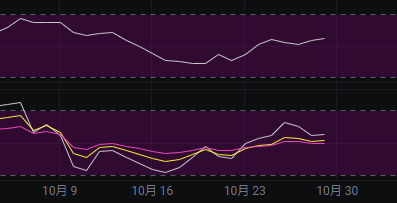

From the MFI and RSI perspectives, both indicators are in a neutral range, and their directions are inconsistent. We cannot see a clear direction here, and the market needs to continue for a few more days.

From the moving averages perspective, after two days of upward movement, the market has ultimately fallen, leaving a noticeable upper shadow. Additionally, the closing price is below the 30 and 120 levels, which is critical for the bulls. It is difficult to regain the key levels after such a drop.

From the Bollinger Bands perspective, the market continues to narrow as we predicted, and it has now reached the conditions for a trend change. Therefore, it is logical for the market to make a move. However, it would be best to transition to a sideways movement for a few days to repair various indicators before starting a new trend.

In summary: The market is narrowing as we predicted, and there is a possibility of a trend change at any time. However, we are more inclined to see a few days of sideways movement before any trend change. The resistance is seen at 115,000-117,000, and support is at 112,000-110,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。