Everyone lends, no one invests: How is innovation being squeezed out?

Written by: arndxt

Translated by: AididiaoJP, Foresight News

The market will not self-correct; the government has once again become a key factor in the production function.

The ultimate outcome is not collapse, but possibly a controlled decline, a financial system that survives on reflexive liquidity and policy scaffolding rather than productive reinvestment.

The U.S. economy is entering an era of managed capitalism:

- Stocks are retreating

- Debt is dominant

- Policy has become the new driver of growth

- And finance itself has turned into the economic leader

Nominal growth can be manufactured, but true productivity requires restoring the connection between capital, labor, and innovation.

Without this, the system can be maintained but will no longer generate compounding effects.

Structural Shift in Capital Composition

The stock market was once the core engine of American capitalism, but it now fails to systematically provide accessible capital to a broad range of American businesses. The result is a massive shift towards private credit, which now acts as the capital allocator in most middle markets and capital-intensive industries.

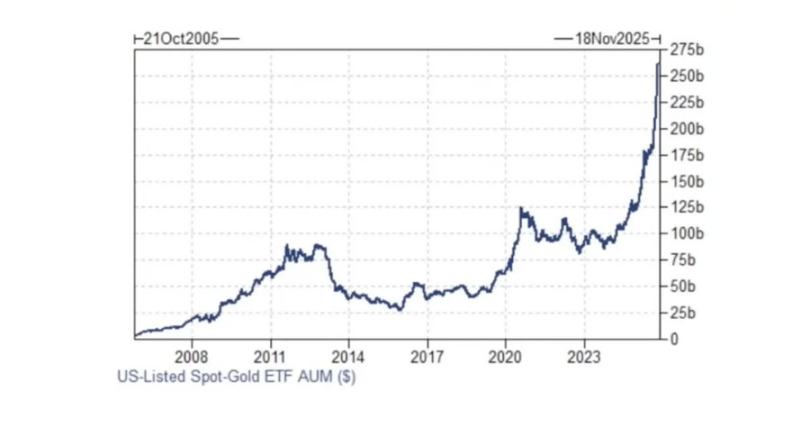

The volume of public stock offerings remains near decades-low levels, while the scale of private debt asset management has exceeded $1.7 trillion, reflecting the late stage of the financialization cycle. Companies are increasingly favoring debt over equity, not because they have better credit, but because the structure of the public market has been damaged: low liquidity, concentration of passive investment, and punitive valuation multiples for asset-heavy business models have made going public less attractive.

This has created an anomalous incentive cycle: no one wants a balance sheet. Asset-light, rent-extraction business models dominate the valuation framework, while capital-intensive innovation lacks equity funding. Meanwhile, private credit has embraced an "asset capture" model: lenders win in any outcome, earning high spreads in success and seizing hard assets in distress.

The Era of Financialization

This trend is the culmination of a forty-year experiment in hyper-financialization. With interest rates structurally below growth rates, investors pursue returns not through productive investment but through appreciation of financial assets and leveraged expansion.

Key consequences:

- Households have replaced stagnant wage growth with rising asset values.

- Companies prioritize shareholder supremacy, outsourcing production and pursuing financial engineering.

- Economic growth has decoupled from productivity, relying on asset inflation to sustain demand.

This dynamic of "debt with no productive use" has hollowed out the domestic industrial base and created an economy optimized for capital returns rather than labor returns.

Crowding Out Effect and Credit Reflexivity

The post-COVID fiscal regime has exacerbated this issue. Record sovereign issuances have crowded out private borrowers in the public credit market, driving capital into private loan structures.

Private credit funds are now pricing loans based on artificially compressed public spreads, creating a reflexive feedback loop:

- Public issuances decline

- Forced buyers chase limited high-yield supply

- Spreads tighten

- Private credit reprices lower

- More issuances shift to private

- Cycle reinforces

Meanwhile, since 2020, the Federal Reserve's implicit support for corporate credit has distorted the informational value of spreads, with default risk no longer priced by the market but managed by policy.

The Problem of Passive Investment

The rise of passive investment has further undermined price discovery. Index-based fund flows dominate stock trading volumes, concentrating ownership in a handful of trillion-dollar asset management firms, whose incentives are homogenized and benchmark-constrained.

The result:

- Small and mid-cap public companies suffer from structural liquidity shortages.

- Stock research coverage collapses.

- The IPO market shrinks, replaced by late private financing rounds (Series F, G, etc.) inaccessible to public investors.

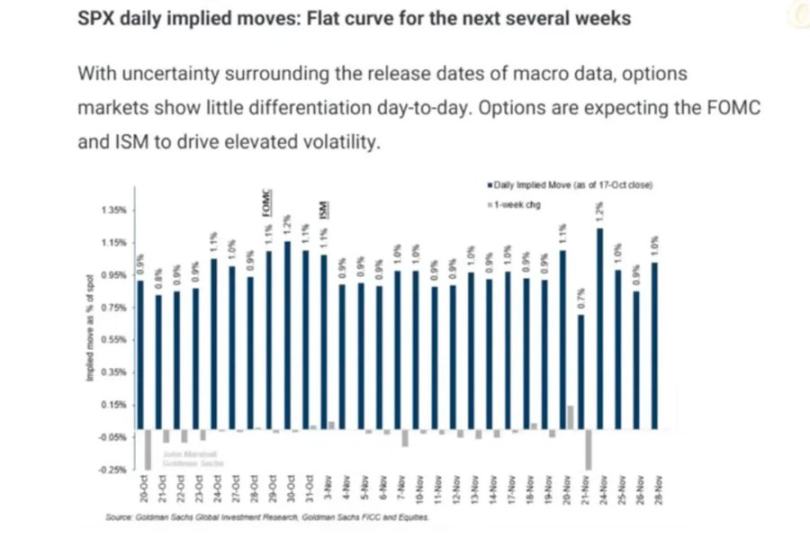

The breadth and vitality of the market have been replaced by oligopolistic concentration and algorithmic liquidity, leading to volatility clusters when fund flows reverse.

Crowding Out Innovation

The homogeneity of finance is reflected in the real economy. A healthy capitalist system requires heterogeneous incentives: entrepreneurs, lenders, and investors pursuing different goals and time horizons. In contrast, today's market architecture compresses risk-taking into a single dimension: maximizing returns under risk constraints.

Historically, innovation has thrived at the intersection of diverse industries and capital structures. The collapse of this ecosystem of "everyone lends, no one invests" is reducing serendipitous innovation and long-term productivity growth.

The Necessity of New Industrial Policy

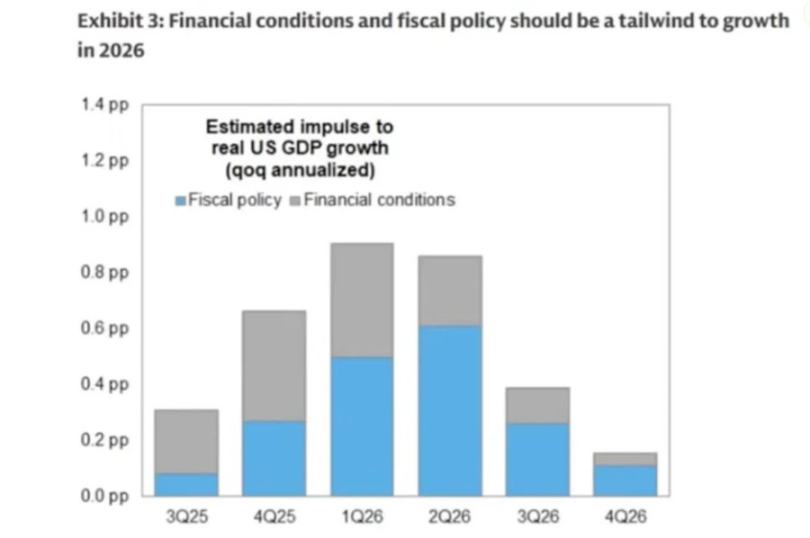

As this structure erodes organic growth potential, the state is re-emerging as a major economic player. From the CHIPS Act to green subsidies, fiscal industrial policy is being used to compensate for failures caused by private capital.

This represents a partial inversion of the U.S.-China model: the U.S. is now using targeted public-private partnerships to re-anchor supply chains and create nominal growth, while China leverages state-owned enterprises and manufacturing to assert global dominance.

However, execution remains uneven, constrained by political limitations, resource inefficiencies, and geographic mismatches (e.g., building semiconductor plants in water-scarce Arizona). Nevertheless, the philosophical shift is decisive:

Social Contract and Political Reflexivity

The consequences of forty years of financialization are reflected in the gap between asset wealth and wage income. Housing and stocks now account for a record share of GDP, while real wages have stagnated.

If opportunities cannot be redistributed, not through transfer payments but through ownership, political stability will be eroded. From tariffs to industrial nationalism, the rise of populist and protectionist movements is symptomatic of the deprivation of economic rights. The U.S. is not immune; it is leading this experiment.

Outlook: Stagnation, State Capitalism, and Selective Growth

Unlike a singular "Minsky moment," this regime implies gradual erosion: declining real returns, slow de-equitization, and managing intermittent volatility through policy intervention.

Key themes to watch:

- Dominance of public credit: As deficits persist, the crowding-out effect will continue to intensify

- Onshoring of industries: Government-driven nominal growth through subsidies

- Saturation of private credit: Ultimately leading to margin compression and individual defaults

- Stagnation of the stock market: Due to capital chasing certainty rather than growth, price-to-earnings ratios will face a decade-long compression

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。