Bitcoin ETF Inflows Vs. Ethereum ETF Outflows: Impact on This Week?

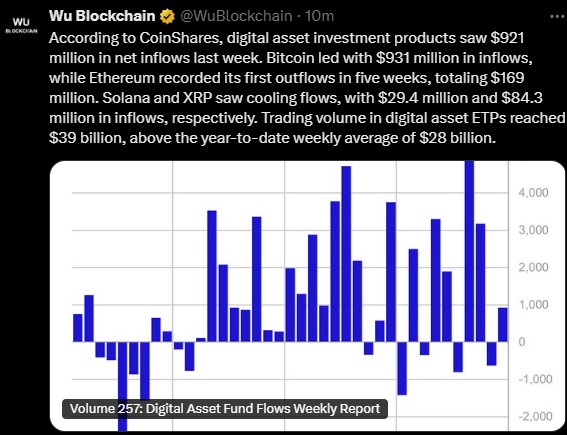

The crypto market saw a big action last week which may trigger the current week's momentum. As per Wu Blockchain data and CoinShares, digital asset funds got $921 million in new money.

Most of it went into Bitcoin ETF inflows, which reached $931 million, while Ethereum ETF outflows touched $169 million — its first loss in five weeks.

This sudden change made many wonder: why is Bitcoin price surging while the other altcoin is falling? Let’s break it down.

What’s Behind Bitcoin ETF Inflows Weekly Rise? 3 Reasons

The asset again proved that it’s the “digital gold” of the crypto world. Even when prices go up and down, people trust it more. That’s why btc exchange traded funds inflows are rising this year.

-

Trump Pardon CZ: Two years after his legal issues, Donald Trump pardoned Binance’s founder CZ, and many believe he may return to Binance. This news made investors happy and confident, pushing Bitcoin ETF inflows even higher .

-

Whale Buying Increased Trust: As per last week’s news, a famous crypto whale known for always winning trades, bought 173.6 BTC last week. This kind of massive whale activity fuels bullish momentum.

-

Institution and Country Adoption: Dubai recently accepted $BTC and other cryptocurrencies for legal use. This step encouraged big companies and investors in the Middle East to move funds into crypto king.

Ethereum ETF Outflows: Can ETH Recovery Flip The Momentum?

$169 million ETH outflows showed short-term fear in the market. The U.S. Federal Reserve is expected to cut interest rates three times this year. Usually, this is good for all risky assets like crypto.

But this time, investors showed more trust in crypto king and avoided altcoins like $ETH. Top cryptocurrency experts call this “reverse psychology”, when markets look risky, people prefer safer options like digital asset gold.

In the latest ETH news, as seen in the chart, even the altcoin index fell from 75 to 43, showing that small coins lost demand. This profit-booking caused Ethereum ETF outflows as traders moved their money to safer sides.

But now, assets seem to be bouncing back. As per TradingView data , it is trading at $4,168.76, up 5% in 24 hours. The daily trading volume jumped 156% to $40.1B, showing strong interest again.

-

RSI: 53.15 → means more buying than selling

-

MACD: turned positive → shows upward trend

If Ethereum price surge continues , it can reach $4,300–$4,400 soon, and maybe $4,800 later. But if it drops below $4,000, this recovery might stop.

Bitcoin Price Prediction: $120K in Sight After Inflows?

Token’s TradingView chart looks strong. After finding support near $110,000, it is trading close to $115,400 now. The daily volume of $59.5B shows high demand.

-

RSI: 55.6 → still not overbought

-

MACD: bullish crossover → signals more rise

If it crosses $116,500, price prediction could hit $120,000 soon. These numbers and the strong Bitcoin listed funds inflows confirm that it is still the top choice in 2025’s crypto market assets.

Between Caution and Confidence: What’s Next

Last week, both the assets showed mixed moves, going up and down without a clear trend. Still, Bitcoin ETF inflows proved that investors didn’t lose trust in it.

Now that ETH’s recovery looks stable, the market could soon flip Ethereum ETF outflows into influx, leaving its 2025 target approach higher. balance again. This week might bring a shift where both the tokens regain strong demand, setting the stage for the next big rally in the crypto world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。