In the early hours of October 30 (Thursday) in the East 8 Time Zone, the Federal Reserve will announce its interest rate decision for October. This meeting is highly likely to result in a 25 basis point rate cut.

At the same time, the ADP report, often referred to as the "little non-farm," shows that the U.S. private sector lost 32,000 jobs in September, marking the largest decline since March 2023. The U.S. September CPI rose 3.0% year-on-year, below market expectations. These economic data provide a basis for the Federal Reserve's rate cut decision.

1. Event Overview

The upcoming October interest rate meeting of the Federal Reserve, along with its subsequent policy statement and the chairman's speech, is filled with uncertainty, making it a key event that could shake global financial markets. The market is holding its breath, trying to interpret a clear signal regarding the future path of the Federal Reserve's monetary policy. Probability and Basis for Rate Cut

● The market's expectations for a Federal Reserve rate cut are highly consistent. AiCoin data shows that the market bets on a 25 basis point rate cut in October with a probability as high as 98.3%, while the probability of maintaining the current rate is only 1.7%.

● Huatai Securities research report points out that due to the recent slowdown in the U.S. job market and the mild impact of tariffs on inflation, the Federal Reserve is likely to cut rates by 25 basis points.

● The U.S. September CPI data has provided the market with a "reassurance." The data shows that the overall CPI in the U.S. rose 3.0% year-on-year and 0.3% month-on-month. The core CPI, excluding volatile food and energy prices, rose 3.0% year-on-year and 0.2% month-on-month, both below market expectations.

Cooling Labor Market

● Due to the impact of the U.S. government "shutdown," the non-farm employment data for September was not released as scheduled, adding uncertainty to future expectations.

● The "Beige Book" released by the Federal Reserve on October 15 shows that labor demand is generally sluggish across various regions and industries in the U.S.

● Most Federal Reserve districts report that due to weak demand, increased economic uncertainty, and greater investment in artificial intelligence technology, more employers are reducing their workforce through layoffs and natural attrition.

Possibility of Halting Balance Sheet Reduction

Considering that recent volume and price indicators suggest that the Fed has reached a threshold where it can stop balance sheet reduction. The Federal Reserve has previously communicated sufficiently with the market—the possibility of Powell announcing a halt to balance sheet reduction at the October FOMC cannot be ruled out.

2. Impact on the Cryptocurrency Market

The Federal Reserve's rate cut decision will have a multi-faceted impact on the cryptocurrency market, potentially reshaping everything from capital flows to underlying logic.

Price and Trading Aspects

● Rate cut expectations typically lead to a weaker U.S. dollar index, which directly benefits dollar-denominated cryptocurrencies like Bitcoin. A weaker dollar reduces the cost for global investors to purchase these assets, thereby driving up demand.

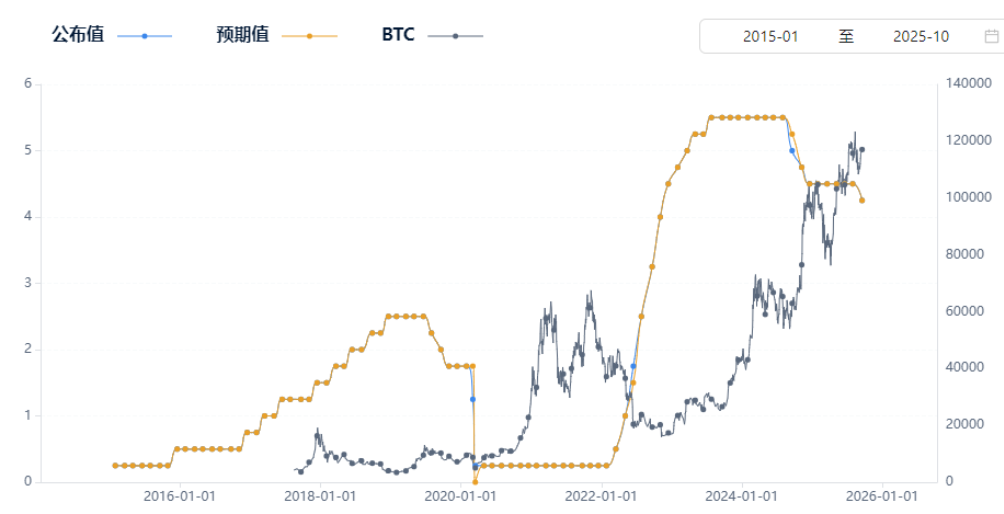

● Historical data shows that during periods of the Federal Reserve's loose monetary policy, cryptocurrencies often perform well. An improved liquidity environment reduces the opportunity cost of holding non-yielding assets, making investors more willing to allocate funds to potentially high-return assets like Bitcoin.

On-Chain Fundamentals

● A Federal Reserve rate cut may change the asset allocation strategies of large institutional investors. The decline in yields in traditional financial markets makes the potential returns of cryptocurrencies more attractive, possibly leading to more institutional funds flowing into the crypto ecosystem.

● If the Federal Reserve continues to cut rates, the yields on corporate bonds will also decline, which may encourage some publicly traded companies to include Bitcoin on their balance sheets, continuing the trend from 2020-2021.

Capital and Liquidity

● Xu Changtai, Chief Market Strategist for Morgan Asset Management in the Asia-Pacific region, pointed out that the Federal Reserve's rate cut is generally favorable for the performance of risk assets. This environment may also benefit the crypto market.

● Rate cut cycles are usually accompanied by an increase in market risk appetite, enhancing investors' willingness to allocate to high-risk assets like cryptocurrencies. The improvement in global liquidity conditions will also bring more incremental funds to the crypto market.

Industry and Sentiment

The Federal Reserve's rate cut will be interpreted by the cryptocurrency community as a signal of the fragility of the traditional financial system, reinforcing the logic of Bitcoin as an alternative store of value. The low correlation between cryptocurrencies and traditional assets may become more attractive in a rate cut environment, especially in the face of economic uncertainty.

3. Market Views and Analysis

Market analysts have offered different insights regarding the impact of the Federal Reserve's rate cut on the crypto market.

● "Traditional Financial Link" Perspective - Zhang Hao, Chief Analyst at Coin Strategy Consulting

“The Federal Reserve's rate cut will narrow the gap between traditional yields and crypto yields, prompting more capital to seek higher returns. Inflows into Bitcoin ETFs have increased in the past two weeks, and a rate cut may accelerate this trend.

“Cryptocurrencies, especially Bitcoin, are becoming a new choice for capital to park.”

● "Macroeconomic Turning Point" Perspective - Li Mengqi, Researcher at On-Chain Capital

“The current crypto market has not fully priced in the impact of the rate cut. The key is that the liquidity gates of the market are opening again, and the growth of stablecoin supply is the next key indicator.

“If the Federal Reserve not only cuts rates but also halts balance sheet reduction, a dual liquidity injection could recreate the crypto market boom seen at the end of 2020.”

● "Crypto Native" Perspective - Mason Thompson, Founder of Crypto Consensus

“The real game changer is not the rate cut itself, but the confirmation of a policy shift. The Federal Reserve's shift from anti-inflation to growth preservation means more fiscal stimulus may follow.

“The narrative of debt monetization will boost Bitcoin's value storage proposition. Smart money is already positioning itself.”

4. Risk Warnings and Dynamic Tracking

Despite the market's optimistic expectations for a Federal Reserve rate cut, investors should remain vigilant about potential risks and closely monitor key dynamics.

Potential Risks

● First, be wary of the market reaction of “buy the expectation, sell the fact.” Even if the Federal Reserve cuts rates as expected, the crypto market may experience a short-term pullback due to profit-taking. The market has partially digested the rate cut expectations.

● Second, there remains uncertainty regarding the Federal Reserve's future policy path. Morgan Stanley Investment Management's global fixed income team believes that the Federal Reserve's statements regarding the pace of future rate cuts may be more important than the rate cut itself.

● Finally, the structural risks within the cryptocurrency market cannot be ignored. Issues such as high leverage and the security of exchange reserves may be exposed during periods of increased market volatility.

Core Dynamic Tracking

In the coming days, investors should focus on the following two core dynamics:

● First, the policy statement following the Federal Reserve's interest rate meeting and Powell's press conference. The market will look for clues on whether there will be another rate cut in December. It is important to note that there are still some differences within the Federal Reserve regarding the future rate cut path.

● Second, the U.S. Treasury's bond issuance plan and the performance of long-term Treasury yields. If the yield on the 10-year U.S. Treasury remains high after the rate cut, it may suppress the gains in the crypto market.

The market generally expects the Federal Reserve to announce a 25 basis point rate cut on Thursday morning, but the real focus of the crypto market is on how Powell will articulate the future rate cut path. If dovish signals are released, Bitcoin is likely to break through its recent trading range and initiate a new round of increases; if the statement is conservative, the market may fall into a “buy the expectation, sell the fact” profit-taking scenario.

For savvy cryptocurrency investors, the rate cut itself is a high-probability event; the real opportunity lies in identifying and investing in specific categories of crypto assets that can benefit the most from improved liquidity.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。