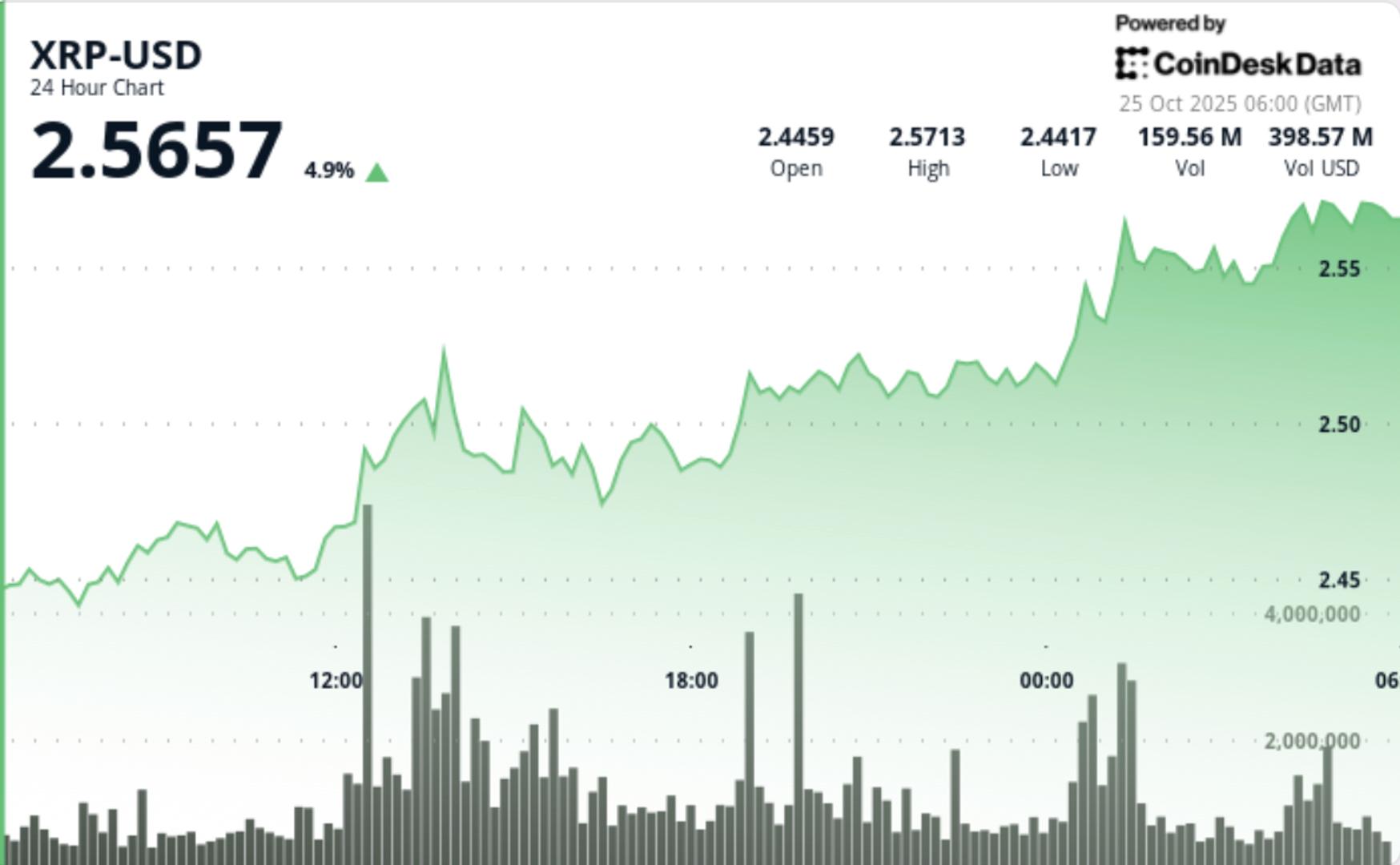

XRP extended gains above the $2.50 mark on Thursday, breaking key resistance as volume surged 31% above weekly averages. The move came amid broader risk-on sentiment across crypto markets, with bitcoin climbing and traders rotating into high-cap tokens showing technically defined setups.

News Background

- The token’s latest advance followed weeks of consolidation between $2.35 and $2.50, with technical strategists tracking an inverse head-and-shoulders base through mid-October.

- Thursday’s decisive move through the neckline at $2.50 confirmed that pattern, opening a potential continuation phase toward the $2.65–$2.80 range if buying persists.

- Market positioning shifted as macro sentiment improved. Softer U.S. inflation data and falling Treasury yields triggered risk-on flows into major altcoins. XRP outperformed the CoinDesk 5 index by roughly five percentage points, signaling asset-specific accumulation rather than sector momentum.

Price Action Summary

- XRP climbed from $2.50 to $2.57 across the session, with intraday volume peaking at 142 million — 31% above its seven-day mean.

- The breakout was defined by three sequential higher lows at $2.44, $2.48 and $2.51, confirming controlled accumulation through the $2.50 zone.

- While brief profit-taking emerged near $2.58, XRP held above breakout support, suggesting institutions added exposure on retests.

- Elevated spot volume combined with muted derivatives leverage confirmed genuine buying interest rather than short-squeeze dynamics.

Technical Analysis

- The completed inverse head-and-shoulders formation now defines XRP’s near-term technical bias. Momentum indicators, including RSI and MACD, both turned higher on the daily chart, while volume expansion validates the strength of the move.

- Immediate resistance lies at $2.60, followed by secondary targets near $2.80. Failure to hold $2.50 on a closing basis would neutralize the bullish structure, potentially inviting rotation back toward $2.40–$2.42 support.

What Traders Should Know

Traders are monitoring whether $2.50 holds as the new base — a level now regarded as the pivot for short-term trend confirmation. Exchange balance data shows XRP reserves down roughly 3.3% since early October, a historically bullish signal linked to whale accumulation phases.

Open interest has stabilized and funding rates remain neutral, leaving the move largely spot-driven. Sustained volume above 130 million through the weekend could validate continuation toward $2.70–$2.80, while fading participation may trap prices back inside the $2.40–$2.55 range.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。