The crypto market staged a steady comeback in Q3 2025, driven by improving liquidity, stronger institutional engagement, and record bitcoin ETF inflows totaling $7.8 billion.

According to the latest Q3 crypto exchanges report by Tokeninsight, bitcoin dominated market activity, pushing total crypto market capitalization from $3.46 trillion in June to nearly $4 trillion by late September.

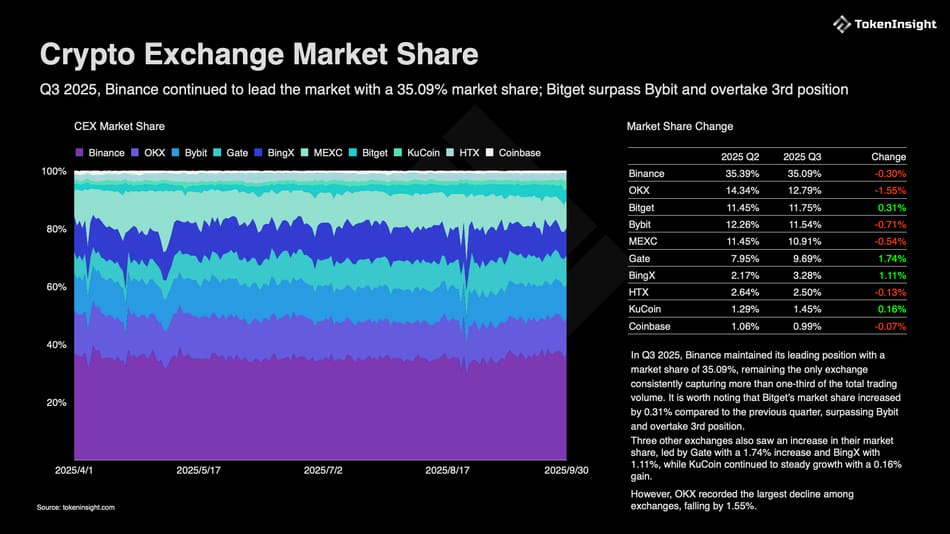

Binance continued to lead global trading with a 35.09% market share, solidifying its dominance as the only exchange handling more than a third of total volume. Bitget climbed to third place, overtaking Bybit with a 0.31% increase in share, while Gate and Bingx recorded robust growth of 1.74% and 1.11%, respectively. OKX faced headwinds, losing 1.55% market share during the quarter.

Spot trading volumes jumped 30.6% quarter-over-quarter to $4.7 trillion, supported by bitcoin’s sustained strength. Meanwhile, derivatives markets also surged, with total volumes up 28.7% to $26 trillion and open interest led by Binance at 24.6%, followed by Bybit and Bitget.

The rise of real-world asset (RWA) tokenization and on-chain derivatives trading highlighted shifting market narratives this quarter. Looking ahead, the sector enters Q4 on a cautiously optimistic note with the Fed’s rate cuts, continued ETF inflows, and growing institutional demand expected to underpin further recovery despite lingering macro and geopolitical risks.

FAQ💰

- What drove crypto’s rebound in Q3 2025?

Stronger bitcoin ETF inflows and renewed institutional interest pushed the total market cap close to $4 trillion. - Which exchanges led global trading?

Binance held 35% of total volume, while Bitget, Gate, and Bingx saw strong growth through the quarter. - How did trading volumes perform?

Spot volumes rose 30.6% to $4.7 trillion, and derivatives activity surged 28.7% to $26 trillion. - What trends are shaping Q4 expectations?

RWA tokenization, ETF momentum, and Fed rate cuts are setting the stage for cautious market optimism.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。