The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome all coin friends to follow and like, and I refuse any market smoke screens!

With the market's recovery, this wave of decline is gradually being defined. Lao Cui has also observed global analyses regarding the reasons for this decline, most of which attribute it to concerns over international trade situations. The reasoning is quite sufficient; when gold plummeted, the cryptocurrency market actually experienced a short-term rebound. This indicates that the flow of funds has begun to reverse. In particular, the views of analysts from Standard Chartered Bank suggest that there is a possibility of falling below $100,000 in the short term; to be direct, to judge the trend of Bitcoin, the trend of gold prices deserves your attention. The flow of funds selling gold to buy Bitcoin may very well determine the mid-term trend of the cryptocurrency market. It is also pointed out that Bitcoin has consistently remained above the 50-week moving average since 2023, so if the price falls below $100,000, it will become the best opportunity to buy. This view aligns with Lao Cui's, except that Lao Cui sees a breakdown pattern, with the support at around $100,000, but does not expect a solid line to break below $100,000; rather, it will be in the form of a spike, and everyone can place orders to enter the market.

Today's market discussions are more about Zhao Changpeng. If you hold BNB, it is indeed meaningful to pay attention to such news; the trend of BNB also shows that the short-term rebound is indeed due to the founder's influence, and the impact on other coins will not be too significant. This only indicates that the American strategy will lean towards the cryptocurrency market. Lao Cui's focus remains on interest rate cuts and ending balance sheet reduction. The CPI data released this week will not have too much impact; the current trend almost indicates that the wave of interest rate cut expectations may have already begun. This is almost the same as our previous estimates; as long as it is speculation, after the interest rate cut, it may start to look bearish. Meanwhile, the American side estimates that the balance sheet reduction will end next week, and the reduction of reserve interest rates has already begun. This series of moves may trigger a bull market. Therefore, in the short term, Lao Cui does not recommend that everyone short the market; you can end your short options.

Solana's DeFi locked value has reached a one-year high, reflecting accelerated ecological development. It can be seen that this decline has actually attracted more investment. Since Lao Cui's spot holdings still favor SOL, I believe many of you feel the same. The on-chain data and investment data for SOL are currently at the top among all cryptocurrencies. As long as the option to start a bull market is opened, the rise of SOL will definitely exceed expectations. You can already see clues in the fees; the initial fee is negative, which is enough to indicate that the long positions have begun to decrease significantly. This may be a precursor to the market's activation, and I hope everyone can be more patient in holding. SOL below $200 is still the first choice for your investment, and it is still a good time to buy spot now. Regarding the current betting options, Lao Cui's personal view is also to suggest that everyone try to choose the same cryptocurrencies as Lao Cui; I am not too optimistic about other cryptocurrencies in this bull market.

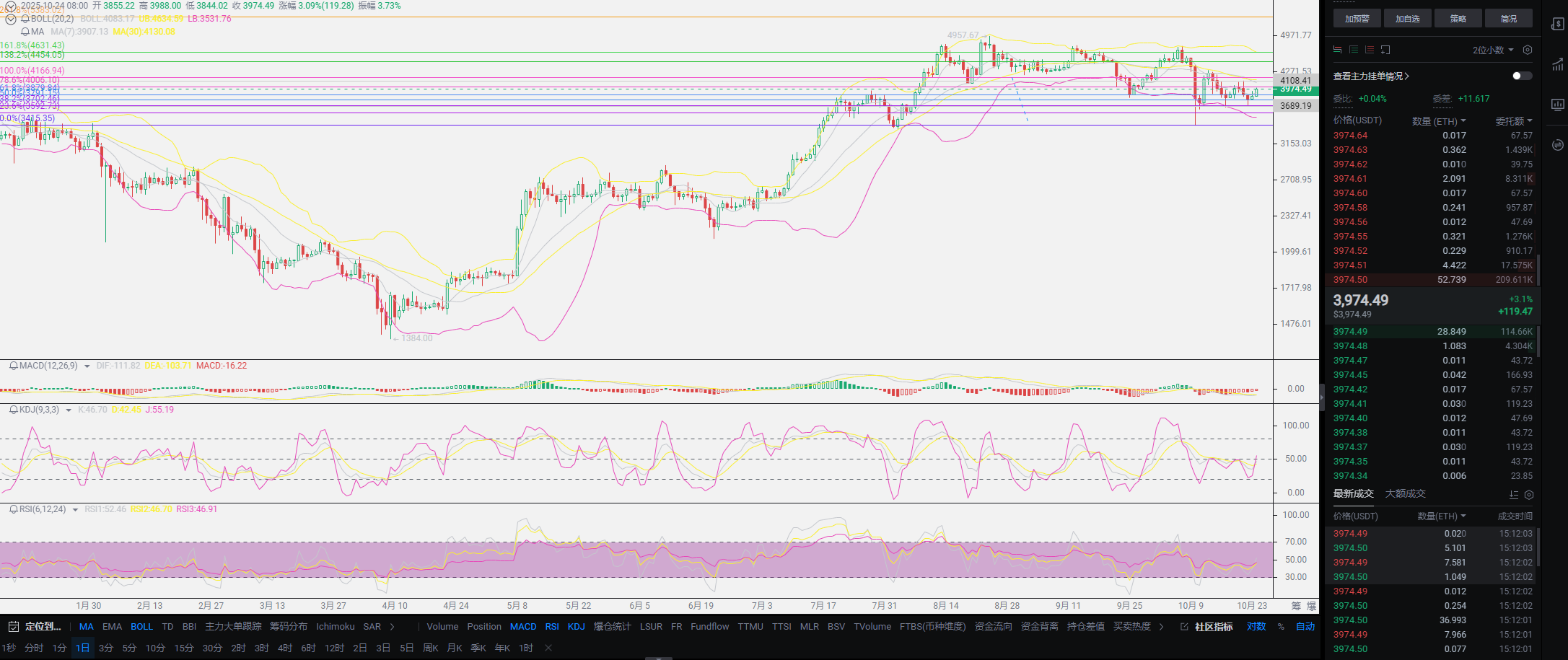

Lao Cui summarizes: Due to the recent trends, Lao Cui is not inclined to share too many views, so I will try to keep it brief. Let's talk about contract users; your choices should abandon short positions and try to enter long positions at lower levels. Lao Cui also provides a low entry point for you; the bullish choice is right-side trading. What is right-side trading? It is choosing a rebound after hitting the bottom. The recent rebound rate will be very high, and the bottoming effect will not be too obvious. As long as new daily lows appear, you can choose to enter long positions. Going long today will have a good response. The evening CPI may be the beginning of interest rate cut speculation. The combination of these two points, along with the end of balance sheet reduction, is very likely to be a reversal signal. Remember to be cautious when shorting. Especially since today's pullback is not obvious, a short-term small new high effect may occur. The CPI data will likely lean more towards interest rate cut speculation, which is favorable for interest rate cuts. Even entering long positions directly at this stage is feasible, with profits controlled around 1500 points for Bitcoin and around 100 points for Ethereum. One point I haven't mentioned, as a reminder, regarding news in the cryptocurrency market, please try to ignore the impact of Hong Kong; it is an exception! If you have questions about entering contracts, you can directly ask Lao Cui, especially regarding position allocation, which needs to be approached with caution!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory, while the novice fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。