Written by: Will A-Wang

Stablecoins have evolved from a cryptocurrency trading tool into an infrastructure. The core questions we are asked daily include: What specific use cases do stablecoins have? What capabilities can they provide that traditional fiat currencies cannot? The most natural starting point is to view stablecoins as a brand new payment infrastructure and assess their potential benefits—such as instant, 24/7 settlement—especially in the context of cross-border payments and remittances.

While clear opportunities can be seen within the existing payment ecosystem, stablecoins are further endowed with the transformative mission of driving the modernization and automation of global lending and capital markets.

The uniqueness of stablecoins lies in their position at the intersection of three massive markets: payments, lending, and capital markets.

As stablecoins enhance the efficiency of cross-border payments, they may become the cornerstone of emerging cross-border lending and the global credit system: leveraging smart contracts to connect global fund providers and demanders, automating the entire lifecycle of loan agreements.

Although integrating stablecoins as "programmable money" into mainstream finance is still in its early stages, the underlying smart contract infrastructure has been publicly deployed, tested in practice, and continuously scaled within the decentralized finance (DeFi) ecosystem. With the publicly verifiable characteristics of blockchain, we can observe and track the scale and performance of loans issued through smart contracts and denominated in stablecoins. For example, over the past five years, loans denominated in stablecoins have exceeded $670 billion cumulatively, with significant year-on-year growth.

It is said that the end of payments is lending, and thus, the potential of stablecoins, built on blockchain and smart contracts, as programmable money is highly attractive for the innovation of lending models and the enhancement of global credit accessibility.

If previous on-chain lending was more suited to cryptocurrency trading scenarios, then with the passage of stablecoin legislation, future on-chain lending will gradually become deeply embedded in real financial payment scenarios. Visa recently announced its Visa Direct service using stablecoins for prefunding, which serves as the best evidence. Visa also released a research report exploring how programmable money can reshape the global lending ecosystem after integrating with smart contract-based lending protocols—making it more transparent, efficient, and accessible.

This is also a direction we are actively exploring recently, whether in 2C global consumer finance scenarios or 2B cross-border supply chain finance scenarios. In these explorations, we have found that the demand for lending in global southern markets is far from being met! At the same time, the payment channels provided by stablecoins can greatly facilitate these demands, perhaps presenting us with a future of integrated financial payments and inclusive finance on-chain.

"The real revolution is not in electronic money, but in electronic trust." — Dee Hock, Founder of Visa

1. What is On-Chain Lending

On-chain lending is an important application scenario in the crypto ecosystem, successfully finding a strong product-market fit both on-chain and off-chain. On-chain lending is a crucial part of building a digital asset financial ecosystem, a subset of on-chain finance: a global credit market driven by stablecoins, operating 24/7, and always open.

On-chain lending replaces traditional financial institutions with smart contracts, automating financial intermediation and completely reconstructing financial services. It allows users to obtain liquidity by collateralizing assets, enabling deployment in the decentralized finance (DeFi) space and trading in both on-chain and off-chain venues.

When combined with stablecoins, these protocols can achieve new lending models through automated execution, near-instant settlement, and borderless capital flow—essentially creating a global credit market that never closes.

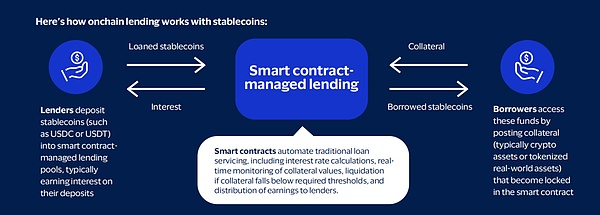

The operation of on-chain stablecoin lending works as follows:

Lenders deposit stablecoins (such as USDC, USDT) into a lending pool managed by smart contracts and earn interest on their deposits.

Smart contracts automatically complete the entire process of traditional loan services: calculating interest rates, monitoring collateral value in real-time, executing liquidation when the collateral ratio falls below the required threshold, and distributing profits to lenders.

Borrowers must provide collateral (usually cryptocurrency or tokenized real-world assets) to obtain funds, with the collateral locked in the smart contract.

1.1 The Role of Stablecoins & New Risk Models

Enhancing capital market efficiency

Smart contracts continuously monitor collateral value and automatically adjust interest rates based on supply and demand algorithms—lowering rates when capital utilization is low and raising rates when liquidity is tight.

Creating an accessible 24/7 credit market

These global markets never close, operate automatically, and all participants can see transparent pricing. Anyone with internet access can lend and borrow without the need for central authority approval.

Providing a reliable value anchor

Stablecoins maintain stability by being pegged to fiat currencies while possessing the flexibility and efficiency of programmable money, providing a trustworthy unit of valuation and settlement for both lenders and borrowers.

On-chain lending fundamentally changes the way risk is managed. Traditional lending typically assesses counterparty risk through credit checks and contract terms; on-chain lending reduces such specific risks through automatic liquidation—protocols do not need to trust the borrower's willingness to repay but rather trust that the smart contract code will enforce the loan terms.

This does not eliminate risk but transforms it:

Counterparty risk can be managed through smart contracts;

Technical risk becomes a focus. Liquidity providers no longer analyze balance sheets but must assess the security audits, governance structures, and reliability of data sources of the protocols.

1.2 Business Models of On-Chain Lending

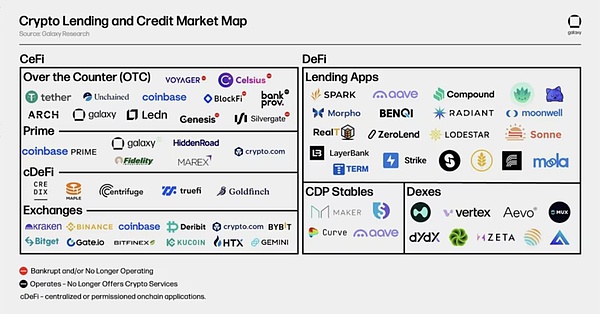

On-chain lending services are primarily provided through two channels: decentralized finance (DeFi) and centralized finance (CeFi), each with its unique characteristics and products.

Here is a brief overview of CeFi and DeFi lending:

A. Centralized Finance (CeFi)

CeFi refers to off-chain centralized financial institutions that provide cryptocurrency and related asset lending services, some of which utilize on-chain infrastructure or build their entire business on-chain. CeFi lending mainly includes the following three types:

Over-the-Counter (OTC): Off-chain trading services provided by centralized institutions, offering a range of customized lending solutions and products. OTC transactions are conducted bilaterally, allowing both parties to reach customized arrangements. Transaction terms (including interest rates, maturity dates, and loan-to-value ratios) can be adjusted based on the specific needs of both parties. These services are typically available only to qualified investors and institutions.

Prime Brokerage: A comprehensive trading platform that provides margin financing, trade execution, and custody services. Users can withdraw margin financing from the broker for other uses or keep it on the platform for trading activities. Brokers typically provide financing services only for a limited number of cryptocurrencies and crypto ETFs.

Onchain Private Credit: Allows users to pool funds on-chain and deploy them through off-chain agreements and accounts. In this case, the underlying blockchain effectively becomes a platform for crowdfunding and accounting for off-chain credit needs. Debt is typically tokenized, either as collateral or directly through tokens representing shares of the debt pool. The scope of fund usage is usually narrow.

B. Decentralized Finance (DeFi)

DeFi refers to applications driven by smart contracts running on the blockchain, allowing users to borrow against collateralized crypto assets or earn yields through lending, even obtaining leverage in trading. DeFi lending has the following characteristics: it operates 24/7, offers a wide range of borrowable assets and collateral options, and is completely transparent and auditable by anyone.

Lending Applications: On-chain applications allow users to deposit collateral assets (such as BTC and ETH) and borrow other cryptocurrencies against them. Loan terms are based on the collateral and borrowed assets provided, predetermined through the application's risk assessment. Lending through these applications is similar to traditional over-collateralized lending.

Collateral Debt Position Stablecoins: Dollar stablecoins over-collateralized by a single cryptocurrency or a group of cryptocurrencies. The principle is similar to over-collateralized lending, but a synthetic asset is generated when users deposit collateral.

Decentralized Exchanges: Some decentralized exchanges allow users to obtain leverage to amplify trading positions. Although the functionalities of decentralized exchanges vary, the role of providing margin is similar to that of CeFi brokers. However, funds typically cannot be transferred out of decentralized exchanges.

2. Key Data and Insights

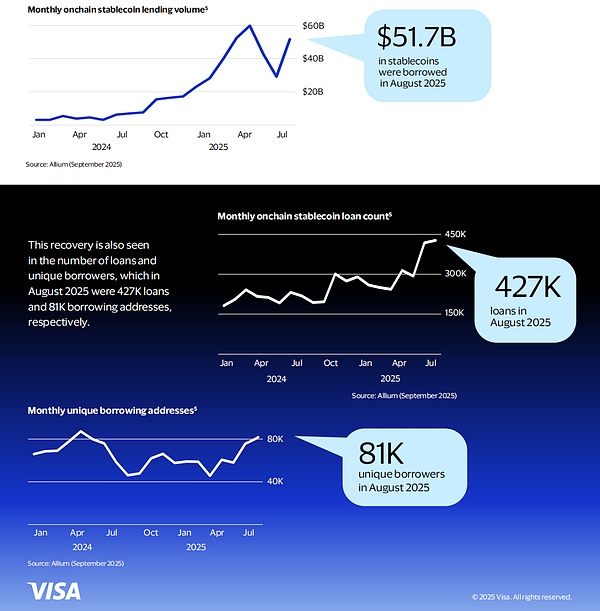

The global on-chain lending market is rapidly expanding, with a monthly scale reaching $51.7 billion in August 2025 and over 81,000 active borrowers, demonstrating the scale and growth rate of the credit market driven by stablecoins.

2.1 Transaction Volume and Borrowers

In August 2025, a total of $51.7 billion in stablecoins was borrowed, bringing the cumulative total of stablecoin lending since January 2020 to over $670 billion.

From 2022 to early 2024, on-chain stablecoin lending activities significantly declined due to the collapse of Terra Luna, FTX, and several centralized crypto lending institutions; however, it began to recover at the end of 2024 and reached new highs in recent months.

This recovery is also reflected in the number of loans and unique borrower addresses: in August 2025, the number of loans reached 427,000, with borrower addresses totaling 81,000.

2.2 Sectoral Transaction Volume

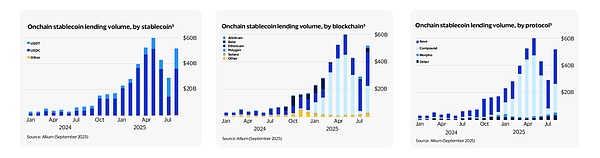

Breaking it down, USDC and USDT dominate the market, accounting for over 99% of the historical cumulative lending volume, which aligns with their combined share of over 98% in the surveyed stablecoin total supply.

In the previous cycle, lending primarily occurred on Ethereum, Avalanche, BSC, and Polygon. So far in this cycle, Ethereum and Polygon continue to lead, collectively accounting for 85% in August 2025; Base, Arbitrum, and Solana have seen their shares rise, totaling 11% during the same period.

At the protocol level, in August 2025, Aave and Compound accounted for 89% of the monthly trading volume, maintaining a long-standing lead; Morpho, which launched V1 in early 2024 and V2 in June 2025, increased its share to 4%.

2.3 Average Loan Size

During the previous downturn, the average loan amount declined, but it has rebounded with the market recovery, reaching $121,000 in August 2025, reflecting a potential increase in institutional lending demand.

2.4 Outstanding Loans and Deposits

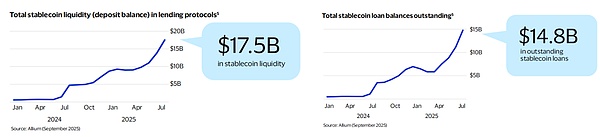

The active loan balance and the supply of stablecoins deposited in lending protocols have also rebounded, exceeding the previous peak. In August 2025, the average retained stablecoin within protocols was $17.5 billion, of which $14.8 billion (84%) was being lent out.

2.5 Interest Rate Levels

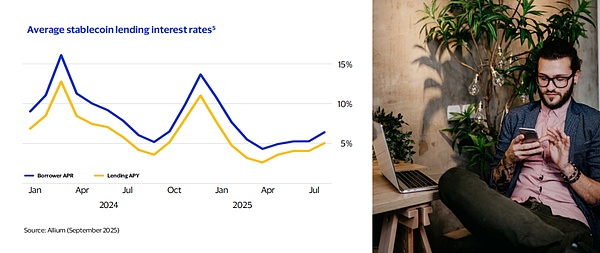

Due to price fluctuations of non-stablecoin collateral such as ETH and BTC, on-chain stablecoin lending rates have shown volatility, with annual percentage rates (APR) for borrowers ranging from below 2% to above 16%.

In August 2025, the average rates were: borrowing APR at 6.4% and deposit APY at 5.1%; these figures are close to historical averages—over the past 12 months, the average borrowing APR was 6.7% and deposit APY was 5.0%, with the historical overall average being a borrowing APR of 6.4% and deposit APY of 4.8%. This indicates that, supported by high-quality collateral, on-chain rates can differ from traditional market loan rates by only a few percentage points.

3. Key Market Participants

3.1 Historical Key Participants

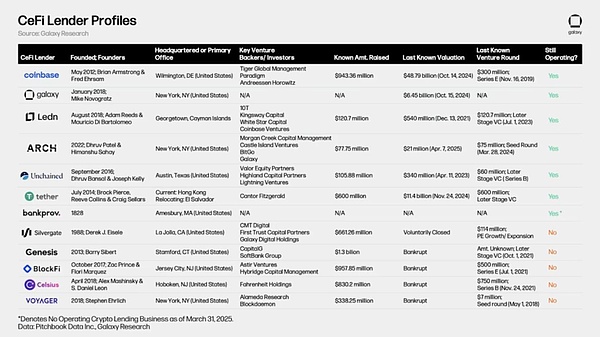

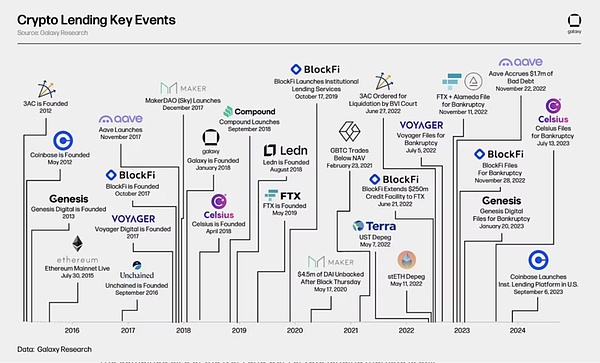

The above image highlights some of the major past and present participants in the CeFi and DeFi crypto lending markets. In 2022 and 2023, as cryptocurrency prices plummeted and market liquidity dried up, several of the largest CeFi lending institutions collapsed. Notably, Genesis, Celsius Network, BlockFi, and Voyager all filed for bankruptcy within two years. This led to an estimated 78% shrinkage in the total scale of the CeFi and DeFi lending markets from their peak in 2022 to the bear market low, with outstanding loans in CeFi lending decreasing by 82%.

The following image compares some of the largest CeFi crypto lending institutions in history. Some companies provide a variety of services to investors, such as Coinbase, which primarily operates as an exchange but also offers credit services to investors through OTC cryptocurrency loans and margin financing.

Although on-chain and off-chain crypto lending did not become widely used until late 2019/early 2020, some current and historically significant participants were established as early as 2012. Among them, Genesis is particularly noteworthy, having reached a loan scale of up to $14.6 billion and founded in 2013. On-chain lending giants like Aave, Sky (formerly MakerDAO), and Compound Finance launched on Ethereum between 2017 and 2018. The emergence of these on-chain lending/borrowing solutions was made possible by the birth of Ethereum and smart contracts, which officially launched in July 2015.

The end of the 2020-2021 bull market marked the beginning of 18 months of turmoil in the on-chain lending market, during which numerous bankruptcy events occurred. Significant events during this period included: the de-pegging of Terra's stablecoin UST, which ultimately became worthless along with LUNA; the de-pegging of the largest liquid staking token (LST) stETH on Ethereum; and the shares of Grayscale Bitcoin Trust (GBTC) beginning to trade below net asset value (NAV) after years of trading at a premium.

3.2 Innovative Lending Models Under Stablecoin Legislation

The recent surge in stablecoin lending highlights new use cases for stablecoins in on-chain finance. Protocols like Morpho aggregate global liquidity through stablecoins, optimizing the lending market; Rain, a stablecoin-linked issuer, leverages platforms like Credit Coop and Huma Finance to fund its credit projects. In addition to card solutions, Credit Coop also conducts cash flow and income-based loans, while Huma utilizes stablecoins for more efficient trade financing and faster cross-border payments. Leading lending protocols are powering card projects, cross-border payment financing, and aggregating lending markets with stablecoins, demonstrating viable commercial applications that extend beyond crypto capital market use cases.

A. Morpho

Morpho is a lending protocol that aggregates demand and liquidity across platforms. As a backend lending infrastructure, Morpho integrates with third-party platforms and wallets such as Coinbase, BitPanda, Safe, Ledger, Trust Wallet, and banks like Société Générale. With Morpho's "engine," users on these platforms can share demand and liquidity from the same pool of funds: for example, USDC borrowed by a user on Coinbase may have initially been deposited by another user of the Ledger wallet. This model replaces traditional fragmented bilateral or trilateral lending relationships with a single multi-sided lending market, enhancing lending rates and capital efficiency.

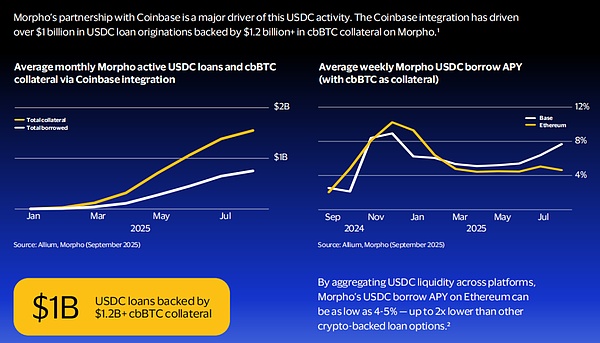

Currently, Morpho's monthly stablecoin lending volume reaches $1.7 billion, with outstanding stablecoin loans at $1.9 billion; of this, USDC accounts for $1.6 billion (90%) of the lending volume and $1.8 billion (91%) of the outstanding loans. The partnership with Coinbase is the biggest driver of this USDC activity: through the integration with Coinbase, Morpho has facilitated over $1 billion in USDC loans, collateralized by over $1.2 billion in cbBTC.

By aggregating USDC liquidity across platforms, Morpho's USDC borrowing annual yield can be as low as 4-5%, about half that of other crypto collateralized loan options.

For exchanges, wallets, and fintech companies partnering with Morpho, the protocol can also enhance user retention: in-app financial services allow users to borrow without transferring assets, rather than selling them. Since Morpho's market operates autonomously on-chain, loan and collateral information is completely transparent, providing participants with higher trust and more comprehensive information to manage market and counterparty risks.

B. Credit Coop

Credit Coop is a structured finance protocol that supports lending against on-chain cash flows as collateral. Its smart contracts allow lenders to automatically share profits from the borrower's "revenue contract"; if the borrower defaults, the contract immediately transfers 100% of that revenue stream to the lender, achieving trustless recourse.

Stablecoin credit card issuer Rain, a partner of Visa, obtains liquidity through Credit Coop: borrowing funds against the cardholder's future receivables to meet daily operations. As the issuer, Rain must settle cardholder spending amounts with Visa daily, while user repayments typically come in at the end of the month. Credit Coop's "Spigot" technology sets up programmable lockboxes for these future repayment streams, allowing Rain to borrow funds in advance without additional collateral, addressing the timing mismatch in working capital. To date, Rain has borrowed or repaid over $175 million in USDC through Credit Coop, and this number continues to accelerate as Rain's user base expands.

On the acquiring side, crypto-native payment processor Coinflow also utilizes Credit Coop to provide merchants with "instant advances for card payments that have not yet settled, with funds already received" using USDC.

Overall, Credit Coop has seen a significant increase in business volume in recent months: in August 2025, lending exceeded $30 million, with outstanding loan balances surpassing $8.8 million; particularly in August, there was a surge, with the scale on Ethereum expanding and Base chain also beginning to contribute significantly to new growth.

The repayment flows of Credit Coop are highly matched with the lending amounts (over $29 million in repayments in August 2025), as the protocol continuously collects from the borrower's income streams and distributes them instantly to lenders.

For lenders, Credit Coop offers 12-15% annualized returns, with complete transparency on-chain, allowing real-time monitoring of loan performance; at the same time, it achieves trustless recourse through programmatic control of revenue contracts. The protocol also natively integrates funding channels, enabling institutions to easily start lending and earn on-chain returns through bank wire transfers.

C. Huma Finance

Huma Finance is a "payment financing" platform that utilizes blockchain and stablecoins, specializing in compliant cross-border payment financing, stablecoin credit card financing, trade financing, and other financing solutions. Its PayFi network provides three types of stablecoin credit to businesses: revolving credit lines, accounts receivable-backed credit lines, and accounts receivable factoring limits. Currently, approved enterprises mainly use Huma to accelerate cross-border payments and vendor payments, allowing recipients to receive stablecoin funds immediately, thus eliminating prepayment, capital lock-up, and related costs and delays.

Businesses only need to pay daily during the loan balance period (usually 6-10 basis points); due to rapid capital recovery (generally 1-5 days), the same capital can be reinvested frequently, allowing funders on Huma to achieve annualized returns of over 10%.

Huma's business has significantly accelerated since the second half of 2024. Current monthly transaction volume is approximately $500 million, with lending and repayments roughly equal; active liquidity has reached $140 million, of which $98 million in PayFi assets are in outstanding loans, the vast majority of which are used for cross-border payment financing scenarios.

4. Future Opportunities Outlook

The intersection of stablecoins and on-chain lending is giving rise to three major frontier opportunities, which we expect will reshape traditional finance over the next decade.

4.1 Tokenized Assets to Unlock Collateral Pools

The tokenization of real-world assets (RWA) is opening up new frontiers for on-chain lending collateral. The market size has grown from $5 billion in December 2023 to $12.7 billion today; McKinsey predicts that by 2030, the total amount of tokenized assets could reach $1-4 trillion.

BlackRock's BUIDL fund is a prime example of institutional adoption, with its tokenized U.S. Treasury holdings reaching a record market value of $2.9 billion in May 2025, and several on-chain lending protocols have become its revenue distribution partners. Franklin Templeton's OnChain U.S. Government Money Fund (BENJI) additionally brings in $800 million in tokenized bonds, while MakerDAO has nearly 30% of its $6.6 billion balance sheet coming from real-world assets.

Corporate bonds, private credit, real estate, and other traditional assets are set to become collateral in a 24/7 global lending market, linking over $40 trillion of the traditional credit market with the efficiency and transparency of programmable money, creating new sources of liquidity for traditional assets. Large asset management firms are piloting scalable solutions, with the potential to tokenize trillions of addressable traditional assets over the next decade.

4.2 Crypto Asset Collateral to Support Next-Generation Credit Programs

Credit card programs are about to expand into a new model of "collateralized by crypto assets," opening up incremental market space. Pioneers like ether.fi are launching non-custodial credit cards, allowing users to retain asset ownership, avoid capital gains taxes, and continue to enjoy exposure to price increases while obtaining liquidity against their crypto holdings. Smart contracts monitor collateral in real-time, automatically triggering margin calls and risk management. Banks and private credit funds can act as liquidity providers, supplying institutional funds to these programs through programmable lending protocols rather than traditional credit facilities, creating new revenue opportunities for institutional investors while reducing counterparty risk through transparent, automated collateral management.

4.3 On-Chain Identity to Facilitate Large-Scale Unsecured Lending

One of the most transformative opportunities is unsecured lending based on on-chain behavior and digital identity. The current over-collateralized model, while secure, is inefficient and limits the market to borrowers who already possess significant assets. The next wave of innovation will focus on solving this problem through on-chain identity and credit scoring systems.

Emerging solutions build credit profiles by analyzing wallet transaction histories, asset holdings, and interactions with other protocols, while employing technologies like zero-knowledge proofs to protect user privacy. Platforms like 3Jane, Providence, and Credora are experimenting with credit assessment methods based on verifiable on-chain behavior, and in the future, protocols may offer unsecured or even pure credit loans based on reputation and credit history, potentially opening up entirely new serviceable markets and bringing the full spectrum of traditional credit products into this efficient on-chain framework.

4.4 Another Spring for Fintech

Whether it is the aforementioned tokenized asset/crypto asset collateralized lending (on-chain settlement logic) or credit lending logic based on on-chain and off-chain digital identities, the upgrades, iterations, and evolution of these technologies ultimately need to serve the current largest scenario holders, which aligns with the logic of stablecoin issuance & distribution. Therefore, we believe that flexible Fintech will combine innovative technologies within its scenarios to create more value, while financial institutions will need to seek a balance between regulatory compliance and innovative growth.

5. Conclusion

The evolution of the on-chain lending market represents an important milestone in the maturation of digital asset infrastructure. Lending capabilities have become a foundational pillar of both decentralized and centralized crypto finance, creating significant market mechanisms that run parallel to the traditional financial system while introducing novel technological innovations.

The autonomy and algorithmic nature of on-chain lending infrastructure establish a new paradigm for market operations, which runs transparently while implementing programmatic risk management. This technological framework represents a significant breakthrough for the traditional financial system, with the potential to enhance efficiency and reduce intermediary risks.

Looking ahead, the on-chain lending market appears ready to enter a new growth phase characterized by improved risk management frameworks, increased institutional participation, and clearer regulatory guidelines. The integration of traditional financial expertise with blockchain innovation suggests that future on-chain lending services will become increasingly mature and reliable, capable of penetrating real business scenarios while retaining the unique advantages of blockchain technology.

As the industry continues to mature, it is likely to become a bridge between traditional finance and the emerging digital asset ecosystem, facilitating broader applications of on-chain financial services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。