撰文:Seedly.eth

曾执掌全球最大加密货币交易所的币安创始人赵长鹏(CZ),在2023年底承认违反美国《银行保密法》,因未能建立有效的反洗钱计划被判4个月监禁。这位华人富豪在2024年刑满获释后,仅时隔一年便迎来命运转折——美国总统特朗普的一纸特赦令,让他重获完全自由。

这纸特赦令,对许多观察者而言是一只「靴子落地」;但它的签署,或者意味着一段更为复杂的余波才刚刚开始。

特朗普政府宣称对加密货币的「战争已经结束」,并将前任拜登政府对CZ的起诉描述为一场政治迫害。

与此同时,此事背后还浮现出特朗普家族深度涉足加密产业的复杂利益网络——一方面是CZ领衔的币安一度在美受挫,另一方面则是特朗普及其子女在加密货币领域大举进军所构建的庞大帝国。

这一切交织成当下华盛顿和华尔街之间一出令人瞠目的现实剧:金钱、权力、数字货币,以及美国最高权力核心的利益交易。

CZ被定罪:从调查和解到四个月刑期

CZ曾是加密世界最具传奇色彩的人物之一,却在美国监管铁拳下经历了命运急转直下的定罪过程。

美国司法部多年来调查币安涉嫌的反洗钱和制裁违法行为,指控其放任平台被用于可疑交易,包括恐怖组织哈马斯等参与的转账。在巨大的法律压力下,CZ于2023年11月21日与美国司法部达成认罪协议,承认未能在币安建立有效的反洗钱合规程序,违反了美国《银行保密法》(BSA) 。

作为协议的一部分,币安公司也承认相关违反行为,双方同意支付总额超过40亿美元的巨额罚款以和解——其中币安公司缴纳约43亿美元,CZ个人另付5,000万美元罚金。这一罚款规模使其成为美国史上规模最大的企业和解案之一 。

和解协议还对币安和CZ本人施加了严厉限制:CZ当场宣布辞去币安首席执行官职务,由原亚太区负责人Richard Teng接任,并同意接受终身行业禁令,永久不得参与管理或运营币安全球业务,尤其不得在币安美国公司担任任何高管职务 。

币安则需接受为期三年的独立合规监察,以确保其运营符合法律要求 。值得一提的是,CZ成为美国历史上首位仅因单一BSA指控而获刑入狱的人 。在2024年4月30日的量刑听证上,西雅图联邦法官最终判处CZ入狱4个月 。

这一刑期看似不长,却具有标志性意义——显示监管当局决心将加密巨头绳之以法,也一度令全球加密行业人心惶惶。

服刑期间,CZ被关押在美国联邦监狱。直到2024年9月,他刑满获释,结束了四个月的铁窗生涯 。

此时的CZ在名义上已不再担任币安任何职务,币安也因为认罪和法规问题被禁止在美国境内开展业务 。昔日呼风唤雨的加密首富骤然跌落谷底,个人声誉和商业帝国均遭重创。

出狱后的CZ:沉寂抑或暗流涌动?

CZ出狱后最初一段时间选择保持低调,远离公众视线。

但表面的沉寂之下,社交媒体和行业传闻显示他并未完全退出币圈舞台。2025年初,有关特朗普政府可能特赦CZ的流言悄然兴起,一度在推特(现称X平台)等社交媒体上传播。

对此,CZ本人积极回应媒体报道并参与公共讨论,展现出他的影响力并未因入狱而彻底消退。

2025年3月,《华尔街日报》突然爆出猛料:特朗普家族的代表从2024年起一直与币安方面密洽,讨论由特朗普家族收购币安美国分公司部分股权,同时透露CZ正寻求总统特赦 。这篇报道震动业界,也将CZ再次推上风口浪尖。

当日,CZ迅速在X平台发声予以驳斥:「很抱歉让大家失望了,《华尔街日报》的报道搞错了事实。事实是:我没有和……任何人讨论过收购币安美国的交易。」 然而,话锋一转,CZ又坦言:「没有重罪犯会介意获得赦免,尤其我是美国历史上唯一因为单一BSA指控而入狱的人。」 这番话被视为其默认确有特赦想法。CZ还进一步暗示那篇报道带有政治动机,称其感觉像是在「攻击特朗普总统和加密货币」,「拜登政府对加密货币的战争遗留势力仍在运作」 。

到了2025年5月初,CZ开始更公开地表达寻求特赦的意愿。

他在5月7日参加一档播客节目时首度证实,自己已经正式向特朗普政府递交了总统特赦申请 。CZ解释说,之所以提交申请,是因为既然主流媒体都在报道此事,「那不如干脆正式提出请求」。据他透露,申请于3月下旬至4月上旬提交,即相关报道见报后两周内完成 。

这一时期,细心的观察者还发现CZ在社交平台个人简介中悄然移除了「前@Binance CEO」的字样——此举被视为其对未来身份转变的某种暗示,也引发了外界对他「东山再起」的种种揣测。

2025年8月,美国媒体进一步披露CZ为获取特赦所做的努力:他于8月13日聘请了一位与特朗普长子小唐纳德·特朗普关系密切的游说人士Ches McDowell,在华盛顿游说特赦事宜。这一消息坐实了CZ在幕后积极运作的猜测。

与此同时,加密社区对CZ命运的关注达到高潮:去中心化预测市场Polymarket上围绕「CZ能否获特赦」的赌注激增,10月中旬押注成功的概率曾飙至64% 。甚至有加密圈人士创造了「币安人生」等网络迷因,戏称CZ若获自由将继续他与币安难解难分的人生旅程。

特朗普突然特赦:白宫干预与政治风暴

2025年10月22日,特朗普总统在白宫签署对CZ的特赦令,并于次日向公众宣布这一决定。白宫新闻秘书卡罗琳·莱维特通过声明表示:「总统行使宪法赋予的权力,赦免了在拜登政府针对加密货币的战争中被起诉的CZ先生。拜登政府对加密货币的战争已经结束。」

特朗普政府此举等于宣告正式终结前朝对加密行业的高压监管,并公然为CZ平反。特朗普本人据称对CZ及其他业内人士「蒙受迫害」的说法一直持同情态度,多位接近特朗普的消息人士称他认为针对CZ的案件「相当薄弱,绝不该上升到重罪指控和监禁的程度」 。

特赦消息一出,立刻在华盛顿引发激烈的政治反应。支持者认为这体现了特朗普拥抱创新、纠正前朝错误的决心,而批评者则痛斥这是一场赤裸裸的利益交换,严重破坏法治和道德规范。在野的民主党人士尤为愤怒。参议院银行业委员会资深委员伊丽莎白·沃伦等多位民主党参议员在特赦宣布后火速发表联合声明,直指特朗普政府纵容加密犯罪、削弱金融监管 。沃伦早在5月,当特朗普家族的加密企业与币安牵涉巨额交易时就曾警告称:「一个外国政府支持的基金宣布将用特朗普的稳定币达成20亿美元交易,而参议院正准备通过所谓‘GENIUS法案’——这部稳定币立法将让总统及其家人更容易中饱私囊。这就是腐败行径,没有任何一位参议员应该支持。」 在她看来,特朗普赦免CZ的背后暗含着巨大利益输送和冲突。

共和党阵营则基本欢迎这一举措,认为拜登时期对CZ的处理是过度执法的体现。

特朗普政府官员和支持者强调,CZ的罪名在其他金融业高管身上通常不会被判监禁,认定拜登政府出于敌视加密行业的政治动机「选择执法」,而特朗普只是及时纠正了这一不公。 特朗普的新任财政部长在接受采访时甚至表示:「对加密行业的战争已经画上句号,美国将致力于成为全球加密资本。」市场也对此迅速反应:特赦消息公布后,币安交易所发行的BNB代币价格瞬间拉升,短短数小时内从1083 USDT上涨到1160 USDT,涨幅达6.7% 。

可以说,此次特赦在政界和舆论场掀起了一场风暴,也在资本市场激起了阵阵涟漪。

从法律形式上看,总统特赦意味着CZ的联邦罪名将被免除,由此衍生的处罚限制也可能一笔勾销 。法律专家指出,总统享有美国宪法赋予的最高赦免权,可以赦免联邦罪行的定罪和刑罚。因此,特朗普的特赦不仅让CZ免受进一步法律后果,还可能解除他与司法部认罪协议中所承诺的若干限制条款 。这意味着CZ理论上有机会重新掌控自己一手缔造的加密帝国 ——这一点令支持者振奋,却令监管强硬派深感忧虑。

特朗普家族的加密版图:NFT、代币与隐秘利益网络

CZ案的跌宕起伏背后,特朗普及其家族在加密货币领域的迅速崛起成为贯穿始终的暗线。

特朗普虽曾在2019年公开表示对比特币「不感兴趣」,但在离开白宫后的几年里却摇身一变成为加密圈的积极参与者。尤其是2024年重返政坛竞选期间,特朗普一改过去姿态,高调拥抱数字货币:他不但公开宣称要让美国政府持有的比特币永不出售、将比特币列为国家战略储备资产,还通过官方网站宣布接受加密货币捐款以支持竞选 。更重要的是,特朗普家族开始将「Trump」这一金字招牌商业化,深度嵌入到一系列NFT和加密代币项目中,构建出一个跨政商两界的加密商业帝国。

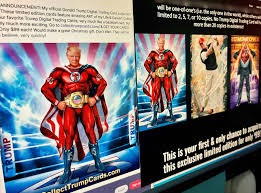

首先是在NFT领域。2022年12月,特朗普推出了第一套个人NFT系列——「特朗普数字交易卡」,每张售价99美元。

这些NFT卡以特朗普扮演超级英雄、宇航员、西部牛仔等夸张形象为卖点,上线即引发抢购,在18小时内售罄,销售额达445.5万美元 。尝到甜头的特朗普此后陆续发行了四套NFT系列,总计售出超过20万枚数字收藏卡,直接销售收入累计逾2,200万美元 ;再加上二级市场交易的版税分成,保守估计其NFT项目已为特朗普带来超过800万美元净利润 。特朗普成功将自己的个人IP转化为区块链上的热销品,不仅填充腰包,也培育了庞大的加密支持者社群。

然而,与NFT相比,特朗普家族在代币和加密金融领域的布局影响更加深远。2024年9月,特朗普的两个儿子小唐纳德·特朗普(Donald Trump Jr.)和埃里克·特朗普(Eric Trump)高调宣布进军数字资产市场,创立了一家名为「世界自由金融」(World Liberty Financial,简称WLF)的加密公司 。10月,该公司推出首款加密货币——WLFI代币,并大肆宣称这种代币将由特朗普家族背书、赋予持有人参与公司决策的「股东式」权益 。尽管最初发行反响平平,到2024年10月底仅售出价值270万美元的WLFI 。

但时来运转:2024年11月特朗普赢得总统大选后,WLFI需求骤然飙升。伴随特朗普胜选的东风,WLF公司在2025年初吸引到多笔巨额融资和代币认购。数据显示,WLF迄今共进行了8轮私募融资,筹集资金至少5.9亿美元,WLFI代币场外交易推算其完全稀释市值一度高达约1,230亿美元 。

WLF之所以估值爆棚,一个重要原因在于其打通了白宫与币圈的隐秘通道:特朗普现任总统的身份为这家家族企业带来了无与伦比的「政策背书」。根据WLF公司披露和媒体调查,特朗普本人透过家族信托持有WLF 60%的股权,并享有公司代币销售收入75%的分成 。

特朗普的两个儿子则直接参与管理运营,担任所谓「Web3大使」,与几位资深加密创业者联合掌舵日常业务 。更令人瞠目的是,WLF以预留巨额代币的方式锁定了家族利益:特朗普家族及其关联方被直接分配了225亿枚WLFI代币(占代币总量的22.5%) 。短短不到一年时间,《纽约客》估计特朗普家族通过这一项目已获利约4.125亿美元 。可以说,特朗普家族俨然将白宫「First Family」的政治影响力,转化为了币圈炙手可热的「一级资本」。

除发行WLFI代币外,WLF公司还于2025年3月推出了一款锚定美元的稳定币USD1,声称由美国国债和现金资产100%背书 。

在特朗普重新入主白宫仅一个多月后,这款稳定币便在一笔重磅国际交易中登上舞台:阿布扎比国家安全顾问塔努恩·本·扎耶德旗下的主权投资企业MGX宣布,将使用价值20亿美元的USD1来收购币安交易所的部分股权 !WLF联合创始人扎克·维特科夫(Zach Witkoff)在迪拜加密大会上兴奋地公开此消息,称「USD1已被选为MGX 20亿美元投资币安的官方稳定币」 。

值得注意的是,扎克正是特朗普的中东特使、老友史蒂夫·维特科夫之子 。而现场与扎克同台出席的,还有特朗普的次子埃里克·特朗普和亚洲加密富豪、波场创始人孙宇晨。

MGX交易的曝光在美国政坛引发强烈质疑:一方面,外国政府背景的阿联酋主权基金透过特朗普家族企业发行的稳定币,向因洗钱案受罚的币安注入巨资;另一方面,特朗普政府几乎同时批准向塔努恩掌控的公司出口价值数亿美元的尖端芯片设备,尽管国安机构担心这些芯片可能流入中国 。

这样的巧合引发媒体和监督机构质问——特朗普政府是否在以国家利益交换家族生意利益?美国《纽约时报》的深度调查称WLF业务「打破了私营企业与政府政策之间的界限,在现代美国史上前所未见」 。报道揭露WLF曾暗中接受外国投资者的巨额款项及数字货币交换,以换取接近特朗普的门径,并指出至少有一宗针对相关人士的调查在支付完成后被撤销 。例如,中国加密富豪孙宇晨在2025年初斥资至少7,500万美元入股WLF并担任顾问 ,随后美国证券交易委员会(SEC)暂停了对孙旗下公司的调查 。诸如此类的利益关联,让特朗普家族的加密帝国蒙上一层浓厚的利益冲突阴影。

特朗普家族的加密历程中还有一个耐人寻味的篇章——特朗普个人的 Meme 币。就在他第二任期就职前夕,特朗普团队于2025年1月17日意外发布了一款名为$TRUMP的迷因代币(meme coin) 。该代币在Solana链上发行,总量10亿枚,其中20%通过ICO公开售出,其余80%由特朗普家族旗下公司持有 。$TRUMP发行不到一天,市值即暴涨至270亿美元,使特朗普持有的代币市值超过200亿美元 。

尽管这一估值虚高难以持续,但据《金融时报》分析,该项目在数月内仍为特朗普带来了至少3.5亿美元的真金白银收益 。更令人关注的是,特朗普在重返白宫后多次公开吹捧$TRUMP代币价值,并采取行政措施推高其价格,这直接导致他的个人净资产大幅增长。伦理学家对此口诛笔伐,称特朗普身为总统却推广私人加密项目、操纵政策有利于自家代币,已构成前所未有的利益冲突。然而特朗普的发言人则辩称,总统的商业资产已由其子女托管经营,因此「没有利益冲突」 。

特赦疑云:选票交易抑或金钱输送?

综合上述,多方迹象表明特朗普赦免CZ并非单纯出于政策理念,而很可能涉及选票交换和利益输送的盘算。在2024年大选中,加密行业从业者和投资人被视为一支不可忽视的新兴政治力量。拜登政府时期对加密市场的严厉监管激怒了不少币圈人士,特朗普敏锐地捕捉到这股民意,将自己塑造成「加密总统」,承诺上台后解放加密生产力 。据报道,特朗普竞选阵营不仅获得了一些加密巨鲸和机构的捐款支持 ,更通过高调涉足NFT和代币向加密社区传递善意。

他本人重返白宫首月即签署多项有利于加密行业的行政令,例如推动国会放松稳定币监管的「GENIUS法案」,邀请温克莱沃斯双胞胎等知名加密企业家到白宫参加「美国加密复兴」主题活动 。在这样的背景下,赦免CZ无疑进一步巩固了特朗普在加密圈的声望和票源。CZ在全球拥有大批粉丝和客户,特朗普特赦他被视为向整个加密社群释放友好信号,意在笼络这一新兴选民群体。

另一方面,不容忽视的是特朗普家族的海外金主在CZ案上的潜在利益。币安作为全球性的交易平台,与无数国际资本存在千丝万缕的联系,其中就包括前文提到的阿布扎比MGX基金和孙宇晨等海外投资者。

这些人既是CZ业务帝国的重要伙伴,也是特朗普加密企业的座上宾。从MGX用特朗普稳定币投资币安、到特朗普政府向阿联酋输送高科技芯片,再到孙宇晨投资特朗普公司换取SEC网开一面,整条链条中利益互换的意味昭然若揭 。特朗普对CZ的赦免,很可能是这场跨国利益博弈中的关键一环:一旦CZ恢复自由,其影响力和资源都将回流市场,间接惠及与特朗普家族结盟的海外资本。有人猜测,正是这些幕后的利益相关方积极游说甚至施压,才推动了特朗普最终拍板特赦CZ。

目前尚无直接证据证明特朗普收受金钱交换特赦,但大量细节已令舆论高度警惕。美国众议院少数党领袖呼吁对特朗普特赦CZ的决定启动调查,审视其中是否存在以权谋私或利益交换行为。政府伦理监督组织也纷纷发声,要求透明公布特朗普家族加密投资的情况和决策过程,以澄清总统行为是否受私人商业利益影响。可以说,CZ特赦事件已超越司法范畴,上升为一次对美国政治清廉与法治底线的拷问。

监管冲击与全球格局:加密行业路在何方

CZ案件和特朗普特赦的余波,正深刻地影响着美国乃至全球加密行业的监管走向和市场格局。在美国国内,特朗普的上台标志着联邦政府对加密货币政策的180度转向:证券交易委员会(SEC)等机构纷纷放缓甚至撤回对加密企业的诉讼行动。例如,SEC曾于2023年对币安提起民事诉讼,但在特朗普就任总统后不久便撤销了该案 。监管部门负责人也大多更换为对加密持开放态度的人选,「安全港」「豁免」成为关键词。这让此前战战兢兢寻求合规的美国加密企业松了一口气。《福布斯》报道称,2025年已有多家加密交易所(如Winklevoss兄弟创办的Gemini和Bullish)成功上市,加入Coinbase行列 。比特币价格在2025年屡创新高,一度突破12.6万美元,市场人士直呼「寒冬已过,牛市重启」 。可以说,特朗普政府的上任和一系列友好举措,令美国加密行业出现了久违的复苏景象。

然而,这种监管环境的骤变也引发合规趋势的复杂变化。

一方面,美国放松管制释放红利,吸引资本与项目回流,加密创业和投融资活动急剧升温。据统计,仅2025年第三季度,全球加密领域的并购交易额就突破了100亿美元,同比激增30倍 。不少华尔街传统巨头(如摩根大通、贝莱德等)趁势大举进军加密市场,推出受监管的比特币基金、现货ETF等产品。监管障碍的缓解和政策背书,使这些金融机构愿意深度参与加密领域 。这又进一步刺激了行业整合,像21Shares这样的资管公司被并购,加密原生企业为巩固护城河也掀起了收购浪潮 。总体来看,美国在特朗普主导下正努力打造「全球加密资本」,试图让合规的资金与技术在本土汇聚,从而在下一轮创新中占据主动。

但另一方面,美国监管的突然宽松也引发了外界对风险失控和监管套利的担忧。

欧洲和亚洲一些国家选择保持审慎,甚至加固监管篱笆,以防范美国政策转向带来的投机风险。例如,欧盟在2024年推出的MiCA监管框架依然严格执行,对稳定币发行人资本要求、交易所运营规范等毫不松懈。相比之下,美国如今对大型加密企业的执法力度明显减弱,连CZ这样因反洗钱问题定罪的人都能被迅速赦免回归。这被批评人士形容为「开历史倒车」。有金融犯罪专家警告称,美国的软化态度可能滋长行业侥幸心理,一些企业会放松内部合规,因为他们看到即使踩线也有可能逃过制裁甚至通过政治途径翻案。这对全球反洗钱、反恐融资体系是潜在威胁,其他司法管辖区可能不得不与美国在加密监管上「各行其是」,全球监管协调难度加大。

对于币安这样的国际平台来说,美国政策转变无疑是重大的转机。币安尽管在2023年遭受重挫退出美国市场,但凭借特朗普的特赦和监管松绑,或许有机会卷土重来。分析人士指出,币安美国公司原本陷入瘫痪状态,如今可能迎来特朗普家族的投资入股,实现「曲线救场」 。更值得注意的是,CZ个人的行为空间显著增大。如果他真要重返行业领导岗位,特朗普赦免扫清了主要法律障碍。当然,这需要看CZ与美国监管当局未来的微妙关系:在特朗普政府时期他或许平步青云,但若政权再度更迭,他和币安依然可能面临清算风险。这种不确定性也折射出美国加密监管的政治化隐忧——企业的兴衰竟与白宫易主高度相关,长远来看不利于行业稳定。

在国际市场格局上,CZ案与特朗普特赦同样带来连锁反应。亚洲和中东资金正积极捕捉这一机遇,加紧在全球加密版图中布局。阿布扎比、新加坡、香港等地的机构投资者过去担心触碰美国红线而对币安保持距离,如今则可能因为特朗普的态度转变而放胆与之合作。

币安自身也或将在合规与灰色地带之间寻找新的平衡:既然美国市场重新露出曙光,币安势必投入资源重建合规形象、修补与美国监管的关系,同时巩固其在非美国市场的霸主地位。在Coinbase、Gemini等美资交易所因政策利好向海外扩张之际,币安如果能够重新获得一定的美国准入,无疑将稳固其全球龙头的位置。

结语

CZ的故事看似告一段落,但由此引发的讨论却远未结束。

这件事之后,所有人都看得更清楚了。美国的监管逻辑并非铁板一块,它会在权力博弈中松动,也会在产业压力下调整。而加密世界也不再是那个可以完全置身事外的孤岛,它必须学会在政策的缝隙中生存,甚至主动参与规则的制定。

特朗普的特赦令,与其说是一个终点,不如说是一个全新的开局。它让市场看到政治对加密行业的巨大影响力,也让各国监管机构意识到——对待这个新兴领域,或许需要比想象中更灵活的策略。

CZ重获自由,但加密世界与主流社会的这场漫长磨合,还远远没有走到终点。唯一确定的是,未来的每一次技术突破、每一次政策调整,都将继续考验着各方智慧。这条路会通向何方,没有人能提前剧透。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。