Written by: Daniel Kim, Ryan Yoon, Jay Jo

Translated by: Shaw Golden Finance

This report presents Tiger Research's outlook for Bitcoin in the fourth quarter of 2025, targeting $200,000. The rationale includes institutional investors continuing to buy amid market volatility, the Federal Reserve's interest rate cuts, and the October crash confirming the dominance of institutions in the market.

Key Points

- Institutional investors continue to accumulate during volatility—third-quarter ETF net inflows remain stable, with MSTR increasing its holdings by 388 Bitcoins in a single month, reinforcing long-term investment beliefs;

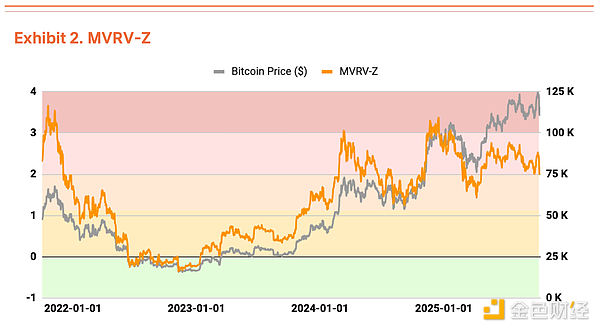

- Overheated but not extreme—MVRV-Z index stands at 2.31, indicating high valuation but not at extreme levels; the clearing of leveraged funds has removed short-term traders, creating space for the next wave of increases;

- Global liquidity environment continues to improve—broad money supply (M2) surpasses $96 trillion, reaching a record high, with expectations of further interest rate cuts from the Federal Reserve, anticipated to occur 1-2 more times this year.

Institutional Investors Buy Amid US-China Trade Uncertainty

In the third quarter of 2025, the Bitcoin market slowed from a strong upward trend in the second quarter (quarter-on-quarter growth of 28%) to a volatile sideways phase (quarter-on-quarter growth of 1%).

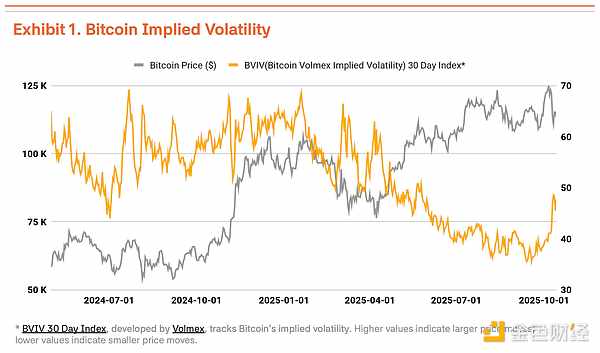

On October 6, Bitcoin reached an all-time high of $126,210, but the Trump administration's renewed trade pressure on China led to an 18% price correction to $104,000, significantly increasing volatility. According to Volmex Finance's Bitcoin Volatility Index (BVIV), Bitcoin's volatility narrowed from March to September as institutional investors steadily accumulated, but surged 41% after September, exacerbating market uncertainty (Chart 1).

Driven by the resurgence of US-China trade frictions and Trump's tough rhetoric, this correction appears temporary. The strategic accumulation led by Strategy Inc. (MSTR) is actually accelerating. The macro environment has also played a supportive role. The global broad money supply (M2) has surpassed $96 trillion, reaching a record high, while the Federal Reserve lowered interest rates by 25 basis points to 4.00%-4.25% on September 17. The Fed hinted at 1-2 more rate cuts this year, with a stable labor market and economic recovery creating favorable conditions for risk assets.

Institutional capital inflows remain strong. Third-quarter Bitcoin spot ETF net inflows reached $7.8 billion. Although this is lower than the $12.4 billion in the second quarter, the net inflow throughout the third quarter confirms the steady buying by institutional investors. This momentum continued into the fourth quarter—recording $3.2 billion in just the first week of October, setting a new weekly inflow record for 2025. This indicates that institutional investors view price corrections as strategic entry opportunities. Strategy continued to buy during the market correction, purchasing 220 Bitcoins on October 13 and 168 Bitcoins on October 20, totaling 388 Bitcoins in one week. This shows that regardless of short-term volatility, institutional investors firmly believe in Bitcoin's long-term value.

On-Chain Data Signals Overheating, Fundamentals Unchanged

On-chain analysis reveals some signs of overheating, but valuations are not concerning. The MVRV-Z metric (market cap to realized value ratio) is currently in the overheated zone at 2.31, but has stabilized compared to the extreme valuation range approached in July-August (Chart 2).

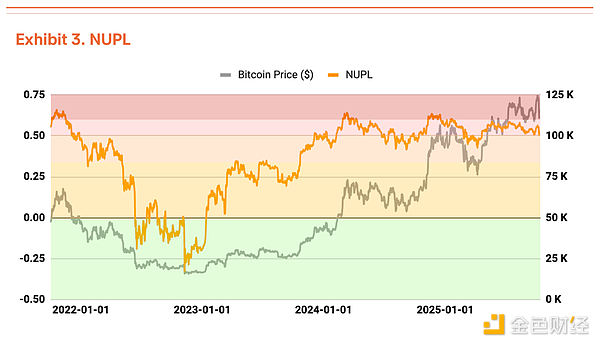

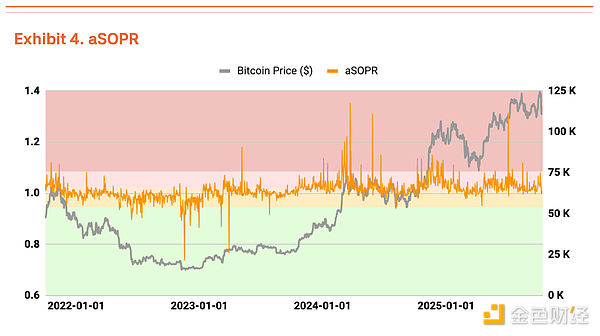

The Net Unrealized Profit/Loss (NUPL) also shows signs of overheating, but has eased from the high unrealized profit status of the second quarter (Chart 3). The Adjusted Spent Output Profit Ratio (aSOPR) reflects investors' realized profits and losses, which is very close to the equilibrium value of 1.03, indicating no cause for concern (Chart 4).

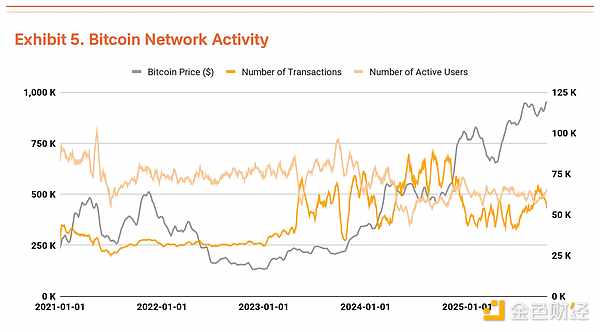

The number of Bitcoin transactions and active users remains at similar levels to the previous quarter, indicating a temporary slowdown in network growth momentum (Chart 5). Meanwhile, total transaction volume is on the rise. A decrease in transaction count but an increase in transaction volume means larger amounts are being transferred in fewer transactions, indicating an increase in large capital flows.

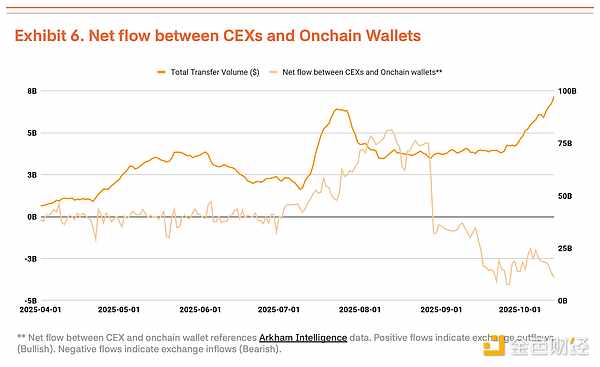

However, we cannot simply view the expansion of transaction volume as a positive signal. Recently, there has been an increase in funds flowing into centralized exchanges, which typically indicates that holders are preparing to sell (Chart 6). In the absence of improvements in fundamental indicators such as transaction count and active users, the rise in transaction volume more reflects short-term capital flows and selling pressure in a high-volatility environment, rather than an expansion of genuine demand.

The October 11 Crash Proves the Market Has Shifted to Institutional Dominance

The crash on centralized exchanges on October 11 (down 14%) proves that the Bitcoin market has shifted from retail dominance to institutional dominance.

The key point is that the market reaction is markedly different from before. In a similar environment at the end of 2021, panic among retail investors spread, leading to a crash. This time, the correction was limited. After large-scale liquidations, institutional investors continued to buy, indicating that they are firmly defending the market's downside. Furthermore, institutions seem to view this as a healthy consolidation, helping to eliminate excessive speculative demand.

In the short term, the chain reaction of selling may lower the average purchase price for retail investors and increase psychological pressure, potentially exacerbating volatility due to market sentiment being affected. However, if institutional investors continue to enter during the sideways consolidation, this correction may lay the groundwork for the next round of increases.

Target Price Raised to $200,000

Using our TVM method for third-quarter analysis, we derive a neutral benchmark price of $154,000, up 14% from $135,000 in the second quarter. Based on this, we applied a -2% fundamental adjustment and a +35% macro adjustment, resulting in a target price of $200,000.

The -2% fundamental adjustment reflects a temporary slowdown in network activity and an increase in deposits to centralized exchanges, indicating short-term weakness. The macro adjustment remains at 35%. The global liquidity expansion and continued institutional capital inflows, along with the Federal Reserve's dovish stance, provide a strong catalyst for increases in the fourth quarter.

Short-term corrections may stem from signs of overheating, but this represents a healthy consolidation rather than a trend or shift in market perception. The continued rise in benchmark prices indicates that Bitcoin's intrinsic value is steadily increasing. Despite temporary weakness, the medium to long-term upward outlook remains solid.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。