Written by: Bitget Wallet

Introduction

From the casual discussions about "whether Zelensky wears a suit" to the global focus on the U.S. elections and the Nobel Prize allocations, the prediction market has periodically "caught fire." However, since Q3 2025, a real storm seems to be brewing:

In early September, industry giant Polymarket received regulatory approval from the U.S. CFTC, returning to the U.S. market after three years;

In early October, the parent company of the New York Stock Exchange, ICE, proposed to invest up to $2 billion in Polymarket;

In mid-October, the weekly trading volume of the prediction market reached a historic high of $2 billion.

The massive waves of capital, the opening of regulations, and the market's excitement have all arrived simultaneously, accompanied by rumors of Polymarket's token launch—where does this wave come from? Is it merely another brief hype, or is it a "value singularity" in a new financial track? Bitget Wallet Research will delve into the underlying logic and core value of the prediction market in this article, and provide a preliminary assessment of its core dilemmas and development directions.

1. From "Distributed Knowledge" to "Dual Oligopoly": The Evolution of the Prediction Market

The prediction market is not a unique creation of the crypto world; its theoretical foundation can even be traced back to 1945. Economist Hayek proposed in his classic discourse that scattered, localized "distributed knowledge" can be effectively aggregated by the market through price mechanisms. This idea is considered the theoretical cornerstone of prediction markets.

In 1988, the University of Iowa launched the first academic prediction platform—the Iowa Electronic Markets (IEM), which allowed users to trade futures contracts on real-world events (such as presidential elections). Over the following decades, extensive research has generally confirmed that a well-designed prediction market often surpasses traditional opinion polls in accuracy.

However, with the emergence of blockchain technology, this niche tool found new soil for scaling. The transparency, decentralization, and global accessibility of blockchain provided an almost perfect infrastructure for prediction markets: automated settlement through smart contracts can break the entry barriers of traditional finance, allowing anyone globally to participate, thus greatly expanding the breadth and depth of "information aggregation." The prediction market has gradually evolved from a niche gambling tool into a powerful on-chain financial sector, deeply binding with the "crypto market."

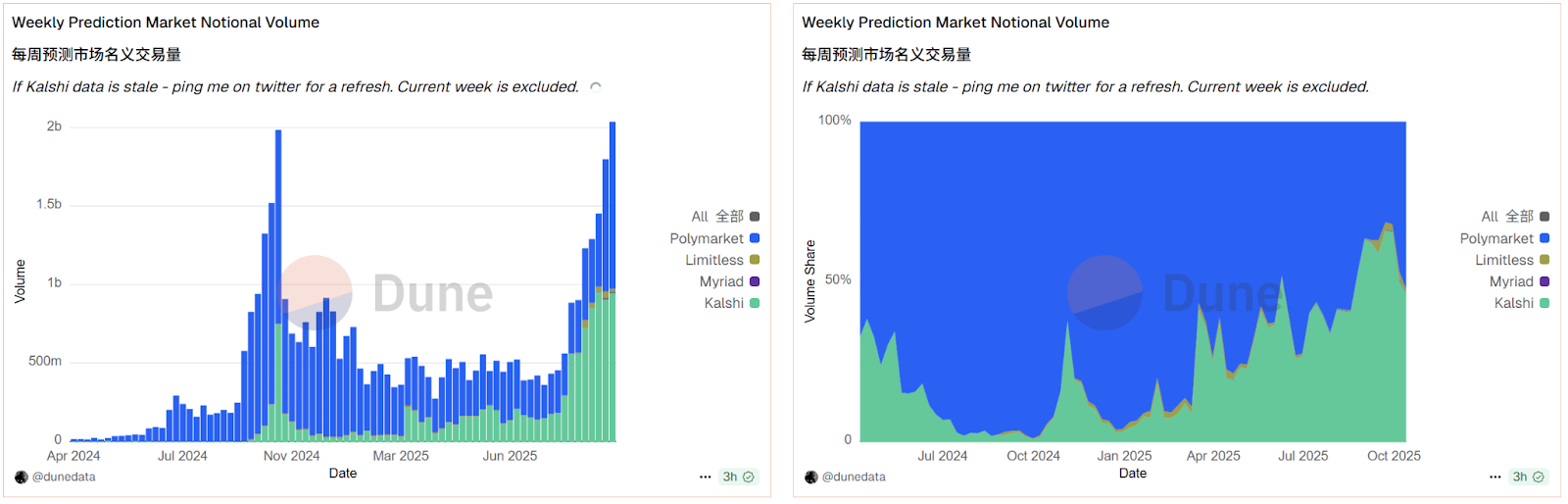

Data Source: Dune

Data from the Dune platform intuitively confirms this trend. On-chain data shows that the current crypto prediction market has exhibited a highly monopolized "dual oligopoly" pattern: Polymarket and Kalshi together account for over 95% of the market share. With the dual benefits of capital and regulation, this sector is being activated as a whole. By mid-October, the total weekly trading volume of the prediction market surpassed $2 billion, exceeding the historical peak before the 2024 U.S. elections. In this explosive growth, Polymarket, with its key regulatory breakthrough and potential token expectations, has temporarily gained an edge in the fierce competition with Kalshi, further solidifying its leading position.

2. "Event Derivatives": Beyond Gambling, Why is Wall Street Betting?

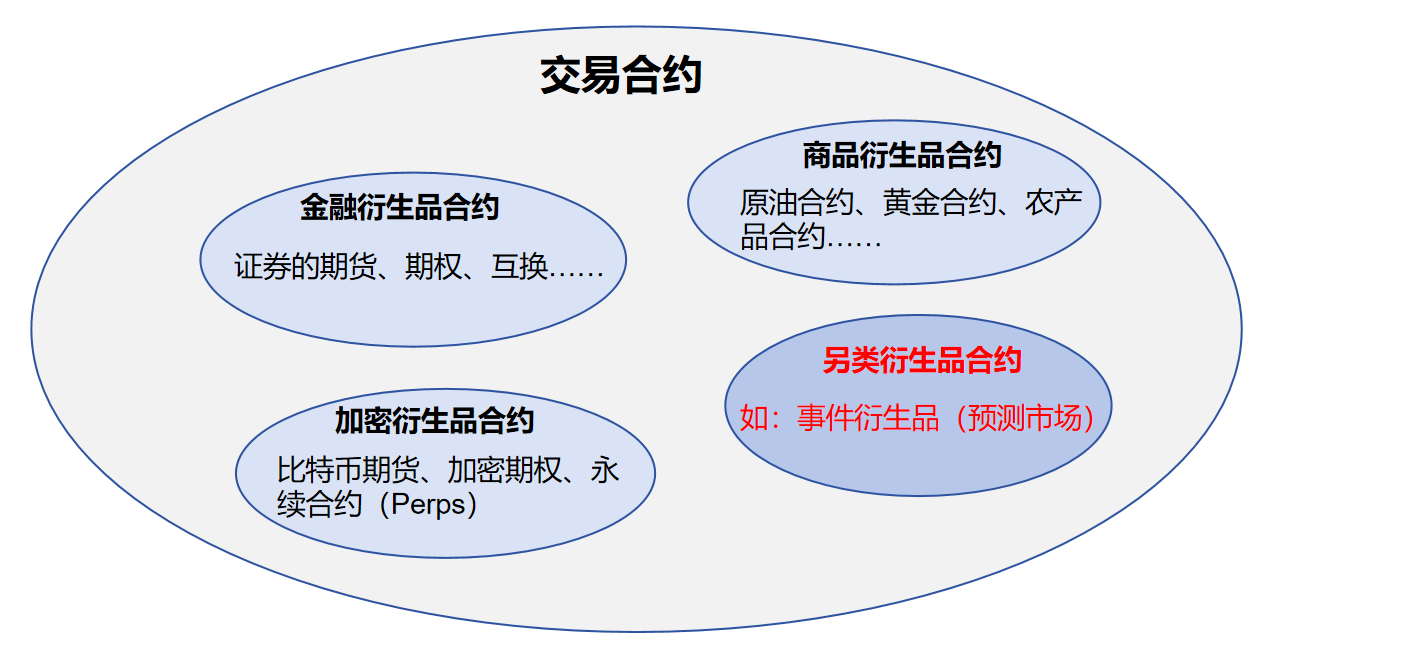

To understand why ICE is heavily investing in Polymarket, one must strip away the "gambling" facade of the prediction market and see its core as a "financial tool." The essence of the prediction market is an alternative trading contract (Contract), belonging to a type of "event derivatives."

This differs from the "price derivatives" we are familiar with, such as futures and options. The latter's trading targets the future prices of assets (like crude oil or stocks), while the former's trading targets the future outcomes of specific "events" (like elections or climate). Therefore, the contract price represents not the asset value, but the market's collective consensus on the "probability of the event occurring."

With the support of Web3, this difference is further amplified. Traditional derivatives rely on complex mathematical models like Black-Scholes for pricing and settle through brokers and centralized exchanges; whereas on-chain prediction markets automatically execute through smart contracts, driven by oracle mechanisms, with pricing (like AMM algorithms) and liquidity pools being completely transparent on-chain. This greatly lowers the entry barriers but also introduces new risks (such as oracle manipulation and contract vulnerabilities), contrasting sharply with the counterparty risks and leverage risks of traditional finance.

Comparison Table of Prediction Markets and Traditional Financial Derivatives

| Web3 Prediction Market | Traditional Financial Derivatives (e.g., "Futures, Options") | |------------------------|-------------------------------------------------------------| | Core Essence | Event Derivatives | Price Derivatives | | Trading Target | Outcomes of underlying events | Prices of underlying assets | | Pricing Basis | Collective belief | Supply and demand of underlying assets and price fluctuations | | Pricing Model | Market self-discovery (e.g., AMM algorithm) | Complex mathematical models (e.g., Black-Scholes model) | | Price Meaning | "Probability" of event occurrence | Future delivery "price" of underlying assets | | Settlement Method | Oracle-driven | Counterparty trading | | Operating Vehicle | Smart contracts | Traditional brokers, exchanges | | Transparency | Extremely high (trading and liquidity pools are public on-chain) | Relatively low (only visible to exchanges and regulators) | | Entry Barriers | Permissionless | Permissioned (strictly regulated, requires account opening, KYC, etc.) | | Main Risks | 1. Oracle manipulation risk | 1. Counterparty default risk (OTC) | | | 2. Smart contract vulnerability risk | 2. Market liquidity risk | | | 3. Regulatory uncertainty | 3. Leverage risk | | Main Functions | 1. Quantifying "probability" uncertainty | 1. Managing "price" uncertainty | | | 2. Aggregating information for event risk hedging | 2. Price discovery for underlying asset risk hedging |

This unique mechanism is the core attraction for mainstream financial institutions. It offers three core values that traditional markets cannot reach, which is the key reason why giants like ICE are truly betting on it:

First, it is an advanced "information aggregator," reshaping the landscape of information equity. In an era of AI-generated content, fake news, and information bubbles, "truth" has become expensive and hard to discern. The prediction market provides a radical solution: truth is not defined by authorities or media, but is "bid" by a decentralized, economically driven market. It responds to the growing distrust of traditional information sources (especially among the younger generation) by providing a more honest alternative source of information that realizes "voting with money." More importantly, this mechanism transcends traditional "information aggregation" itself, achieving real-time pricing of "truth," forming a highly valuable "real-time sentiment indicator," ultimately realizing information equity across various dimensions.

Second, it capitalizes on "information asymmetry," opening up a new investment track. In traditional finance, investment targets are ownership certificates like stocks and bonds. The prediction market creates a new tradable asset—"event contracts." This essentially allows investors to directly convert their "beliefs" or "information advantages" about the future into tradable financial instruments. For professional information analysts, quantitative funds, and even AI models, this represents an unprecedented profit dimension. They no longer need to express their views indirectly through complex secondary market operations (like going long/short on related company stocks) but can directly "invest" in the events themselves. The enormous trading potential of this new asset class is the core interest point attracting exchange operators like ICE.

Finally, it creates a risk management market where "everything can be hedged," greatly expanding the boundaries of finance. Traditional financial tools struggle to hedge the uncertainties of "events" themselves. For example, how can a shipping company hedge the geopolitical risk of "whether the canal will be closed"? How can a farmer hedge the climate risk of "whether rainfall in the next 90 days will be below X millimeters"? The prediction market provides a perfect solution for this. It allows participants in the real economy to convert abstract "event risks" into standardized tradable contracts for precise risk hedging. This essentially opens up a brand new "insurance" market for the real economy, providing a new entry point for finance to empower the real economy, with potential far beyond imagination.

3. Hidden Concerns Beneath Prosperity: The Triple Dilemmas Facing Prediction Markets

Despite the clear value proposition, the prediction market still faces three interlinked real challenges on its path from "niche" to "mainstream," which together constitute the ceiling for industry development.

The first dilemma: the contradiction between "truth" and "arbiters," namely the oracle problem. Prediction markets are "result-based trading," but who announces the "results"? A decentralized on-chain contract paradoxically relies on a centralized "arbiter"—the oracle. If the definition of the event itself is ambiguous (like the definition of "wearing a suit"), or if the oracle is manipulated or makes errors, the entire market's trust foundation can collapse instantly.

The second dilemma: the contradiction between "breadth" and "depth," namely the liquidity exhaustion of the long tail. The current prosperity is highly concentrated on major focal events like the "U.S. elections." However, the true value of prediction markets lies in serving those vertical, niche "long tail markets" (such as the aforementioned agricultural and shipping risks). These markets naturally lack attention, leading to extreme liquidity exhaustion, making prices easily manipulable, thus losing their actual functions of information aggregation and risk hedging.

The third dilemma: the contradiction between "market makers" and "informants," namely the "adverse selection" problem of AMMs. In traditional DeFi, AMM market makers (LPs) bet on market volatility to earn trading fees. However, in prediction markets, LPs are directly betting against "informed traders." Imagine a market for "whether a new drug will be approved," where LPs are betting against scientists with insider information—this is a guaranteed loss due to "adverse selection." Therefore, in the long run, automated market makers find it extremely difficult to survive in such markets, and platforms must rely on expensive human market makers to maintain operations, greatly limiting their scalability.

Looking ahead, the breakthrough points for the prediction market industry will inevitably revolve around the aforementioned three dilemmas: more decentralized and manipulation-resistant oracle solutions (such as multi-party verification and AI-assisted review) are the foundation of trust; guiding liquidity into long tail markets through incentive mechanisms and better algorithms (like dynamic AMMs) is key to realizing its intrinsic value; and more sophisticated market maker models (such as dynamic fee rates and information asymmetry insurance pools) will be the engine for its scalability.

4. Conclusion: From "Probability Game" to "Financial Infrastructure"

The CFTC's approval and ICE's entry are clear signals: the prediction market is transitioning from a marginalized "crypto toy" to a serious financial tool. It centers on "aggregating truth" as its core value and "event derivatives" as its financial core, providing a new dimension of risk management for modern finance. Indeed, the path from "probability game" to "financial infrastructure" is not without challenges. As mentioned earlier, the oracle problem regarding "arbiters," the liquidity dilemma of long tail markets, and the "adverse selection" of market makers are all real challenges the industry must calmly face after the excitement.

Nevertheless, a new era that integrates information, finance, and technology has begun. When top traditional capital starts to re-invest in this track, what it leverages will far exceed a weekly trading volume of $2 billion. This may be a true "singularity" moment—it heralds the acceptance of a new asset class (the pricing power of "belief" and "future") by the mainstream financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。