Bitcoin ETFs Slip With $101 Million Outflow; Ether Follows With $19 Million Exit

Just a day after roaring back into inflow territory, crypto exchange-traded funds (ETFs) stumbled again midweek. The optimism that pushed billions into bitcoin and ether ETFs on Tuesday faded fast, replaced by a wave of cautious withdrawals.

Bitcoin ETFs saw a net outflow of $101.29 million, a stark reversal from the prior session’s surge. Blackrock’s IBIT tried to keep momentum alive with a solid $73.63 million inflow, joined by a modest $2.14 million entry from Valkyrie’s BRRR.

But heavy redemptions drowned the positives. Grayscale’s GBTC ($56.63 million) and Fidelity’s FBTC ($56.56 million) led the outflows, while Ark & 21shares’ ARKB posted a $53.87 million exit and Bitwise’s BITB shed $9.99 million. Trading volume held strong at $6.58 billion, though net assets slipped to $146.27 billion.

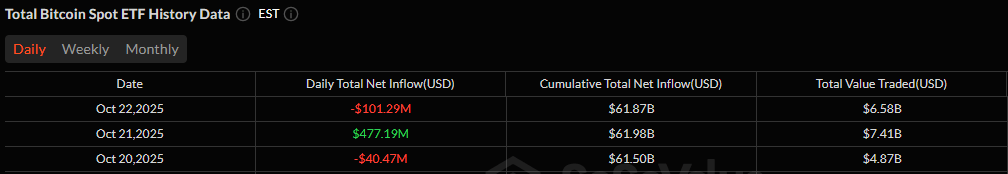

Two days of outflows have dampened the week for bitcoin ETFs, although the week remains in the green due to the big inflow on Tuesday. Source: Sosovalue

Ether ETFs didn’t fare much better. Despite Blackrock’s ETHA pulling in a notable $110.71 million, the market leaned negative as redemptions piled up elsewhere. Fidelity’s FETH lost $49.46 million, Grayscale’s Ether Mini Trust shed $46.57 million, and ETHE saw $33.46 million flow out. The result, a $18.77 million net outflow, kept ether funds in the red for the day. Total trading value came in at $2.63 billion, with net assets easing to $25.81 billion.

After a brief burst of confidence, the midweek reversal shows investors remain selective and volatility continues to shape the ETF landscape for crypto’s biggest names.

FAQ

What happened to crypto ETFs on Wednesday?

Bitcoin and ether ETFs saw renewed outflows, losing $101 million and $19 million, respectively.Which bitcoin ETFs were most affected?

Major redemptions hit Grayscale’s GBTC, Fidelity’s FBTC, and Ark’s ARKB, reversing Tuesday’s gains.Did any funds record inflows despite the downturn?

Yes, Blackrock’s IBIT and ETHA continued to attract strong investor interest.What does this mean for the crypto market outlook?

The midweek pullback highlights ongoing investor caution and persistent market volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。