Author: Shoal Research

Compiled by: Felix, PANews (This article has been edited)

Most of the trading volume and activity in DeFi is still concentrated on a few fundamental functions: trading pair exchanges, perpetual contracts, staking services, and money markets. There is currently no simple and intuitive way to access all these functions through a single margin account. These DeFi fundamental functions operate independently, leading to fragmented liquidity, with a large amount of funds idling and unable to generate returns.

The lack of a unified margin account is not a conceptual issue but more of a structural problem. Different DeFi protocols have their own accounting and risk parameters. This design makes DeFi safe when operating independently, but inefficient as a whole.

Most protocols today are designed as a set of smart contracts with fixed parameters that can run autonomously indefinitely. However, traditional finance relies on dynamic parameters to adapt to real-time situations. Banks, market makers, and derivatives trading departments continuously reprice risk, widen spreads, and adjust leverage based on market activity.

Building DeFi infrastructure that can respond to real-time market conditions can achieve better performance, safer risk management, and more efficient and productive capital utilization. These protocols can adjust key parameters such as collateral ratios, lending rates, and execution routing based on real-time market conditions. This responsiveness is most critical during periods of market stress.

The question is, how does this manifest in practice?

Flying Tulip has launched an on-chain financial system aimed at standardizing pricing, credit, and risk across a unified set of markets. The protocol integrates spot trading (AMM + CLOB), lending, perpetual contracts, insurance, and a protocol-native stablecoin within a shared margin framework.

The core principles are as follows:

- First, make collateral reusable across multiple functions. A single deposit can support various forms of activity, earning base returns, trading margin, or loan collateral without being locked into a single use or module.

- Second, use real, executable liquidity to price risk. The protocol measures its market depth and volatility in real-time, with these readings directly input into parameters such as margin ratios, funding rates, and liquidation thresholds.

- Third, return protocol cash flows back into the system. Revenue from trading, lending, and settlements will flow to FT tokens through programmatic buybacks or user allocations.

These principles reflect the protocol's design aimed at achieving higher yields and a better user experience. Higher yields come from capital efficiency, meaning assets remain efficient throughout the stack. The same deposit can earn base returns while providing collateral for loans, placing limit orders on a centralized limit order book (CLOB), or serving as margin for derivatives. A better user experience comes from the integration of services. Core mechanisms are directly encoded in the contracts and consistently applied across all products.

The design of Flying Tulip is based on the original Deriswap concept proposed by Andre Cronje in 2020. His concept was simple: to merge multiple DeFi functions into a more efficient capital protocol. Deriswap proposed that the same liquidity pool could be used simultaneously for swapping, lending, and options to reduce idle liquidity. Here, this principle is extended to the entire financial stack. The architecture of the protocol integrates trading, credit, and risk management within a single environment, managing capital and risk exposure through a unified framework.

Flying Tulip will be natively deployed across multiple chains, initially launching on Sonic Labs and then expanding to Ethereum, Avax, BNB Chain, and Solana. Each chain will have its own local instance of Flying Tulip, ensuring that all deployed liquidity and settlements occur in a native environment.

Flying Tulip Stack

Flying Tulip consists of a set of integrated DeFi components. ftUSD, lending, spot, and perpetual contracts operate based on a shared liquidity base and a unified margin layer. The parameters of the entire system will be adjusted in real-time according to market conditions, maintaining consistent pricing, collateral, and risk across all products.

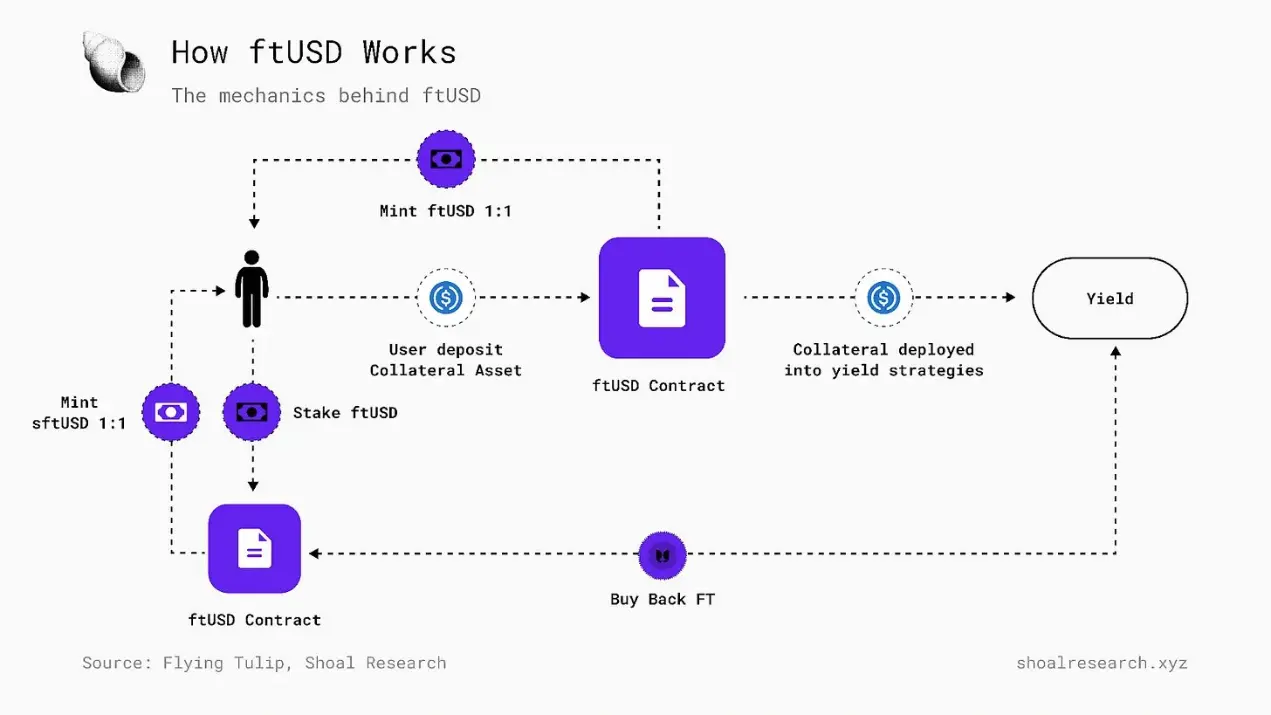

ftUSD: FT Native Stablecoin

To avoid relying on third-party stablecoins when launching liquidity, Flying Tulip has introduced ftUSD, a protocol-native, USD-pegged stablecoin that serves as the primary margin and settlement asset for the protocol's automated market maker pools, order books, and derivatives markets. ftUSD is minted by depositing supported stablecoins or blue-chip assets and can be held as a stable unit of account or staked as sftUSD to earn returns from Flying Tulip's underlying yield strategies. Staking means converting to a yield accumulation pool, with the distribution reflected through a variable exchange rate between sftUSD and ftUSD.

The collateral used to mint ftUSD will be deployed in delta-neutral strategies across multiple platforms and executed through on-chain programming to maintain transparency and auditability. Assets will be allocated among money markets, staking pools, and hedged positions, with the yields generated from these positions distributed to sftUSD holders, while the yields from un-staked ftUSD will be retained by the protocol for operations and liquidity.

How it works:

ftUSD maintains its peg to the USD through delta-neutral strategies, meaning the collateral for ftUSD is deployed on-chain to earn yields while keeping net exposure to market volatility close to zero. The yields of ftUSD primarily come from the interest earned on collateral provided in money markets (such as Aave) and staking rewards generated from the long portion of hedged positions. Positions will be regularly rebalanced and constrained by caps, scale ranges, and trading venue limits to maintain solvency and reduce volatility transmission.

After deducting borrowing costs, fees, and safety buffers, the yields will be distributed proportionally based on the amount of sftUSD held. Distributions to sftUSD holders will be reflected through a variable exchange rate between sftUSD and ftUSD. Un-staked ftUSD does not generate yields; its yields will be used to fund the protocol's operations, expand liquidity, and support token priority models.

This structure keeps collateral productive while minimizing directional risk. Under normal circumstances, the long (staking) and short (borrowing) portions are calibrated to offset each other, thereby reducing the likelihood of liquidation during volatility. This approach prioritizes conservative scaling and transparent, programmatic management. All strategies and rebalancing logic are executed on-chain and can be audited through public dashboards.

The underlying yield strategies of ftUSD operate entirely on-chain, with key parameters (such as pool rates and collateral risk exposure) remaining transparent for tracking performance and risk composition. All positions are marked to market and managed within the same delta-neutral framework, with regular adjustments based on observed liquidity and volatility conditions.

A native stablecoin like ftUSD allows Flying Tulip to price risk, settle trades, and manage liquidity within a unified framework. Anchoring market activity to such a stablecoin enables Flying Tulip to unify its collateral management across AMM, CLOB, and derivatives markets. ftUSD serves as the fundamental unit for margin, settlement, and lending, allowing the same collateral to support multiple positions without leaving the system. The yields generated from these activities (such as funding payments or lending spreads) will be retained within the protocol's liquidity base and routed to sftUSD stakers or operational reserves based on policy.

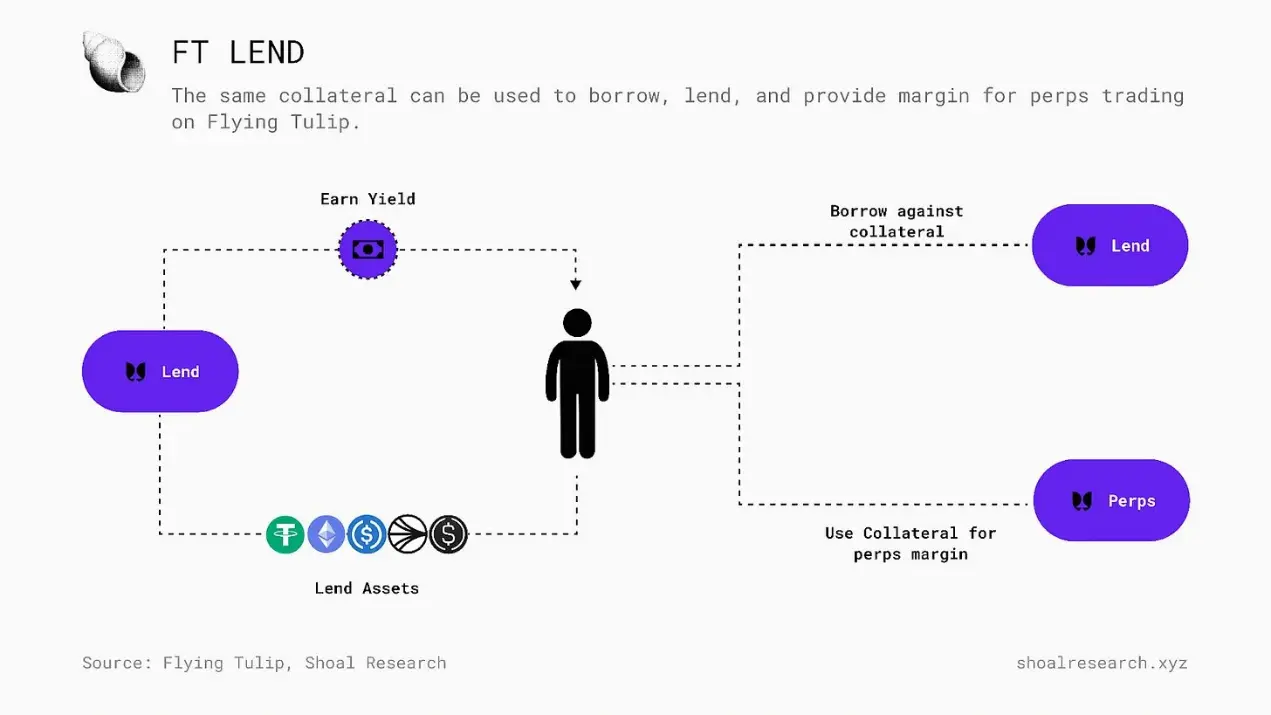

FT Lend: New Money Market Structure

Flying Tulip has launched FT Lend, a native money market directly integrated into the protocol's unified margin system. It allows users to borrow and lend assets using the same collateral, which supports trading, settlement, and derivatives positions across the entire protocol. The design of FT Lend is intended to operate within an adaptive framework based on real-time market data regarding liquidity depth and volatility.

Today, most major money markets rely on fixed loan-to-value (LTV) ratios and over-collateralization thresholds. Borrowers deposit collateral valued above the loan amount, maintaining a margin buffer that depends on the price of the underlying asset. Liquidation occurs when debt exceeds the adjusted value of the collateral.

Static LTV parameters are chosen for their simplicity and predictability. They allow protocol designers to set a borrowing threshold for each asset, defining the maximum debt a borrower can take relative to the collateralized asset. These thresholds typically assume worst-case volatility and enforce over-collateralization to protect lenders during rapid price fluctuations. However, this design also limits capital efficiency and can create cascading effects. Capital is underutilized during market stability; when volatility spikes, static parameters amplify the cascading liquidation effects as prices drop and the entire protocol reaches collateral thresholds. The design of static risk parameters cannot distinguish between stable and volatile market conditions. FT Lend replaces static assumptions with adaptive parameters that can continuously adjust to market conditions. Borrowing limits, interest rates, and liquidation behaviors are derived directly from on-chain data rather than fixed governance rules.

- Trading Weighted Loan-to-Value Ratio (TWAR). Borrowing capacity is adjusted based on the ratio of position size to liquidity pool depth. Smaller loans receive higher limits, while larger loans face gradually decreasing caps to account for execution impact. The ratio of collateral to the liquidity pool determines the maximum allowable loan-to-value ratio, which predictably tightens as position size or volatility increases.

- Volatility-Aware Interest Rates. Borrowing costs are adjusted based on actual volatility. Assets are classified as stable or volatile, and the interest rate formula automatically responds: during high volatility, interest rates rise, and borrowing capacity contracts; during calm periods, interest rates decrease, increasing available credit.

- Snapshot Loan-to-Value Ratio. When a borrower opens or modifies a position, the borrowing limit is locked in at the current market conditions. Existing positions remain within these limits even if policy parameters change, maintaining predictability while allowing future loans to reflect the latest market conditions.

- Market-Aware Liquidation. Liquidation is executed through a liquidity engine that integrates AMM reserves and order book depth to minimize slippage. Before execution, the engine simulates price impacts, splitting large positions into smaller trades and prioritizing limit orders in the Central Limit Order Book (CLOB) when available. This approach reduces volatility transmission and ensures orderly liquidation behavior under stress.

- Unified Collateral System. The permissionless layer operates similarly to an automated market maker (AMM): each trading pair has its own lending market, parameterized by real-time depth and volatility. The permissioned pool manages a curated set of cross-margin assets. Funds deposited in this pool remain active throughout the system—earning base returns, supporting open orders, and collateralizing perpetual contract positions. The net debt mechanism offsets delta-neutral risk exposure, reducing traditional liquidation pathways and reinforcing the collateral logic supporting ftUSD.

All parameters, including loan-to-value ratio (LTV), interest rates, and utilization rates, are updated in real-time on-chain. The AMM publishes time-weighted (TWAP) and reserve-weighted (RWAP) price windows, which are directly used in lending logic to ensure collateral value reflects executable market conditions. Borrowers pay interest; suppliers earn interest. Cash flows are settled through a token priority model, where lenders receive yield distributions priced in FT, and policy fees flow into protocol reserves and buyback mechanisms.

Flying Tulip's protocol research indicates that collateral utilization adjusts with changes in market volatility and liquidity depth, as shown in the figure above. As volatility rises or liquidity decreases, the maximum allowable loan-to-value ratio (LTV) declines along a predictable curve, allowing leverage to expand and contract with changes in market stability rather than remaining fixed. This relationship directly determines how FT Lend calibrates borrowing capacity and liquidation behavior in real-time, ensuring that capital allocation within the protocol is both responsive and risk-aware.

Adaptive AMM-CLOB Spot Trading

Flying Tulip offers spot trading through a dual-engine exchange that combines adaptive AMM and CLOB. These two systems operate within a unified framework, allowing liquidity to dynamically switch between continuous liquidity and limit order liquidity based on market conditions. Orders are executed along the path that achieves the best execution price with minimal market impact, aiming to maintain price consistency within the protocol.

The AMM features curve adaptiveness, referencing short-term volatility inputs including realized volatility (rVOL), implied volatility (IV), time-weighted average price (TWAP), and reserve-weighted average price (RWAP), continuously adjusting its pricing curve. In stable conditions, the curve flattens to reduce slippage and compress bid-ask spreads. During heightened volatility, the curve steepens, exhibiting constant product characteristics to maintain depth and preserve price integrity against the impact of rapid order flows. This allows the market to self-regulate without manual intervention, adjusting the curvature of the curve based on current liquidity and volatility conditions.

Price and flow data are smoothed using exponential moving averages (EMA), dampening the effects of short-term fluctuations while enabling the protocol to respond to structural market changes. Guardrails limit the range of curve migration within a single window period, ensuring that both traders and liquidity providers can expect predictable behavior. The result is a trading engine capable of continuously adapting to a changing environment while avoiding instability.

Before execution, each swap transaction is simulated on-chain to assess its price impact relative to the current liquidity pool depth and defined pool thresholds. Large trades are automatically split into multiple orders to smooth market impact. If a better price is available through the CLOB, orders are routed there by priority; any remaining portion is settled through the AMM. Fees are dynamic, decreasing during market stability to encourage trading activity and increasing during market volatility to compensate LPs for their risk.

LPs can provide assets across a full range or concentrated range. Full-range positions provide stable fees based on the x*y=k principle. Concentrated liquidity allows for increased fee density while prices remain within a range, but requires proactive rebalancing when market trends change. Adaptive curves adjust these dynamics: spreads narrow during market stability and widen during increased volatility, thereby reducing spread losses during periods of stress. Fees act as a dynamic policy variable rather than a fixed parameter, adjusting with observed market conditions. During stable market periods, fee schedules gravitate toward their lower limits to attract capital inflows; during market volatility, fees rise toward their upper limits to compensate LPs and slow adverse capital outflows. All limits and coefficients are publicly visible and updated in real-time on-chain.

By unifying the execution of AMM and CLOB under a shared liquidity and risk framework, the protocol maintains price discovery consistency across various conditions and avoids fragmentation of depth. The AMM also serves as the foundation for other components; perpetual markets, lending, and liquidation—all reference prices and depth windows derived from the AMM for collateral valuation and impact-aware execution.

Flying Tulip's protocol research indicates that AMM curvature dynamically adjusts based on market volatility, as shown in the figure above.

This figure compares the simulated performance of several LP strategies under range volatility, upward trends, and downward trends. During stable periods, concentrated and triggered strategies generate higher fee income, while passive LPs preserve value during directional movements. The results highlight the trade-off between responsiveness and risk exposure: adaptive strategies perform better in balanced markets but tend toward passive outcomes during sharp market volatility.

This relationship illustrates how the protocol's adaptive curve manages liquidity under stress. By adjusting curvature based on volatility, the AMM maintains depth, stabilizes fee generation, and supports collateral assets like ftUSD, ensuring yield and price stability across the entire protocol.

By unifying two types of markets under a shared liquidity and risk framework, Flying Tulip's spot module maintains efficient pricing across various conditions and avoids the fragmentation of AMM and order book liquidity. The CLOB also integrates volume-based fee adjustments, order rebates, and a referral system that rewards LP trading activity, aiming to align user incentives with liquidity depth.

FT Perps

Flying Tulip has launched a native perpetual contract engine that allows users to take long or short positions on assets with leverage, settling directly based on prices discovered within the protocol's own AMM and CLOB. FT Perps internally derives these values from the protocol's real-time trading activity. Prices, funding rates, and liquidation thresholds reference actual executable liquidity rather than delayed or external data sources.

This design enables the protocol to keep the mark price aligned with actual trading depth. If an asset trade is completed at a given price on the AMM or CLOB, that price becomes the effective settlement price. Prices are continuously updated. Funding rates automatically adjust based on borrowing demand, position imbalances, and the actual costs of holding long or short positions within the protocol. When longs are effectively borrowing stable assets to hold, and borrowing costs become high, the funding rate reflects this; when the imbalance reverses, the direction of the funding rate changes accordingly. All funding inputs and parameters are transparent and observable on-chain.

Perpetual contracts can be traded in isolated or cross-margin modes. In isolated mode, collateral supports a single position, thereby controlling risk within that market range. In cross-margin mode, users can deposit collateral from a permissioned lending pool, allowing a single deposit to support multiple positions within the Flying Tulip protocol while continuing to earn its base returns. Borrowing capacity and leverage limits are determined by real-time depth and volatility metrics and are snapshot at the time of opening or adjusting positions to prevent retroactive changes.

Liquidation follows the same logic as the rest of the protocol. When a position approaches the liquidation threshold, the engine simulates the next execution step on the AMM's adaptive curve. If the simulated impact exceeds safe limits, the position will be gradually liquidated, first matching orders in the limit order book, then splitting the remaining position on the AMM to minimize price fluctuations.

All positions are settled in ftUSD. ftUSD itself does not generate yields, but users can stake it as sftUSD to earn protocol yields. LPs that choose to join the settlement pool can earn fees for each settlement and provide ftUSD to support the perpetual contract engine.

Since pricing, funding, and liquidation logic all derive from internal markets, FT Perps becomes an integrated component. It shares the same liquidity base, depth windows, and collateral pools to support the spot and lending layers, ensuring that leverage, pricing, and liquidation behavior remain consistent across the entire protocol. This structure creates a mutually reinforcing trading environment: market data influences pricing, pricing influences leverage, and both evolve within the same collateral and liquidity framework.

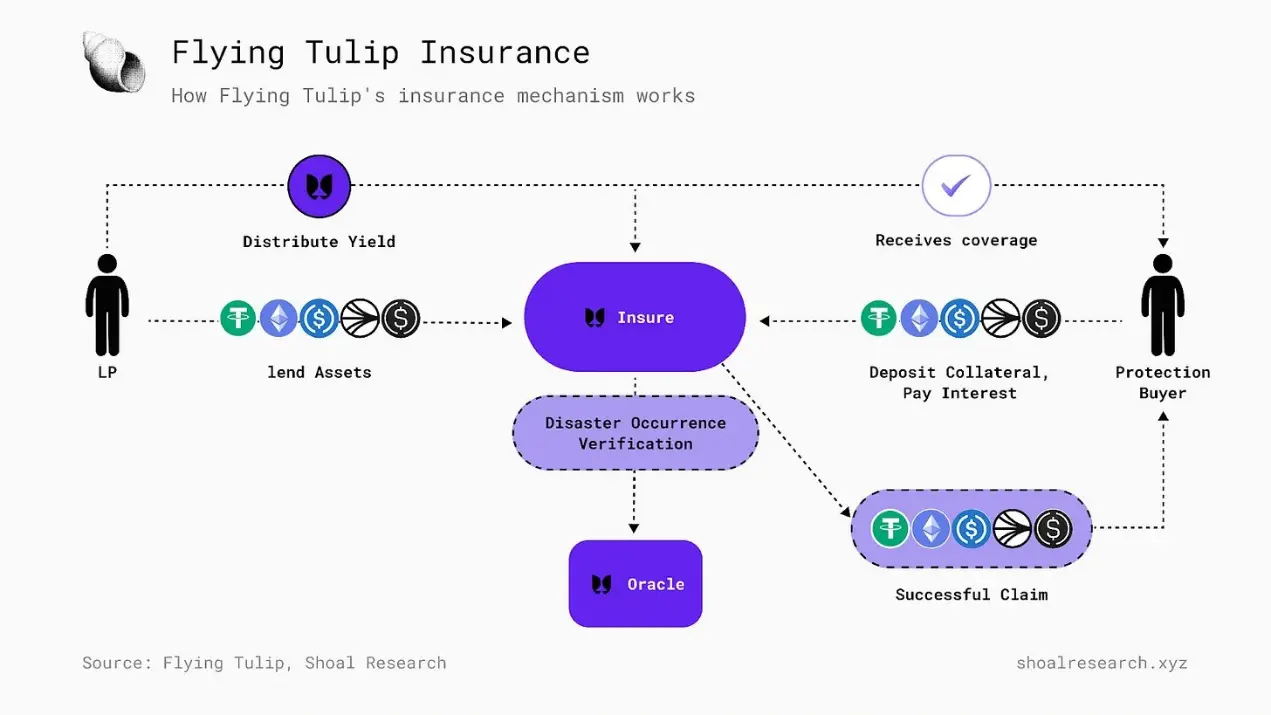

Insurance

Flying Tulip has launched a native protocol insurance layer that provides on-chain protection for investors against unprecedented protocol events. These events include smart contract vulnerabilities, erroneous liquidations, or other technical failures occurring within the protocol's trading, lending, and settlement layers. The insurance engine operates as a continuous market between underwriters (investors seeking to protect their capital) and capital providers who earn income by collecting premiums. Underwriting is constructed as active positions within a shared fund pool. Buyers provide collateral and pay ongoing premiums during the coverage period. Providers deposit funds in USDC, which serves as the base asset and payment currency for the fund pool. In return, they receive pool tokens representing their proportional share of assets and accumulated premiums, allowing protection capacity and pricing to automatically adjust based on utilization and risk conditions.

Premiums are variable rates that respond to real-time data. Utilization rates, underwriting demand, and internal risk metrics derived from the protocol's AMM and order book collectively determine rate adjustments. When fund pool utilization rises or volatility increases, premiums rise to attract liquidity; when conditions normalize, premiums fall.

If an event occurs, external validators such as UMA's oracles will assess whether it meets the predefined on-chain conditions, including the affected system, time frame, and loss threshold. Once verified, users with valid insurance positions can redeem their insurance amount, priced in USDC, directly from the fund pool. If no qualifying event occurs, the insurance can be closed at any time, immediately stopping premium payments.

The insurance layer is integrated with the collateral and pricing systems that manage lending and trading. Assets deposited in Lend can support open positions and coverage, while the same liquidity and volatility metrics that drive funding and liquidation logic are also used to adjust premiums and underwriting capacity.

Capital providers bear the risk of verified payout events; underwriting buyers rely on the oracle's judgment. Both face typical smart contract and liquidity risks, with potential temporary withdrawal restrictions during claims.

In this model, insurance acts as part of the internal risk infrastructure of the protocol rather than an external add-on, allowing coverage capacity, premiums, and liquidity to change directly with the system's conditions.

FT and Economics

The economic structure of Flying Tulip is built around its native FT token. Each component of the protocol—ftUSD, Lend, Perps, AMM, and insurance—generates transaction fees, funding payments, and yields; these yields are then used to buy back and burn FT.

The launch of FT introduces a new structure in DeFi, allocating 100% of the token supply at the same valuation simultaneously to private and public participants through a public capital allocation mechanism. FT has a fixed supply of 10 billion tokens, with no set inflation plan, and the founding team has not pre-allocated any tokens; any exposure is obtained through public market buybacks funded by protocol revenue. Minting occurs only through public capital allocation (PCA) at a fixed ratio of 10 FT per $1. If $500 million is raised, exactly 5 billion FT will be minted; once the cap of 10 billion is reached, issuance will permanently cease.

Participants in the fundraising will receive their FT positions in the form of on-chain perpetual put options (PUT). During the option's validity period, holders can redeem FT at face value, with the redeemed tokens permanently burned, and the redeemable asset being the original collateral; alternatively, they can withdraw FT, rendering the option void, and release the collateral for market buybacks and destruction.

Each PUT exists as an NFT and encodes specific redemption rights for the participant's underlying deposit, meaning that if the holder withdraws 50% of the tokens allocated to their NFT, they can still redeem the remaining 50% of their invested capital. This provides investors with partial redemption functionality and transparent accounting, but it also means that redemptions are irreversible; once tokens are withdrawn, they cannot be re-deposited into the NFT.

Funds raised through PCA will be invested in conservative on-chain yield strategies, including Aave V3, stETH, jupSOL, AVAX staking, and sUSDe. The yields generated from these investments are first used to cover the protocol and its operational costs; the remaining portion is used for buybacks and destruction of FT. This structure aims to ensure that the protocol's revenue and capital gains can sustain themselves without relying on new issuance.

Both pathways will reduce the circulating supply, either through direct reductions from redemptions or indirect reductions through the release of reserves for buybacks. FT in the secondary market does not have this redemption right; if holders redeem their underlying capital, the corresponding FT will be burned, thereby reducing the circulating supply of FT and concentrating more value for existing holders.

Business Model

The revenue generated by the FT product stack is used for FT buybacks:

- ftUSD revenue flows into the treasury for FT buybacks.

- Lend contributes its net interest margin, i.e., the spread between borrower rates and supplier rates.

- Perps transfers a portion of trading and funding rates into the same buyback mechanism.

- Insurance also transfers a portion of its active premiums into the same buyback mechanism.

When holders withdraw FT from the PUT, the funds released from the redemption reserve will be used for additional market buybacks.

The repurchased FT will then be divided into two parts: one part will be burned; the other part will be unlocked for distribution.

The unlocked tokens are managed by revenue-funded buybacks and follow a fixed distribution plan. When protocol revenue funds buybacks, the foundation, team, ecosystem, and incentives are unlocked in a 4:2:2:2 ratio at 1:1.

Just as Flying Tulip's products are designed to adapt to real-time market conditions, the protocol's business model is also designed to adapt to real-time protocol activity. When protocol utilization rises, whether through higher trading volumes, lending activity, or insurance demand, the total revenue available for buybacks will increase proportionally. When utilization declines, supply contraction will continue, but the rate of contraction will slow, as no new issuance occurs.

In practice, FT serves as a coordinating layer of value within the native ecosystem of Flying Tulip. Revenue at the product level and conservative yields constitute inflows; buybacks and destruction are outflows; when there is revenue support, unlocking can maintain consistency for contributors. The result is a closed capital loop where operational output, user activity, and liquidity depth converge into measurable supply changes, effectively linking the value of FT directly to the protocol's actual performance and operational efficiency.

Outlook

The current architecture of DeFi remains too fragmented for the open, composable financial system it aims to become: each primitive manages its own risk parameters and collateral base. This isolation preserves the solvency of protocols but limits overall capital efficiency.

This issue is not unique to cryptocurrency, nor is it a new problem. Fidelity's brokerage accounts cannot seamlessly interact with assets held at Charles Schwab. Transferring securities between them involves settlement delays and manual coordination. Even within a single institution, transferring funds across accounts requires intermediate steps and time-consuming processes. However, DeFi protocols operate on shared public infrastructure. Open standards and transparent states make composability a native attribute rather than a function built through integration.

Flying Tulip stands at the intersection of two major structural shifts in DeFi: aggregation and real-time adaptability. As DeFi becomes increasingly crowded, the demand for a unified margin framework that places DeFi services (such as trading, lending, and derivatives) under shared liquidity and collateral is becoming more pronounced. At the same time, the need for DeFi products and services that can adjust parameters such as collateral rates, borrowing limits, and funding rates based on real-time market conditions is also becoming more evident.

Flying Tulip connects the core elements of DeFi: stablecoins, trading, lending, derivatives, and insurance, aiming to dynamically adjust risk and pricing through a unified margin account based on real-time liquidity and volatility. Undoubtedly, if the launch and early development of Flying Tulip are successful, dozens of imitators will emerge with similar products. Nevertheless, first-mover advantage remains a force to be reckoned with in the DeFi space.

Related reading: AC's new work Flying Tulip: Aiming to use DeFi treasury yields to "nurture" a trading giant

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。