1. Function Overview: Redefining Technical Analysis of Digital Currency

The AI interpretation of candlestick charts feature launched by AiCoin is an intelligent analysis tool specifically designed for Bitcoin investors. This feature utilizes advanced artificial intelligence interaction capabilities to instantly understand Bitcoin price charts, helping investors quickly grasp market trends and trading opportunities.

2. Core Functionality Details

2.1 Intelligent Technical Indicator Analysis

The AI system conducts a multi-dimensional scan of Bitcoin's candlestick data, including:

- Candlestick pattern recognition: Automatically identifies classic candlestick patterns, including reversal signals and trend continuation patterns.

- Moving average trend analysis: Determines trend direction and momentum strength.

- Bollinger Bands volatility analysis: Assesses market volatility and price position using the BOLL indicator.

- RSI sentiment indicator: Identifies overbought and oversold areas and divergence signals through RSI.

- Volume correlation analysis: Analyzes the relationship between volume and price, identifying breakout and consolidation patterns.

- Support and resistance positioning: Identifies key support and resistance levels based on historical price behavior.

- External environment assessment: Integrates macroeconomic data and market sentiment indicators for impact analysis.

- Deep integration judgment: Validates multiple indicator signals to generate comprehensive trading signals and risk ratings.

- Custom indicator extension: Supports dynamic analysis of custom technical indicators using AIScript.

- Real-time news sentiment: Adjusts technical analysis results based on the latest news sentiment.

2.2 Professional-Level Analysis Report

The system generates a detailed analysis report within 10 seconds, including:

1) Core Viewpoints Summary

- Trend judgment: Identifies the current market state (bullish/bearish/sideways) and confidence score based on multi-indicator resonance.

- Technical drivers: Identifies the most important technical resonance signals and key breakout points.

- External environment impact: Integrates the fear and greed index and macroeconomic data to rate their impact on the market.

2) Overall Analysis Judgment

- Multi-dimensional integration: Organically combines candlestick patterns, moving average trends, RSI/BOLL indicators with the external environment.

- Market state qualification: Clearly identifies whether the market is in a trending, sideways, or turning phase.

3) Key Evidence Interpretation

- Key support and resistance levels: Identifies the most important support and resistance price levels based on price behavior analysis.

- Technical signal validation: Cross-validates the effectiveness and strength of buy and sell signals using multiple indicators.

- Risk conflict identification: Identifies conflicts between technical signals and corresponding risk levels.

4) Strategy Recommendations and Key Levels

- Dual strategy configuration: Provides two complete trading strategies (conservative and aggressive) based on risk preference.

- Precise level setting: Includes specific entry areas, stop-loss prices, and target areas in USDT prices.

- Strategy failure conditions: Clearly defines the failure scenarios and risk control measures for each strategy.

- Operation suggestion rating: Provides clear strong buy/buy/hold observation/sell/strong sell signals based on comprehensive scoring.

3. Usage Process Details

3.1 One-Click Start Analysis

Users only need to click the "AI Interpretation" button in the AiCoin client under Market to activate the intelligent analysis system. The entire process requires no complex settings, truly achieving zero-threshold usage.

3.2 Result Display and Interpretation

The core feature of AI analysis is the balance of systematic and cautious approaches—quickly outputting structured conclusions through multi-dimensional data while emphasizing risk management and signal validation, making it suitable as a "second opinion" for decision-making.

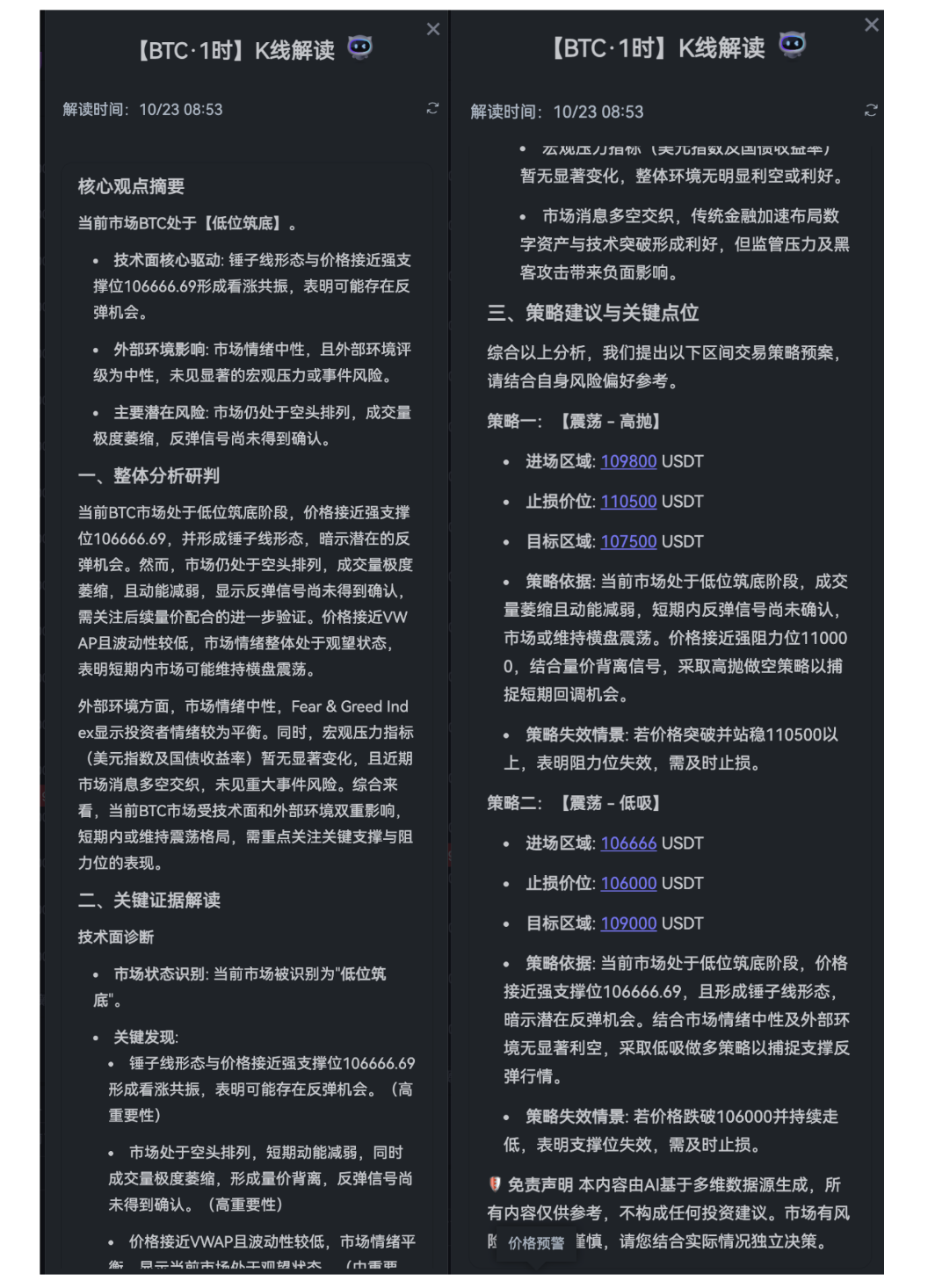

Taking the current analysis results as an example:

As shown in the figure

1. Clear Structure, Rigorous Logic

- Layered interpretation: The report progresses from the [Core Viewpoints Summary] to the [Key Evidence Interpretation], finally providing [Strategy Recommendations], with a complete logical chain.

- Multi-dimensional diagnosis: Covers technical aspects (candlestick patterns, volume, moving average arrangement), sentiment aspects (fear and greed index), and macro aspects (US dollar index, market news), avoiding the limitations of a single perspective.

2. Dialectical Conclusions, Highlighting Risk Alerts

- No blind bullish/bearish stance: Clearly states that the current stage is "building a base at a low level," but emphasizes that "rebound signals are unconfirmed" and "volume is shrinking," indicating the possibility of short-term fluctuations.

- Risk preemption: Lists "major potential risks" (such as volume-price divergence, bearish arrangement) before proposing strategies, preventing users from overlooking negative signals.

3. Specific Strategies, Strong Operability

- Bidirectional strategy adaptation for sideways markets: Provides both "high sell" (looking for a pullback) and "low buy" (betting on a rebound) strategies, marking specific levels (e.g., support at 106666, resistance at 110000).

- Clear failure conditions: Each strategy has stop-loss levels and failure scenarios (e.g., "stop loss if it breaks 110500"), helping users control risk.

4. Advantages of AI Analysis Stand Out

- Efficiency and objectivity: Generates a complete report within minutes that includes pattern recognition, data validation, and strategy simulation, reducing emotional interference from manual analysis.

- Systematically integrates six major data sources for three-dimensional analysis: Includes (technical data, technical indicators, macroeconomic data, market sentiment data, news sentiment data, custom indicator data).

5. Little Surprise, Seamless Trading Integration

At the end of the analysis, one-click links to drawing/alerting/order placement functions allow traders to place orders immediately upon seeing market opportunities, eliminating any time lag that could result in missed opportunities.

4. Technical Advantages and Innovations

4.1 Optimized for the Bitcoin Market

Unlike traditional stock analysis tools, AiCoin's AI model is specifically optimized for the characteristics of the Bitcoin market:

- Adapts to the 7×24 hour continuous trading feature.

- Considers the impact of global market interconnections.

- Utilizes a weighted scoring model (technical aspects + external environment) to merge multi-source heterogeneous data into a unified investment decision signal, achieving a leap from single-dimensional analysis to panoramic intelligent judgment.

4.2 Multi-Timeframe Collaborative Analysis

Supports full-cycle analysis from 5 minutes to monthly charts, enabling:

- Short-term signals to be combined with long-term trends for judgment.

- Avoidance of errors from a single time frame.

- Provision of a more comprehensive market perspective.

5. Practical Scenario Guide

5.1 Daily Market Analysis

Target Audience: All Bitcoin investors

Usage Frequency: 1-2 times daily

Best Timing: Before market opening, after important data releases

5.2 Key Decision Support

Applicable Scenarios:

- When prices approach important support/resistance levels.

- When significant news or policy changes occur.

- When adjustments to positions or stop-loss/take-profit levels are needed.

5.3 Learning and Review

Educational Value:

- Helps beginners understand technical analysis methods.

- Learn professional analysis thinking through AI interpretation.

- Review historical decisions to improve trading skills.

6. Risk Alerts and Usage Recommendations

6.1 Important Risk Alerts

Auxiliary Tool Positioning: AI interpretation results are for reference only and do not constitute investment advice.

Market Risks: Digital currency investment carries high risks; decisions should be made cautiously.

Technical Limitations: No analysis tool can guarantee 100% accuracy.

6.2 Best Usage Practices

- Combine fundamental analysis for comprehensive judgment.

- Establish a complete risk management system.

- Regularly review the accuracy of AI analysis.

- Adjust positions based on personal risk preferences.

Disclaimer: This feature is intended to provide technical analysis reference; investors should make independent decisions based on their circumstances. Digital currency trading carries high risks; please participate after fully understanding the risks.

Join the community, share your AI interpretation page, or

Official Telegram community:

https://aicoin.com/link/chat?cid=7JmRjnl3w

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Participate in the AI interpretation page screenshot activity in the Twitter comments section for a chance to win a stylish thermos cup.

Make your trading warmer!

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。