Written by: Kevin

The vaults ecosystem on the Hyperliquid platform provides investors with a unique window to observe and participate in on-chain derivative strategies executed by professional managers. This article conducts a systematic quantitative analysis and strategy deconstruction of the top-performing vaults within this ecosystem.

Evaluation Framework and Data Methodology

To conduct an objective, multi-dimensional comparison, we selected five representative vaults on Hyperliquid that rank high in both managed scale and performance: AceVault, Growi HF, Systemic Strategies, Amber Ridge, and MC Recovery Fund.

Our evaluation framework will focus on the following core indicators to construct a complete profile of each vault's strategy:

Performance Indicators:

Total Profit and Loss (PNL), Number of Profitable Trades, Total Number of Trades, Win Rate, Profit Factor.

Trading Efficiency Indicators:

Average Profit and Loss per Trade, Average Profit per Trade, Average Loss per Trade.

Risk Management Indicators:

Maximum Drawdown, Standard Deviation of Profit and Loss per Trade, Profit and Loss Volatility Ratio (i.e., Average Profit and Loss / Standard Deviation).

Strategy Attribution Indicators:

Profit and Loss Contribution by Asset, Long and Short Position Preferences for Specific Assets.

In terms of data acquisition, we extracted the longest available historical trading data for each vault stored on Hyperliquid. It should be noted that due to the platform's data storage limitations, the historical data period for high-frequency trading vaults (HFT) is relatively short, with our analysis window ranging from three days to two months; for strategies with lower trading frequency, we can observe longer historical performance.

AceVault Hyper01

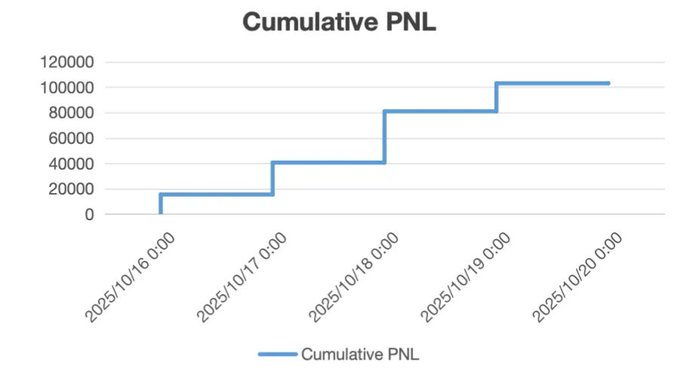

Analysis Data Period: October 16, 2025 - October 20, 2025

1.1 Strategy Overview and Market Position

AceVault Hyper01 is not only one of the largest strategy vaults by total value locked (TVL) in the Hyperliquid ecosystem, but its performance is also noteworthy. As of October 20, 2025, the vault's TVL has reached $14.33 million. Since its operation began in August 2025, this strategy has accumulated a profit of $1.29 million, with an annualized return rate (APR) of 127% over the past month, demonstrating strong and sustainable alpha generation capability.

1.2 Trading Behavior and Performance Quantification

During our selected four-day analysis period, the vault recorded a total of 19,338 closing records, providing us with high-precision samples to deconstruct its strategy.

Core Performance Indicators:

Net Profit (Total PNL): +$103,110.82

Win Rate: 28%

Profit Factor: 3.71

Profit and Loss Structure Analysis:

Average Profit and Loss (Avg. PNL): +$5.33

Average Profit (Avg. Win): +$26.00

Average Loss (Avg. Loss): $2.70

Risk Indicators:

Maximum Drawdown (Max Drawdown): $791.20

Standard Deviation of Profit and Loss (StdDev of PNL): 26.84

Profit and Loss Volatility Ratio (Avg. PNL / StdDev): 0.199

1.3 Strategy Profile and Risk Attribution

Strategy Profile: High Frequency, Asymmetric, Systematic Short

AceVault's trading frequency ranks among the highest of all vaults, belonging to a high-frequency trading (HFT) strategy. Its win rate is only 28%, while the profit factor is as high as 3.71, presenting a typical characteristic of trend-following or momentum strategies: the strategy does not rely on a high win rate but instead covers a large number of strictly controlled losses (average loss of $2.70) with a few but highly profitable trades (average profit of $26.00).

This highly asymmetric profit and loss structure is the core of its profit model.

Profit Attribution: Comprehensive Victory of Shorting Altcoins

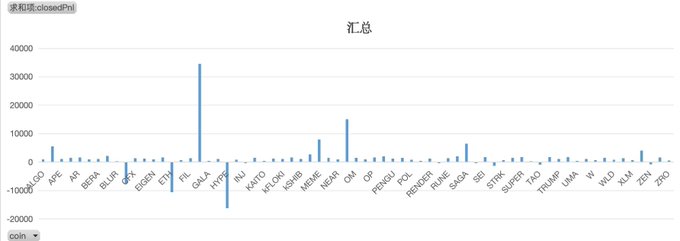

The strategy's trading targets are broad (covering 77 assets), but its long and short operations exhibit remarkable consistency and discipline:

Long Positions: Only executed on three mainstream assets: BTC, ETH, and HYPE.

Short Positions: Only executed short positions on all other 74 altcoins.

During this analysis period, the sources of the strategy's profits are extremely clear:

Short Positions: Cumulative Profit +$137,804

Long Positions: Cumulative Loss $33,726

This indicates that all of AceVault's net profits come from its systematic shorting of 74 altcoins. The position contributing the most profit comes from the short position in $FXS (+$34,579), while losses are concentrated in the long position of $HYPE (-$16,100).

Risk Management: Extreme Loss Control

This strategy demonstrates textbook-level risk management capability. With a TVL of $14.33 million and nearly 20,000 trades, its maximum drawdown over four days is strictly controlled at $791.20, a remarkably impressive figure. This is highly consistent with the average loss of -$2.70, proving that its strategy incorporates a systematic and extremely strict stop-loss mechanism.

1.4 Summary

AceVault Hyper01 is a logically clear, strictly executed, and highly systematized high-frequency strategy. Its core model involves holding a basket of mainstream assets in long positions (possibly as a beta hedge or long-term holding) while systematically executing high-frequency short strategies in the broader altcoin market.

During the analyzed market period, the strategy's excess returns entirely stem from its precise capture of the downtrend in altcoins. Its top-tier risk control system ensures that when executing a low win rate strategy, losses are strictly limited to a controllable small range, thus achieving healthy and robust overall profitability.

Conclusion

Through in-depth quantitative analysis of the five top vaults on Hyperliquid (AceVault, Growi HF, Systemic Strategies, Amber Ridge, MC Recovery Fund), we are able to penetrate the surface of high APR and total profits to gain insight into the core of their strategies— not all high returns are "born equal."

Our analysis reveals several key conclusions:

Risk control, rather than win rate, is the cornerstone of top strategies: Contrary to traditional beliefs, the most successful vaults in this analysis do not rely on high win rates (AceVault 28%, Growi HF 38%, MC Recovery 48%). Instead, their victories stem from a common, strictly executed logic: asymmetric profit and loss structures.

A model of "asymmetric victory": MC Recovery Fund is the ultimate embodiment of this model. Its profit factor of 43.1 is astonishing, backed by nearly perfect risk control: the average loss per trade is only $18, while the average profit reaches +$862. Growi HF (profit factor 10.76) is similarly structured. This indicates that their profit models are not built on "winning more often," but rather on "sustaining light injuries during losses while capturing substantial returns during profits."

Maximum drawdown is the "stress test" of a strategy: Comparing the "maximum drawdown" and "drawdown ratio" columns in the chart clearly delineates the robustness of the strategies. MC Recovery Fund (drawdown $3,922) and AceVault (drawdown $791) demonstrate textbook-level risk control, with their historical maximum drawdowns being almost negligible.

In contrast, Amber Ridge's drawdown reached $340,000, accounting for 87% of its total profits, meaning investors almost experienced "profit zeroing" extreme volatility. Systemic Strategies' recent $128,000 drawdown also exposed the fragility of its model.

- The sources of alpha vary: Successful strategy paths differ. AceVault profits by systematically shorting altcoins through high-frequency trading; Growi HF is an aggressive long hunter capturing trends under strict risk control; while MC Recovery Fund demonstrates mature long-short balancing capabilities, representing an "all-weather" strategy. This proves the depth of the Hyperliquid ecosystem, allowing different types of alpha strategies to coexist.

For investors, evaluating a vault cannot solely rely on superficial APR. The true value of a strategy lies hidden in its profit factor and maximum drawdown, which reveal its risk management capabilities. In the high-volatility, high-leverage arena of Hyperliquid, asymmetric profit and loss structures are the core of achieving long-term profitability, while extreme risk control is the only path to victory.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。