Yesterday we mentioned that the market is increasingly favorable to the bears. Although the bulls launched an attack, it could not be sustained and ultimately fell at the last moment. Here we believe the bulls' attack failed, missing the final opportunity.

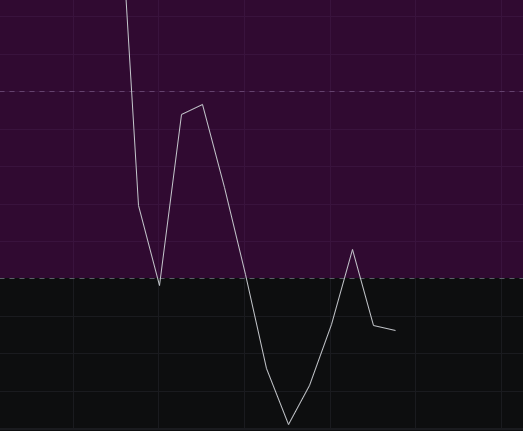

From the MACD perspective, the energy bars are retracting, but the fast line is still moving downward, so we cannot be bullish here.

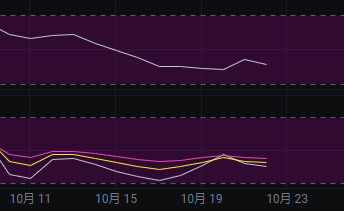

From the CCI perspective, the CCI is still below the zero line and quite far from it, so there is no reason to be bullish here; we continue to maintain a bearish outlook.

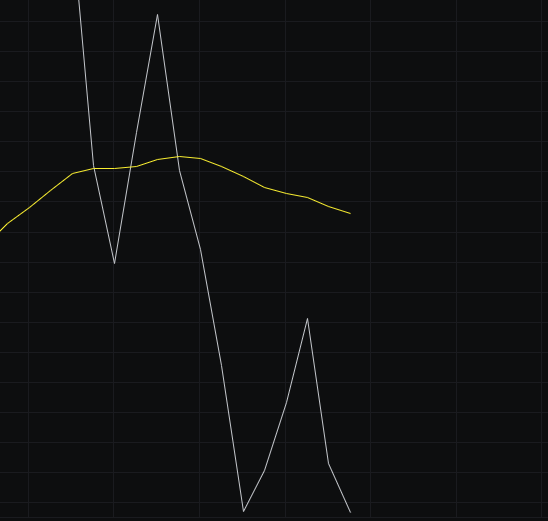

From the OBV perspective, the volume continues to flow out, and the slow line is also continuing to move downwards, indicating a bearish trend in the OBV.

From the KDJ perspective, after the golden cross two days ago, the KDJ has flattened out and is now in a death cross state, with the bears still in control, indicating a bearish trend in the KDJ as well.

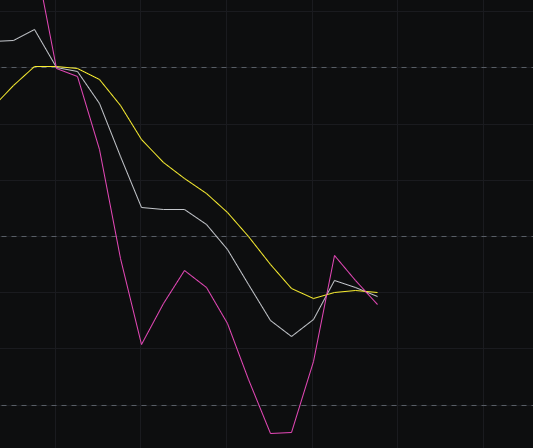

From the MFI and RSI perspectives, both the MFI and RSI are in weak zones and trending downward, so this also indicates a bearish outlook.

From the moving averages perspective, the price surged to 120 yesterday and then collapsed directly. This was originally a great opportunity for the bulls; if they had just pushed a little harder to stay above 120, they could have reversed the downward trend. However, they could not hold on at the last moment, so we believe the bulls' attack failed, missing the final opportunity.

From the Bollinger Bands perspective, yesterday's Bollinger Bands can be seen as transitioning into a downward channel. If it continues to close in the red today, the downward channel will be solidified, increasing the likelihood of forming a downward channel in the future.

In summary: As the bulls missed their final attack opportunity, various indicators are also leaning towards the bears, making the market more favorable to the bears. We continue to maintain a bearish outlook. Resistance is seen at 110500-112000, and support is at 07500-105000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。