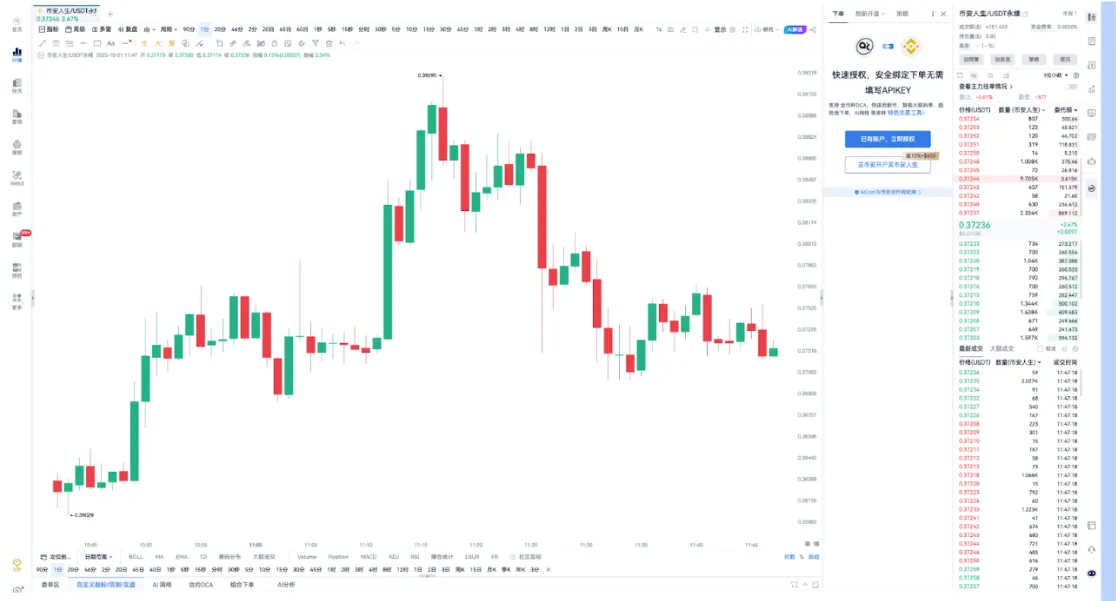

AICoin news shows that on October 22, 2025, according to on-chain analyst Ali (@ali_charts), Binance's stablecoin surged from $32 billion to $44.6 billion, an increase of up to 40%. The data indicates that at this time, investors are shifting their focus from cryptocurrencies to stablecoins!

In recent years, with the rapid rise of the cryptocurrency market and the surge in the number of professional investors, stablecoins have gradually become an indispensable important asset in the market. Given the high price volatility of mainstream cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), investors often need to seek lower-risk, more stable safe-haven assets. Stablecoins, which are issued with the logic of being pegged to fiat currencies (such as the US dollar), maintain a price close to a fixed value and have gradually become the stable "cornerstone" of the crypto market.

Starting from the earliest USDT, the types and scale of stablecoins have gradually expanded with the later introduction of USDC, BUSD, DAI, TUSD, and others. Against this backdrop, more exchanges have also launched stablecoin trading pairs, enriching investors' choices and bringing a more active trading ecosystem and potential profit opportunities for stablecoins. The investment strategy of seeking stability has also emerged. Compared to high-volatility assets, slight price deviations in stablecoin pairs have become new trading focal points. This has led to the grid strategy, an efficient tool for capturing market fluctuations and achieving stable returns. By combining the grid strategy with the characteristics of stablecoins, investors can earn continuous and more stable returns on a low-risk basis.

1. What are stablecoins?

Stablecoins are a unique type of digital asset. Unlike high-volatility cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), stablecoins operate by pegging their value to fiat currencies (such as the US dollar), thereby maintaining value stability. For this reason, stablecoins provide a rare "robust cornerstone" for the crypto market.

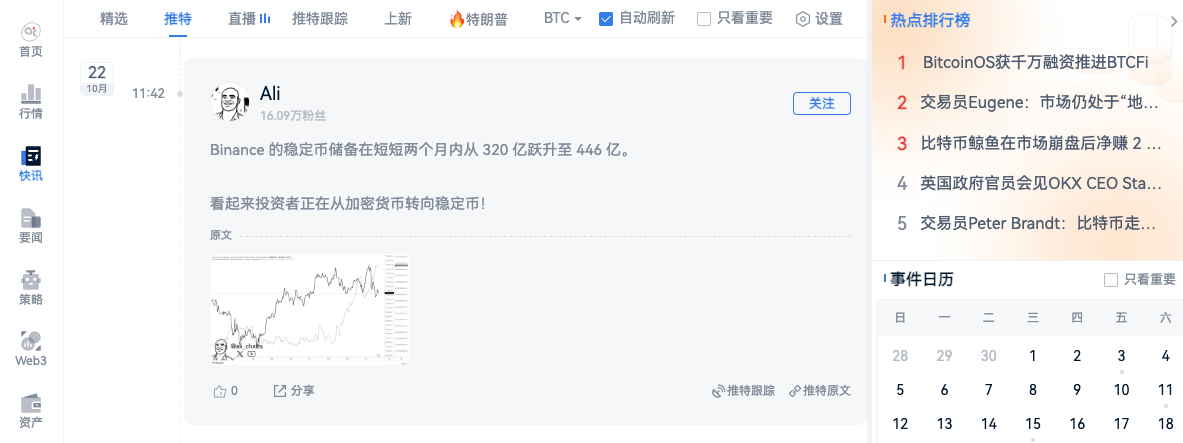

Among them, USDT is the most famous and currently the largest stablecoin by market capitalization, ranking third among all cryptocurrencies; followed by USDC, which ranks eighth in total market capitalization. In addition to these two, the number of stablecoins issued in the market is gradually increasing, with stablecoins represented by USDE and USDS also occupying a significant market share.

With the continuous increase in the types and demand for stablecoins, many trading pairs of stablecoins have emerged in the market, such as USDC/USDT, USDE/USDT, USDS/USDT, etc. These trading pairs are widely circulated on mainstream exchanges, opening new windows for investors to capture price fluctuations and arbitrage opportunities. For example, on OKX, Binance, and Bitget:

OKX offers:

- USDC/USDT spot

- USDC/USDT perpetual contract

Binance offers:

- USDC/USDT spot

- USDE/USDT spot

- USDC/USDT perpetual contract

Bitget offers:

- USDC/USDT spot

- USDE/USDT spot

- USDS/USDT spot

- USDC/USDT perpetual contract

2. Trading characteristics of stablecoin pairs

1. Price stability, low volatility, providing grid trading opportunities

The design purpose of stablecoins is to peg their value to fiat currencies (for example, the US dollar). Therefore, most mainstream stablecoins (such as USDE, USDC, and USDT) fluctuate near the $1 price point. However, in actual trading, due to market supply and demand, liquidity changes, and other influences, the prices of stablecoin pairs will fluctuate within a small range and may experience short-term deviations.

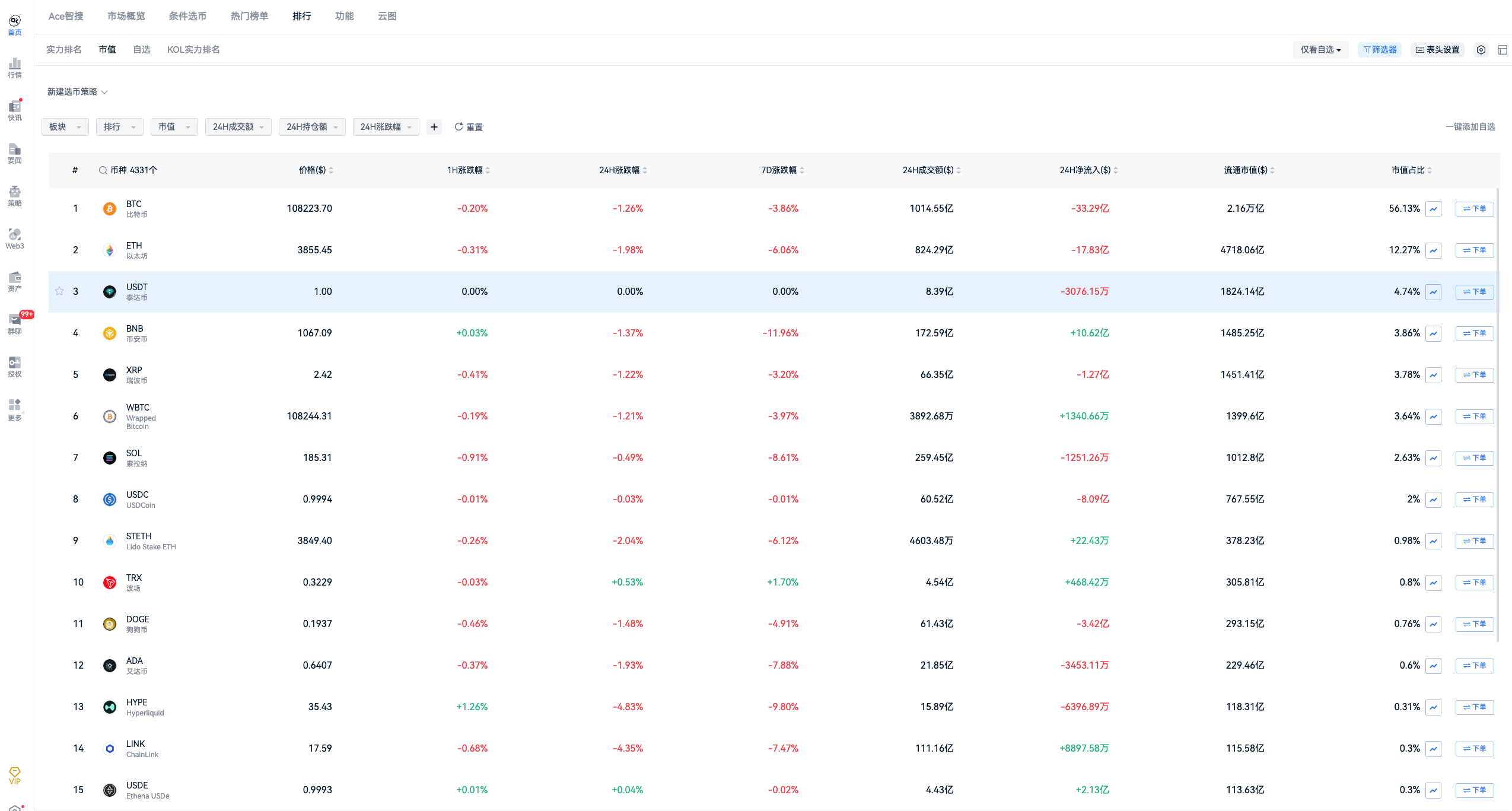

After observing long-term data, we found that trading pairs like USDC/USDT have consistently fluctuated close to the $1.00 range over time, as shown in the figure below. This regularity provides high-quality trading opportunities, laying a stable foundation for strategies that rely on price fluctuations for profit (such as grid strategies).

2. Price anomalies create arbitrage opportunities

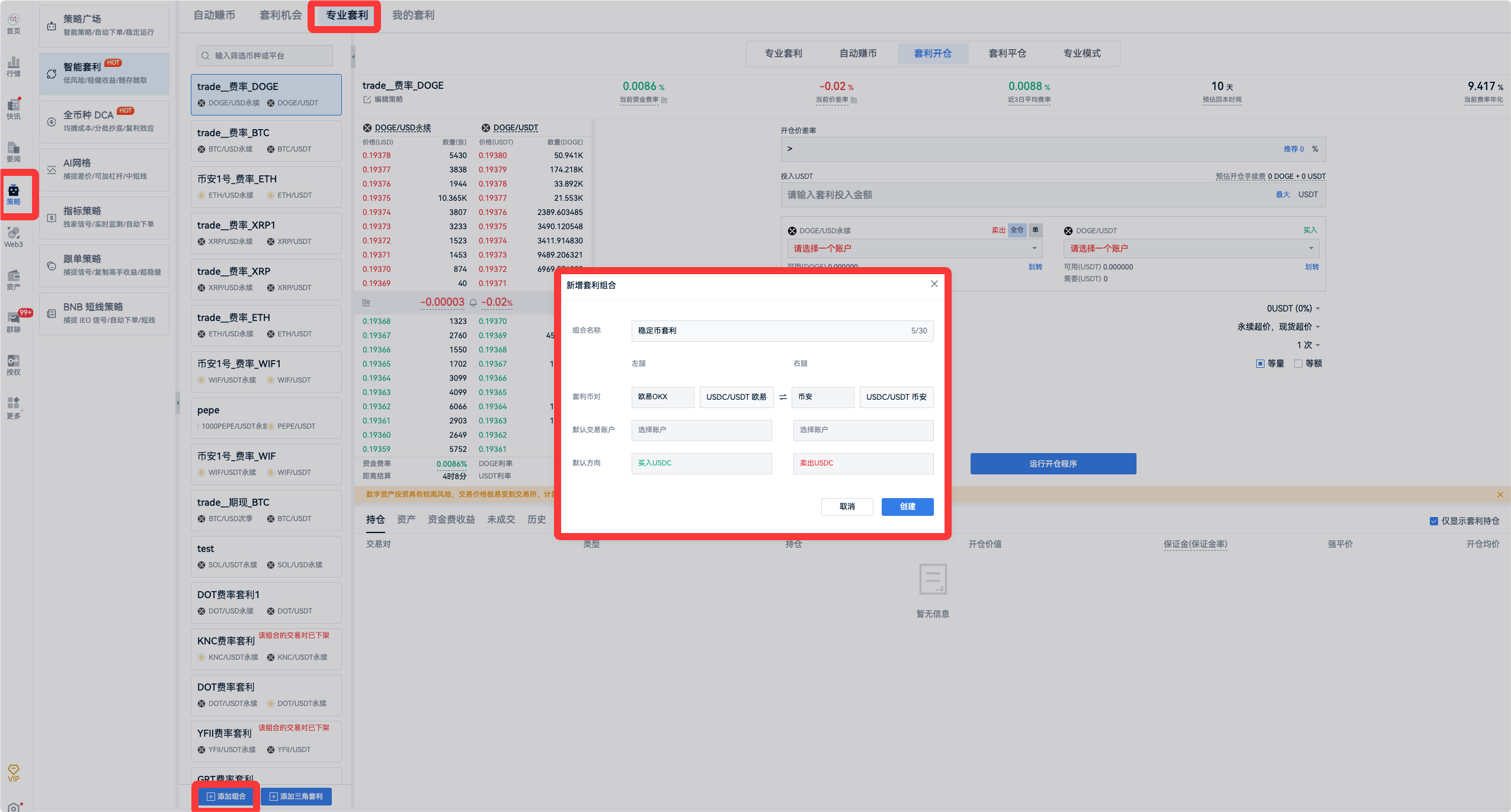

Not only on the OKX exchange with USDC/USDT, but also on other exchanges like Binance, similar stablecoin trading pairs such as USDC/USDT also follow the overall mean principle close to $1. Therefore, when prices briefly deviate, they often hide arbitrage opportunities. By observing prices across multiple mainstream exchanges (such as Binance, OKX, Bitget, etc.), one can efficiently discover and execute cross-platform arbitrage operations.

3. The principle of grid market making for stablecoin pairs

After introducing the basic knowledge of stablecoin pairs, we will further explore how stablecoin pairs create trading opportunities and achieve grid market making.

1. Volatility of stablecoin pairs and trading opportunities

Although the price of stablecoins usually stays close to $1, their daily volatility is not completely zero. For stablecoin trading pairs like USDC/USDT, price trends are still influenced by market supply and demand, liquidity changes, and other factors, resulting in fluctuations within a small range, providing traders with ample profit opportunities.

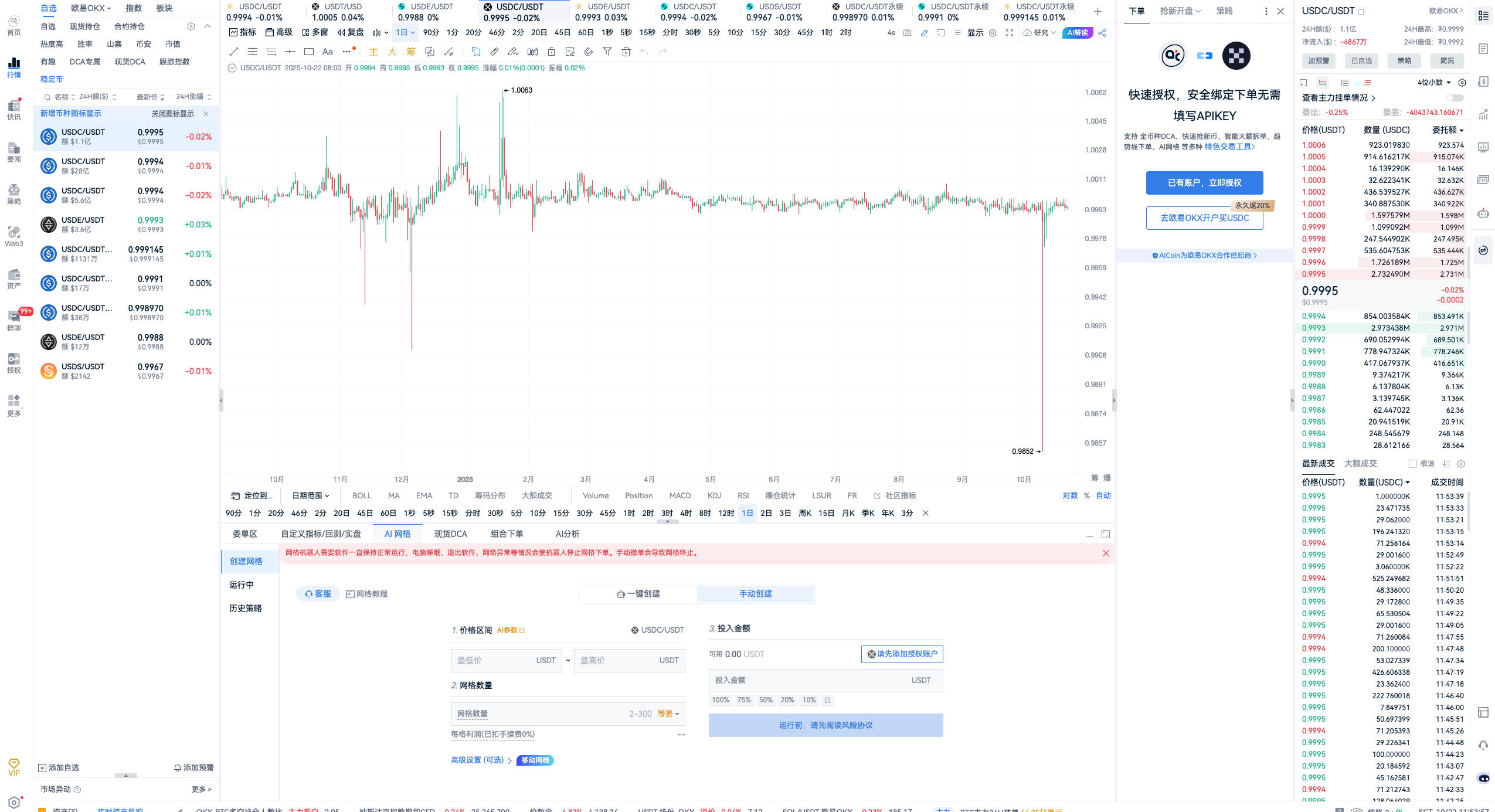

Analyzing the recent price performance of USDC/USDT (as shown in the figure below), we can observe that the lowest price of this trading pair was 0.9852, while the highest price reached 1.0063, with a fluctuation amplitude exceeding 2.14%; although the volatility of stablecoin prices is lower than that of traditional crypto assets, this slight fluctuation is the basis for profit in grid trading strategies.

2. Profit model of grid market making strategy

Asset volatility creates profit space for trading strategies, while grid trading provides a stable mechanism for capturing these fluctuations. Suppose we use a grid strategy to market make on the USDC/USDT trading pair and can evenly capture 1/3 of the daily volatility. Then, over two years, by continuously executing this strategy, a cumulative return of over 40% can be achieved, with an annualized return exceeding 20%. Specifically, the grid strategy utilizes automated low buying and high selling to fully leverage the characteristics of stablecoin pairs' slight and frequent fluctuations, gradually accumulating profits.

In the stablecoin trading market, in addition to the opportunities brought by regular volatility, if we carefully observe the distribution of orders, we will find that orders near the price are usually dense, while orders far from the current price are relatively few. This uneven depth of orders often causes the market to experience short-term violent fluctuations when faced with large market orders, resulting in sudden price spikes or drops. Such market conditions, characterized by abrupt long upper or lower shadows, are often referred to as "spike events."

These abnormal fluctuations are not uncommon in stablecoin trading pairs, and their profit ranges can briefly widen to 5%-10%, or even higher, with extreme cases potentially doubling profits. Investors can seize these market conditions by setting grid trading strategies with larger price differences to achieve ideal returns. By observing order depth and market trends, flexibly adjusting layouts during fluctuations can significantly enhance profit potential and fully exploit the market characteristics during spike events.

3. Summary of the grid principle for stablecoins: Combining grid trading and high-frequency market making to optimize stablecoin pair trading

Stablecoin trading pairs possess the characteristic of deviation must revert; the greater the volatility deviation, the higher the reversion profit, providing a natural advantage for grid trading. The grid strategy captures short-term fluctuations while avoiding the fatal risks brought by grid breaches, and once a grid is breached, the market can optimize positions through increased holdings upon reversion.

By combining grid trading and high-frequency market making, one can capture the frequent intraday fluctuations of stablecoins through small grids while locking in high returns from spike events through larger grids. Reasonably setting grid spacing in conjunction with high-frequency strategies can further stabilize trading results and optimize returns.

4. Automated trading for stablecoin grid market making

The cryptocurrency market operates almost 24/7 without interruption. Whether for high-frequency grid market making or capturing spike events, relying solely on manual trading is clearly difficult to achieve.

If a high-frequency grid market-making strategy is adopted, it is necessary to programmatically and continuously capture subtle fluctuations in the market, completing a large number of trades through actions such as placing orders, executing trades, and closing positions, thereby continuously generating profits. If strategically capturing spike events, it is essential to monitor the liquidity of multiple trading pairs, especially when the market experiences a temporary liquidity gap, which may lead to significant price volatility.

At this time, using automated trading programs not only allows for quick responses but also enables multiple grids to be triggered simultaneously, significantly improving profit efficiency. In this continuous operation mode, profit opportunities in stablecoin trading can be captured more efficiently and continuously, resulting in more substantial returns.

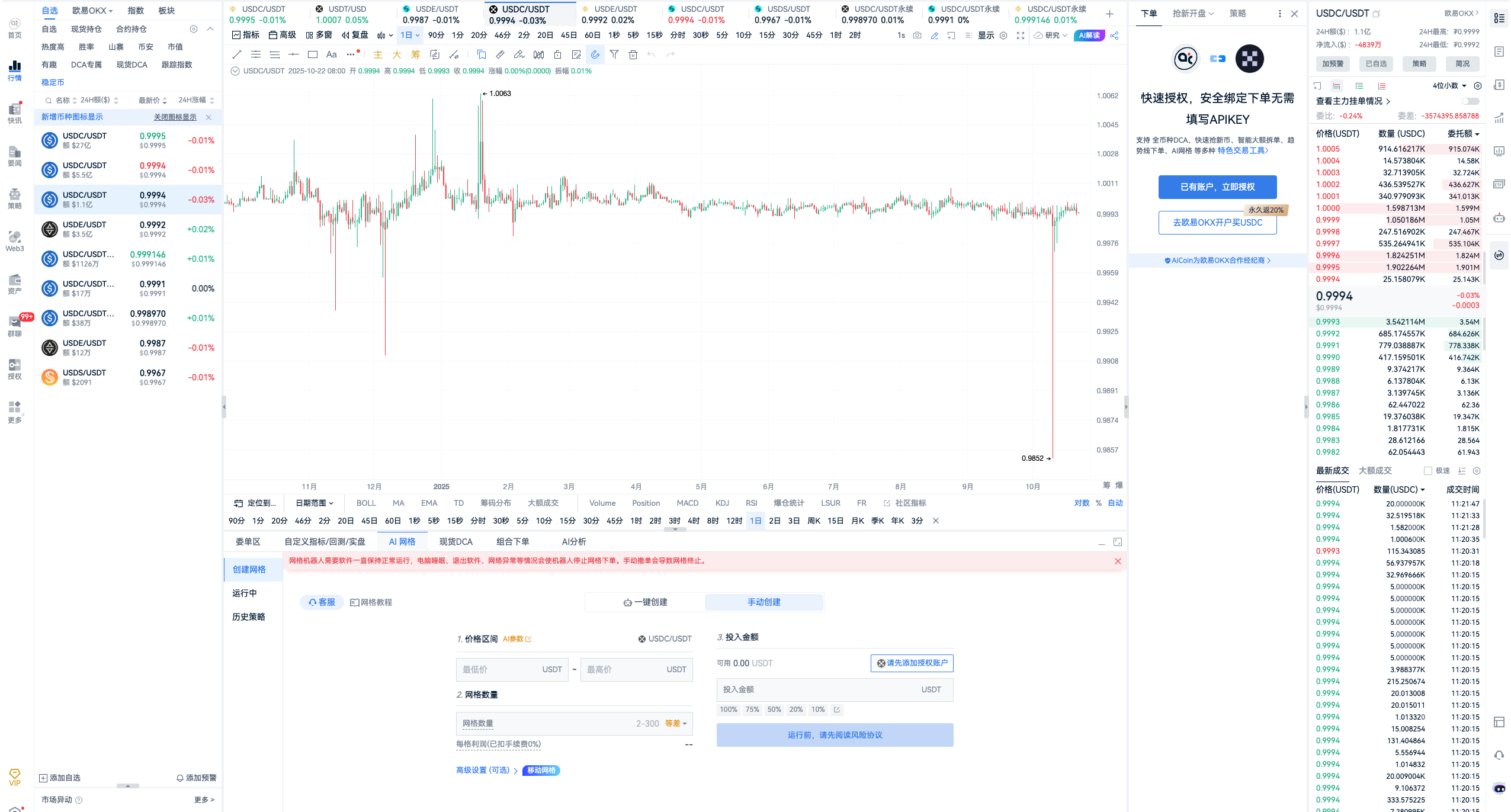

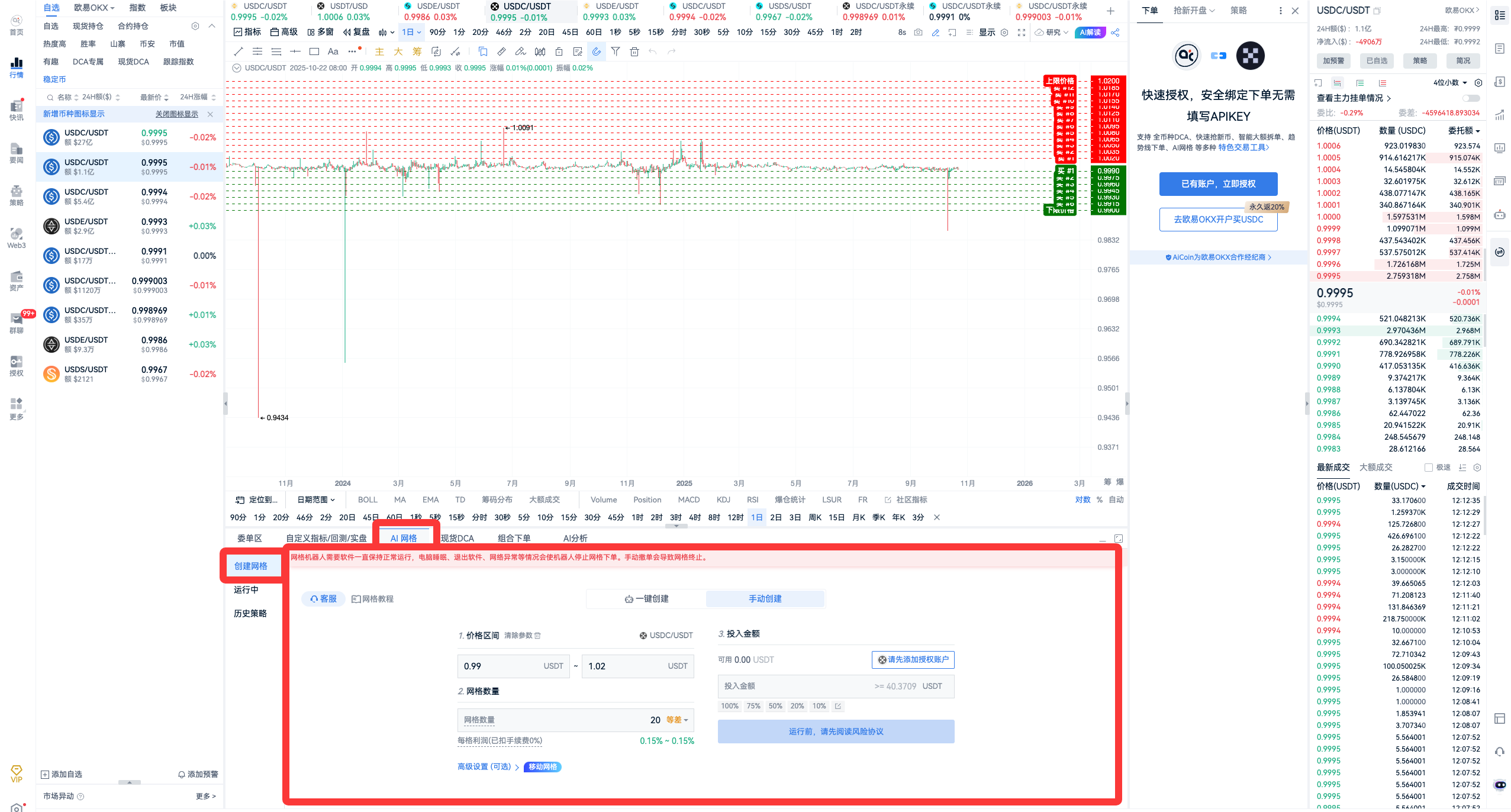

5. AiCoin PC Client AI Grid Tool for Automated Grid Trading

Example:

Target Trading Pair: OKX USDC/USDT Spot Pair

Price Range Selection:

- Lowest Price: 0.99

- Highest Price: 1.02

- Number of Grids: 20 Grids

You can automatically start grid trading! Automated high-frequency transactions!!

You can also directly use the system's recommendations:

For example, Bitget USDC/USDT spot, after system backtesting of recent trends, has integrated the corresponding recommended parameters. One-click to start using it.

Key Reminder:

To activate AiCoin's AI grid robot, the software must consistently operate normally. Situations such as computer sleep, exiting the software, or network anomalies will cause the robot to stop placing orders. Manually canceling orders will lead to the termination of the grid.

6. Recommended Stable and Profitable Stablecoin Grid Strategies

Combining the current stablecoin market ecosystem, we will delve into trading opportunities and strategies, helping you thoroughly understand stablecoins and enjoy stable yet flexible investment returns!

Join our community to discuss and become stronger together!

Official Telegram Community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Welfare Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Welfare Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。