想必大家在经历了 10 月 11 日那场“世纪大爆仓”后,对合约交易的风险都有了更为深刻的认知。此次暴跌来势汹汹,连不少投资者眼中相对安全的低倍杠杆仓位都没能幸免,纷纷爆仓。这也不禁我思考:在币圈,我们普通人的出路到底在哪里?

图1:BTC闪崩瞬间(数据来源于AiCoin快讯)

而最近刷到《人生作弊法则》这个帖子在推特上很火,我认为也很好回答了这个问题。该回答大意是:先研究数字货币,通过刷 Alpha 撸空投积累资金,再开一张 SafePal 的卡把撸空投赚的钱用于日常消费,再选择一个定投指标 AHR999 定投 BTC,剩下的钱就选择合适的标的投资即可。今天,我们就来介绍一下定投和如何使用 AHR999 定投指标,让你慢慢变富,不再为爆仓困扰!

图2:人生作弊法则出处(来源于知乎@Diarriker)

一、如何寻找合适的购买时机?

囤币圈鼻祖,也是 AHR999 指标作者九神在其文章《囤比特币:寻找合适的够买时机》主要表达了以下观点:首先,“任何时候都可以买入比特币” 的说法兼具正确性与非正确性。从长周期维度看,它是正确的——即便在上一轮牛市顶点买入,只要持有至当下,仍能收获数倍收益;但从囤币者资金有限的角度看,它是错误的——若能通过定投等方式将平均成本控制在较低水平,就能持有比在高点买入多几倍的币,甚至能提前一个周期(4 年)实现财富自由,这一点至关重要。

关于如何判断买入时机,李笑来在《比特币世界简明生存指南》中提出 “长期来看,可将矿工成本视为基本面”。从历史情况看,比特币价格从未跌至当时主流矿机的电费成本以下,否则会出现大规模矿机关机,算力下降进而导致挖矿难度降低,所以 “电费成本是比特币价格的硬支撑” 在历史上是成立的。而挖矿难度一直在上涨,BTC 价格也随之水涨船高,因此每一轮熊市的低点都应该比上一轮的低点更高。

图3:比特币挖矿难度(数据来源于AiCoin 指数)

不过,这种现象从经济学角度看并不合理,毕竟通常价格由需求决定,与成本无关。面对理论和事实的矛盾,九神给出了自己的解释:比特币十分特殊,任何人在准备持有它时,都会考量其生产成本——因为获得比特币有 “买币” 和 “挖矿” 两种途径,若能以 5000 美元的成本通过挖矿获得,就不会用 6000 美元去购买。

比特币与苹果手机、葡萄酒等商品存在本质区别,后两者人们更关注品质,而比特币人们更关注成本。尽管每个人的挖矿成本不同(比如有人挖矿成本高达 10000 美元,对他而言直接购买更划算),但总有掌握矿机或电力资源的大资金能实现低成本;一旦比特币价格接近最低成本线,原本要投入矿业的资金就会转向购买比特币,这也就解释了为何币价从未跌破主流矿机的电费成本。

基于此,可得出 “比特币价格的下限是当前主流矿机的电费成本” 这一判断。但要是回调没跌到成本线又涨上去了,那岂不是踏空了?因此,人们就必须在币价相对较低的位置先购买一部分比特币,再留存一些资金或去赚取更多资金,等待那种可遇不可求的绝佳机会——这就是定投合适的购买时机。

二、2025年当下的 BTC 成本

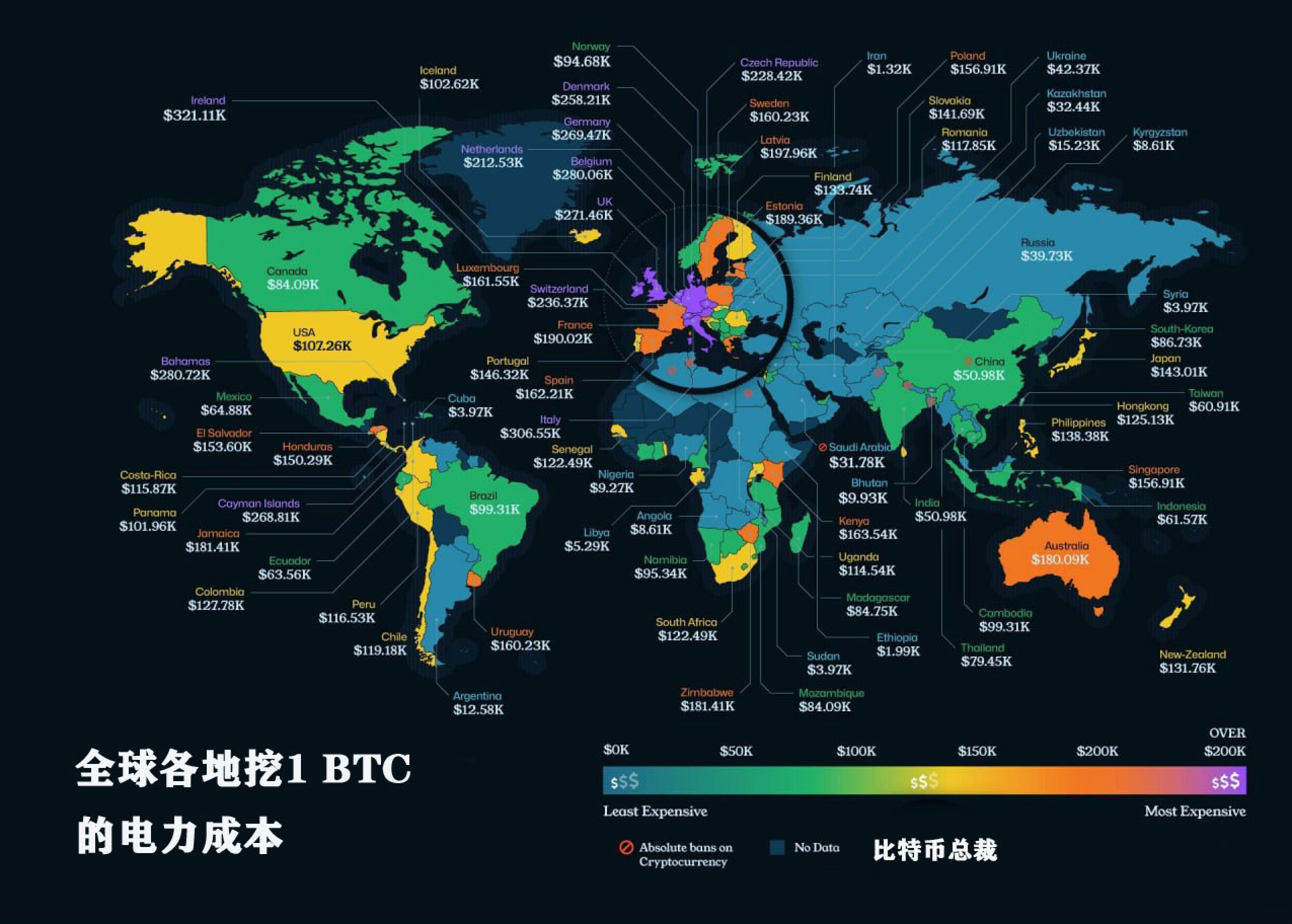

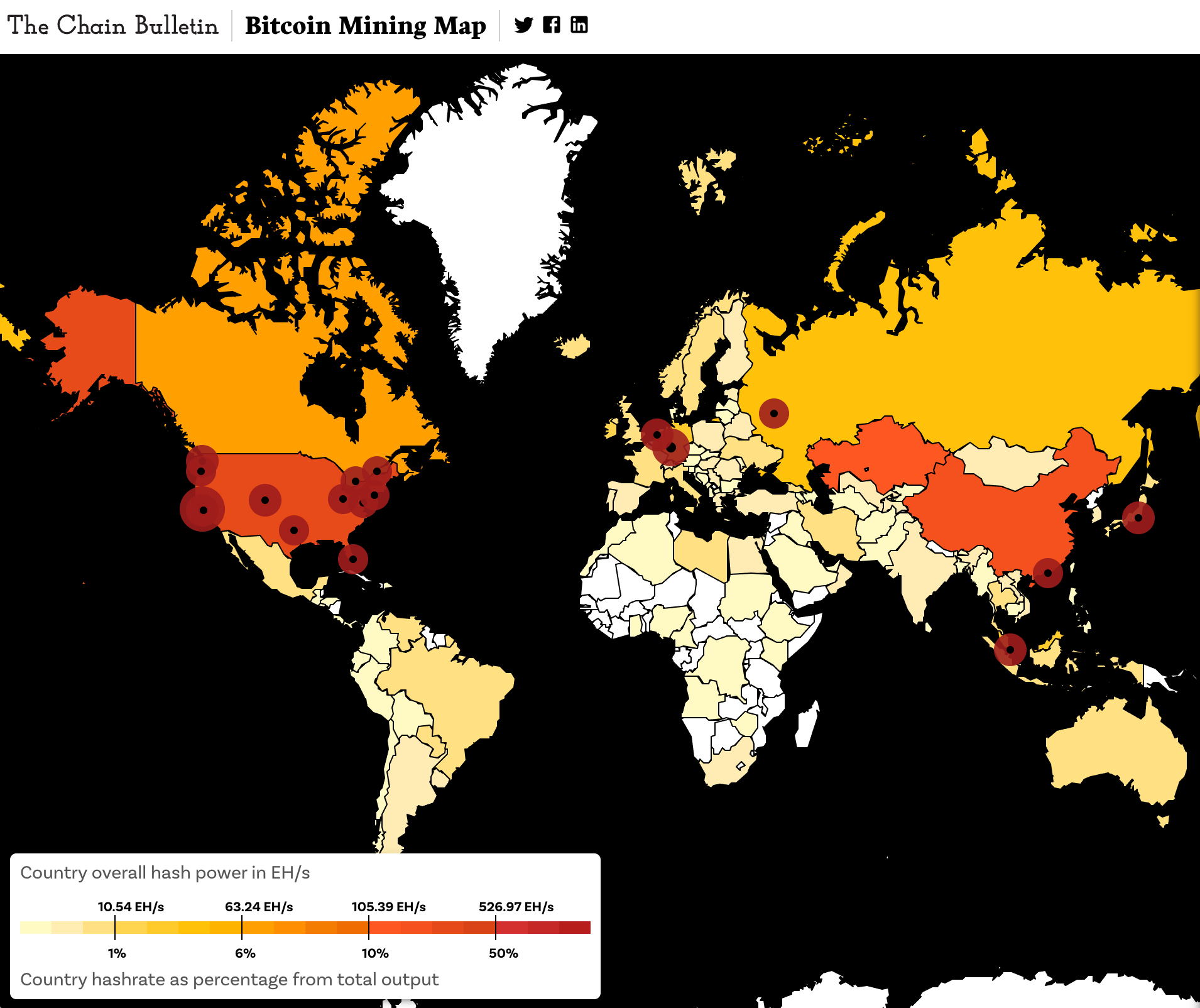

根据九神的观点 “比特币价格的下限是当前主流矿机的电费成本”,现在我们来拆解一下现在 1 枚 BTC 的大概成本:根据全球各地挖 1 BTC 的成本和比特币挖矿地图各地占比可以计算出 BTC 的全球平均成本,其中中国约占全球算力的 20%,哈萨克斯坦约占 15%,俄罗斯约占 5%,美国约占 40%,加拿大约占 5%,世界其他地区约占 15%。各地区算力占比对应相乘其电力成本可得全球 BTC 平均成本约为 7 万左右,低于这个价格全球大部份的矿机都会关机停产,转而购买 BTC。

图4:1枚BTC的电力成本(来源于推特@比特币总裁)

图5:比特币挖矿地图(数据来源于chainbulletin)

因此,我们可以在 BTC 接近七万的价格进行大举买入抄底,这也是为什么四月份最低点出现在七万左右的原因。但是这种机会可遇不可求,我们需要一个更普适的指标来指导我们定投 BTC——AHR999 指标。

图6:比特币四月最低点(数据来源于AiCoin)

三、AHR999 指标的原理及使用方法

我们需要一个能量化判断市场冷热程度的指标,让普通投资者在面对波动时也能有方向感,这就是 AHR999 指标诞生的意义。它由囤币派代表人物九神提出,用于衡量比特币相对长期估值的高低,可以理解为一个 “情绪温度计” 或 “价值锚点”。

在 AiCoin 平台上,普通投资者可以直观查看 AHR999 指数的实时动态和历史走势。如果你想将这个指数融入你的策略里面,AiCoin 也提供便捷的 API 数据接口:https://www.aicoin.com/zh-Hans/opendata 供你调用。

查看路径:打开AiCoin-搜索ahr999指数

ahr999指数 = (比特币价格/200日定投成本) * (比特币价格/指数增长估值)

AHR999 实际上结合了两个关键变量:一个是比特币当前价格与 200 日定投成本的比值,反映市场短期的温度;另一个是比特币当前价格与长期增长曲线之间的偏离程度,代表市场距离长期合理价值有多远。

这两者相乘后,就得到了 AHR999。九神的逻辑是:价格总是围绕长期增长趋势上下波动,当价格远低于趋势线时,就是长期布局的机会,加大定投力度;当价格脱离趋势线过远时,往往意味着市场情绪过热,风险大于收益,停止定投甚至出售。

1. 如何看懂 AHR999?

根据历史数据,AHR999 大致有以下区间参考:

图7:AHR999指标区间

在过去多个周期中,AHR999 < 0.45 时,几乎都对应了极佳的长期买入时机(比如 2015 年、2018 年末、2022 年底的几次低点);而当 AHR999 超过 2.0,往往伴随市场情绪亢奋、牛市后期见顶。

图8:AHR999指标抄底区间(数据来源于AiCoin)

2. AHR999 定投策略示例

如果你是普通投资者,没有时间天天盯盘,那么可以参考以下思路执行:

AHR999 < 0.45 时: 加倍买入,比如平时定投 100U,这时可以买 300U;

AHR999 介于 0.45–1.2 时: 保持原计划定投节奏;

AHR999 > 1.2 时: 暂停或减半定投,逐步积累现金仓;

AHR999 > 2.0 时: 逢高分批止盈或退出。

这样操作的好处是:你既不会在高位重仓,也不会在低位犹豫错过。通过固定周期执行(比如每天或每周一次),把 “择时焦虑” 交给数据,而不是情绪。

3. 为什么 AHR999 特别适合普通人?

在这个信息过载的市场里,绝大多数人都不是能日内博弈的高手,也不具备高频交易的系统。我们真正需要的,是一套能在漫长周期中 “帮你省下错误” 的工具。

AHR999 的意义就在于——它用极简的量化逻辑,把复杂的市场情绪折算成一个直观的数字。当所有人都在恐惧时,它告诉你 “买”;当所有人都在贪婪时,它提醒你 “该收手了”。从过往周期回测看,若在 AHR999 < 1.2 时持续定投甚至抄底,并在 > 2.0 时逐步止盈,长期收益显著高于单纯持币或随意追涨杀跌。对普通人而言,这比频繁交易更现实,也更能让你活得久。

结语

这场“世纪大爆仓”再次提醒我们:

在一个高杠杆、高波动的市场里,没人能永远踩准节奏。 爆仓的根源不是技术太差,而是方法不稳、情绪太重。

AHR999 指标的价值,不仅在于帮我们找到 “买点”,更在于它让普通人能在巨大的噪音里找到秩序感。 它让你明白:财富的积累不在短期暴富,而在长期执行力。

市场会有无数次暴跌,也会有无数次反弹。 但只要你能在恐惧时照计划定投,在贪婪时保持克制,你就已经赢过 90% 的人。

比特币的故事永远在周期中重复,但每一轮周期都会奖励那些守纪律、懂得等待的人。在币圈,真正的 “人生作弊法则”,不是内幕消息,而是用认知和系统,战胜人性。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

群聊 - 致富群:https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。