The original text is from CBB

Original translation by Odaily Planet Daily Azuma

Let's rewind to March 2025, when the cryptocurrency market looked bleak, heavily impacted by tariff conflicts, and we began to think about where the next potential opportunity might lie.

At that time, 40% of Hyperliquid (HYPE) had not yet been allocated to the community, and we thought this could be an opportunity point. Previously, in February, we had tested some market-making strategies on Unit (the asset tokenization layer built specifically for Hyperliquid), but we didn't take it too seriously; it was just a small-scale attempt.

At that time, HyperEVM had just launched some DEXs, and my brother said, "Why don't we try arbitraging between HyperEVM and Hyperliquid? Even if we lose money, we can still earn the rewards for the third quarter of Hyperliquid."

We decided to give it a try. There were indeed arbitrage opportunities, but we were unsure if we could truly compete with others.

Why Are There Arbitrage Opportunities on HyperEVM?

The block time on HyperEVM is 2 seconds. This means that the price of HYPE is updated only every 2 seconds, and during this 2-second interval, the price of HYPE may fluctuate.

As a result, HYPE on HyperEVM often appears "undervalued" or "overvalued" relative to Hyperliquid.

Initial Attempts and Results

We first built a basic version of a bot program.

Whenever there was a price difference between the AMM DEX pool on HyperEVM and the spot price on Hyperliquid, we initiated a trade on HyperEVM and hedged on Hyperliquid.

For example, if the price of HYPE rose on Hyperliquid, it would be undervalued on HyperEVM. The trading logic at that time was — buy "cheap" HYPE with USDT0 on HyperEVM ➡️ sell HYPE for USDC ➡️ then exchange USDC back to USDT0 on Hyperliquid.

In the first few days, our daily trading volume on Hyperliquid reached $200,000 to $300,000, and we did not incur losses; we even made small profits of a few hundred dollars.

Initially, we only executed arbitrage when profits exceeded 0.15% (after deducting DEX and Hyperliquid fees). Two weeks later, we began to see greater potential as profits were on the rise.

We identified two other competitors who were doing the same thing, but on a smaller scale. We decided to "eliminate" them.

In April, Hyperliquid launched a feature to stake HYPE for fee rebates. This was a perfect update for us, as we had a larger capital base and could effectively leverage this advantage.

We staked 100,000 HYPE, received a 30% rebate on trading fees, and lowered our profit threshold from 0.15% to 0.05%. We aimed to suppress our competitors to the maximum extent, hoping they would give up, allowing us to enjoy the cake alone. Our goal was to achieve over $500 million in trading volume within two weeks to elevate our fee tier on Hyperliquid.

As trading volume increased, profits also rose. Ultimately, we reached over $500 million in trading volume, completely crushing our competitors.

I still remember that day — the two competitors were forced to shut down their bot programs while my brother and I were flying from Paris to Dubai, watching our bots "print money" — with profits reaching $120,000 that day.

After the phase of aggressively boosting trading volume, even though our competitors had a clear disadvantage in fees, they still refused to give up, forcing us into a narrow profit margin of 0.04%, which was basically the fee difference between us and them. Our trading volume remained strong, with daily profits stabilizing between $20,000 and $50,000.

Expansion Bottlenecks

As our scale gradually expanded, we began to encounter bottlenecks.

The gas limit per block on HyperEVM is 2 million, and an arbitrage trade requires about 130,000 gas, so each block can accommodate a maximum of 7-8 arbitrage trades.

As more pools and DEXs launched on HyperEVM, this number was far from sufficient, causing some trades to get stuck, leading to transaction queue backlogs and imbalances in capital positions.

To address this, we implemented a series of measures:

- Use 100+ wallets, with each wallet independently sending arbitrage trades to avoid queuing with a single wallet;

- Execute a maximum of 8 arbitrages per block;

- Dynamic gas control: when gas on HyperEVM spikes, we raise the minimum return on investment (ROI) requirement to avoid sending trades during high gwei periods;

- Rate limiting: if too many trades are sent in the past 12 seconds, we will increase profit requirements before sending new trades.

Optimization Strategies

As profits continued to rise and trading volume consistently exceeded competitors by 5-10 times, we also became obsessively focused on optimization.

This wasn't our first experience with such a situation — today you might be printing money while drinking beer, and tomorrow some unknown entity could bring you back to square one overnight.

Becoming a Maker on Hyperliquid

In June, my brother proposed an idea he had been thinking about for weeks: "What if we no longer place orders as takers but instead initiate arbitrage as makers?"

This approach has two main benefits:

- First, it allows us to capture the minute fluctuations of HYPE (wick candles), which will bring more arbitrage opportunities;

- Second, it saves 0.0245% in fees for each trade, thereby increasing net profits.

However, this was also a very challenging move because if we placed a limit order on Hyperliquid first, we could not ensure that we could complete the corresponding hedge on HyperEVM — someone else might be faster than us.

Previously, our arbitrage logic was: initiate a trade on HyperEVM first — if the trade fails, do nothing on Hyperliquid; if the trade succeeds, then execute the hedge on Hyperliquid. But as a maker, we must wait for the order to fill on Hyperliquid first, without certainty that we can execute on HyperEVM in time. This could lead to unbalancing of positions, potentially resulting in losses.

Initially, each test would result in a position deviation of ±10,000 HYPE. We even found it difficult to understand why this was happening, as sometimes we would send 100 trades within 20 seconds without any data analysis tools. The situation was chaotic.

To solve this problem and safely execute limit order arbitrage, we introduced a series of new concepts and translated them into code modules and parameters:

- Profit Range: defines when to place orders, when to hold, and when to cancel and replace;

- Participating AMM pools (e.g., HYPE/USDT0 0.05% fee pool on HyperSwap, HYPE/UBTC 0.3% fee pool on Project X);

- Order size and quantity for each pool.

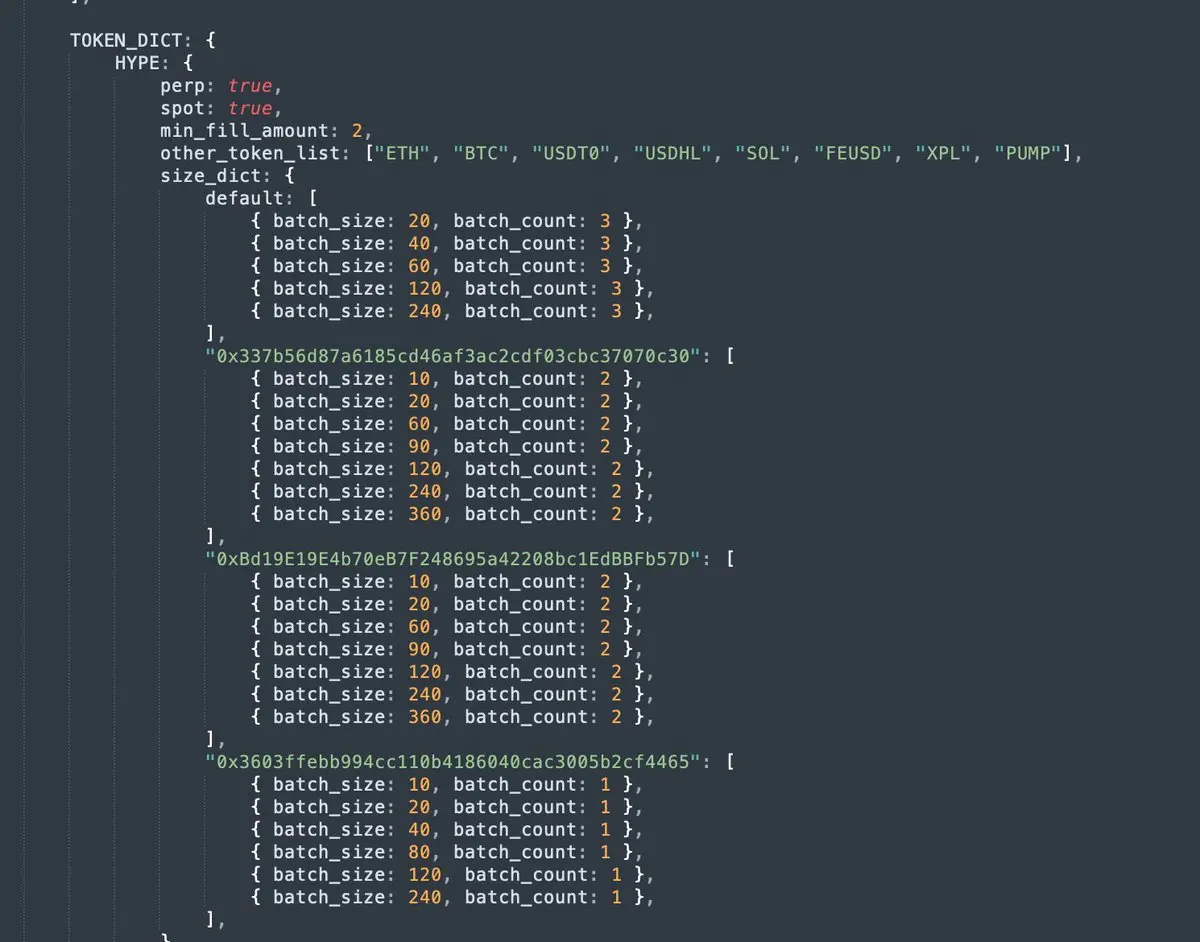

The parameters for taker trades are shown in the image below.

After a few days of fine-tuning, we finally avoided most of the imbalance situations, and once an imbalance occurred, we would immediately use the time-weighted average price to close positions as quickly as possible to limit risk. This completely changed the game, as competitors remained as takers while we were crushing them, with trading volume reaching 20 times theirs.

Skipping USDT/USDC Trades on Hyperliquid

The next challenge we encountered was the unique situation of USDT0. USDC is the number one stablecoin on Hyperliquid, while USDT0 is the number one stablecoin on HyperEVM. The best liquidity pool for trading volume and arbitrage opportunities on HyperEVM is the HYPE-USDT0 pool. However, since we needed to use USDT0 on HyperEVM and USDC on Hyperliquid, we had to execute two trades on Hyperliquid to rebalance between these two assets.

For example, when the price of HYPE rises:

- Limit order fills on Hyperliquid ➡️ sell HYPE for USDC (0% fee);

- Buy HYPE with USDT0 on HyperEVM;

- Sell USDC for USDT0 on Hyperliquid (taker fee rate 0.0245%);

The problem lies in the third step:

- We need to pay the taker fee (lower profits, reduced competitiveness);

- The USDT0/USDC market on Hyperliquid is not yet mature, with high slippage and inaccurate pricing;

Therefore, we decided to skip this step whenever possible. To do this, we built new parameters and logic:

- USDC threshold: only skip the USDT0 → USDC trade when USDC balance > 1.2 million;

- USDT0 threshold: only skip the USDC → USDT0 trade when USDT0 balance > 300,000;

- Real price data source: call the Cowswap API every minute to get real-time USDT0/USDC prices, rather than relying on the Hyperliquid order book.

Introducing Perpetual Contract Arbitrage

First, let me clarify that we have almost never used leverage or perpetual contracts in the cryptocurrency space (except for that not-so-successful attempt on BitMex in 2018), so initially, we didn't really understand this system.

However, we later noticed that the trading volume of HYPE perpetual contracts was far higher than that of spot trading, and the fees were slightly lower (spot 0.0245%, perpetual contracts only 0.019%). We thought we could try to optimize our strategy using perpetual contracts. Our competitors had not yet used perpetual contracts, so we were almost the sole beneficiaries of this market liquidity.

In testing, we found that using perpetual contracts not only allowed us to capture more arbitrage opportunities but also earn funding fees. When the price of HYPE perpetual contracts was at a premium or discount relative to spot, we could further explore arbitrage space. This was something our competitors had completely overlooked.

So, we designed a new set of system parameters:

- Bound: The maximum amount of HYPE that can be shorted/longed to avoid being liquidated or exhausting USDC/HYPE balances;

- Premium/Discount: Real-time monitoring of the deviation of perpetual prices relative to spot;

- Max Premium / Max Discount: Stop going long when the premium is too high and switch to spot;

- Progressive ROI: The larger the position, the higher the required profit margin to prevent getting too deep into long/short positions;

- ROI Formula: Dynamically adjusted based on perpetual premium/discount + position size.

Below is the parameter interface for configuring HYPE shorts as a taker.

It turned out that introducing perpetual contracts was one of our most important improvements. It brought in about $600,000 in revenue just from funding fees and created more arbitrage opportunities based on premiums/discounts.

Division of Labor and Collaboration

Many people ask how we divide our work and collaborate.

To outsiders, I often appear to be the one who just posts random things and jokes on CT, while my brother is the quiet techie who writes code. But the reality is much more complex. Our collaboration style is quite similar to the rhythm during the Blur mining days.

When creating this bot program, you never know when the next bug or market change will occur. We solve problems, optimize algorithms, and align our thoughts every day. Any changes we make must be discussed and agreed upon before execution.

He is responsible for coding and has built the control panel that allows me to manage parameters. I can't write code at all (really not at all), but I know how to configure strategies to achieve optimal performance in the market; my brother, on the other hand, can write programs but doesn't know how to configure strategies.

We are also very different in personality: my brother likes frequent updates and quick experiments (I think it's too aggressive); I tend to be conservative, advocating for not making changes as long as we can make money (he thinks it's too lazy).

A typical dialogue pattern between us is as follows.

Me (actually very sharp-tongued): "This program seems a bit weird… what did you change?"

Him: "Nothing… um, maybe just a little something."

For both of us, one strange aspect of building the bot program without formal company processes is that after 250 updates, you feel like you've created something you no longer fully understand or control. When you push new updates, it can sometimes be hard to grasp all the impacts it will bring.

Conclusion

Over the past 8 months, we have invested almost all our time into this program.

Especially since June, the monster-level market makers from Wintermute joined the battlefield with massive liquidity and a whole quantitative team. I still remember our 5-day journey from Istanbul to Bodrum in July — it was supposed to be a vacation, but we spent the entire 5 days locked in the hotel debugging the program.

Ultimately, our achievements are:

- Profit: $5 million;

- Total trading volume on Hyperliquid: $12.5 billion;

- Gas fees paid on HyperEVM: $1.2 million (accounting for 20% of the total fees on that chain);

- Cumulative development time: 2000+ hours;

- Market share: 5% of Unit trading volume;

Now, we have decided to take a break and let the bots rest. We look forward to the next round of opportunities — Hyperliquid Season 3 and Unit Season 1.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。