Author: arndxt, Independent Researcher

Translation: Luke, Mars Finance

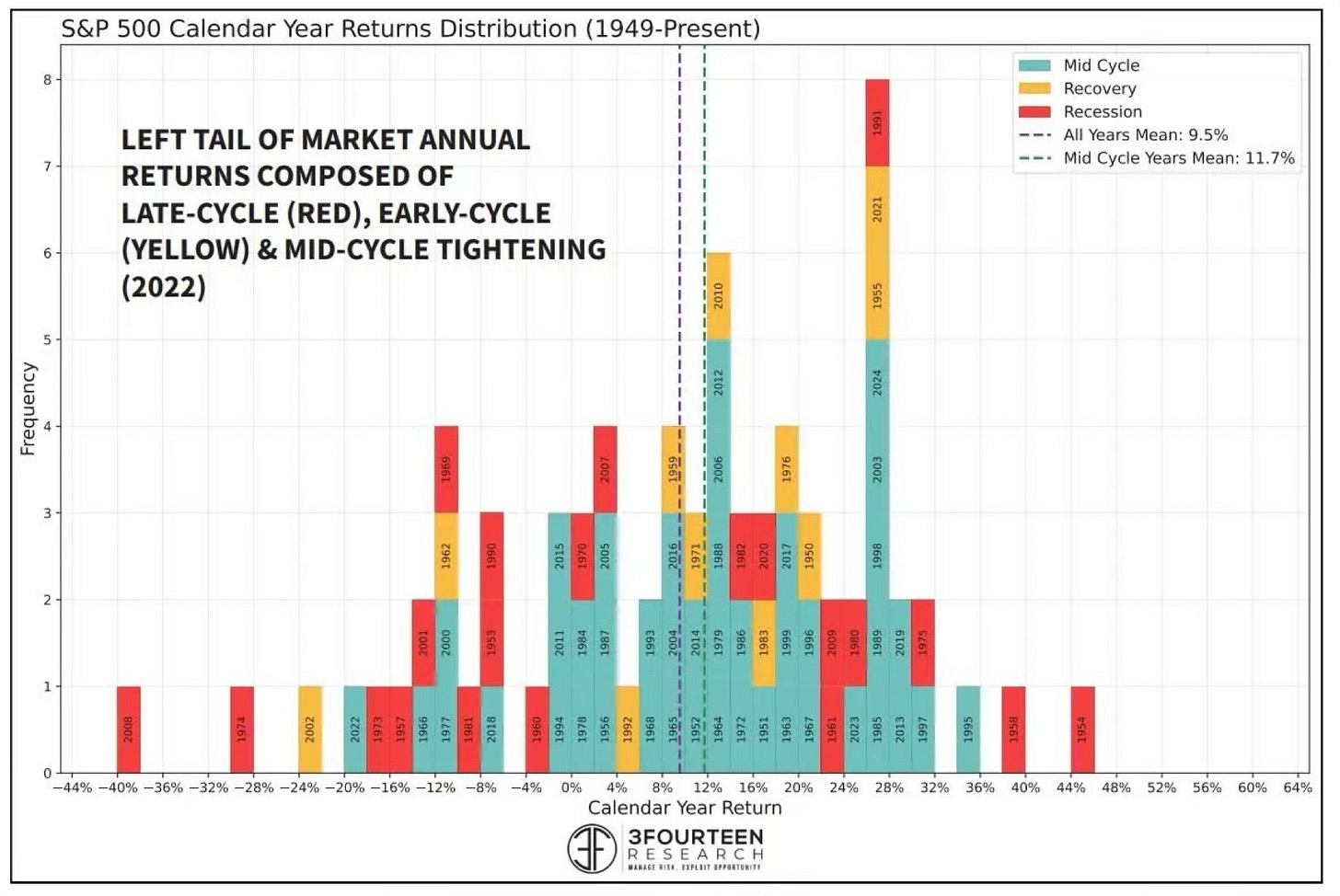

2025 = The Year of the "Mid-Cycle"

The market is caught in a paradox.

Beneath the calm surface of "soft landing" optimism, the global economy is quietly fracturing along the lines of trade policy, credit expansion, and technological overreach.

Core Argument:

The next dislocation in the global economy will not stem from a single failure, unrelated to tariffs or AI debt, but rather from the feedback loop between policy, leverage, and belief.

We are witnessing the late stages of a super cycle: technology supports growth, fiscal populism replaces trade liberalism, and monetary trust is slowly eroding.

The current volatility is a microcosm of this story.

As fears of U.S.-China tariffs reignite, the VIX index saw its largest spike since April, only to retreat later in the week when President Trump confirmed that the proposed 100% import tariffs would be "unsustainable." The stock market breathed a sigh of relief; the S&P 500 stabilized. But this relief is superficial; the deeper narrative is that policy tools are exhausted, and optimism is over-leveraged.

1. The Illusion of Stability

The U.S.-EU trade agreement in July was intended to provide an anchor for a fragile system.

However, it is now unraveling due to climate regulatory disputes and U.S. protectionism. Washington is demanding exemptions for U.S. companies from ESG (Environmental, Social, and Governance) and carbon disclosure rules, highlighting the widening ideological rift: Europe's "decarbonization" versus America's "deregulation."

Meanwhile, China's new restrictions on rare earth exports, including a ban on using any magnets containing trace amounts of Chinese metals, expose the strategic vulnerabilities of global supply chains. The U.S. response—threatening to impose 100% tariffs on Chinese imports—was a political stance with global consequences. Although later retracted, it reminded the market that trade has become "weaponized finance," serving more as leverage for domestic sentiment than as a consideration of economic rationality.

The World Trade Organization (WTO) warns that global goods trade will sharply slow by 2026, reflecting a reality: corporate investment in supply chains is no longer driven by confidence but by contingency preparation.

2. The AI Super Cycle

Meanwhile, a second narrative is unfolding in the AI economy, which is subtler but potentially more far-reaching.

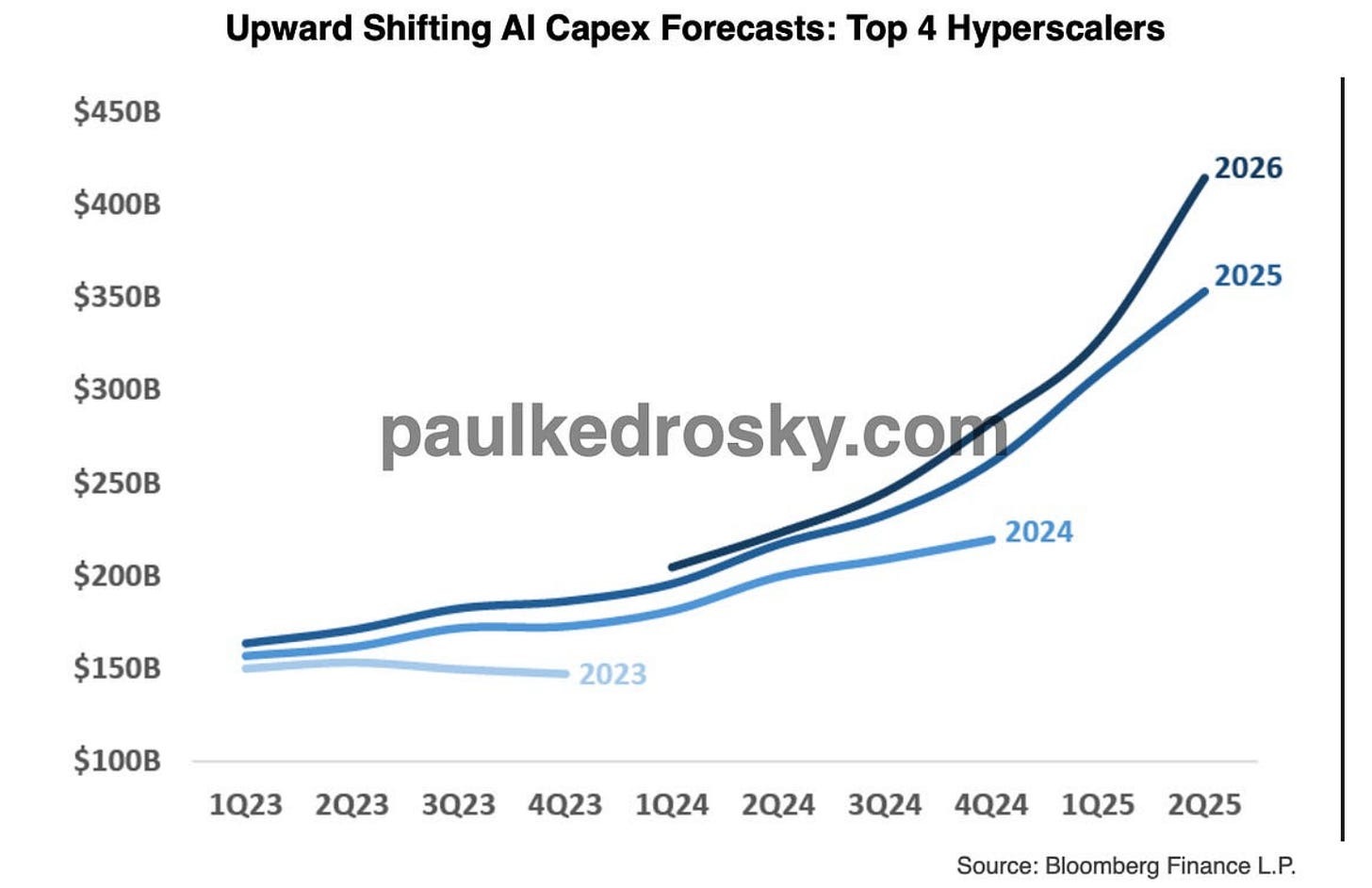

We are transitioning from "productive expansion" to "speculative finance," characterized by "vendor financing surges and declining coverage ratios." Hyperscalers are leveraging their balance sheets at a faster rate than revenue growth, a typical signal of irrational exuberance at the end of a cycle.

This is not new. Of the 21 major investment booms since 1790, 18 ended in bankruptcy, typically occurring when the quality of funding deteriorates. Today's AI capital expenditure (capex) frenzy resembles the telecom bubble of the late 1990s: real infrastructure returns are entangled with credit-fueled speculation. SPVs (Special Purpose Vehicles), vendor financing, and structured debt—tools that once birthed the mortgage-backed securities (MBS) bubble—are making a comeback, this time cloaked in "computing capacity" and "GPU liquidity."

Ironically, the AI boom does have productivity; it is just unevenly distributed. Microsoft is financing its expansion through traditional bonds, indicating confidence. CoreWeave, on the other hand, is financing through SPVs, revealing pressure. Both are expanding, but one is building lasting capabilities; the other is accumulating vulnerabilities.

3. Volatility as a Symptom

The spike in the VIX reflects deeper market unease: policy uncertainty, concentrated stock market leaders (note: referring to a few large tech stocks), and credit pressures beneath the surface of prosperity valuations.

When the Federal Reserve now hints at rate cuts amid slowing growth, it is not stimulus but risk management. The two-year U.S. Treasury yield has fallen to its lowest level since 2022, signaling that investors are pricing in "deflation of confidence," rather than just interest rates. The market may still cheer every dovish turn, but each rate cut undermines the illusion that "growth can sustain itself."

4. Trade, Technology, and Trust

The thread connecting tariff politics and AI irrational exuberance is trust, or more accurately, the erosion of trust.

Governments no longer trust trade partners.

Investors no longer trust the coherence of policies.

Companies no longer trust demand signals, leading to overbuilding.

Gold has surged past $4,000, which is less about inflation and more about the erosion of this belief—trust in fiat systems, in globalization, in institutional coordination. This (note: referring to buying gold) is not about hedging prices but hedging against "policy entropy."

5. The Road Ahead

We are entering a period of "dislocated prosperity"—a time when nominal growth and market peaks coexist with structural fragility:

AI investment drives GDP like 19th-century railroads.

Trade protectionism raises local production while draining global liquidity.

Financial volatility oscillates between "euphoria" and "policy panic."

At this stage, risk is accumulating.

Every tariff rollback, every announcement of capital expenditure, every rate cut extends this cycle, but simultaneously compresses the space for its eventual unwind. The question is not whether the AI or trade bubble will burst, but how inseparable they have become when it does.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。