Author: Nancy, PANews

South Korea's unique "kimchi premium" gives local cryptocurrency exchanges a strong listing effect, serving not only as a "golden ticket" for project parties to gain capital attention and brand exposure but also as an important indicator for investors' FOMO (Fear of Missing Out) to enter the market.

Recently, with the South Korean Financial Services Commission (FSC) announcing new virtual asset legislation plans, including raising listing thresholds, regulating trading behaviors, and introducing stablecoin supervision, the South Korean crypto market is accelerating into a 2.0 regulatory era characterized by institutionalization and standardization.

New Regulations Expected to be Submitted to Parliament by Year-End: Stricter Listing Requirements and First Establishment of Stablecoin Regulation

As major economies like the U.S., Japan, and the EU accelerate the institutionalization of virtual assets, South Korea is also intensifying the establishment of a comprehensive regulatory system while maintaining market innovation vitality.

Recently, the FSC announced the "Virtual Assets Phase 2 Legislation" plan, aimed at shifting the listing business of virtual asset exchanges from the current self-regulatory model to a more open and stringent government direct regulatory system to enhance trading transparency and investor protection levels.

Regarding listing regulation, the FSC plans to require exchanges to establish clear listing and delisting standards, trading suspension and resumption rules, and information disclosure matters to address previous issues of lax listing reviews and the entry of risky assets into the market. In fact, during the fourth virtual asset committee meeting in South Korea this year, the listing issue was already emphasized, and the FSC announced that starting June 1, new regulations under the "Trading Support Demonstration Case Amendment" would be implemented, requiring newly listed coins to have a minimum circulation volume and restricting market price orders in the initial listing phase to prevent "listing pump" and speculation on zombie coins and MEME coins.

In terms of legal definitions and operational behavior norms, the FSC will rename the term "virtual assets" in current legal language to "digital assets" and formally include the concept of "distributed ledger" in the definition, thereby enhancing the clarity and operability of the law. At the same time, the legislation will subdivide the business scope of operators into virtual asset exchanges, traders, custodians, and managers, and introduce basic operational behavior norms prohibiting insider trading and market manipulation. This refinement helps clarify the legal responsibilities of different types of participants, reduce regulatory gray areas, and effectively deter market manipulation behaviors.

Regarding market competition and monopoly issues, as exchanges like Upbit and Bithumb hold a significant market share in the Korean won market, potential monopoly issues may arise. The FSC is conducting related research in collaboration with the Fair Trade Commission. This initiative will help maintain the vitality of the South Korean market and encourage the development of small and medium-sized exchanges, increasing market choices.

It is worth mentioning that the FSC has also officially launched the establishment of a stablecoin regulatory framework for the first time, supporting the development of stablecoin markets for financial services such as payments, remittances, and cross-border transactions while ensuring adequate protective measures. According to the plan, the FSC intends to introduce a licensing system for stablecoin issuers, requiring issuers to hold high liquidity assets such as deposits and government bonds as reserves, with a reserve asset ratio of over 100%, and establish a user redemption rights protection mechanism.

At the same time, South Korea will, in principle, not allow payment-type stablecoins to generate interest payments from holding or using them, and will explore a bank-led alliance model, limiting fintech companies to being mere technical partners and prohibiting virtual asset exchanges from issuing stablecoins independently. The regulatory design will reference the institutional experiences of overseas stablecoins like Tether and Circle (USDC).

"We will formulate the second phase of the legislation through discussions with relevant institutions and the virtual asset committee, and actively support parliamentary review. We are still in the early stages of institutional design, so it is essential to have adequate safety measures. Relevant departments are conducting detailed consultations, and we are currently in the final coordination stage, with hopes to complete the submission by the end of the year," said FSC Chairman Lee Ik-yeon.

South Korea's "Ant Army" Rushes into the Crypto Market, Regulation Moves to 2.0 Era

South Korean retail investors are known globally for their willingness to take risks and chase high-volatility assets, with FOMO deeply embedded in their investment behavior.

According to data from Yonhap News Agency, as of August this year, over 10,000 investors among the five major Korean won exchanges hold more than 1 billion won (approximately $710,000) in virtual assets, with a total of 10.86 million active trading accounts, accounting for about 20% of the national population. This astonishing ratio is enough to demonstrate the penetration of crypto investment in South Korean society.

Today, the Korean won has become the second-largest fiat currency for crypto trading globally, after the U.S. dollar, and South Korean retail investors are particularly keen on speculating on "small coins." According to a recent report by Bloomberg, South Korea's "ant army" (approximately 14 million retail investors) is being swept up by high housing prices and economic anxiety, frantically chasing high-risk assets, from leveraged ETFs to cryptocurrencies, and even extremely volatile altcoins. Over the past five years, the scale of margin loans has tripled, with a large amount of funds flowing out of bank accounts into these high-risk markets. The enthusiasm of South Korean retail investors has led to altcoin trading volumes on local exchanges exceeding 80%, far above the global average (where Bitcoin and Ethereum typically account for about 50%).

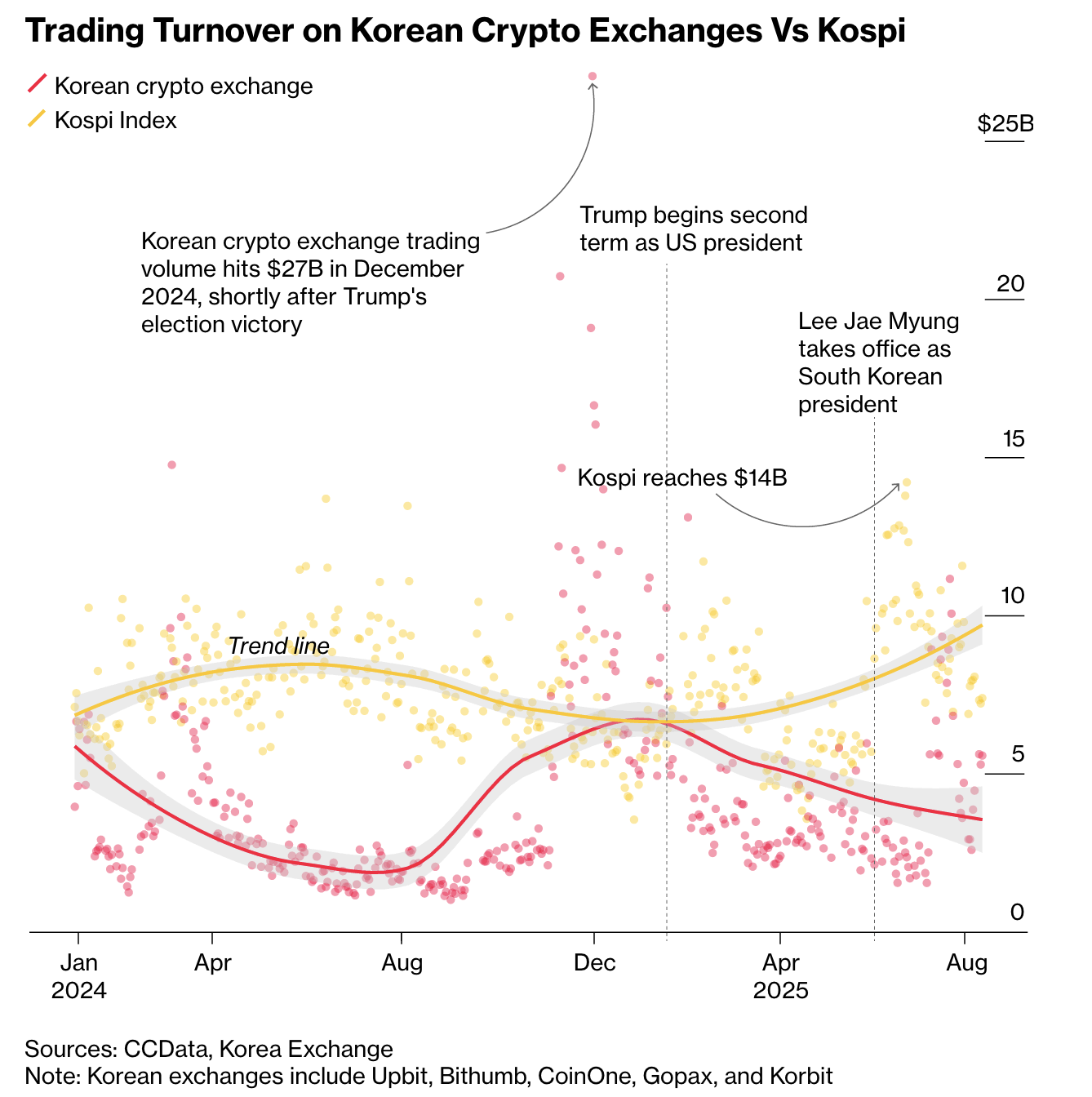

This phenomenon of nationwide investment has not only rewritten the financial ecology of South Korea but has also raised concerns among regulators. In fact, retail investors have a significant influence in the South Korean stock market, accounting for about two-thirds of daily trading volume. Previously, the South Korean government halted a new capital gains tax plan due to strong opposition from retail investors. Now, they are pouring into the crypto market, especially after Donald Trump's election as U.S. president, leading to a surge in trading volumes on local exchanges, which have reached about 80% of the country's benchmark stock index, Kospi, including stablecoins that have also attracted significant attention. Meanwhile, due to strict domestic regulations, many investors have shifted their trading to overseas markets.

To address this high-risk market environment, South Korea has been incorporating retail enthusiasm into a more robust financial framework through legislation and institutional development in recent years.

As early as September 2021, South Korea officially implemented the "Act on the Utilization and Reporting of Specific Financial Transaction Information" (referred to as the "Specific Financial Act"), establishing the initial compliance and transparency framework for the virtual asset market. According to this law, virtual asset service providers (VASPs) must register with the Financial Intelligence Unit (FIU) of South Korea and obtain real-name accounts and Information Security Management System (ISMS) certification to operate legally. According to recent data disclosed by the FSC, as compliance costs have significantly increased, the number of exchanges registered with South Korean authorities has sharply decreased from 60 to 29.

In March 2022, South Korea became the first country in the world to officially implement the "Travel Rule," requiring VASPs to collect and store information on both parties in transactions exceeding 1 million won (approximately $840) to prevent money laundering and illegal fund flows. This marks a shift in South Korean regulation from "entry barriers" to "transaction control."

On July 19, 2024, South Korea implemented the "Virtual Asset User Protection Act." This law focuses on protecting user asset security, regulating market trading behaviors, and strengthening regulatory powers, with a focus on combating market manipulation, insider trading, and unfair trading practices, while clearly granting financial regulatory agencies more intervention authority. The introduction of this legislation is also seen as a response to the recent frequent incidents of exchange collapses and investor losses, indicating that South Korea will gradually establish a healthier, more transparent, and institutionalized crypto market.

With the arrival of the second phase of the virtual asset legislation, South Korea is moving towards more comprehensive and systematic legislation. By clarifying regulations, market blind spots will be eliminated, user protection will be further strengthened, and the predictability of innovation in the crypto industry will be enhanced.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。