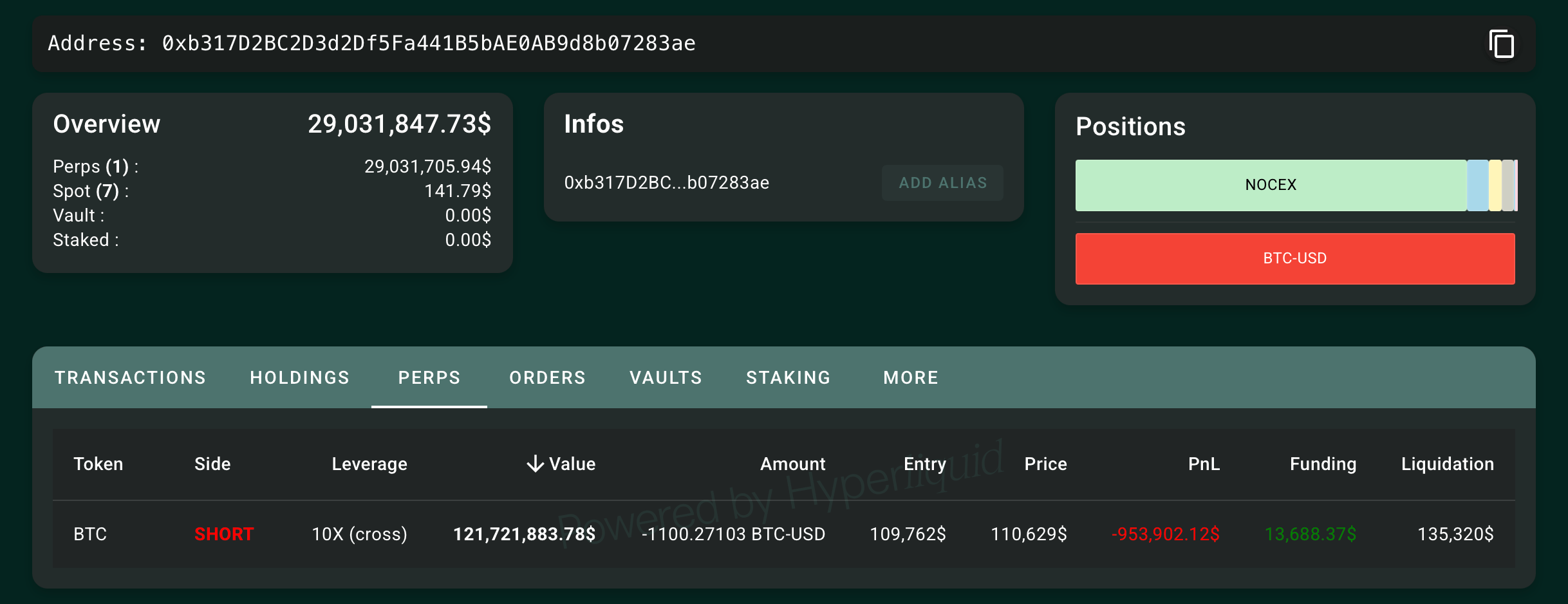

According to onchain data tied to the Ethereum address “0xb317D”—a wallet long associated with the “Hyperunit whale”—the trader currently holds a $121.72 million BTC short at 10x cross leverage on Hyperliquid.

The position size equals roughly 1,100 BTC-USD contracts, with an entry price of $109,762and a current mark around $110,629. As of press time, the trade reflects a -$953,902 unrealized loss, balanced by $13,688 in positive funding gains.

The whale’s liquidation price sits at $135,320, suggesting a strong conviction that bitcoin’s recent rally will reverse. The wallet’s total value stands at $29.03 million, nearly all tied to perpetual contracts, with minor spot holdings of about $141.79.

This trader has a notorious record for precise, high-stakes timing on macro-driven crypto moves. Earlier in October, the same wallet executed multi-hundred-million-dollar bitcoin and ethereum shorts shortly before major political and economic announcements that sent markets sliding. Those earlier plays reportedly netted over $190 million in realized profits.

Market watchers have been monitoring the “Hyperunit whale” closely due to repeated successful directional calls, many of which preceded market-moving news events. While speculation abounds regarding potential insider info, no verifiable evidence has been presented. Onchain analytics platforms such as Arkham and Hypurrscan track the wallet’s movements, which often involve nine-figure deposits via the Hyperunit bridge followed by immediate high-leverage positions.

Per Arkham Intelligence data, the Hyperunit whale’s onchain portfolio totals roughly $4.81 billion, with the majority held in bitcoin. The wallet currently controls 40,720 BTC valued at about $4.51 billion, alongside $300.84 million in USDC and $3.08 million in ethereum (ETH). Smaller allocations include 108,359 0xBTC tokens worth $20,490, 1,444 ARKM tokens valued at $542, and 50,005 LIMO tokens totaling $140. These figures suggest a heavy concentration in bitcoin—over 93% of the total portfolio’s value.

Despite the whale’s renewed short exposure, the wallet’s net worth climbed 1.27% in the last 24 hours, largely due to bitcoin’s modest rebound to $111,000 and back to $110,700. The trader’s stablecoin reserves remain substantial, offering ample liquidity for new leveraged entries or margin support.

With nearly $301 million in USDC and $48 in USDT, the whale retains deep flexibility across onchain positions, reinforcing why this address remains one of the most closely watched entities in the Hyperliquid ecosystem.

As bitcoin trades around $110,800 per coin at 6:45 p.m. Eastern time, the whale’s re-entry suggests a renewed bearish stance after BTC brushed off recent lows and recovered double digits from the week’s open. Traders across the Hyperliquid DEX are watching whether this fresh $121 million short marks the start of another major directional move—or a rare misstep for the market’s most-watched whale.

- Who is the Hyperliquid whale?

An anonymous trader known for massive leveraged bitcoin and ethereum positions on the Hyperliquid DEX. - What is the whale’s current position?

A $121.72 million bitcoin short at 10x leverage with a liquidation price near $135,320. - When was the latest trade opened?

The position was active as of Oct. 20, 2025, per onchain Hyperliquid data. - Why does this whale attract attention?

The trader’s timing often aligns with market-moving events, sparking widespread speculation about their strategy and influence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。