A mysterious trader known as the "Trump Insider Whale" has once again dropped a bombshell in the Bitcoin market, executing nearly $500 million in precise trades within just a week, raising questions and panic about insider trading.

Recently, this mysterious trader stirred up the cryptocurrency market. Just 30 minutes before Trump announced a 100% tariff on China, the trader precisely deployed $700 million in short positions on Bitcoin and $350 million on Ethereum, leading to a market crash to $104,000, with a total market cap evaporating by about $500 billion. This trade ultimately yielded $200 million in profit.

On October 20, this trader, dubbed the "Trump Insider Whale," deposited $40 million into the Hyperliquid platform, using 10x leverage to establish a $340 million short position in Bitcoin.

Meanwhile, Bitcoin prices hovered around the $110,000 mark, intensifying market panic.

01 Precision Strike: Two Massive Short Positions by the Whale

The trading activities of this mysterious whale have garnered widespread attention in the cryptocurrency market over the past two weeks.

● The first operation that caught the market's attention occurred on October 11, when the trader decisively opened short positions worth about $900 million in Bitcoin and Ethereum less than an hour before Trump announced the 100% tariff on China.

● This precise bet garnered nearly $200 million in profit as the market crashed following Trump's tariff announcement. After the successful short, the address withdrew $150 million in profits from Hyperliquid and transferred it to a new wallet, which currently holds about $386 million in USDC.

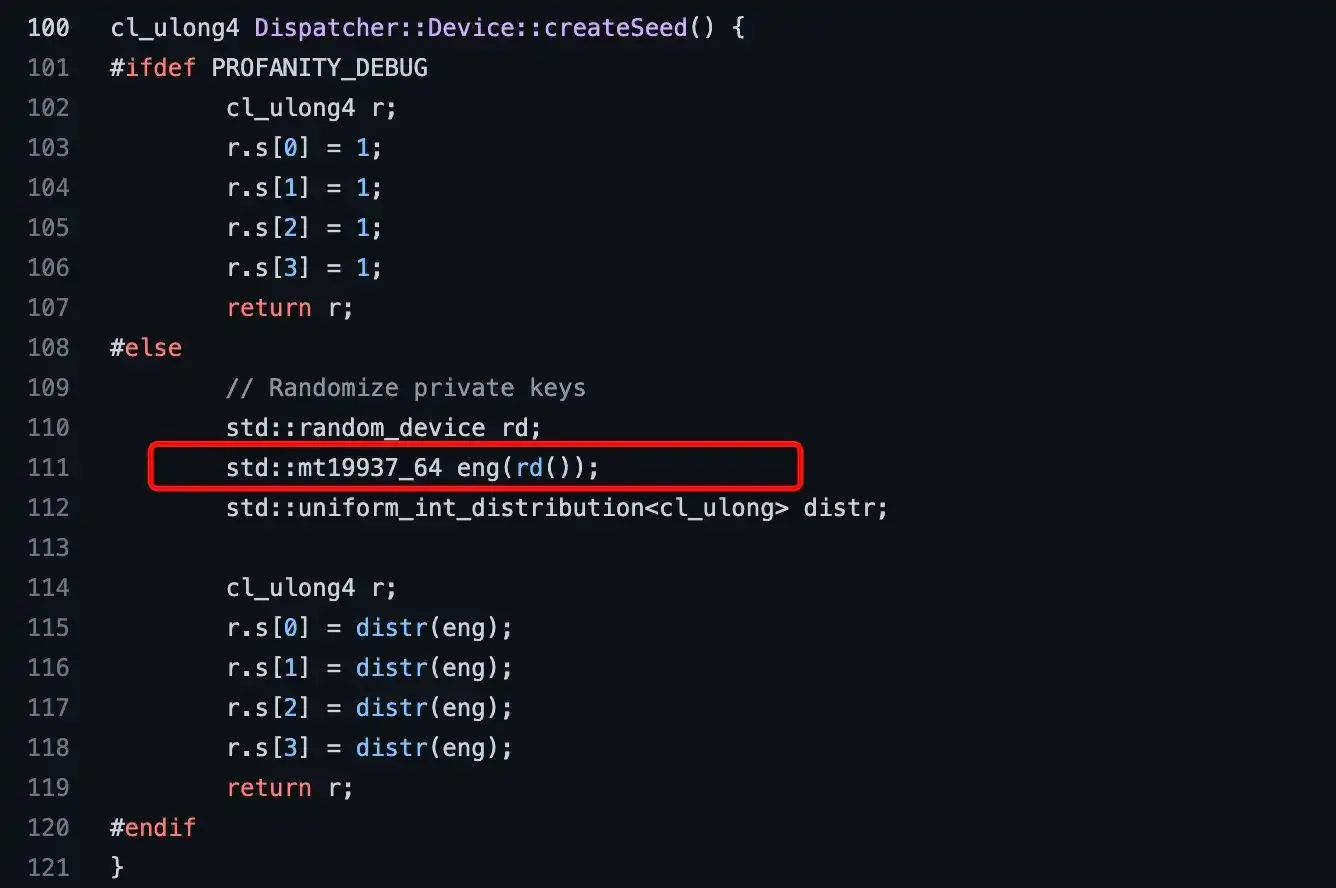

● On October 20, this whale acted again, depositing $40 million in USDC stablecoin as principal into Hyperliquid, using 10x leverage to establish a $340 million short position in Bitcoin. The average entry price for this position was set at $110,009, with a liquidation price set at $130,460.

Event Time

Position Type

Size (USD)

Leverage

Entry/Liquidation Price (USD/BTC)

Profit/Unrealized Profit (USD)

Market Reaction and Follow-up

2025-10-10/11

BTC/ETH Short (Before Crash)

~1.1 billion

10x

~125,500 (Liquidation)

$160-192 million (Realized Profit)

BTC plummeted 12% within 30 minutes, with the market evaporating over $19 billion in leveraged positions.

2025-10-13 (Around)

Profit Withdrawal and Transfer

Withdraw $150 million

-

-

-

Transferred profits to a new wallet, holding about $386 million in USDC, preparing for the next move.

2025-10-19 (Weekend)

BTC Short (New Position)

~$76.19 million (some reports say $340 million, including 10x leverage)

10x

109,133 / 150,085

+$400-455,000 (Unrealized Profit)

Triggered community panic, concerns about "Black Monday," but the market rebounded shortly after.

2025-10-20 (Latest)

BTC Short (Added)

~$340 million

10x

110,009 / 130,460

+$700,000+ (Unrealized Profit)

Market cautious sentiment intensified, with the Fear & Greed index remaining in the fear range of 27-29.

Source: AiCoin Compilation

02 Identity Mystery: BitForex Former CEO and "Insider Information" Controversy

The identity of this mysterious whale has sparked widespread speculation in the market. Blockchain data company Arkham Intelligence has labeled it as the "Trump Insider Whale."

● An on-chain analyst using the pseudonym "Eyeonchains" posted on social media platform X, first linking this address to Garrett Jin, the former CEO of BitForex. This post even garnered attention from Binance founder Zhao Changpeng ("CZ").

● In response to growing speculation, Garrett Jin publicly denied any connection to the Trump family this past Monday. In a reply to Zhao Changpeng's post, he wrote: "This is not insider trading." The account is not his personal account but rather "client funds."

● Jin further explained that these funds belong to clients who "run nodes and provide internal insights for clients." Despite the clarification from the parties involved, community commentator Max Keiser still hinted at improper conduct, claiming: "Banks are lending (i.e., printing) billions to fund unsecured BTC shorts."

03 Market Impact: Structural Fragility and Chain Reactions

The whale's large short positions emerged during a particularly sensitive time for the Bitcoin market.

● Bitcoin prices struggled to maintain upward momentum as Wall Street opened on Monday, quickly retreating to around $110,000. This price level put pressure on short-term holders, whose cost basis is just below $110,000.

● On-chain analysis platform CryptoQuant pointed out that Bitcoin prices have fallen below the 30-day and 90-day simple moving averages, which have converged to form a dynamic resistance zone.

● Contributor Arab Chain noted in an analysis: "This structure indicates that the long-term structural uptrend remains intact (prices are still above the 200-day moving average), but short to medium-term tactical momentum has weakened."

● Meanwhile, tensions in U.S.-China trade relations have escalated again, with China stating it is prepared to "go all the way" and accusing the U.S. of discriminatory trade practices.

This geopolitical backdrop has put global risk assets under pressure, with investors fleeing high-risk assets like cryptocurrencies in favor of traditional safe-haven assets like gold, which hit a historic high on Tuesday.

04 Market Outlook: Key Technical Levels and Long-Short Battle

Despite the pressure from the whale's short positions and geopolitical tensions, differing opinions still exist in the market.

Crypto analyst Egrag Crypto emphasized that Bitcoin must break through $120,000 to confirm the continuation of the bull market. He pointed out that $117,000 is a key level that Bitcoin must convert into effective support. Until Bitcoin's closing price can firmly hold above $117,000, there remains a risk of downward movement in the market.

Veteran trader Peter Brandt believes that despite the recent crash, the Bitcoin bull market is still "ongoing."

On-chain data also provides some positive signals. The supply of short-term Bitcoin holders has increased by about 559,000 BTC since May 2025, reaching approximately 4.94 million BTC. Additionally, 99.4% of Bitcoin supply is in profit, reducing the risk of forced selling.

Furthermore, net trading volume has shifted from -$400 million to neutral, indicating a balance in derivatives liquidity and a more stable market sentiment.

05 Deep Reflection: DeFi Leverage and Regulatory Challenges

The activities of this "insider whale" also highlight the rapid development and potential risks in the decentralized finance (DeFi) space. The trader's primary operating platform, Hyperliquid, is a decentralized perpetual contract exchange known for its deep liquidity and on-chain transparency.

In the recent market crash, Hyperliquid liquidated over 6,000 wallets, increasing solvency but also showcasing the risk of forced exits during extreme volatility. Trading volume in decentralized finance derivatives surged recently, with August trading volume on exchanges reaching $9.72 trillion, indicating the maturity of blockchain infrastructure but also increasing the risk of downward bets.

The rise of this new trading environment allows whales to execute large short positions without going through traditional centralized exchanges. It has also sparked discussions about transparency and regulatory scrutiny.

The market is closely watching two key numbers: the $117,000 resistance level for Bitcoin and the $130,000 liquidation price for the whale's short position. The outcome for either side could trigger significant market volatility in the short term.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。