Author: 0xBrooker

The progress of the US-China tariff conflict continues to be the biggest variable affecting major global financial markets. Although there has been some easing between both sides this week, whether there will be real progress still seems to depend on the upcoming negotiations between the delegations. A key mid-term point will be whether the leaders of both sides can meet as scheduled during the APEC summit in South Korea.

The Federal Reserve continues to adopt a dovish stance, combined with the sluggish US job market, leading to a strong market expectation for two rate cuts of 50 basis points this year. This provides underlying support for risk assets.

In addition to the US-China tariff conflict and the Fed's dovish stance, BTC is still constrained by internal structural issues within its own market. On one hand, long positions in the contract market have been cleared by over $20 billion in nominal value, making it difficult to gather strength in the short term; on the other hand, the influence of cyclical patterns has led to continuous selling by long holders, making it hard for the market to stabilize and rebound due to insufficient funds.

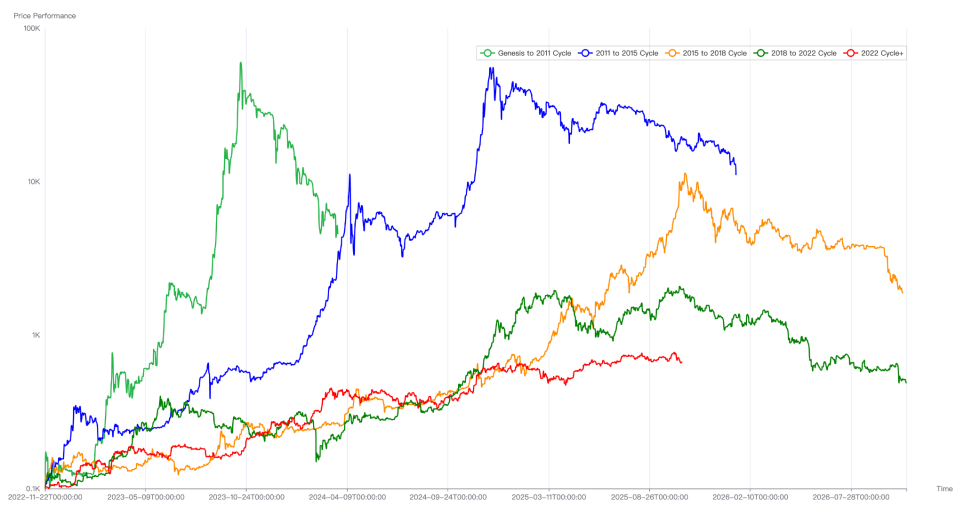

Comparison of BTC's historical cycle trends

Another point of interest is that next week, US stocks in AI and tech sectors will enter the Q3 earnings reporting period, and whether their performance meets expectations will also have a significant impact on the financial markets.

Policy, Macro Finance, and Economic Data

Recently, the main factor affecting the US stock market has been various statements regarding the US-China trade war. Following last week's major moves by both sides, this week both have released some moderate statements to ease market sentiment. Particularly from the US side, President Trump and the Treasury Secretary have made calming remarks in various occasions—high tariffs are unsustainable; US-China relations remain good; the US is unwilling to decouple economically from China, and believes China feels the same way. In contrast, the Chinese response has been more composed—blaming the "global panic" on the US's words and actions; emphasizing that export controls are necessary for national security and industrial policy.

According to media reports, both delegations are about to engage in another round of contact and negotiations. South Korea has confirmed that the US President will visit South Korea during the APEC summit at the end of the month. Of course, whether the leaders of both sides can meet as scheduled during this period still depends on whether the upcoming new round of negotiations can make progress.

Due to the easing of the tariff war, the US stock market, which is in a data vacuum period, has temporarily stabilized, with the Nasdaq rising 2.14% for the week. The dollar index, which approached the 100 mark, fell 0.3% to close at 98.547. However, risk appetite has not truly improved, as funds flowed in, pushing the 10-year US Treasury yield down 2.53% for the week, closing at 4.015%. Gold experienced a FOMO-style rally, surging 5.76% this week.

Due to the US government shutdown, the release of several economic and employment data has been delayed. Federal Reserve Chairman Powell emphasized at a meeting in Philadelphia that "the risk of weakening employment is more concerning"; he also mentioned the possibility of ending balance sheet reduction under certain conditions. The overall tone remains cautiously dovish, reserving space for further rate cuts. FedWatch has already fully priced in rate cuts of 50 basis points for October and December this year.

In terms of US stock sectors, large bank earnings reports exceeded expectations, but two regional banks were reported to have over $50 million in bad debts, causing a momentary panic in the market. Starting next week, AI and tech stocks, which will determine market direction, will enter the Q3 earnings release period. Exceeding expectations could provide some support for the turbulent market, but if they fall short, it is likely to push the market downward.

Crypto Market

In last week's report, we mentioned that BTC and the crypto market are currently under the dual influence of the US-China tariff war and cyclical patterns. The resonance of these two factors has prevented BTC from recovering the losses it incurred last week alongside the Nasdaq, instead continuing to decline, dropping another 5.55% on top of last week's 6.84% drop.

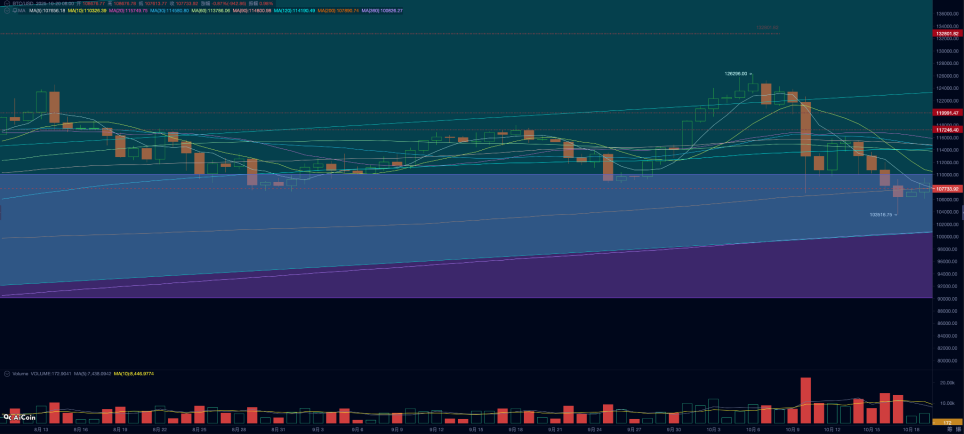

BTC Daily Chart

Technically, BTC's price has fallen into the "Trump bottom" range ($90,000 to $110,000), a range that has formed a suppression/support space for BTC's operation for nearly a year since Trump was elected in 2024. Additionally, BTC has also briefly fallen below the 200-day moving average of $107,500, technically placing BTC on the boundary between bull and bear markets.

Although BTC's price has previously fallen below the 200-day moving average multiple times during this bull market, this time may be different? According to BTC's cyclical patterns, BTC has now entered a topping phase. It can be observed that the long holder group, which is most affected by cyclical patterns, is accelerating its selling, making it difficult for the market, which is already weak in capital inflow, to bear the burden.

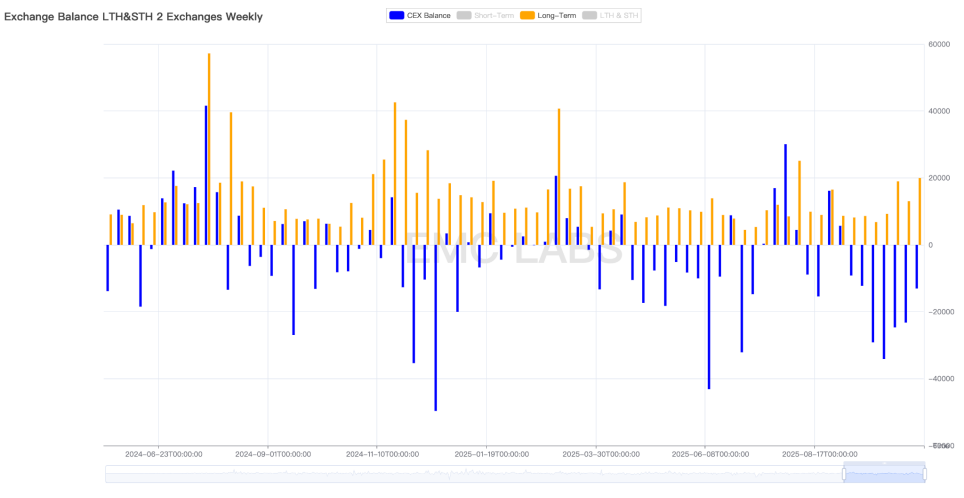

According to eMerge Engine statistics, the selling scale of long and short holders this week was 149,496 coins, down from last week, with long holders selling 19,978 coins, significantly higher than last week.

Statistics on long holder selling and centralized exchange inventory changes (weekly)

Long holders are traditional cycle believers in BTC, and their selling has a profound impact on the market, being the most important shaping force at previous cycle tops. Their continued selling may be governed by the cyclical "curse," and breaking the old cycle to form a new one will require greater structural forces (such as DATs companies and BTC Spot ETF channel funds).

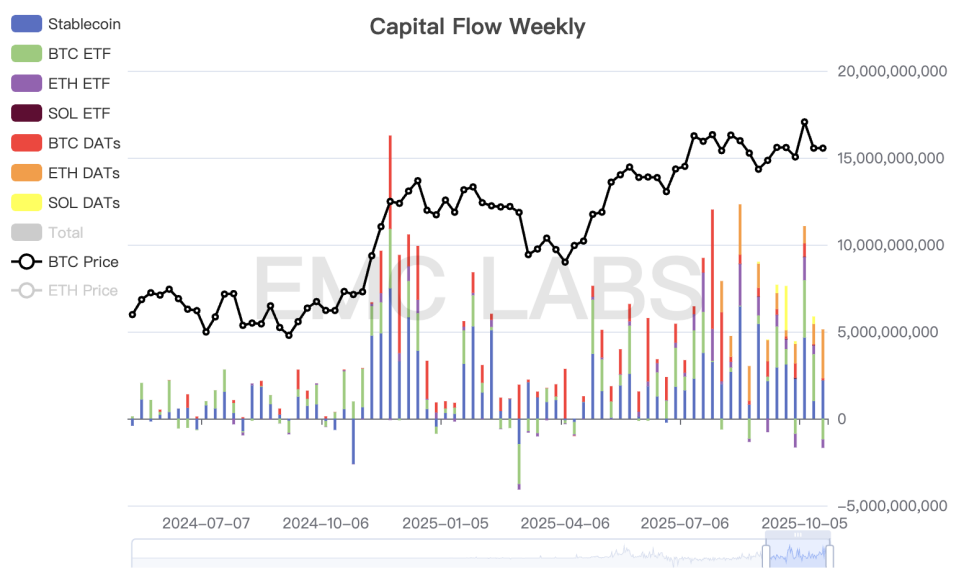

In terms of capital inflow, this week saw a further decline following last week's drop, with BTC Spot ETF outflows nearing $1.2 billion. The short-term capital withdrawal from ETF channels due to the US-China tariff conflict is another major reason for BTC's rapid and sustained price decline, in addition to long holder selling.

Statistics on capital flow in the crypto market (weekly)

Furthermore, the opening scale of the contract market continued to decline this week after a significant drop last week, with rates briefly falling into negative territory. This indicates that the long positions in the contract market are struggling to regroup for another battle after a large-scale squeeze.

From the perspectives of technical analysis, long holder selling, capital inflow and outflow, and contract market structure, BTC's current price is under immense pressure. Unless there is a significant improvement in the US-China tariff war to drive a reversal in market sentiment, it is unlikely to see a reversal in the short to mid-term. Coupled with the influence of cyclical patterns, we believe long-term investors should focus on trading layouts around the end of the cycle. As mentioned in the September monthly report, the end of the old cycle and the beginning of a new cycle is a probabilistic event, not impossible, but it is currently viewed as a high-probability event.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, indicating a transition period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。