Written by: Yoliiiya

The biggest problem with traditional finance is not a lack of assets, but a lack of liquidity.

The financial logic of RWA is to "deconstruct, map, and chain" these low-liquidity assets, allowing them to circulate like currency. This is actually a long-standing demand in the financial industry. RWA simply adopts a "digital, compliant, and automated" approach to achieve this.

1. Key: Connecting the Mapping of Two Types of Assets

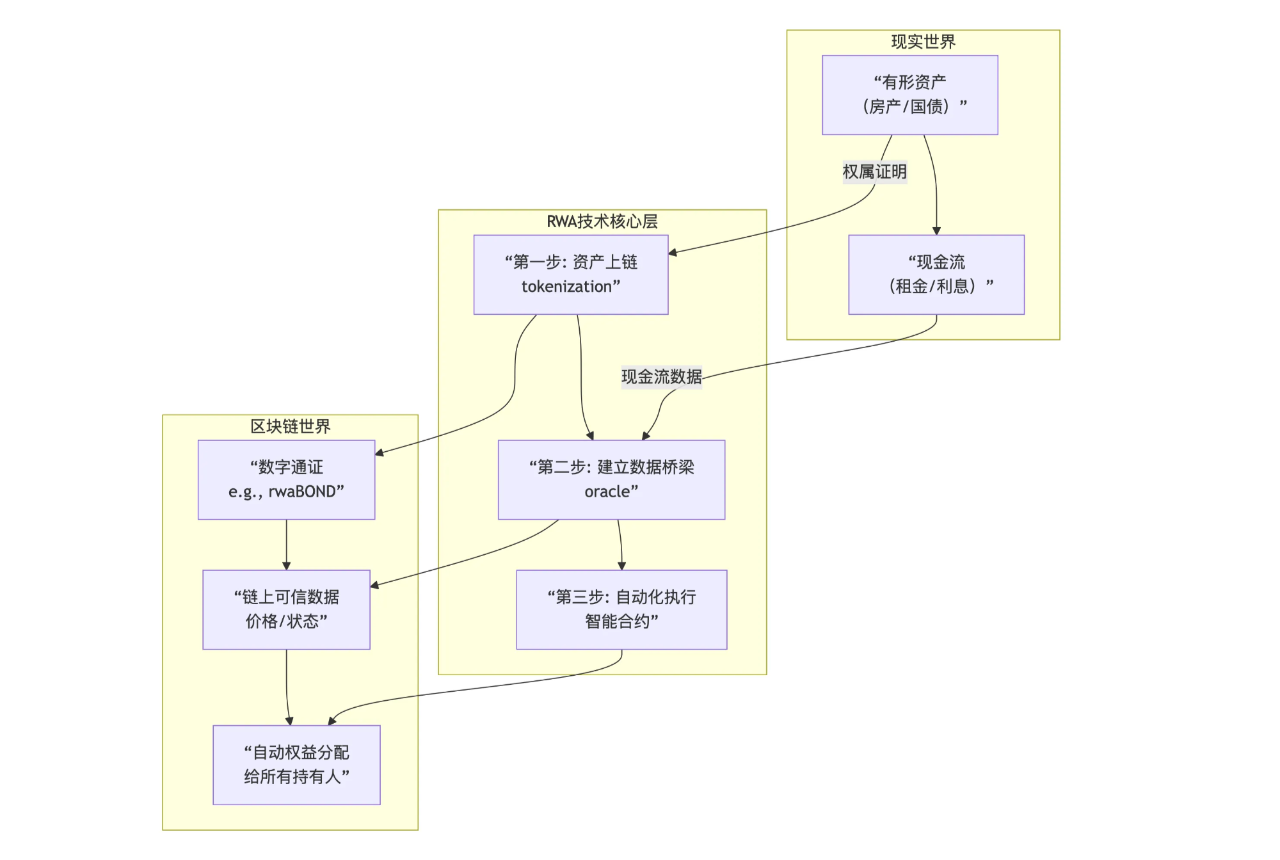

Mapping real-world assets (off-chain) to the blockchain (on-chain) requires solving three core issues:

1. Rights confirmation: How to prove that off-chain assets truly exist and have clear ownership?

2. Synchronization: How to reliably synchronize changes in asset status (such as price, yield) to the chain?

3. Circulation: Can assets be traded, settled, and redeemed at any time? How to ensure that all rights of the assets (dividends, redemptions) can be executed automatically and accurately?

The diagram below illustrates the complete technical flow logic for RWA to achieve trust:

2. Technical Logic: Trust is "Codified"

The trust system in traditional finance is "human-centered." You trust banks, auditors, and custodians.

In the RWA model, trust is "technologized": using smart contracts, oracles, and cryptographic proofs to ensure the authenticity of rules and assets.

We can view the technical logic of RWA as a four-layer closed loop:

These four layers collectively complete the closed-loop transformation "from reality to on-chain." We can understand it as:

Law allows assets to exist in reality;

Blockchain allows assets to exist in the digital world;

Smart contracts enable assets to "automatically flow" between the two worlds.

This is the essence of "Trust Automation."

3. Four Major Technical Underpinnings

The smooth operation of the above process relies on the collaborative synergy of the following four core technologies:

Conclusion: From "Trust Institutions" to "Trust Mathematics"

We summarize the migration process in the following table to better understand how this transition occurs:

It is foreseeable that ultimately, we may enter an era where assessing the reliability of a financial asset will no longer depend on whose name it is under, but rather on what kind of code it operates on.

In the next article, we will shift our focus from technology to regulations, examining how regulatory bodies around the world are responding to this transformation and attempting to delineate the runway and boundaries for this emerging market. Stay tuned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。