The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens!

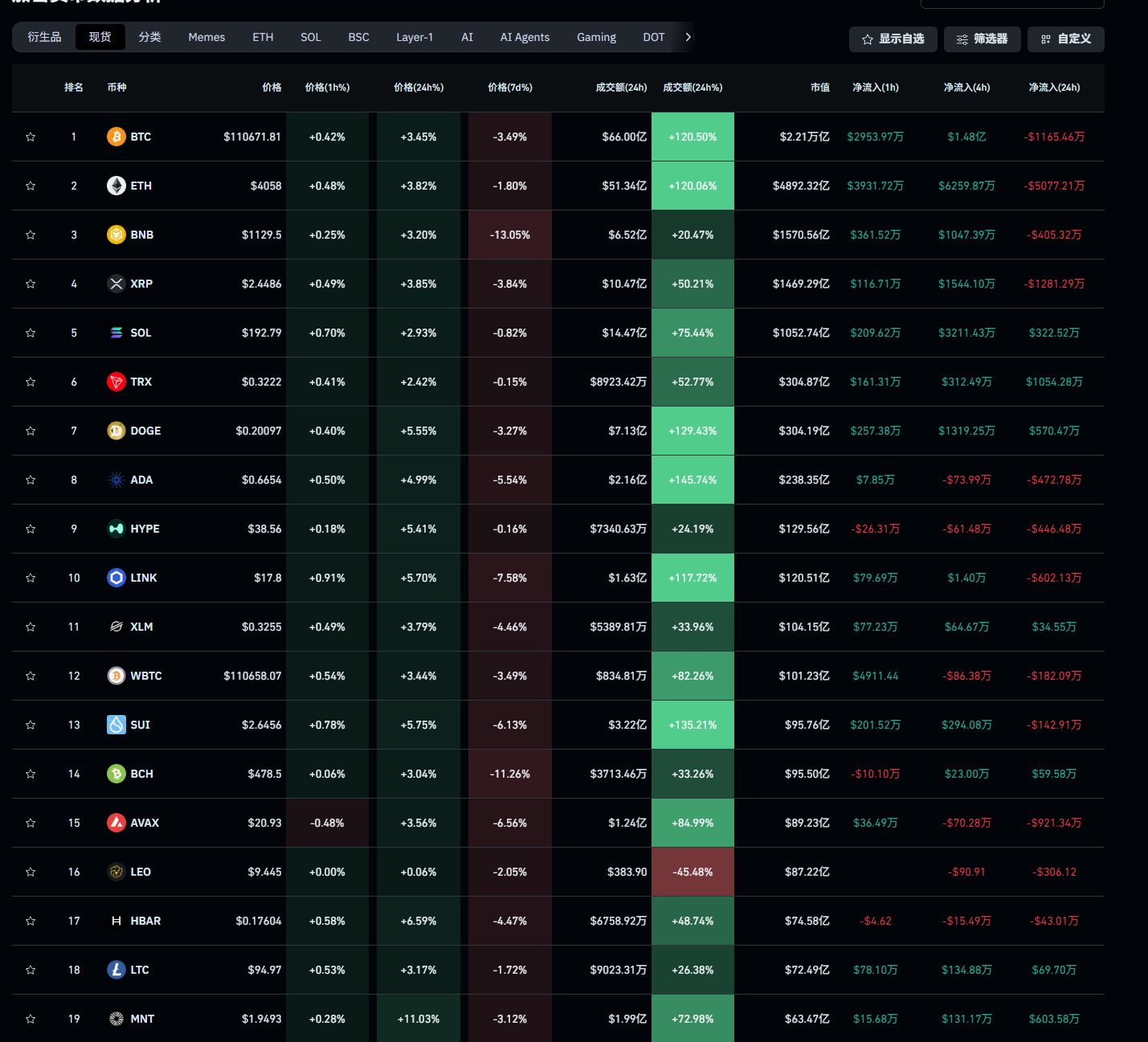

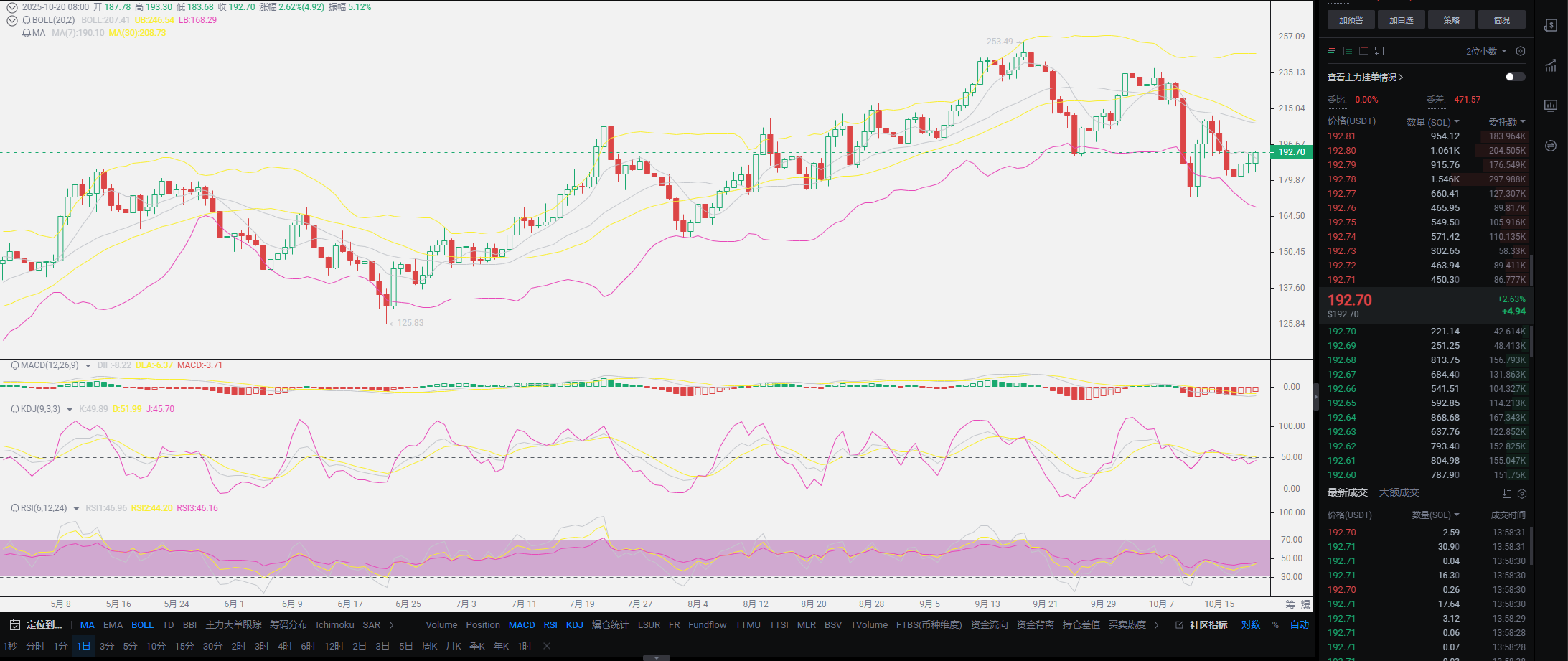

Yesterday's market trend was not significant, so it stagnated for a day, and the rebound strength can be considered considerable. Many friends have started to wonder whether this downward trend has ended. Today, I will talk about the entry positions for spot and contract trading, providing some solid insights. From the cryptocurrencies recommended by Lao Cui earlier, most have shown signs of stabilization, with the exception of BNB, which has not rebounded as expected. However, looking at Bitcoin's trend, there are certain signs, and it is still too early to draw conclusions, especially since there are still ten days left in the controllable range before the interest rate cut, so everyone needs to be cautious. The potential for a rebound mentioned a couple of days ago, along with the insufficient depth issue, has slightly eased today. A common saying goes, the downward depth still exists, but Lao Cui will no longer view the downward trend because I have always been a firm supporter of the bull market and have never operated short positions. Some friends do not understand why Lao Cui maintains this approach and when I will turn to short positions. Today, I will provide a detailed explanation of my approach.

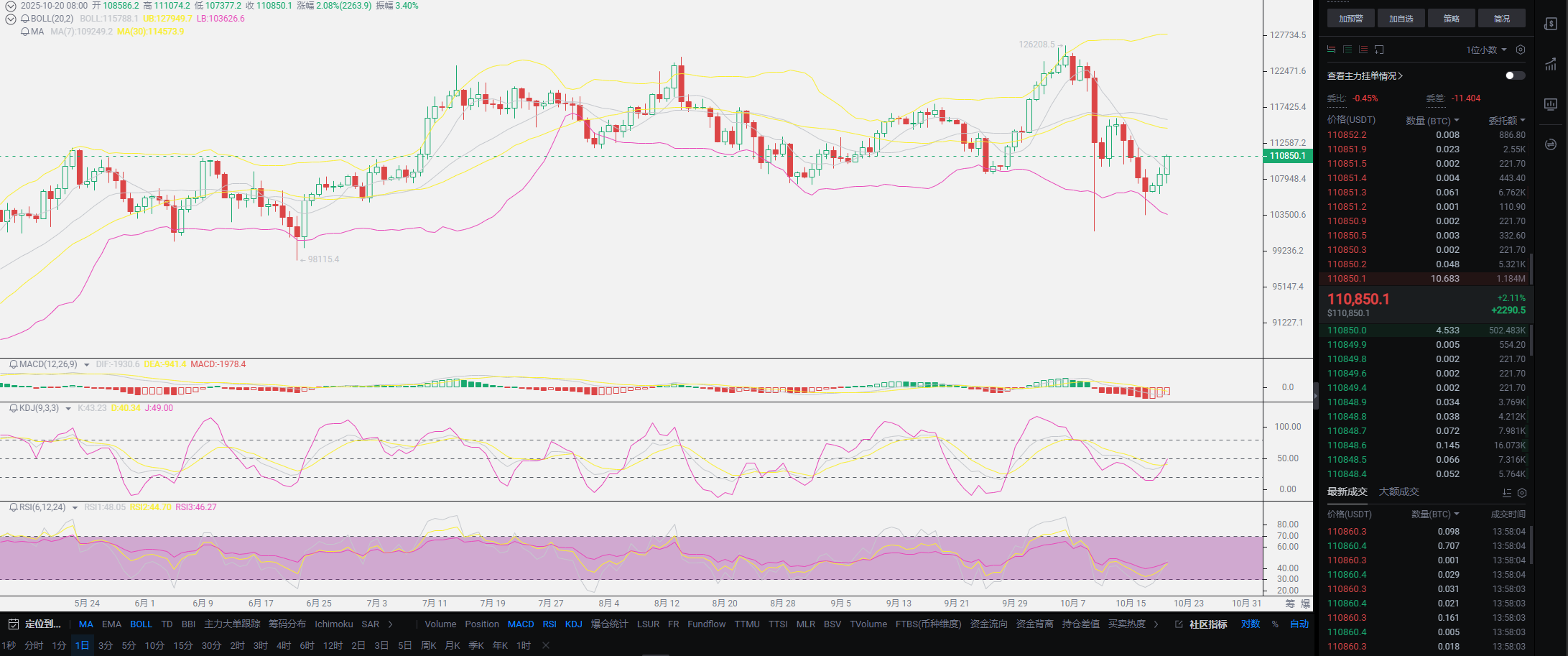

It's quite simple. The trend we observed earlier is still within the movement, especially after the spike, Lao Cui also mentioned that in the short term, the entire lower shadow line might solidify. Currently, it seems that Bitcoin's trend is almost complete. What many do not understand is why, despite clearly seeing the current downward trend, I remain firmly bullish. Isn't that a foolish choice? This is because since the last bull market started, I have been accumulating a large amount of spot positions, heavily invested in the bullish side, and I am unable to turn back. Moreover, the upper take-profit point seems a bit too high because it is based on a one-year investment plan, and there are no plans to exit in the short term. Once I start to reverse my position, it will indicate that this bottom-fishing attempt has failed. The only possibility for a reversal would be if this spike trend solidifies and then spikes again, for example, if Bitcoin reaches the 100K support level and then shows a downward sweep at the 80K mark, it would indicate that the reversal opportunity has arrived, and it would also signify a complete transition between bull and bear markets.

As long as there is no signal of a trend reversal, this kind of spot trading cannot be concluded with a stop-loss. During the bull market phase, unless one is purely a contract player who can be flexible, for spot traders, remaining inactive is the best choice. The uniqueness of the cryptocurrency market, which differs from traditional finance, is that the concept of stop-loss points has become outdated, especially with the establishment of a 24-hour settlement system. Choosing to reverse in the spot market is essentially no different from a stop-loss. Since one chooses to reverse, why not sell the spot for a more practical approach? When everyone wants to reverse, they can ask themselves if they can accept selling their spot positions at this stage. If they cannot accept it, then they can only lower the average price of their spot through a T-trading method, and this downward movement actually provides an opportunity for everyone to enter the spot market. Isn't replenishing positions also a form of T-trading? The most important principle of T-trading in the cryptocurrency market is that selling must exceed the cost line after increasing positions to be profitable, which is a completely different mechanism from stocks. This replenishing method is easier for everyone to profit from.

Of course, what has been discussed above is under the premise of a firm bull market trend. If the market reverses, T-trading would be a losing game. The depth of this downward movement happens to be near our cost price, with SOL being ten points away, and OKB is also fine, still far enough that there is no need for unnecessary operations; everyone should just hold steady. If a reversal comes, I will also remind everyone. Of course, those with high spot prices can choose to reverse at high positions, but the premise must ensure that the contract entry time does not exceed one day, and one must exit before going to sleep. The current rebound is merely a signal; whether the market reversal is confirmed depends on the strength of the breakout and the coordination of capital volume. There is also good news: this time, the SOL fee has reversed for the first time, showing negative growth. This signal also indicates that previous spot users have finally started to exit, marking the first reversal since the last break of the 100 support level, with shorts exceeding longs. In the future, it will depend on whether the market makers choose to speculate on interest rate cut expectations or the post-rate cut period; the next ten days of movement are crucial.

Why discuss trends based on signals at this stage? Because the biggest signal for shorts comes from exits at high positions. It can be said that the past two days have basically been a repair of the bullish market; however, the top four cryptocurrencies by market capitalization have all shown outflow within 24 hours, which is not a good sign for the cryptocurrency market. For contract users, shorting at high positions theoretically remains a profitable choice. Personally, I do not want to predict the future market trends, as the current movements are beyond my control. The current entanglement is not only among retail investors; market makers are also questioning future trends, with both bullish and bearish movements not being obvious. As the U.S. strategy progresses, the signals visible to everyone also show that various continents or the U.S. itself are utilizing a certain proportion of pension funds for dollar-cost averaging into Bitcoin. Although this is a positive signal, the proportion is not large for the U.S., so a market reversal is also very likely.

Especially regarding this interest rate cut, it represents a funding gap period for the entire month of November. Even at the beginning of December, there will be more outflows for Europe and the U.S. Therefore, this interest rate cut is extremely important. If the cut is 25 basis points, it can basically confirm that the inflow of funds in November will not be proportional, especially after speculating on interest rate cut expectations. Thus, the latter part of November, except for a few days at the beginning of the month, is likely to be dominated by shorts. As long as there is no speculation on interest rate cut expectations, the trend will still be predominantly bullish. After saying so much, you might think most of it is nonsense, so I will also provide my viewpoint. Based on the current trend, it is highly likely to be bullish because the depth of this downward movement is sufficient to smooth out the previous growth, and the clearing effect of the bubble is quite evident. Therefore, in the current trend, you can judge based on the long-short ratio; a large accumulation of long positions will lead to a downward state. Only when the market makers' chips are sufficiently gathered will there be growth; currently, retail investors are selling, and it is highly likely that there will be a period of repair.

Lao Cui's summary: At this stage, the entry has already been reminded to everyone in the past two days, and the entry for spot users is basically complete. Therefore, today I will provide entry points based on contract users' standards, with the main judgment basis for entry points being your operational space. If you are operating with high leverage, you need to wait for an absolute low point, which is 500-1000 points below the daily new low for Bitcoin contracts. If you are responding to the trend, you must definitely wait for the daily new low; as soon as a new low appears, it is your entry opportunity. After entering based on the trend, you must primarily focus on the take-profit position for spot trading, which can be coordinated with exiting the spot. The bearable point for Bitcoin is around 20K; everyone can find a position to enter at this stage, trying to stay below 110K. Just as I finished writing the position, the pop-up broke through 110K. During this period, do not chase long positions; wait for a downward entry. There will definitely be a downward trend every day, so do not chase long or short positions. Overall, it is best to give up the pursuit of short positions at this stage; do not short easily. Even for those speculators primarily in contracts, the market may have already reversed. Look for low positions to enter long positions; the same goes for Ethereum, as long as it does not drop below 4000, you can enter long below 4050. When entering, you can communicate with Lao Cui; I will see and reply to everyone, trying to focus on the actual trend and not jump to conclusions easily. Those who bear the risk should be cautious in their moves!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or positions, aiming for the ultimate victory. The novice, however, fights for every inch of ground, frequently switching between long and short positions, only contending for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。