Momentum in the leveraged exchange-traded fund (ETF) market is accelerating as Volatility Shares filed last week to introduce 27 highly leveraged ETFs, including the first-ever proposed 5x products tied to XRP, bitcoin, ether, solana, and other digital and equity assets. The filing represents one of the most ambitious moves yet by an ETF issuer, seeking to expand access to both crypto and traditional stock exposure through high-leverage instruments at a time of growing market volatility.

Bloomberg’s ETF analyst Eric Balchunas commented on the development, stating:

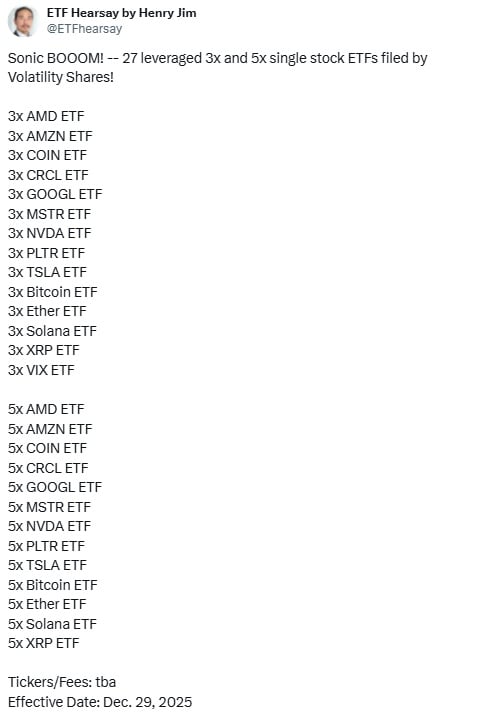

Volshares filed for 5x single stock and crypto ETFs incl COIN, CRCL, GOOG, MSTR, NVDA, PLTR, TSLA, bitcoin, ether, solana, XRP…

He noted that Volatility Shares filed for 5x ETFs despite the SEC not yet approving 3x ETF filings. “Volshares is like, let’s try 5x,” the analyst said, suggesting it might depend on the possibility of a long-term government shutdown, noting: “If there’s no government in 75 days, they can launch — but I don’t know.” His remarks underscore both the speculative timing of the filing and the ongoing uncertainty surrounding regulatory approval.

List of 3x and 5x ETF filings by Volatility Shares. Source: Henry Jim, ETF Analyst, Bloomberg Intelligence.

While the broader filing covers single stocks such as Tesla, Nvidia, and Amazon, XRP’s inclusion stands out given its prominence in recent regulatory developments and its strong following in the crypto sector. The proposal comes amid renewed investor appetite for high-risk, high-reward vehicles and arrives as SEC operates with limited capacity during a government shutdown, potentially slowing review of these unprecedented filings.

Despite skepticism, proponents of digital asset innovation see the XRP-linked ETF as an important signal of the market’s evolution. Supporters argue that such leveraged products could increase liquidity and deepen institutional participation in crypto markets. Whether the SEC allows these 5x products to move forward could determine the future path of leveraged crypto ETFs and the role of assets like XRP in bridging digital finance with traditional markets.

- What makes Volatility Shares’ 5x ETF filing significant for investors?

This filing marks the first-ever proposal for 5x leveraged ETFs tied to both crypto assets like bitcoin, ether, solana, and XRP, as well as top equities, signaling a new era of high-octane investment opportunities in both markets. - How could the proposed 5x XRP ETF impact the broader crypto market?

The XRP-linked 5x ETF could dramatically boost liquidity and institutional participation, positioning XRP as a bridge asset connecting digital finance to traditional markets. - What are the regulatory challenges facing these 5x leveraged ETFs?

The SEC has yet to approve even 3x ETF products, meaning Volatility Shares’ 5x proposals face significant regulatory hurdles, especially amid limited agency capacity during a potential government shutdown. - Why are investors watching Volatility Shares’ filing closely?

Investors view the 27-product filing as a bold test of regulatory boundaries and a potential catalyst for the next phase of leveraged ETF innovation in both crypto and equity sectors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。