An offhanded quip by Jamie Dimon, CEO of JPMorgan Chase (JPM) on Tuesday, may have tanked stocks as fears of a bank credit crunch triggered a multi-day sell-off. But while equities appear to have recovered, bitcoin, which has been battered by U.S.-China tensions lately, continues to flounder.

Dimon took aim at Tricolor Holdings, a subprime auto lender that went bankrupt last month in the wake of fraud allegations. JPMorgan held $170 million in Tricolor debt, which had to be written off following the auto lender’s liquidation.

“My antenna goes up when things like that happen,” Dimon said. “I shouldn’t say this, but when you see one cockroach, there’s probably more. Everyone should be forewarned on this one.”

Sure enough, just days after Tricolor filed for Chapter 7, along came First Brands, an auto parts maker saddled with $10-50 billion in debt, but with assets worth only $1-10 billion. First Brands filed for bankruptcy at the end of September, citing concerns over off-balance sheet liabilities. Fears of market contagion began spreading after it was revealed that Jefferies, a Wall Street investment bank, had nearly a quarter billion in exposure to First Brands. “We believe we were defrauded,” said Jefferies CEO Rich Handler on Thursday.

It appears Dimon guessed correctly that more than one cockroach had infiltrated the markets. But by Thursday, most investors believed there was no broader systemic risk. The S&P 500, Nasdaq, and Dow were all up 0.57%, 0.56%, and 0.69% respectively. Bitcoin was the odd one out, down 1.25% at the time of reporting.

“You can never completely avoid these things, but the discipline is to look at it in cold light and go through every single little thing, which you can imagine, we’ve already done, and maybe there might be more to do,” Dimon told reporters on Tuesday.

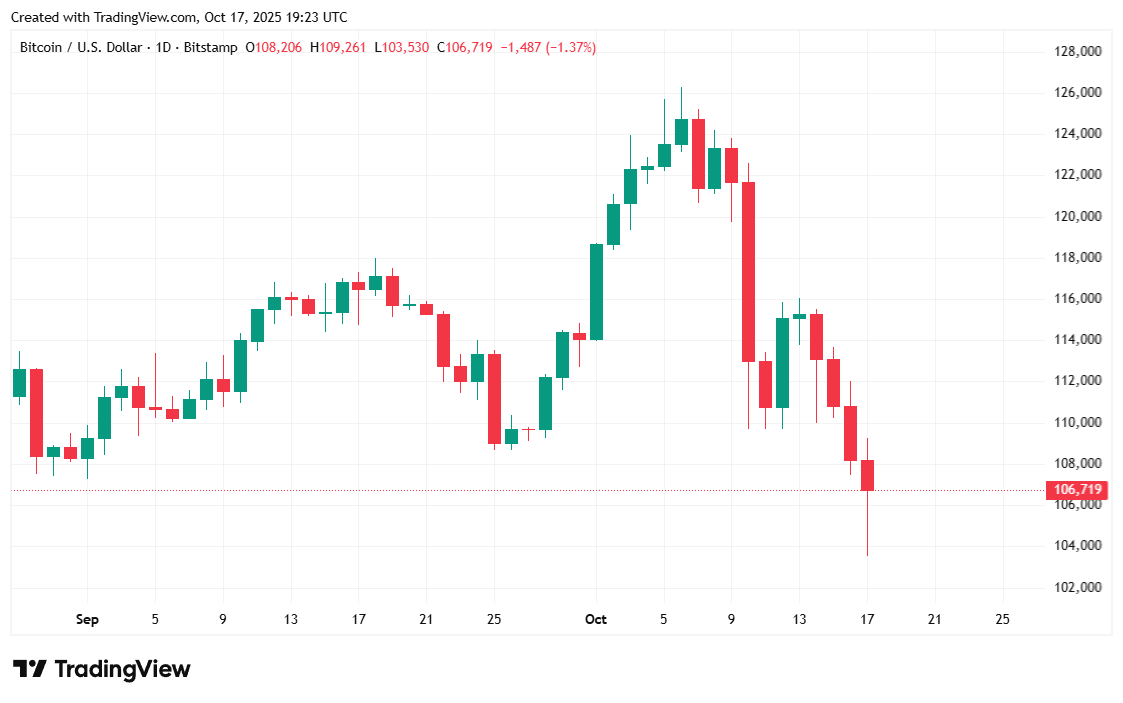

Bitcoin was priced at $106,727.15 after shedding 1.25% over 24 hours at the time of writing, Coinmarketcap data shows. Weekly performance fared worse, with the cryptocurrency tumbling 8.19% over seven days. BTC fell as low as $103,598.43 earlier today, after topping $109,235.81 just after midnight.

( Bitcoin price / Trading View)

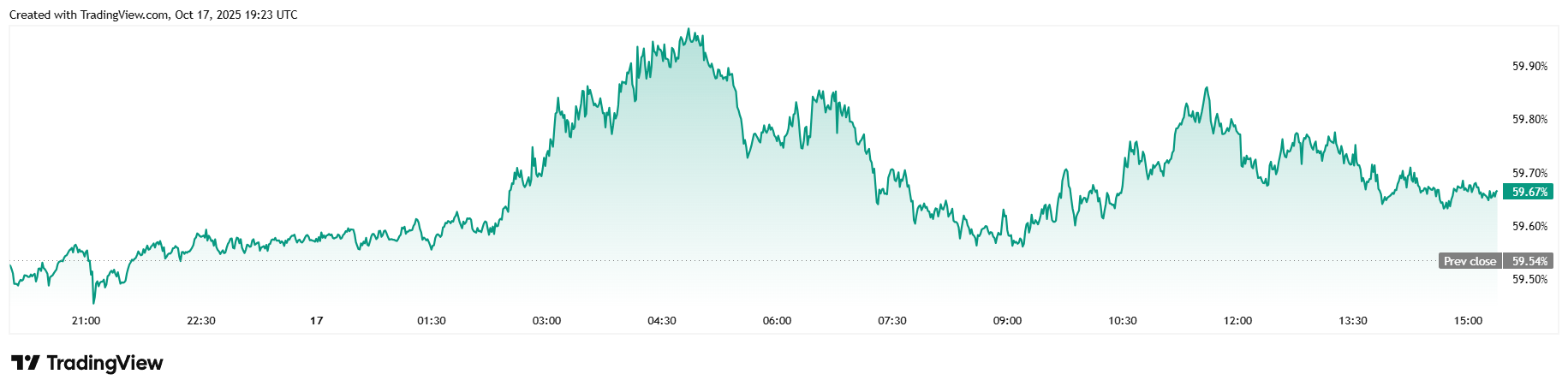

Twenty-four-hour trading volume jumped 31.43% to $107.7 billion, but market capitalization, which is tied to price, dipped 2.1% to $2.12 trillion at the time of reporting. Bitcoin dominance edged up 0.21% to reach 59.66%.

( BTC dominance / Trading View)

The total value of open bitcoin futures contracts tumbled 4% to reach $70.38 billion according to Coinglass data. Liquidations climbed to a grand total of $349.58 million for the day, dominated by $229.78 million in losses from long investors. The remaining $119.80 million came from overzealous short sellers.

- Why did Bitcoin fall after Jamie Dimon’s comment?

Bitcoin dropped to $103K after Dimon compared corporate fraud to “seeing one cockroach,” sparking fear of wider market trouble. - What did Dimon mean by “cockroach”?

He warned that one bankruptcy might signal deeper hidden problems across credit markets. - How bad was Bitcoin’s decline?

BTC slid over 8% for the week and briefly touched $103K before rebounding above $106K. - Did stocks react the same way?

Stocks recovered modestly, but Bitcoin and crypto futures faced heavy liquidations totaling nearly $350 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。