Question: How far can human vision reach? Some say it is the horizon, as we can see the sun, moon, and stars; others say it is just a short distance, as a single leaf can block our view. Different perspectives on different matters always provide unexpected insights and surprises. Today, let’s speculate on what exactly happened on October 11th from the perspective of the mechanisms of "leverage and liquidation."

This article has no conclusions, no sides taken, only different perspectives. If you are ready, give me 10 minutes.

Statement:

- I empathize with the dissatisfaction everyone feels; this article will be presented in a casual style, attempting to immerse in this context.

- This article does not take sides or determine right from wrong; it merely approaches the issue from another angle—dialectically examining the problem from a mechanistic perspective, providing an additional viewpoint to discuss the underlying mechanisms. The examples and numbers are not important; Binance is used merely as an example to focus on logic and principles.

I. The Financial Techniques of Market Makers and Leverage

In the 31st year of the Daoguang era, I wrote an article about how market makers (using call options) utilize borrowed coins from project parties to provide liquidity. (Link: https://x.com/agintender/status/1946429507046645988)

I calculated that it might be time to update a version.

The previous article mentioned that due to the setup of call options and the peak market environment upon listing, one of the optimal solutions for market makers is to sell the borrowed coins at the beginning of the listing when liquidity is at its highest (keeping a small amount for market making) and then buy them back at a low point.

This model has two conditions: first, liquidity must be sufficient; second, there must be no third-party regulation, meaning the exchange does not intervene.

What happened next is well-known; the market environment (spot) took a sharp downturn, liquidity became insufficient, and with Binance's oversight, this relatively smooth path gradually dimmed, or rather, became less bold. But does this mean market makers were left with no options? Clearly not. They turned their attention to contract trading.

The problem arises: they only have a handful of tokens, while altcoin contract trading only recognizes USDT. What to do?

Thus, they focused on (taking Binance as an example) full-margin leverage/investment/unified accounts. We can ignore all other functions here and focus solely on the use of collateral. This collateral module supports market makers or large holders to pledge nearly 200 types of assets listed on Binance as margin to trade spot/contracts/options. However, different altcoins have different collateral rates, which will be mentioned later with examples.

So how does it work specifically?

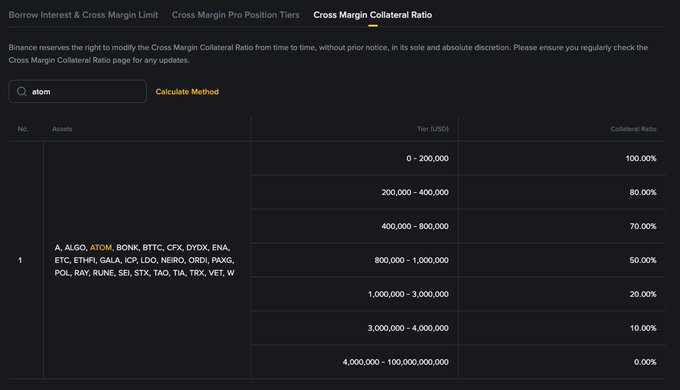

Taking ATOM (full-margin leverage) as an example:

I borrowed 1 million ATOM from the ATOM Foundation, with one ATOM = 5 USDT.

For example, I keep 200,000 ATOM for daily market making and pledge the remaining 800,000 ATOM (the "collateral"). Assuming the market price is 4 million USDT, the available limit is 1,120,000 (200,000 * 100% + 200,000 * 80% + 200,000 * 70% + 200,000 * 50% +….)

Using the official (unified account) example:

Here, there are two variables: one is the value change of the collateral, and the other is the value change of the trading product.

The remaining operations depend on individual skills; Trader A will open a short position in contracts and profit by controlling the spot supply; Trader B will open a long position in contracts and profit by controlling the contract price, and so on.

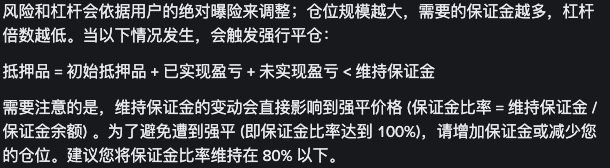

Why is the collateral rate so low? — This is similar to the principle of contract margin; the larger the amount, the exponentially higher the risk. Additionally, the liquidation of collateral is calculated based on the "marked price," not the market price.

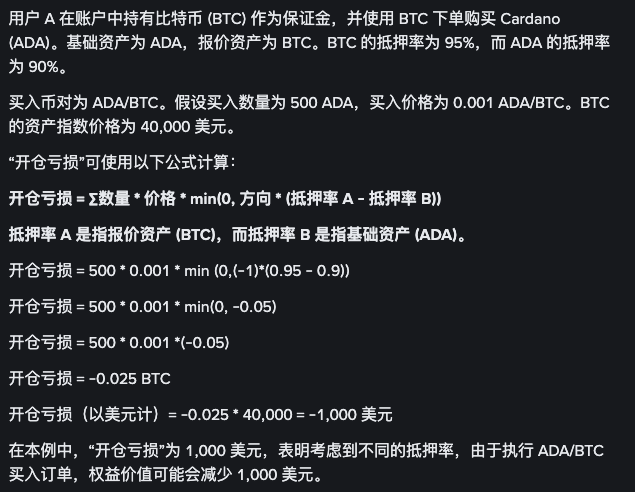

Binance's official statement on contract liquidation:

II. How Does Collateral Trigger Liquidation and Position Closing?

The collateral in unified accounts/investment/leverage is not calculated based on the value of individual assets/collateral but rather based on the equity and margin ratio of the entire account/position.

Here, we use the unified account as an example for demonstration:

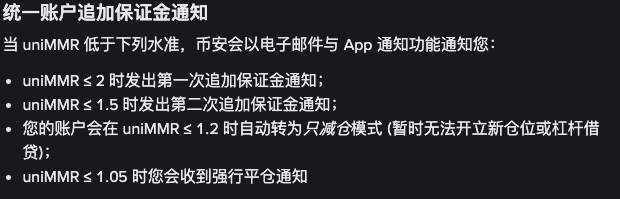

Unified account margin rate uniMMR = adjusted equity of the unified account / maintenance margin amount of the unified account.

The specific calculation method is quite complex; essentially, all collateral/position values must exceed the margin requirements. I won’t elaborate on the liquidation/forced closing of other full-margin leverage/investment; I will only introduce the key points:

When the unified account maintenance margin rate is less than or equal to 1.2, the account will enter "stiff mode" (unable to open positions), and when it is less than or equal to 1.05, it will be forcibly liquidated. (This information is crucial!! It will be tested later)

Similarly, full-margin leverage/investment also has similar procedures during liquidation.

Regardless of the method, the main ways to liquidate collateral are through market orders or canceling existing orders.

III. The Capital Efficiency Hammer of Large Holders and Whales

In addition to market makers, various institutions, whales, and large holders also adopt this investment/full-margin leverage/unified account model.

Imagine if you are a staunch believer in ATOM, holding 10 million ATOM, what would you do? You would pledge these 10 million ATOM to engage in circular loans, open contracts—constantly buying the dip, bottom fishing, and perhaps not just buying ATOM but also investing in projects within the ATOM ecosystem, some even hedging, and holding on until the dream altcoin bull market arrives, making a name for yourself?

This is not a fable; it is a real OG story (now it has turned into a tragedy).

Unfortunately, your position has deteriorated amidst the constant turmoil, and at this moment, the storm and landslide have arrived.

IV. Review of October 11

Now, let’s return to that dark and windy night of October 11 (taking ATOM spot as an example).

Starting from 5 PM, the price of ATOM began to decline, and the volume chart below also started to increase, but the price remained stable around 3.7-3.8, indicating there was still liquidity.

At 5:13, the market began to drop sharply, with significant volume, and the next bar continued to drop from the end of the previous bar, indicating that the arbitrage liquidation bots had started working. The collateral of large holders/whales began to be liquidated (this also explains why the movements of spot and contracts were basically consistent). The liquidation bots would directly execute the large holders' collateral (ATOM) at market price (taker) until the liquidation process was complete.

How did we conclude that the liquidation bots were the instigators?

By 5:19, there was still liquidity on the order book (with high trading volume), but by 5:20, the order book had basically fallen into a vacuum state, crashing down to 0.001.

ATOM spot price chart

ATOM futures price chart

However, looking at the contract trading, the lowest price at 5:20 was 1.4. If it were an arbitrage order between futures and spot, the prices should be close, and a price of 0.01 for ATOM is not a price a rational trader would execute. Only a ruthless liquidation bot could "hard-heartedly" complete this. (The liquidation bot handles "collateral," i.e., the spot).

In other words, it was the unwillingness and greed of large holders/whales that created this situation, and the liquidation bots carried out this slaughter.

As for why Binance's ATOM spot experienced a brief "liquidity vacuum"?

I irresponsibly speculate that this should be due to the main market-making account's leverage/investment/unified account maintenance margin rate falling below the threshold (being liquidated and unable to open new positions), triggering the account's "stiff" state, forcing the cancellation of existing orders, thus failing to provide normal liquidity.

Attached: Price charts of WBETH and BNSOL

The liquidity vacuum occurred mainly between 5:43 and 5:44, suggesting that the main market maker for these two pairs should be the same account, and at that moment, the investment/leverage/unified account fell into a "liquidation/stiff" state, unable to provide normal liquidity.

WBETH price chart

BNSOL price chart

Postscript

I actually hesitated for a long time about whether to publish this article; after all, posting it at this time is like adding fuel to the fire, and I might be targeted, even labeled as a "traitor," "BNx dog," "whitewashing," or "being paid off." However, I feel that all parties involved are quite wronged.

After much thought, I wrote this casual and conversational article for everyone's reference.

Attached is the risk protection fund chart for ATOM, which lost 150 million USD in just one day on October 11 (with a nominal price of 750 million USD at 5x leverage). Only when liquidity is sufficient can exchanges make guaranteed profits; in extreme environments, exchanges also suffer significant losses. From a motivational standpoint, they really have no need to deliberately cut off liquidity.

Finally, I am also a victim and am currently seeking compensation; I have not yet received it.

I publish this casual article to be a rational advocate for rights, providing everyone with another perspective.

Right or wrong, I will not back down.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。