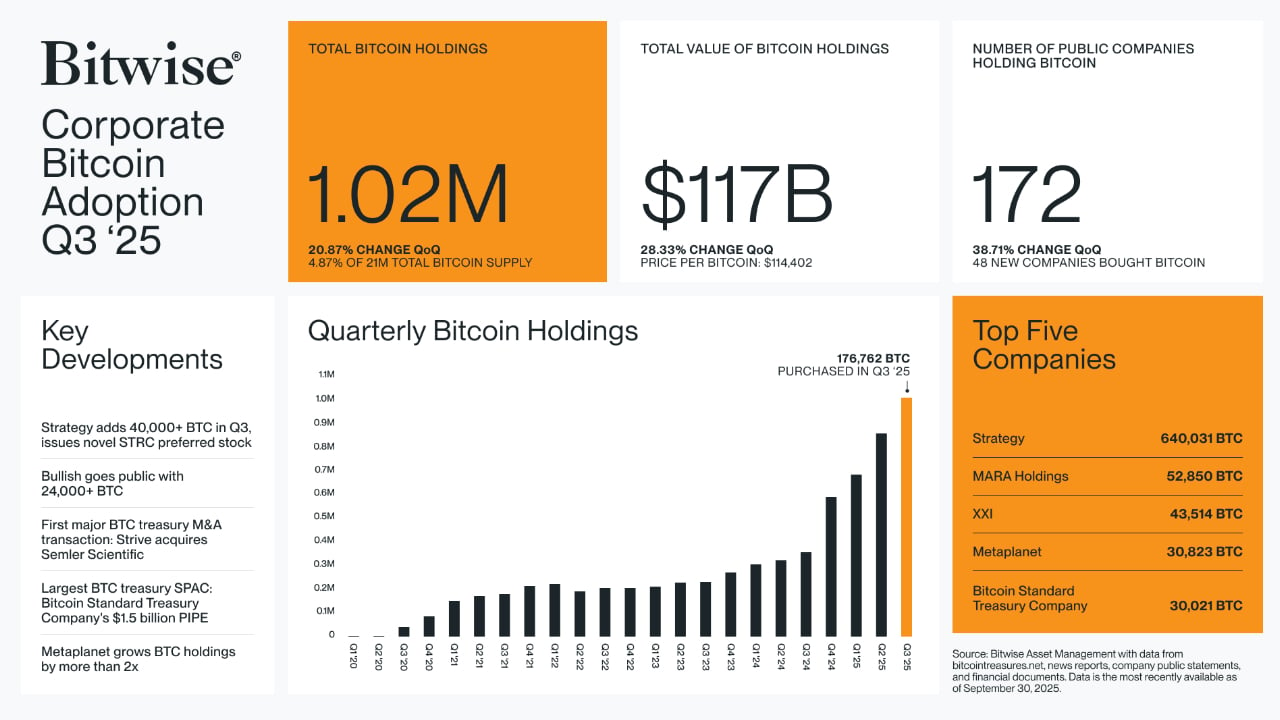

Corporate bitcoin ownership continues to accelerate, underscoring growing institutional engagement in digital assets. Bitwise Asset Management shared on Oct. 13 on social media platform X a chart highlighting how companies are buying bitcoin in Q3 2025. The firm reported that total corporate holdings reached 1.02 million BTC in the third quarter, a 20.87% increase from the prior quarter. The combined value of these holdings rose to $117 billion, supported by bitcoin’s average price of $114,402 during the period.

Bitwise stated:

There are almost 40% more public companies holding bitcoin today than there were 3 months ago.

The chart shows that 172 public companies now hold bitcoin on their balance sheets, with 48 new firms entering the market. Strategy Inc. led with 640,031 BTC, followed by MARA Holdings with 52,850 BTC, XXI with 43,514 BTC, Metaplanet with 30,823 BTC, and Bitcoin Standard Treasury Company with 30,021 BTC.

Bitwise’s corporate bitcoin adoption Q3 2025 data. Source: Bitwise.

Notable corporate actions during the quarter included Strategy adding more than 40,000 BTC and issuing STRC preferred stock, Bullish Holdings going public with over 24,000 BTC, and Strive completing the first major bitcoin-related M&A transaction through its acquisition of Semler Scientific.

Bitwise’s chart also emphasized expanding bitcoin-focused corporate financing, such as Bitcoin Standard Treasury Company’s $1.5 billion Private Investment in Public Equity (PIPE) via a Special Purpose Acquisition Company (SPAC) and Metaplanet’s move to more than double its bitcoin reserves. While critics caution that corporate concentration could amplify market volatility, advocates argue that the trend solidifies bitcoin’s role as a legitimate reserve and treasury asset. Bitwise’s data signals that institutional demand is now one of the primary forces shaping bitcoin’s long-term market trajectory.

- How much bitcoin do public companies hold as of Q3 2025?

Public companies now collectively hold 1.02 million BTC, a 20.87% increase from the previous quarter. - Why is institutional interest in bitcoin accelerating?

Institutions are increasingly adopting bitcoin as a treasury asset, driving long-term demand and market influence. - Why is growing corporate bitcoin ownership significant for investors?

The 40% increase in public firms holding bitcoin underscores its emergence as a mainstream reserve asset, reinforcing institutional confidence and shaping bitcoin’s long-term market trajectory. - What role does corporate financing play in bitcoin adoption?

Major financing moves like PIPE deals and M&A transactions are reinforcing bitcoin’s place in corporate strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。