The core variables of the fourth quarter market still hinge on the direction of macro policies and regulatory signals. If the liquidity environment of the US dollar does not improve significantly, the market may continue to experience a pattern of oscillation and bottom-seeking.

Abstract

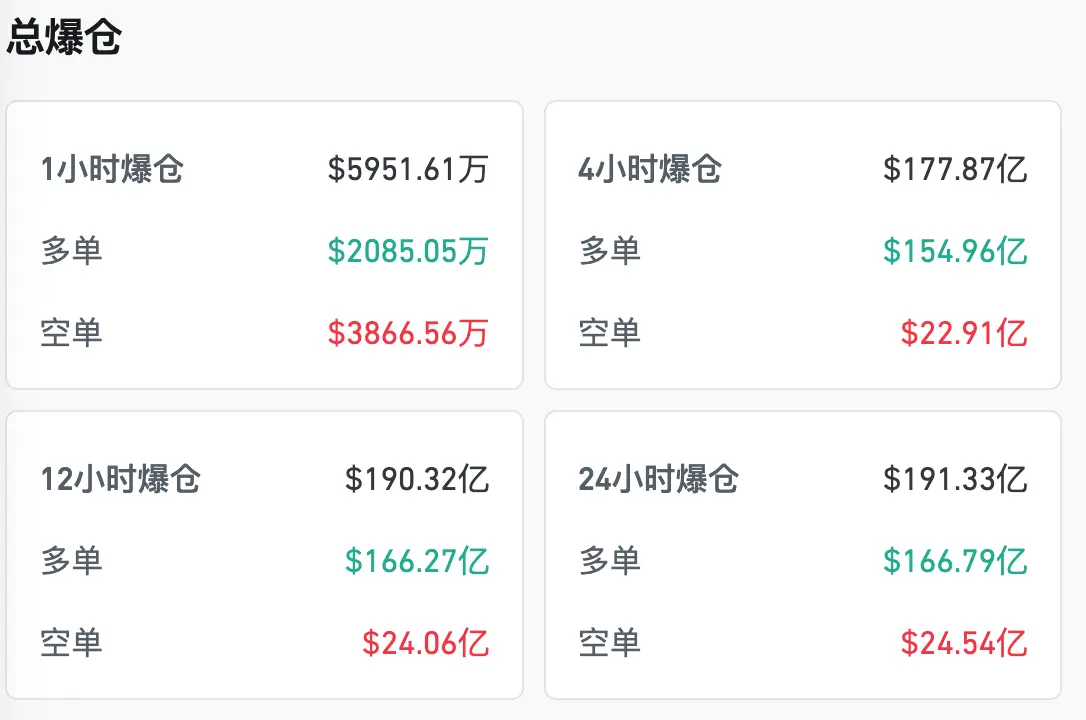

The crypto industry crash on October 11, 2025, referred to as the "1011 Incident" within the industry, saw a liquidation amount exceeding $19 billion in a single day, more than ten times the previous historical peak. Bitcoin plummeted from $117,000 to below $102,000, marking the largest single-day drop in nearly three years. This incident differs from the "312" liquidity crisis during the pandemic in 2020 and the "519" regulatory crackdown in 2021, as its trigger stemmed from Trump's announcement of a 100% tariff on China, a macro-political surprise, while the true destructive power came from the inherent leverage fragility of the crypto market. The market's hotly debated "TACO trade" (Trump Anticipated China Outcome trade) essentially involved the pre-pricing and speculative operation of Trump's policy signals. The market generally believes that Trump is adept at creating price volatility through extreme rhetoric and policy surprises, thereby indirectly manipulating market expectations. The incident not only severely impacted the Meme sector and shook the market confidence of digital asset reserve companies (DAT), but also subjected Perp DEX to the largest on-chain liquidation test in history, fully highlighting that the crypto market is deeply embedded in the global financial and geopolitical landscape. The 1011 incident may become the "Lehman moment" for the crypto industry, with aftershocks and confidence restoration potentially taking weeks or even months to digest. Looking ahead to the fourth quarter of 2025, the market is likely to enter a "risk repricing" and "de-leveraging" cycle, with overall volatility remaining high. BTC and ETH may seek to establish a bottom at key support levels, while high-risk assets like Meme are unlikely to regain vitality in the short term, and DAT companies and related US stock targets may continue to face pressure. In contrast, stablecoin liquidity, DeFi blue chips on mainstream chains, and staking derivative assets with robust cash flow may become temporary safe havens for funds. The core variables of the fourth quarter market still hinge on the direction of macro policies and regulatory signals. If the liquidity environment of the US dollar does not improve significantly, the market may continue to experience a pattern of oscillation and bottom-seeking.

I. Background and Analysis of the Incident

The market shock on October 11, 2025, has been dubbed the "1011 Incident" by the industry. This extreme market event, with over $19 billion in liquidations and Bitcoin plummeting by $15,000 in a single day, is not an isolated incident but rather the result of a combination of macro-political factors, structural market fragility, and localized triggering mechanisms. Its complexity and destructiveness evoke memories of the Lehman moment during the 2008 global financial crisis. Below, we will outline the deep logic of this crisis from several aspects: macro background, market fragility, triggering mechanisms, transmission chains, and liquidation mechanisms. Global macro: Trump's tariff policy and the US-China trade conflict. In the second half of 2025, the global economy was already under high pressure. After several rounds of interest rate hikes and deficit expansion, the sustainability of US fiscal policy was under scrutiny, with the US dollar index remaining high and global liquidity tightening. Against this backdrop, late on October 10 (Eastern Time), Trump suddenly announced a 100% tariff on all imports from China, far exceeding market expectations and escalating the US-China trade conflict from "structural friction" to "full economic confrontation." This policy instantly shattered the market's fantasy of "US-China easing." The Asia-Pacific stock markets were the first to feel the pressure, and US stock futures plummeted before the market opened. More importantly, the pricing logic of global risk assets was completely disrupted. For crypto assets that heavily rely on US dollar liquidity and risk appetite, this was undoubtedly a systemic shock. It can be said that the macro level provided the "black swan" external shock, becoming the initial trigger of the 1011 incident. Additionally, there were market fragilities: liquidity tightening, excessive leverage, and emotional exhaustion. However, whether any external shock can evolve into a crisis also depends on the market's own fragility.

The crypto market in 2025 was in a delicate phase: first, liquidity was tight due to the Federal Reserve's balance sheet reduction and high interest rate environment, leading to a shortage of US dollar funds. The issuance of stablecoins slowed, arbitrage channels both inside and outside the market were obstructed, and the depth of on-chain liquidity pools significantly decreased. Secondly, there was excessive leverage; with BTC breaking the $100,000 mark and ETH returning to a market cap of $1 trillion, market sentiment was extremely exuberant, and perpetual contract positions reached new highs, with overall leverage surpassing the peak of the 2021 bull market. Additionally, there was emotional exhaustion; the explosive growth of the Meme sector and the frenzy of funds attracted a large number of retail and institutional investors, but behind this was a singular expectation of "continuing bull market." Once the trend reversed, the destructive power would be immense. Therefore, the market had long become a "house of cards built on high leverage," where a single spark could lead to an instant collapse. Triggering mechanism: USDe, wBETH, BNSOL decoupling. The true catalyst for the crisis was the simultaneous decoupling of three key assets: USDe (a new type of over-collateralized stablecoin) briefly fell below $0.93 due to insufficient liquidation of some reserve assets, triggering a chain panic; wBETH (a liquidity derivative of staked Ethereum) saw its discount widen to 7% due to insufficient liquidity and liquidation pressure; BNSOL decoupled under the withdrawal of cross-chain bridge funds, with a discount of nearly 10%. All three were widely used as collateral and trading pairs in the market. When their prices rapidly diverged from fair value, the liquidation engines misjudged the risk, and the value of collateral plummeted, further amplifying the chain reaction of liquidations. In other words, the failure of these "core liquidity assets" became the ignition point for the market's self-destruction. The transmission chain of the market crash: from decoupling to liquidation. The logic of the event's transmission can be summarized as: decoupling shocks collateral → insufficient margin triggers liquidation → CEX/DEX compete to liquidate and sell off → price avalanche → more collateral decouples, forming a positive feedback loop, especially under the "unified account margin model," where user asset pools are shared, the plummeting of collateral like USDe and wBETH directly dragged down the overall account health, leading to large-scale non-linear liquidations. This flaw became the most fatal structural risk point in the 1011 incident. Differences in liquidation mechanisms between CEX and DEX. Centralized exchanges (CEX) often employ automatic deleveraging (ADL) and forced liquidation mechanisms; once margin is insufficient, the system enforces liquidation. This often exacerbates "liquidation cascades" during high volatility. Exchanges like Binance and OKX, due to high user concentration, faced extremely large liquidation scales. Decentralized exchanges (DEX) typically use smart contracts for liquidation, which is transparent on-chain, but due to limited on-chain settlement speed, price slippage and Gas congestion restrict liquidation efficiency, leading to some positions being "unable to be liquidated immediately," further distorting prices. In the 1011 incident, the combination of CEX and DEX liquidation mechanisms created a "double liquidation effect." Collateral risk: the fatal flaw of the unified account margin model. The "unified account margin model" (Cross-Margin with Shared Collateral) that has become popular in the crypto market in recent years was intended to improve capital efficiency by allowing different assets to share margin. However, in extreme cases, this model amplified risks: USDe and wBETH discounts → total account equity shrinks; margin rates worsen → triggering a chain of forced liquidations; forced liquidation pressure → further dragging down collateral prices. This positive feedback loop caused small-scale collateral decoupling to rapidly evolve into systemic liquidation.

The 1011 incident was not a single black swan but rather the result of a combination of macro surprises, leverage fragility, collateral failure, and liquidation defects. Trump's tariff policy was the trigger, the market's excessive leverage and unified account model were the explosive agents, the decoupling of USDe, wBETH, and BNSOL were the direct triggering points, while the CEX/DEX liquidation mechanisms acted as amplifiers accelerating the crash. This crisis reveals a harsh reality: the crypto market has evolved from an "independent risk asset pool" into a complex system highly coupled with global macro and geopolitical factors. In this framework, any external shock can potentially trigger a chain reaction through leverage and collateral structures, ultimately evolving into a liquidity collapse akin to a "Lehman moment."

II. Historical Comparison and Analysis

On March 12, 2020, the global capital markets faced historic panic amid the spread of the COVID-19 pandemic and a collapse in oil prices, entering the "crypto Lehman moment" of the COVID liquidity crisis. US stocks triggered circuit breakers, US dollar liquidity became extremely tight, and risk aversion led to a market sell-off of all high-risk assets. Bitcoin plummeted from around $8,000 to less than $4,000 in a single day, a drop of over 50%, leading to widespread descriptions of the "crypto Lehman moment." The essence of the 312 incident was the transmission of macro liquidity shocks to the crypto market: a dollar shortage forced investors to sell off all non-core assets, and the difficulty of exchanging stablecoins surged; at that time, market infrastructure was weak, DeFi was still small, and liquidations were mainly concentrated on centralized exchanges like BitMEX. Leveraged funds were forced to liquidate, and on-chain collateral assets were also subject to runs, but the overall market was still in its early stages, and the crisis, though fierce, was more a result of external macro shocks combined with leveraged liquidations. Entering 2021, Bitcoin broke through $60,000, and market sentiment was euphoric. In May, the Chinese government successively introduced policies to regulate mining and crack down on trading, coupled with the SEC's compliance review of trading platforms, putting significant regulatory pressure on the crypto market. Against a backdrop of excessive leverage and optimism, over $500 billion in market value evaporated in a single day, with Bitcoin dropping to around $30,000. The characteristics of the 519 incident were the combination of policy and internal market fragility. On one hand, as a major player in mining and trading, China's regulation directly weakened BTC network hash power and market confidence; on the other hand, high perpetual contract positions quickly transmitted the liquidation chain. Compared to the 312 incident, the trigger point of the 519 incident leaned more towards the combination of policy and structural risks, indicating that the crypto market, in its process of mainstreaming, could no longer avoid regulatory and policy variables. The "1011 bloodbath" on October 11, 2025, marked a "complex system moment" of macro factors, leverage, and collateral decoupling, with liquidation amounts exceeding $19 billion in a single day, and Bitcoin falling from $117,000 to $101,800. Compared to the 312 and 519 incidents, the complexity and systemic characteristics of the 1011 incident are more pronounced. First, at the macro level: Trump's imposition of a 100% tariff on China directly escalated geopolitical friction into economic confrontation, putting pressure on the dollar and all risk assets. Its impact is similar to that of the 312 incident, but the backdrop is no longer a pandemic black swan, but a predictable conflict under political and economic competition. Second, market fragility: leverage rates were again at historical peaks, with BTC and ETH hovering at high levels, and the Meme frenzy brought excessive optimism, while liquidity was significantly insufficient due to the Federal Reserve's balance sheet reduction and the slowdown in stablecoin expansion. This is similar to the environment of the 519 incident—where optimistic sentiment and fragile structures overlapped, but to a greater extent. Third, the triggering mechanism: the simultaneous decoupling of USDe, wBETH, and BNSOL, three types of core collateral, was a unique "internal ignition point" of the 1011 incident. As foundational collateral and trading pairs, once their prices deviated from fair value, the entire margin system would collapse. This situation had not occurred in the 312 and 519 incidents, marking collateral risk as a new systemic weakness.

The similarities among the three crises reflect the fateful logic of the crypto market's "high leverage—liquidity fragility—liquidation chain." External shocks serve as the ignition points (312 pandemic, 519 regulation, 1011 tariffs), while internal leverage and insufficient liquidity act as amplifiers; single-day volatility has exceeded 40%, accompanied by massive liquidations and a severe blow to market confidence. The differences lie in that 312 was a singular macro shock, with the market still small and on-chain effects limited; 519 was a resonance of regulation and leverage, demonstrating the direct shaping of the market by policy variables; 1011 combined macro factors, leverage, and collateral decoupling, with the crisis transmitting from external shocks to internal core assets, reflecting the complexity after system evolution. In other words, the chain of crises is continuously extending: from "macro single point" → "policy overlay" → "internal core asset self-collapse." Through these three historical collapses, we can observe the evolutionary path of risk in the crypto market: from marginal assets to system coupling: the 312 incident in 2020 was more of an external shock, while the 1011 incident in 2025 is highly bound to global macro and geopolitical factors, indicating that the crypto market is no longer an "independent risk pool." From single leverage to collateral chain: early crises primarily stemmed from excessive contract leverage, whereas today it has evolved into issues of the stability of collateral assets themselves, with the decoupling of USDe, wBETH, and BNSOL being typical cases. From external amplification to internal self-destruction: the 312 incident primarily relied on macro sell-offs for transmission, the 519 incident combined regulation and leverage, while the 1011 incident showed that the market could form a self-destructive chain internally. The gap in infrastructure and institutional constraints: the unified account margin model amplifies risks in extreme market conditions, and the overlapping liquidation of CEX/DEX accelerates the cascading effect, indicating that the current market institutional design still prioritizes "efficiency," while the risk buffer mechanisms are severely lacking. The three crises of 312, 519, and 1011 have witnessed the evolution of the crypto market from "marginal assets" to "system coupling" in just five years. The 312 incident revealed the lethality of macro liquidity shocks, the 519 incident exposed the double-edged sword of policy and leverage, while the 1011 incident presented the comprehensive outbreak of collateral failure and structural risks for the first time. In the future, the systemic risks of the crypto market will become more complex: on one hand, it is highly dependent on US dollar liquidity and geopolitical patterns, becoming a "highly sensitive node" in the global financial system; on the other hand, internal high leverage, cross-asset collateral, and the unified margin model make it prone to accelerated collapse during crises. For regulators, the crypto market is no longer a "shadow asset pool," but a potential source of systemic risk. For investors, each collapse is a milestone in the iteration of risk awareness. The significance of the 1011 incident lies in the fact that the crypto market's Lehman moment is no longer just a metaphor, but may become a reality.

III. Impact Analysis of the Sectors: Repricing of the Crypto Market After the 1011 Incident

Meme Sector: From Frenzy to Retreat, the Value Disillusionment After FOMO. The Meme sector was undoubtedly the most eye-catching track in the first half of 2025. The classic effects of Dogecoin and Shiba Inu, combined with the emergence of new Chinese meme trends, made Meme a gathering place for young users and retail funds. Driven by FOMO sentiment, the daily trading volume of individual coins exceeded billions of dollars, becoming a major source of trading volume for both CEX and DEX. However, after the 1011 incident, the structural weaknesses of Meme coins were fully exposed: concentrated liquidity: overly reliant on top exchanges and a single liquidity pool, leading to significant price slippage once market panic set in. Lack of underlying value: the valuation of Meme coins relies more on social narratives and short-term traffic, making them unable to withstand systemic liquidity runs. The funding effect is fleeting: retail investors retreat, and institutions cash out, leading to a "value disillusionment" in the short term. It can be said that the "traffic—price—funding" closed loop of the Meme sector cannot be maintained under macro shocks. Unlike traditional assets, the fragility of Meme stems from the lack of verifiable cash flow or collateral logic, making it one of the sectors with the largest declines during the crash. Meme is not only a speculative asset but also a "social expression" for the younger generation of investors. Its explosion reflects group psychology, identity recognition, and internet subculture. However, in the current highly financialized environment, the lifecycle of Meme is shorter, and the funding effect is more prone to backlash. After 1011, the short-term narrative of Meme has essentially collapsed, and it may return to a niche survival pattern of "long-tail cultural coins" and "branded Memes."

DAT Sector: Repricing of Digital Asset Treasury. Three representative cases: MicroStrategy (MSTR): continuously increasing Bitcoin holdings through bond issuance, representing a "single-coin treasury model"; Forward: focusing on Solana treasury asset management, emphasizing ecological binding; Helius: switching from a medical narrative to a "Solana treasury platform," relying on staking income and ecological cooperation to obtain cash flow. The core of the DAT model is to hold crypto assets as "quasi-reserves" and obtain cash flow through staking, re-staking, and DeFi strategies. In a bull market, this model can achieve NAV premiums, similar to "crypto closed-end funds." After the 1011 incident, the market's pricing logic for DAT companies rapidly contracted: asset shrinkage: the prices of BTC/ETH plummeted, directly lowering the net asset value (NAV) of DATs. The direct impacts include: 1. Disappearance of premiums: the previously granted mNAV premium (Market Cap / NAV) was based on expectations of expansion and cash flow, but after the crisis, the premium quickly reverted, with some small DATs even trading at a discount. 2. Liquidity differentiation: large companies like MSTR have financing capabilities and brand premiums, while small DATs lack liquidity and experience significant stock price volatility. 3. Large companies vs. small companies: liquidity differences. Large companies (like MSTR): can still expand their treasury through secondary market offerings and bond financing, demonstrating strong risk resistance; small companies (like Forward and Helius): rely on token issuance and re-staking income for funding, lacking financing tools, and once faced with systemic shocks, they suffer from a double whammy of cash flow and confidence. Sustainability of the model and ETF substitution effects. The long-term competitive pressure on DAT comes from ETFs and traditional asset management tools. As BTC and ETH spot ETFs gradually mature, investors can gain exposure to crypto assets through low-fee, compliant channels, compressing the premium space for DATs. Their future value will depend more on: whether they can build excess returns through DeFi/re-staking; whether they can establish ecological synergy (such as binding to a public chain); and whether they can transform into "crypto asset management companies."

Perp DEX Sector: Restructuring of the Contract Market Landscape. The Hyperliquid ETH-USDT liquidation event revealed large-scale liquidations on the ETH-USDT contract on Hyperliquid, with temporary liquidity shortages leading to price dislocation. This event exposed the liquidity fragility of the on-chain contract market under extreme conditions: market makers withdrew funds, causing a sharp drop in depth; the liquidation mechanism relies on oracle and on-chain prices, with response speed limited by block confirmations; when user margin is insufficient, the efficiency of forced liquidations is low, leading to additional losses. The ADL mechanism and funding rates hit historical lows. Decentralized contract platforms often use ADL (automatic deleveraging) to prevent liquidation, but in extreme conditions, ADL can lead to passive liquidations for ordinary users, creating secondary cascades. Meanwhile, funding rates fell to multi-year lows after the 1011 incident, indicating that leverage demand was severely suppressed and market activity declined. On-chain vs. centralized: differences in stress resistance: centralized exchanges (CEX): have stronger liquidity depth and higher matching efficiency, but the risk lies in user concentration; once a systemic liquidation occurs, the scale is massive; decentralized exchanges (DEX): have high transparency, but under extreme conditions, they are limited by block throughput and gas fees, making their stress resistance even weaker. This incident shows that Perp DEX has yet to resolve the contradiction between "efficiency and safety," performing worse than CEX in extreme conditions, becoming a shortcoming in the market. Looking ahead, the restructuring of the contract market landscape may exhibit the following trends: CEX continues to dominate: leveraging liquidity and speed advantages, CEX remains the main battlefield; DEX seeks innovation: enhancing stress resistance through off-chain matching + on-chain settlement, cross-chain margin, etc.; emergence of hybrid models: some new platforms may adopt a CEX-DEX hybrid structure, balancing efficiency and transparency; rising regulatory pressure: after the 1011 incident, the liquidation chain of the contract market has drawn attention, and may face stricter leverage restrictions in the future.

Repricing logic of the three major sectors: Meme sector: from frenzy to retreat, the future may return to niche culture and branding direction, making it difficult to recreate a market-level liquidity center. DAT sector: premium logic is compressed, large companies have strong risk resistance, while small companies are highly fragile, with ETFs becoming long-term substitute competitors. Perp DEX sector: extreme conditions expose liquidity and efficiency defects, requiring technological innovation and institutional reform in the future, or it will still struggle to compete with CEX. The 1011 incident is not only a market liquidation but also the starting point for sector repricing. Meme has lost its bubble support, DAT has entered a phase of rational valuation, and Perp DEX faces challenges of restructuring. It is foreseeable that the next round of expansion in the crypto market will inevitably occur under a more complex institutional and regulatory framework, with 1011 becoming an important milestone in this turning point.

IV. Investment Outlook and Risk Reminders

The 1011 incident once again revealed the collective behavior patterns of the crypto market: during bullish trends, leverage usage often rises exponentially, with both institutions and retail investors inclined to maximize capital efficiency in hopes of obtaining short-term excess returns. However, when external shocks occur, the excessive concentration of leverage makes the market extremely fragile. Data shows that the open interest (OI) of perpetual contracts for BTC and ETH was nearing historical highs just a week before 1011, with funding rates once soaring to extreme levels. Accompanied by a price crash, the scale of liquidations accumulated to $19 billion within hours, forming a typical "herd liquidation": once market expectations reversed, investors rushed to liquidate and flee, exacerbating the price avalanche. The market's hotly debated "TACO trade" (Trump Anticipated China Outcome trade) essentially involved the pre-pricing and speculative operation of Trump's policy signals. The market generally believes that Trump is adept at creating price volatility through extreme rhetoric and policy surprises, thereby indirectly manipulating market expectations. Some funds even positioned short before the announcement, leading to asymmetric games in the market: on one side were retail investors and momentum traders with high leverage, and on the other side was the "smart money" engaging in "expectation trading." This arbitrage operation based on political signals reinforced the emotional disconnection and irrational volatility in the market.

Investor Stratification: Old Era "Hope Strategy" vs. New Era "Narrative Arbitrage." The 1011 incident highlighted the stratification differences among investors: old-era investors still rely on the "hope strategy," which involves long-term holding and believing that prices will rise due to macro liquidity or halving cycles, lacking awareness of structural market risks; new-era investors are more adept at "narrative arbitrage," quickly switching positions based on policy news, macro signals, or on-chain capital flow dynamics, pursuing short-term risk-reward ratios. This stratification leads to a lack of intermediate forces in extreme market conditions: either overly optimistic long-termists passively bear losses, or high-frequency arbitrage funds dominate short-term fluctuations, exacerbating overall market volatility. The 1011 incident once again proved that the crypto market has become highly financialized and cannot exist independently of the macro environment. The Federal Reserve's interest rate decisions, the state of US dollar liquidity, and US-China geopolitical frictions are all shaping the pricing logic of crypto assets in real-time. From a regulatory perspective, countries around the world have begun to notice three major concerns: insufficient transparency: limited disclosure of stablecoin and derivative collateral assets, which can easily trigger a trust crisis; user protection gaps: opaque leverage and liquidation mechanisms expose retail investors to asymmetric risks; financial stability risks: the chain reaction effects of the crypto market have already spilled over to the US stock market and even the commodity market. It is foreseeable that future regulation will focus on improving transparency, protecting user rights, and establishing a stable framework that connects with traditional finance. In the short term, the market will enter a "de-leveraging" phase. Funding rates have fallen to negative values, indicating a significant contraction in bullish momentum; after the clearing of leverage, BTC and ETH may gradually stabilize at key support levels, with market volatility remaining high but tending to converge. The recovery space for high-risk assets like Meme coins is limited, while staking derivative assets and stablecoin ecosystems with robust cash flow may become safe havens during the recovery process. The pace of market recovery depends on two factors: the speed of on-site leverage digestion and whether there is marginal improvement in the macro environment. The high correlation between Federal Reserve liquidity and the crypto market. In the past two years, the correlation between Federal Reserve liquidity and crypto market prices has significantly increased. When US dollar liquidity tightens, stablecoin issuance slows, and on-chain capital pool depth declines, directly weakening the market's capacity. Conversely, when liquidity is loose or expectations of interest rate peaks increase, the crypto market often rebounds first. Therefore, the market's performance in the coming months will largely depend on the Federal Reserve's policy direction before the end of the year. If the interest rate hike cycle indeed ends, the market may welcome a phase of recovery; if the US dollar remains strong, risk assets will still be under pressure.

Regulatory Trends: Transparency, User Protection, Financial Stability Framework. The focus of regulatory efforts in various countries will include: transparency of stablecoin reserves: requiring disclosure of asset composition to avoid "shadow banking"; regulation of leverage and liquidation mechanisms: setting reasonable leverage limits and increasing risk control buffers; systemic risk firewall: establishing cross-market risk monitoring to prevent crypto risks from spilling over into the banking system. For investors, regulation may bring short-term uncertainty, but in the long run, it will help reduce systemic risks and enhance institutional confidence in entering the market. Risk points and opportunities in the coming months. Risk points: the ongoing escalation of US-China trade frictions further impacts risk assets; stablecoins or derivatives may experience localized decoupling again, triggering market panic; if the Federal Reserve maintains a hawkish stance, worsening liquidity conditions will drag down crypto valuations. Opportunity points: high-quality staking derivatives (such as LSTs and re-staking protocols) may benefit from safe-haven demand; the compliance process for stablecoins may bring long-term incremental investments from institutions and compliant funds; quality public chains and DeFi blue chips may have mid- to long-term layout value after valuation corrections. The 1011 bloodbath serves as a collective awakening for the crypto market, reminding investors that crypto assets are deeply embedded in global financial logic, and that leverage overextension and herd effects will amplify risks in extreme conditions. In the coming months, the market's recovery path will depend on the progress of de-leveraging and shifts in macro policy, while regulatory trends will gradually clarify under the frameworks of transparency and financial stability. For investors, risk management and narrative recognition capabilities will be key to navigating high-volatility cycles.

V. Conclusion

After the 1011 incident, the investment logic of the crypto market is undergoing a profound repricing. For investors in different sectors, this crisis is not only a loss but also a mirror reflecting the strengths and weaknesses of their respective models. First, Meme sector investors need to recognize that the essence of Meme is "narrative-driven short-cycle flow assets." During bull market phases, social effects and FOMO can amplify price increases, but under systemic shocks, their lack of cash flow and underlying value weaknesses can easily be exposed. Second, DAT sector investors should be wary of the contraction of premium logic. Large treasury models like MicroStrategy still possess risk resistance due to their financing capabilities and brand advantages; however, small and medium DAT companies, overly reliant on token issuance and re-staking income, often face discounts first under liquidity shocks. Third, Perp DEX investors need to confront the inadequacies of on-chain liquidity in extreme conditions. Finally, from a global perspective, liquidity fragmentation will be the norm in the future. Against the backdrop of high US dollar interest rates, tightening regulations, and complex cross-chain ecosystems, market capital will become more dispersed, and volatility will occur more frequently. Investors need to build "resilient portfolios": on one hand, by controlling leverage and diversifying positions to adapt to volatility, and on the other hand, by locking in assets with cash flow, institutional resilience, and ecological binding advantages. The 1011 incident teaches us that the evolution logic of crypto investment is shifting from "pure speculation" to "adaptive survival": investors who can adjust strategies and identify structural value will gain stronger survival capabilities, while those blindly chasing bubbles and leverage are destined to be eliminated in the next systemic shock.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。