The cryptocurrency market experienced the largest liquidation event in history on '10.11' last week, causing market sentiment to plummet to freezing levels. Influenced by panic stemming from U.S. President Trump's tariff policies, the global crypto market liquidated up to $19 billion in contract positions within just 24 hours from October 10 to October 11, setting a historical record.

However, the market is not entirely pessimistic. On October 14, Federal Reserve Chairman Powell delivered two dovish signals in his speech. First, Powell indicated that data before the potential government shutdown suggested that economic growth might be better than expected, but the downside risks in the U.S. job market have increased, making the Fed's decision to restart interest rate cuts in September entirely reasonable. Second, he indicated that the Fed might continue its monetary easing policy and plans to cut rates again at the upcoming FOMC meeting at the end of this month.

Another point of interest is that the correlation between Bitcoin and gold has risen above 0.85, with both showing a high degree of synchronization in capital flows. Gold has surpassed the $4,000 mark due to continued central bank purchases and rising market risk aversion. Bitcoin, viewed as "digital gold," may also be driven by similar market logic. Meanwhile, institutional buying power is gradually becoming the core momentum of the market, with inflows from digital asset treasury companies and ETFs further driving up Bitcoin prices.

This week, although Bitcoin and Ethereum prices have slightly rebounded, the uncertainty brought by Trump's tariff policies has not dissipated, and market buying power remains relatively weak. As of the time of writing, Bitcoin is priced at $111,710, with a 24-hour increase of approximately 0.39%. Ethereum is priced at $4,057, with a 24-hour increase of approximately 3.28%.

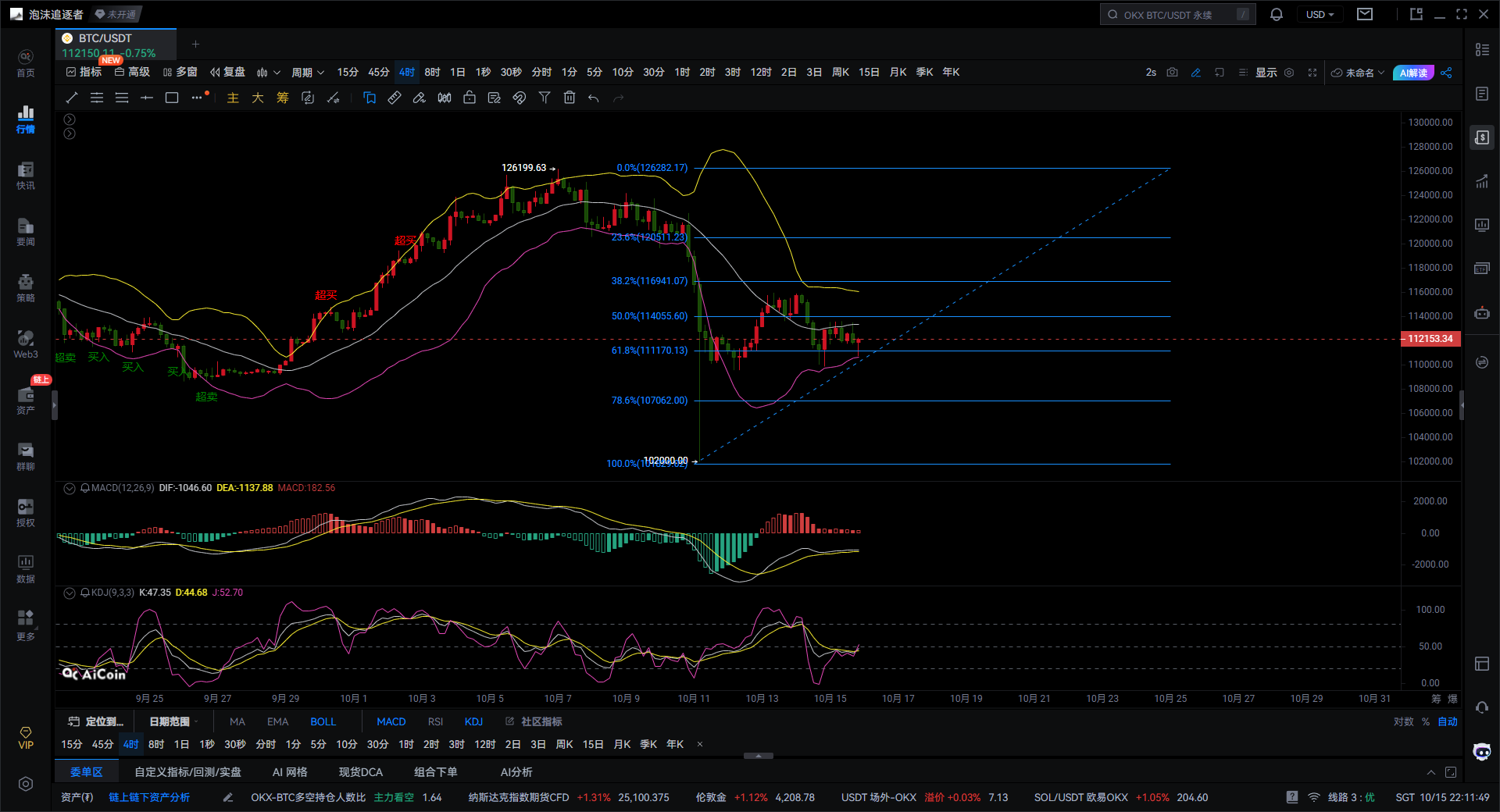

Bitcoin Four-Hour Chart

From a technical indicator perspective, the current market shows a mixed situation of bulls and bears. The MACD indicator shows that the DIF line is above the DEA line, and the MACD histogram is red, indicating some upward momentum in the market. However, the MACD red histogram is gradually shortening, suggesting that the upward momentum may be weakening, and market forces may face a shift. If a MACD death cross signal appears subsequently, it could trigger a price correction.

Regarding the KDJ indicator, the K line has risen above the 80 overbought area, the D line is also at a high level, and the J line is approaching extreme levels. This overbought state suggests that the market may need a short-term adjustment. Special attention should be paid to whether the K line and D line form a downward cross, creating a death cross signal that would trigger a downward price correction.

The Bollinger Bands indicator shows that the price has broken through the upper band, indicating a strong upward trend. However, considering that the price has reached the upper edge of the channel, caution is warranted regarding potential correction risks. The widening of the Bollinger Bands indicates increased market volatility, suggesting that significant fluctuations may be faced in the future.

From the Fibonacci retracement levels, the current price hovers around the 61.8% level at approximately $111,710. This key level serves as both support and resistance. If it cannot break through effectively, it may test the 78.6% level at $107,062 for support. Conversely, if it can hold above the 61.8%, it may challenge the 50% level at $114,055 and the 38.2% level at $116,941 for higher resistance.

In summary, although the MACD and Bollinger Bands indicate that the market still has upward potential, the KDJ overbought signal and weakening MACD momentum both suggest short-term correction risks. Especially near the 61.8% Fibonacci level, the battle between bulls and bears intensifies.

Based on the above analysis, the following suggestions are provided for reference:

Buy Bitcoin on a pullback to around $111,000-$110,700, targeting $112,500-$113,200.

Instead of giving you a 100% accurate suggestion, I prefer to provide you with the right mindset and trend. Teaching someone to fish is better than giving them fish; learning to earn can last a lifetime!

Time of writing: (2025-10-15, 22:10)

(Written by - Daxian Says Coin) Disclaimer: Online publication has delays; the above suggestions are for reference only. Investment carries risks; proceed with caution!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。