Fidelity Leads ETF Comeback With Strong Bitcoin and Ether Inflows

After Monday’s steep sell-off, the crypto exchange-traded fund (ETF) market found its footing again. Investor appetite returned swiftly, with both bitcoin and ether ETFs swinging back into the green with a combined $339 million in inflows, signaling confidence remains alive in both asset classes.

Bitcoin ETFs recorded $102.58 million in net inflows. Fidelity’s FBTC led the recovery with a robust $132.67 million inflow, followed by Bitwise’s BITB with $7.99 million and Ark 21Shares’ ARKB adding $6.76 million.

Redemptions from two major funds partially offset the positive flows. Blackrock’s IBIT saw $30.79 million in outflows, and Valkyrie’s BRRR saw a $14.05 million exit. Still, inflows comfortably outweighed exits, keeping sentiment buoyant. Trading volume remained high at $6.92 billion, with total net assets steady at $153.55 billion.

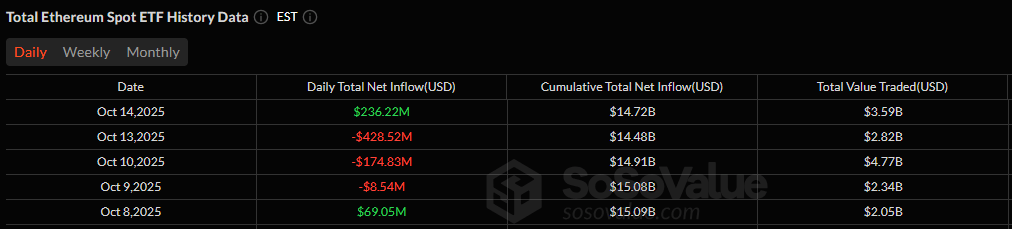

Ether ETFs turn green after three straight days of red.

Ether ETFs began their recovery with $236.22 million in total inflows across six funds. Fidelity’s FETH once again led the charge, adding $154.62 million. Grayscale’s Ether Mini Trust and ETHE followed with inflows of $34.78 million and $15.19 million, respectively.

Bitwise’s ETHW ($13.27 million), Vaneck’s ETHV ($10.55 million), and Franklin’s EZET ($7.81 million) rounded out the day with solid gains. Total value traded came in at $3.59 billion, and net assets closed at $28.02 billion, marking another confident session for ether products.

After Monday’s retreat, Tuesday’s recovery underscored a key message: crypto ETF investors aren’t backing down, they’re just catching their breath before the next leg up.

FAQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。