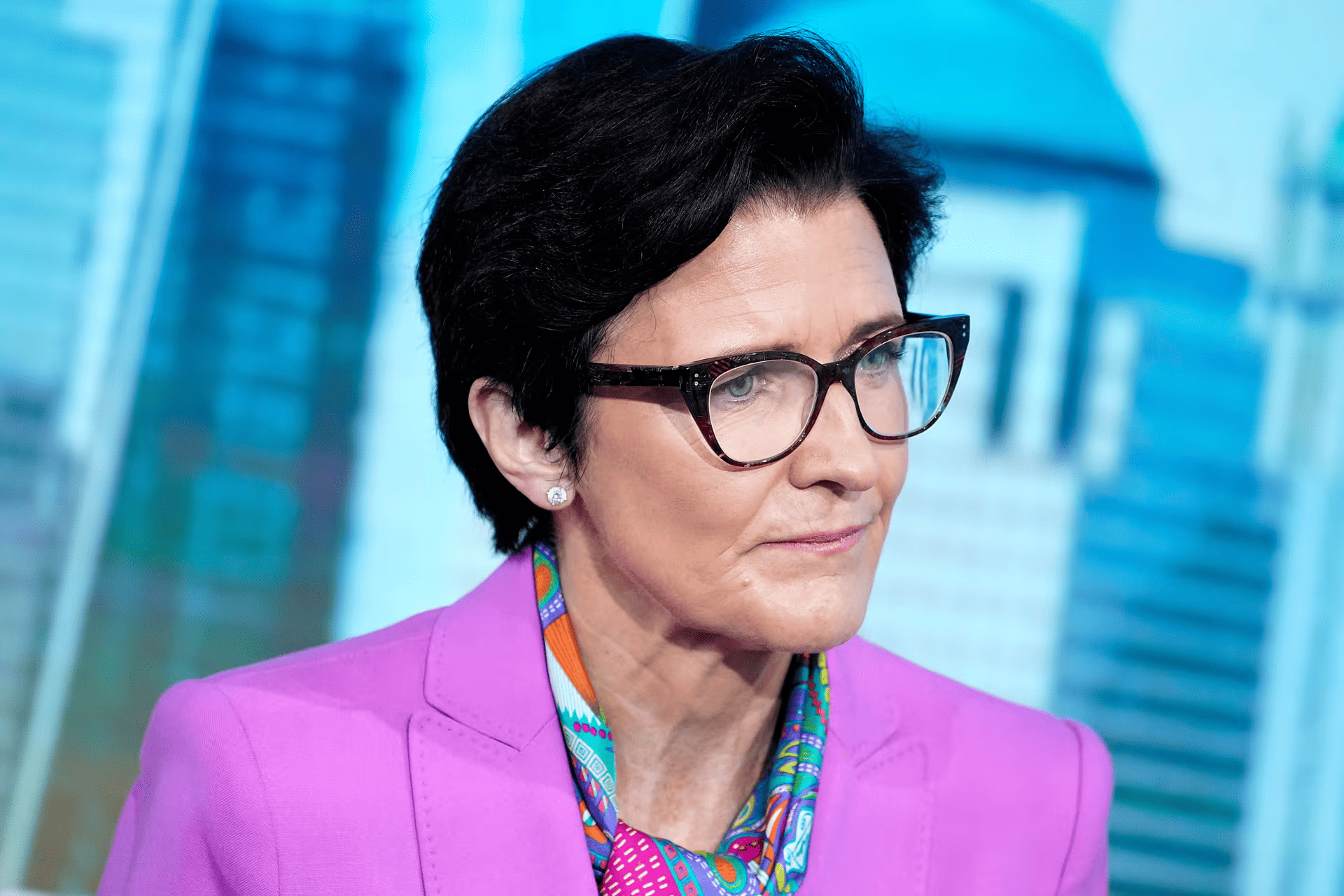

The global cryptocurrency market has encountered the most severe "black swan" event of the month so far—unexpected fluctuations in the stablecoin market, leading to a temporary severe de-pegging of some mainstream stablecoins, triggering panic selling and a chain reaction in the market. Following the incident, Tether's USDT quickly initiated a large-scale issuance to stabilize market liquidity, while Jane Fraser, CEO of traditional financial giant Citigroup, emphasized the "huge potential of tokenized deposits" in a public appearance on October 14, indirectly pointing out that the current market's focus on stablecoins may be "over-amplified."

1. Stablecoin De-pegging, Market Confidence Instantly Collapses

1. Stablecoins: The "Trust Cornerstone" of the Crypto Ecosystem

Stablecoins serve as a key bridge connecting traditional fiat currencies and the cryptocurrency market, with their core value being "1:1 pegged to the US dollar," providing investors with a relatively stable medium of exchange and a hedging tool. However, once this pegging relationship is disrupted, market confidence can quickly disintegrate, potentially leading to systemic panic.

2. Anomaly: Temporary De-pegging of Stablecoins

Real-time monitoring indicated that in the early hours of October 11, 2025, several stablecoins exhibited significant deviations from their US dollar peg. Among them, USDT briefly dropped to $0.965 on some centralized exchanges (CEX), USDC was quoted below $0.99 on certain platforms, and DAI fell below $0.98 at one point. Although these de-pegging phenomena did not occur simultaneously across all platforms, and prices on major platforms like Binance and Coinbase were quickly corrected, the temporary price deviations were sufficient to trigger programmatic trading and leveraged strategies.

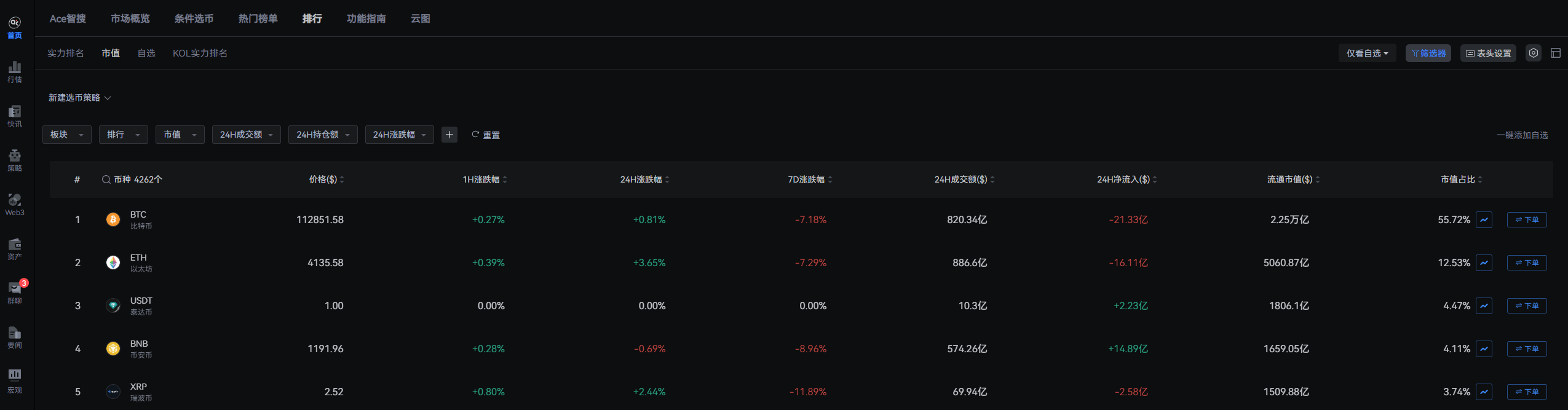

Market data showed that on that day, the total market capitalization of the cryptocurrency market evaporated by over $280 billion, with Bitcoin (BTC) dipping to a low of $101,500 and Ethereum (ETH) falling to $3,355, while several altcoins experienced declines exceeding 80%.

3. Market Reaction: Liquidity Tightening and Trust Crisis

Although this de-pegging event did not cause a global systemic crisis like the "LUNA collapse" in 2022, its impact on market confidence should not be underestimated. Some institutional investors began to question the "stability" of stablecoins, especially among those relying on stablecoins for asset reserves, trading hedges, and cross-chain bridging.

2. Tether Takes Action to Stabilize, Market Liquidity is Supplemented

In the face of severe market fluctuations, Tether (USDT), the leading issuer in the stablecoin sector, quickly activated its emergency mechanism, starting large-scale issuance of USDT on the morning of October 11 to alleviate the tight liquidity situation. According to data, from October 11 to 12, Tether issued over 12 billion USDT across multiple chains including Ethereum, Tron, and Solana, setting a historical record for weekly issuance.

In a subsequent statement, Tether officials said: "This issuance aims to respond to market demand, ensuring that global users have sufficient stablecoin liquidity to maintain the stable operation of the crypto ecosystem." The market generally believes that Tether's rapid response effectively curbed the further spread of panic, avoiding larger-scale chain liquidations and trust collapses.

However, some industry insiders have questioned Tether's "issuance to save the market" model, arguing that it essentially compensates for short-term liquidity gaps by expanding supply, which may exacerbate the "trust dependency" and "centralization risk" in the stablecoin market in the long run.

3. Huge Potential of Tokenized Deposits, Focus on Stablecoins May Be "Over-Amplified"

While market sentiment has not fully stabilized, Jane Fraser, CEO of Citigroup, delivered a speech at the New York Fintech Summit on October 14, highlighting the development prospects of "tokenized deposits" and warning against the current market's excessive focus on stablecoins. Fraser pointed out: "Tokenized deposits—which convert traditional bank deposits into digital tokens that can circulate on the blockchain—have the potential to reshape the global payment system and financial infrastructure. They can not only improve the efficiency of fund circulation but also provide financial institutions with new risk management and compliance tools."

She further emphasized: "The current market's focus on stablecoins may, to some extent, have exceeded their actual role and risk tolerance. While stablecoins are an important part of the crypto ecosystem, their original design was not to replace traditional fiat currencies or bank deposits, but to serve as a transitional tool."

Fraser's remarks were seen as a significant statement from the traditional financial sector regarding the "demystification" of stablecoins. She hinted that although stablecoins play a key role in the crypto market, their long-term value and stability still heavily depend on the credit of the issuing institutions, the improvement of regulatory frameworks, and the robustness of market infrastructure.

4. The Role, Risks, and Future Positioning of Stablecoins

1. The Essence of Stablecoins: Trust-Driven, Not Technology-Driven

The ability of stablecoins to achieve "pegging to fiat currencies" fundamentally relies on the credit backing of the issuer and the management capability of reserve assets, rather than the blockchain technology itself. For example, the question of whether USDT truly has sufficient dollar reserves has long been a point of contention in the market. Despite Tether releasing multiple audit reports, its transparency and independence remain highly questioned.

2. Regulatory Pressure Continues to Increase

Since 2023, major economies around the world have been strengthening their regulatory efforts on stablecoins. The U.S. Treasury, SEC, CFTC, and other agencies have repeatedly issued warnings regarding the compliance, anti-money laundering (AML), and consumer protection issues of stablecoins. The European Union's Markets in Crypto-Assets Regulation (MiCA) explicitly includes stablecoins under strict regulatory oversight, requiring issuers to hold sufficient fiat reserves and undergo regular audits.

The de-pegging event on October 11 once again highlighted the vulnerability of stablecoins under extreme market conditions and served as a wake-up call for global regulatory agencies. In the future, stablecoin issuers may face stricter capital adequacy requirements, reserve transparency standards, and emergency liquidity management regulations.

3. Tokenized Deposits: Traditional Finance's "Cryptoization" Attempt

Unlike stablecoins, tokenized deposits are digital assets issued by traditional banks or financial institutions, directly corresponding to real bank deposits. These assets not only possess the instant settlement and programmability of blockchain but also enjoy clear regulatory protection and credit support within the traditional financial system.

International banking giants like Citigroup, JPMorgan, and HSBC have been actively exploring the application scenarios of tokenized deposits in recent years, including cross-border payments, supply chain finance, and securities settlement. Fraser's statement this time is, in fact, a public acknowledgment and promotion of this trend.

5. What Should Stablecoins Be Pegged To?

While pursuing the popularity of stablecoins and crypto innovations, one should not overlook the deep accumulation of the traditional financial system in asset security, compliance management, and risk control.

The future of stablecoins may not lie in whether they can completely replace fiat currencies or become independent means of value storage, but in whether they can truly become a "trustworthy bridge" connecting traditional finance and the crypto ecosystem based on compliance, transparency, and trust.

For investors, in the face of the short-term volatility and long-term uncertainty of stablecoins, maintaining rationality, diversifying risks, and paying attention to underlying assets and regulatory trends will be key to navigating this complex market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。