The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome all coin friends to follow and like, and I refuse any market smoke screens!

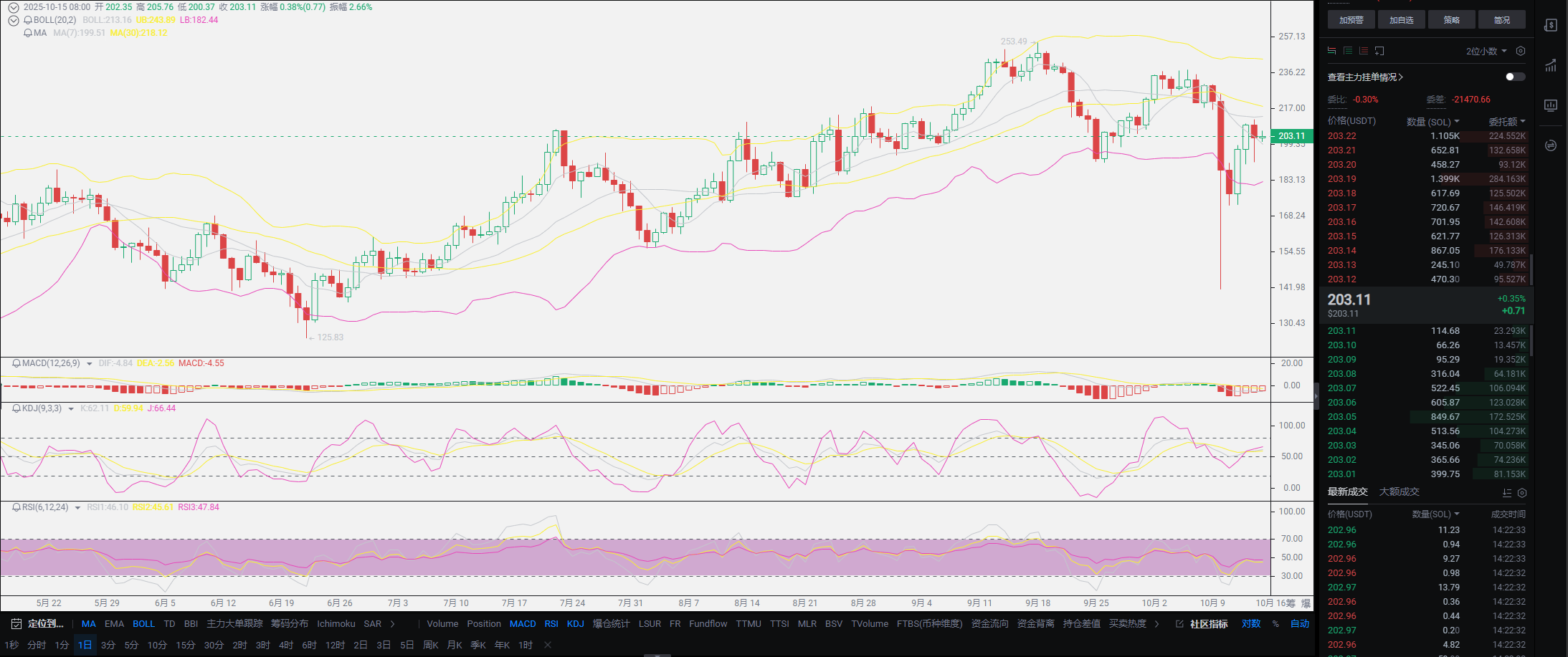

Yesterday, I explained the practices of spot and contract trading at the end of the article, which left many users confused, as it seems they do not fully understand the practices of both. The main purpose of today's article is to provide a detailed answer to this. The misunderstanding of practices actually stems from an inability to accurately gauge the market. First, the known condition is that the market is fixed; once the future trend is determined, it will influence current short-term operations. Short-term trading is not something that spot traders need to engage in. From the daily Bitcoin chart, one can conclude that since the breakdown of the bottom pattern on October 10, it has caused deep unpredictability below, especially since the market did not rebound the next day but instead attacked the lower shadow line. Although there was a two-day adjustment, it recovered to the 115912 position on the 13th, but what followed was another spike yesterday, once again piercing through the 110,000 bottom support.

You can also see that the calls for a bull market are gradually weakening, including myself, Lao Cui, who is also gradually losing confidence. This lack of confidence stems from the piercing on the 10th, which completely disrupted the entire pattern, coupled with insufficient rebound strength and the instability of Trump. The biggest variable lies here; we cannot predict market trends; avoiding risks is what I should consider. This includes a user asking me this morning whether to exit Ethereum around 4000 yesterday. If there had been no prior losses, I might have chosen to exit and secure profits. However, because I did not capture profits at the previous high, I must ensure that the contract form is held until the previous round of profits. This is a completely different approach; if you do not hold spot, or even did not enter the market previously, the decision-making for short-term trading becomes much simpler.

As mentioned yesterday, users focused on contracts only need to short at the daily new high, but if you hold spot, you cannot enter the market in this way. Because holding spot puts you in an overall loss state, once the market reverses, how will you handle it? The financial market is under attack from Trump, and all trends are questioning the bull market. Even so, Powell's speech yesterday also released signals that the tapering might end. Looking at the major information of this year, the weak dollar at the beginning of the year combined with interest rate cuts at the end of the year can drive the financial market towards a bull market, and ending the tapering will push the entire bull market to its peak. This is the key factor for liquidity; if this decision is made by the end of this year, the market will immediately change. There is an overestimation of me; I actually dislike predicting the market because no one remembers you for a thousand times, but if you make one wrong prediction, it will be irreparable.

The nature of predictions is merely my personal opinion, and you need to consider it carefully and be responsible for yourself. The trends of the past two days also reveal some issues; once the market breaks, there will always be a phenomenon of crashing, and selling at highs seems to have become a tacit agreement among the giants. This contains a slight signal of a bull market turning point; a breakdown of the bottom mentality often leads to the end of a bull market. It is still too early to draw conclusions; the subsequent stimulus strategies have not yet played out. We still need to observe the trend after this interest rate cut. If this interest rate cut still poses a problem for the inflow of funds into the crypto space, you can confirm one thing: the end is near. My prediction is that it will end next year because the funds in 2026 will face many issues. Large enterprises have basically completed their positioning options this year; Trump's strategy has successfully acquired many shares of American companies, and the confrontation is escalating.

For enterprises, choosing sides will face the issue of fund inflow. If the American option is primarily based on the US stock market, then next year may become a period of explosion for the US stock market, with not much capital flowing into the crypto space. This year's Bitcoin trend has already revealed many issues; the 130,000 high has not been broken for a long time, only driving the growth of smaller coins like Ethereum and BNB, indicating insufficient funds in the crypto space. In comparison, as long as Bitcoin breaks down, other coins often move but do not break, and there may even be outflows. If Bitcoin, the leader, cannot move, how can we talk about the growth of the crypto market's market value? As for the crypto space, the necessary stimulus strategies have basically been exhausted; the biggest positive news has only pushed Bitcoin to the 100,000 high. What other positive news can drive Bitcoin's growth in the future? Unless we agree, but that is completely wishful thinking.

Explaining these things does not mean that I, Lao Cui, am bearish on the crypto space; it is just that at this stage, I do indeed question the value manifestation of the crypto space. Talking about global connectivity or the situation of the world is somewhat self-deprecating; the important issue is still the current profit problem. The future variables in the crypto space are too large. If you ask me where the upper limit of Bitcoin is, I am also at a loss; the only thing I understand is that this year's high point has definitely not yet arrived. However, constrained by short-term fluctuations, the current consideration is the lower limit issue. The lower spike pattern makes the lower support extremely difficult to gauge. If predicting based on Bitcoin, then the lower depth is to stabilize at 100,000 to consider it a victory. If predicting the crypto space based on BNB's trend, the bull market is far from over. Because BNB's benchmark is completely different, while major coins are still struggling below, BNB is continuously refreshing new highs at high positions. The current trend of BNB can only be described as a pullback after a new high, and it is also possible to refresh new highs again in the near future.

In summary, my current response method is only for those who hold spot and keep in sync with me. If viewed from the perspective of contracts, shorting in the short term indeed belongs to the response method of the Asian盘 state, as the lower depth is still continuously testing. For those holding spot, if you want to return to previous profits as soon as possible, you can only lower the average price continuously at the lows; I do not recommend shorting contracts. If the market reverses, I believe you do not have the determination to eliminate the losses from short positions. If you have that determination, of course, you can also use short positions in the short term to offset the losses from spot. As long as BNB does not show a turning point, the bull market is still on the way. At this stage, you should not think about exiting the market with your spot; the recent exit timing is also around the interest rate cut. Whether it is speculating on interest rate cut expectations or subsequent dips, there are still two opportunities for interest rate cuts, which will become the key nodes for your profits this year. Yesterday's long position in contracts can be exited if you do not hold spot, but if you hold spot, do not consider short-term exit opportunities; at least wait until you have profits of over 200 points in Ethereum. Today's entry timing for contracts remains the same as yesterday, buying long at 4000-4100. Regardless of the returns, you must clear your positions on the same day; contracts are not suitable for long-term holding again.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or positions, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only contending for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。