Washington and Beijing were at it again on Tuesday morning as China moved to sanction five U.S. subsidiaries of Hanwha Ocean, a South Korean ship manufacturer with alleged links to the U.S. government. Hanwha’s shares plunged 8% on the news, and bitcoin fell 4% before later recovering in the afternoon.

(China is accusing Hanwha Ocean, a South Korean shipbuilder, of assisting the U.S. in its Section 301 investigation / Hanwha Ocean)

“In order to counter the U.S. 301 investigation measures against China’s maritime, logistics and shipbuilding industries…we hereby announce the ‘Decision on Taking Countermeasures against Five U.S.-Related Subsidiaries of Hanwha Marine Co., Ltd.’, which will take effect on October 14, 2025,” the official notice from the Chinese Ministry of Commerce states.

Section 301 of the U.S. Trade Act allows the government to respond to unfair trade practices. The U.S. claims China covertly engaged in shady activities designed to dominate the maritime, shipbuilding, and logistics sectors. Beijing allegedly subsidized these industries and even deployed “forced technology transfer” designed to “reinnovate [foreign] technology.”

The U.S. subsequently applied service fees and tariffs of up to 150% on Chinese maritime items. Beijing countered the move with even higher service fees and today, proceeded to sanction Hanwha’s U.S. subsidiaries, which Beijing accused of aiding Washington in its investigation.

“The U.S.’s Section 301 investigation and measures against China’s maritime, logistics, and shipbuilding industries seriously violate international law,” a Google-translated version of China’s official announcement states. “Hanwha Marine Corporation’s U.S. subsidiaries have assisted and supported the U.S. government’s investigations, endangering our country’s sovereignty, security, and development interests.”

Bitcoin and Hanwha stock weren’t the only assets negatively impacted by the news. The broader crypto market was down 2% and stocks stumbled after the announcement but later regained their footing. The Nasdaq however, was still down 0.18% at the time of writing.

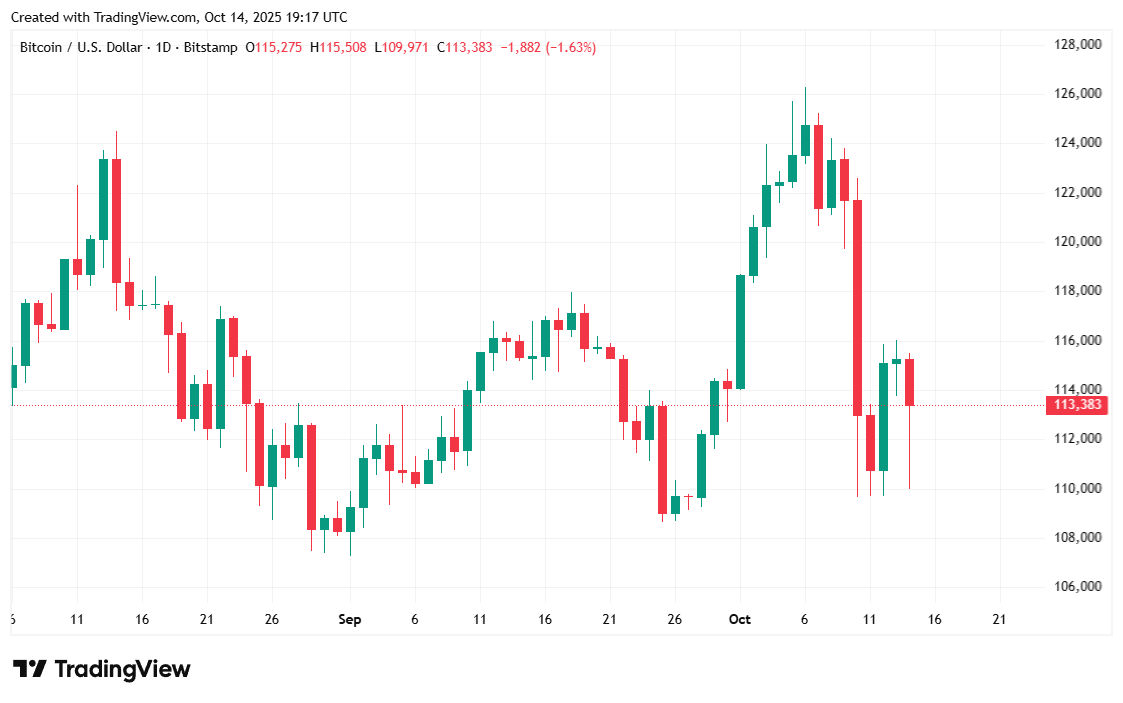

Bitcoin fell 1.61% over the past 24 hours and was trading at $113,334.40 at the time of writing after briefly nosediving to $110,029.49 after China’s announcement. The cryptocurrency was also down 6.27% for the week, even after trading as high as $116,020.49 since Monday.

( BTC price / Trading View)

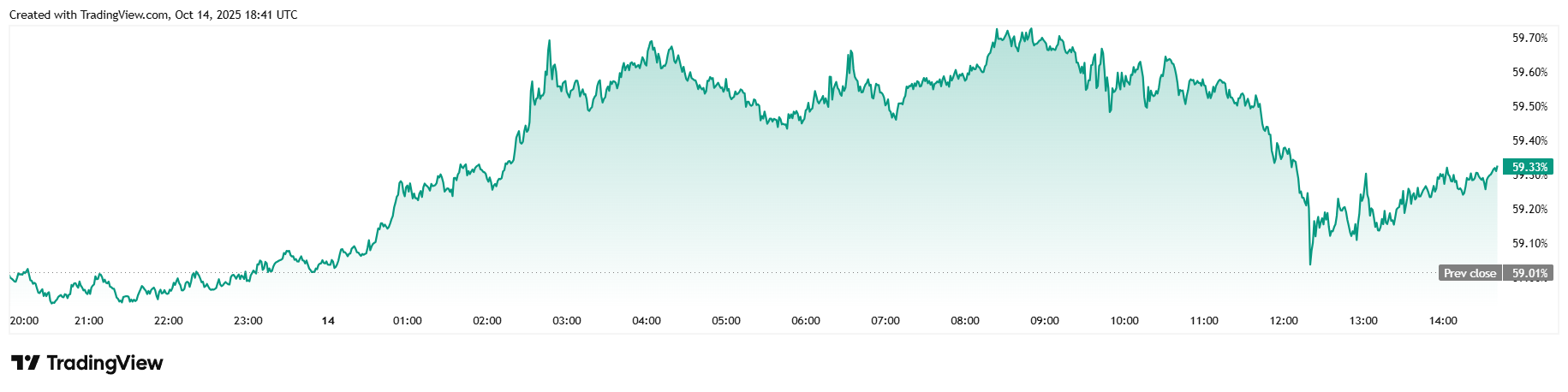

Twenty-four-hour trading volume rose 8.34% to $90.28 billion and market capitalization eased to $2.25 trillion, a 1.8% decline. Bitcoin dominance inched upward, climbing 0.52% to 59.32% at the time of reporting.

( BTC dominance / Trading View)

Total futures open interest fell 0.95% to $74.25 billion according to Coinglass data. Liquidations reached a total of $172.16 million, dominated by long investors who lost $126.67 million in margin after the price decline triggered by Beijing’s surprise announcement. Short sellers completed the liquidation picture with $45.49 million wiped out.

- Why did Bitcoin fall today?

Bitcoin slid over 4% after China announced sanctions on U.S.-linked subsidiaries of South Korea’s Hanwha Ocean. - What triggered the U.S.-China dispute?

Washington imposed steep Section 301 tariffs on Chinese maritime industries, prompting Beijing to retaliate. - How bad was the market reaction?

Crypto lost roughly 2% overall, while Bitcoin briefly plunged to $110,000 before recovering. - What’s Section 301 anyway?

It’s a U.S. trade law that allows tariffs on countries accused of unfair or coercive trade practices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。