Most tokens are "toxic waste," and this is my last hope.

Author: Kyle

Compiled by: Deep Tide TechFlow

I cannot comment on the perpetual contract market mechanisms, as this is not my area of expertise.

But I can share my market perspective—I believe the market is undergoing a structural trend shift.

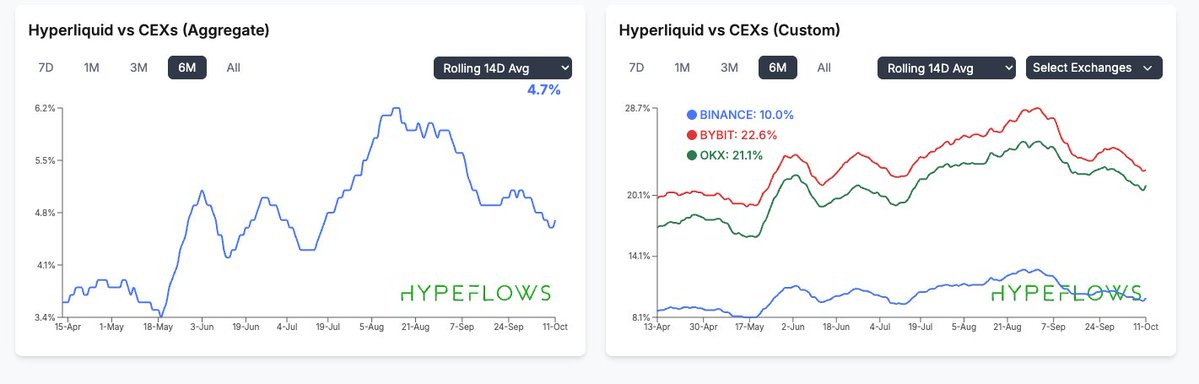

First, the driving force of the entire market in 2025 comes from the competition between decentralized exchanges (DEX) and centralized exchanges (CEX), thanks to the emergence of Hyperliquid and on-chain capital markets—both of which have their reasons for existence. On-chain capital markets provide price momentum (price increases) with low trading volume and low fully diluted valuation (FDV), making them very attractive as they require less marginal buying and have no early market sellers.

The reason perpetual contract decentralized exchanges (Perp DEX) can thrive is that Binance seems to be gradually losing its appeal to traders. Many newly listed tokens on Binance (such as NXPC, Zerebro, and the perpetual contract market) have seen continuous price declines after their launch. This price action (PA) has driven many traders away from Binance, as they perceive the environment to be unfriendly to traders and not a platform where one can make money.

At that time, I also discussed these two trends. I remember saying something like, "The Binance dynasty is gradually declining with the continued drop of these newly listed tokens."

However, I believe this "DEX vs CEX" narrative will no longer be the main driving force in the market moving forward. In fact, overall, this trend peaked a month or two ago and has been declining since then.

This does not mean I am pessimistic about decentralized exchanges (DEX), perpetual contract decentralized exchanges (Perp DEX), or Hyperliquid. What I want to express is that this narrative has been asymmetric over the past year, but now this asymmetry is no longer apparent to me.

For beginners:

1) Many competitive and capable perpetual contract decentralized exchanges (like Lighter) are competing for resources in a market that is already small (especially after over $20 billion in liquidations, further shrinking the market size).

2) Many events related to perpetual contract decentralized exchanges and DEX have occurred in the past few months—mainly these platforms have become the preferred trading venues for insiders and criminals.

For example, insider trading at the White House, wash trading by North Korea, on-chain scams involving celebrities, Milei tokens, Trump tokens, etc. DEX is at the forefront, but perpetual contract decentralized exchanges have also witnessed numerous ethically questionable events.

The transparency of perpetual contract decentralized exchanges seems to have backfired in these events. For instance, whale users dislike being "tracked" (like Launchcoin, Jelly Jelly), obvious insider deposit behaviors, and the loss transparency that few discuss. In most centralized exchanges (CEX), leaderboards only show the most profitable users, while the transparency of perpetual contract decentralized exchanges simultaneously reveals the users with the most losses.

This may seem unimportant temporarily, but imagine if traditional finance giant Citadel joins, and everyone can see they are in a loss position. Traditional finance (TradFi) values privacy.

In any case, these events did not have a huge impact like the Trump token did (the Trump token led to the decline of on-chain DEX), but over time, these issues gradually accumulate.

3) Clearly, the events of the past few days have had an impact on the market almost equivalent to the Trump event.

Considering these factors, I believe perpetual contract decentralized exchanges no longer possess the advantage of asymmetry. Again, please make sure to understand my point.

Overall, I am optimistic about perpetual contract products. But as an ordinary trader and someone skilled at identifying asymmetric opportunities, I must say that the field of perpetual contract decentralized exchanges no longer holds great appeal for me.

However, I believe we will soon see a narrative of competition between centralized exchanges. You might think this is contradictory, as the events of the past two days also involved centralized exchanges.

But this actually works in my favor. Let me explain my thoughts.

The broader narrative is very simple. In the past few months, there have been several key criteria when selecting tokens:

Alignment of token holder interests, meaning ideally there should be no venture capitalists continuously unlocking and selling tokens. This is a spectrum, ranging from fully diluted supply to fully controlled supply.

Sustained growth in products and revenue.

Prioritization of token holders, meaning the token must have some utility or focus, rather than just meeting points 1 and 2 while completely ignoring the token itself.

The token must have some incremental demand.

Combining these indicators with my thoughts over the past two days—in the crypto space, there are actually only three broadly investable areas: traceability, exchanges, and stablecoins.

Based on these three points and the investment criteria I mentioned, the final selected investable tokens are as follows:

Traceability tokens - Bitcoin (BTC) / Ethereum (ETH)

Exchange tokens - BNB / HYPE / MNT / ASTER

Stablecoins - Unfortunately, many DeFi protocols do not meet the above three standards. In fact, I believe the best way to express stablecoin investment is through equity, such as Circle (CRCL), or even better, equity in Tether.

The events of the past two days have further made me realize the importance of these standards. I have no interest in 99% of the tokens on the market, especially those that rely on crypto Twitter (CT). Crypto Twitter has not only suffered significant losses in the past week but also has no new incremental funds flowing in (retail investors are betting on "meme stocks").

The investment logic for Bitcoin and Ethereum is clear; they have sustained demand from traditional finance (TradFi) and do not need to rely on revenue. Their narrative is self-contained.

But for other altcoins, 99% cannot pass these standard tests. The only area I am interested in is exchange tokens.

Now back to the competition between centralized exchanges (CEX). What do I mean? First, I have explained how perpetual contract decentralized exchanges (Perp DEX) have gradually lost their advantage over the past year, until the flash crash event completely changed the trend.

Secondly, another impact point of this black swan event is Binance, especially how they handled the crisis. I won’t delve into specific details (mainly because I am not good at detailed analysis and am not an expert in this area), but I want to give a few examples:

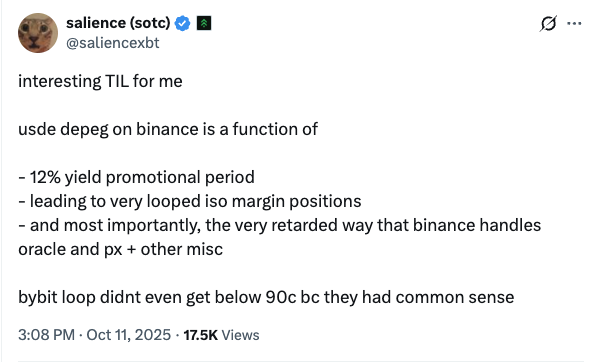

The most notable point is that the de-pegging of USDe on the Binance platform was more severe than on Bybit, causing considerable pain for Binance users.

I would not choose to bet against Binance, as it is clear that it has once again gained the upper hand in the narrative between centralized exchanges (CEX) and decentralized exchanges (DEX)—bringing back the Binance Smart Chain (BSC) craze, with BNB prices possibly breaking $1000, etc. Binance is also an excellent product, serving millions of users worldwide.

However, I believe this may mark the beginning of an emerging centralized exchange starting to capture a larger market share. Just as exchanges like Lighter are challenging Hyperliquid, I believe there is room for emerging CEX to grow in the market.

Clearly, my choice is very simple. Bybit has repeatedly demonstrated professionalism and the ability to handle matters correctly.

In my view, Bybit is more growth-oriented than any other exchange—so far as I know, it is the only large exchange boldly trying in multiple areas. They have ventured into stock trading, launched Byreal (a Solana-based decentralized exchange), and support trading in forex, commodities, etc.

They remind me of Robinhood (?), that kind of viral founder style, constantly releasing new products and iterating—full of an arena atmosphere. And most importantly, their token is in a very asymmetric advantageous position, meeting all the standards:

Exchange tokens have the largest demand pool among all token mechanisms. Exchanges worth billions of dollars require their VIP traders to purchase MNT for fee discounts, creating a permanent demand pool that can continuously attract new buyers, rather than relying on "weekly hot spots" or "transient" liquidity—this is a sustained buying pressure.

The interests of token holders and the project team are highly aligned. Since they have a source of income, they do not need to sell tokens for funds—in fact, the opposite is true. Additionally, there is no venture capital involvement, etc.

Sustained growth in products and revenue. This is certainly a must.

Prioritization of token holders—holding MNT now allows participation in Launchpool (i.e., the issuance of new tokens).

Overall, from a price perspective, the positioning of MNT is also asymmetric for me. In terms of fully diluted valuation (FDV), the "valuations" of these tokens are all higher than it: WLFI, CRO, SUI, ADA; in terms of market capitalization (MC): SHIB, LTC, LINK, etc.

I want to remind everyone that BNB ranks 4th among all tokens, only behind BTC, ETH, and Tether. Yet Mantle (MNT) ranks 34th, which is truly baffling. In any case, the most important thing is that I want to emphasize again that these past few days have made me deeply realize that most tokens are "toxic waste," and this is my last hope.

I am a long-term holder myself; I do not like to chase hot trades (I am really not good at it); my strength has always been similar to swing trading. Therefore, what I am showing you is the only token I truly hold right now:

gMNT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。