Written by: arndxt, Independent Researcher

Translated by: Luke, Mars Finance

Liquidity expansion remains the dominant macro variable. Signals of economic recession are lagging; structural inflation is sticky. Policy rates are above neutral levels but below tightening thresholds. The market has priced in a "soft landing," but the real adjustment is paradigm-level—shifting from cheap liquidity to measurable productivity.

The "second curve" is not cyclical. It is a structural normalization in the financial sector under real constraints (yields, labor, and credit).

1. Cycle Transition

The TOKEN2049 conference in Singapore marks a turning point for the market from speculative expansion to structural integration. The market is repricing risk, shifting from "narrative-driven liquidity" to "income-supported yields."

Key shifts:

- Perpetual contract DEXs (Perp DEXs) continue to dominate, with Hyperliquid ensuring liquidity at network scale.

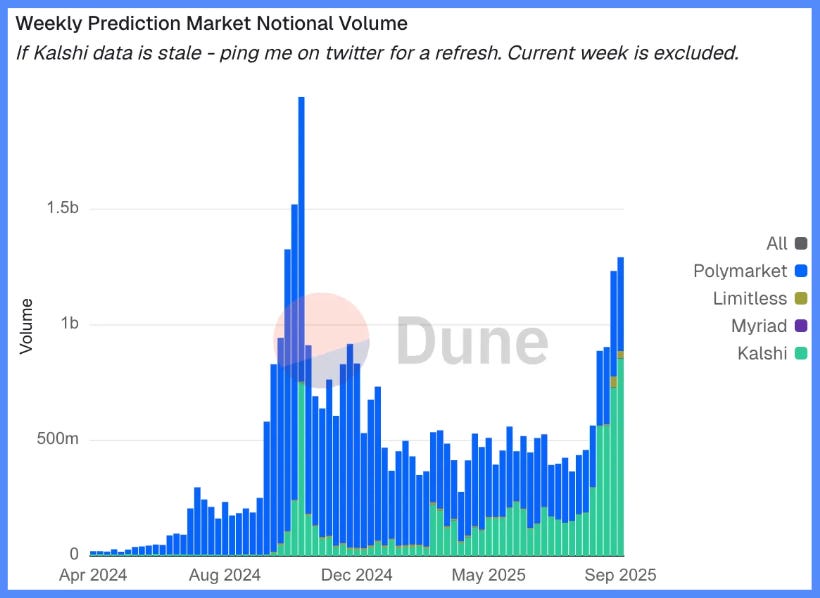

- Prediction markets are emerging as functional derivatives of information flow.

- Protocols related to AI, with real Web2 contracts, are quietly expanding their revenue scale.

- Restaking and Data Availability Tokens (DATs) have peaked; liquidity fragmentation is evident.

2. Macro Paradigm: Currency Depreciation, Demographics, Liquidity

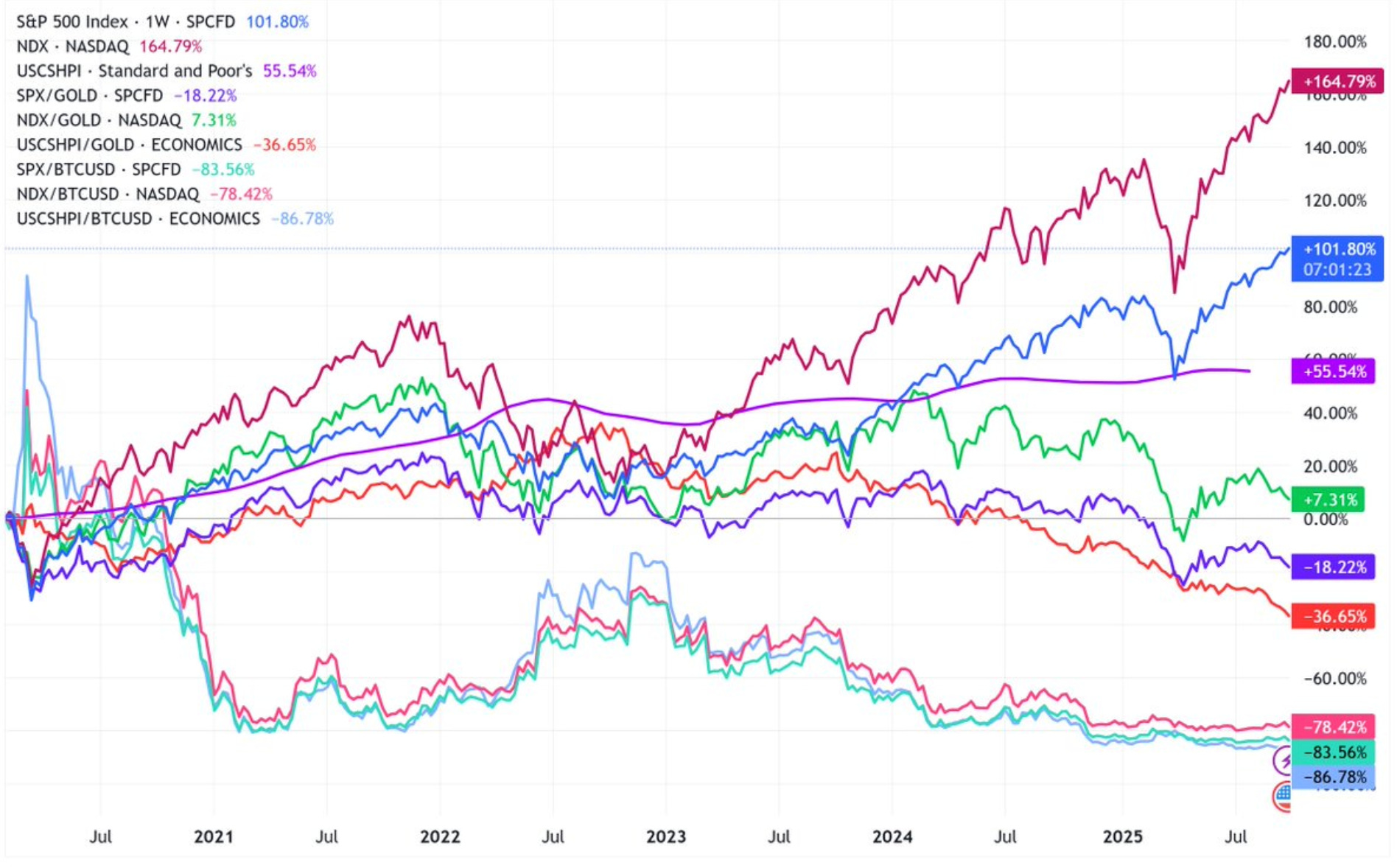

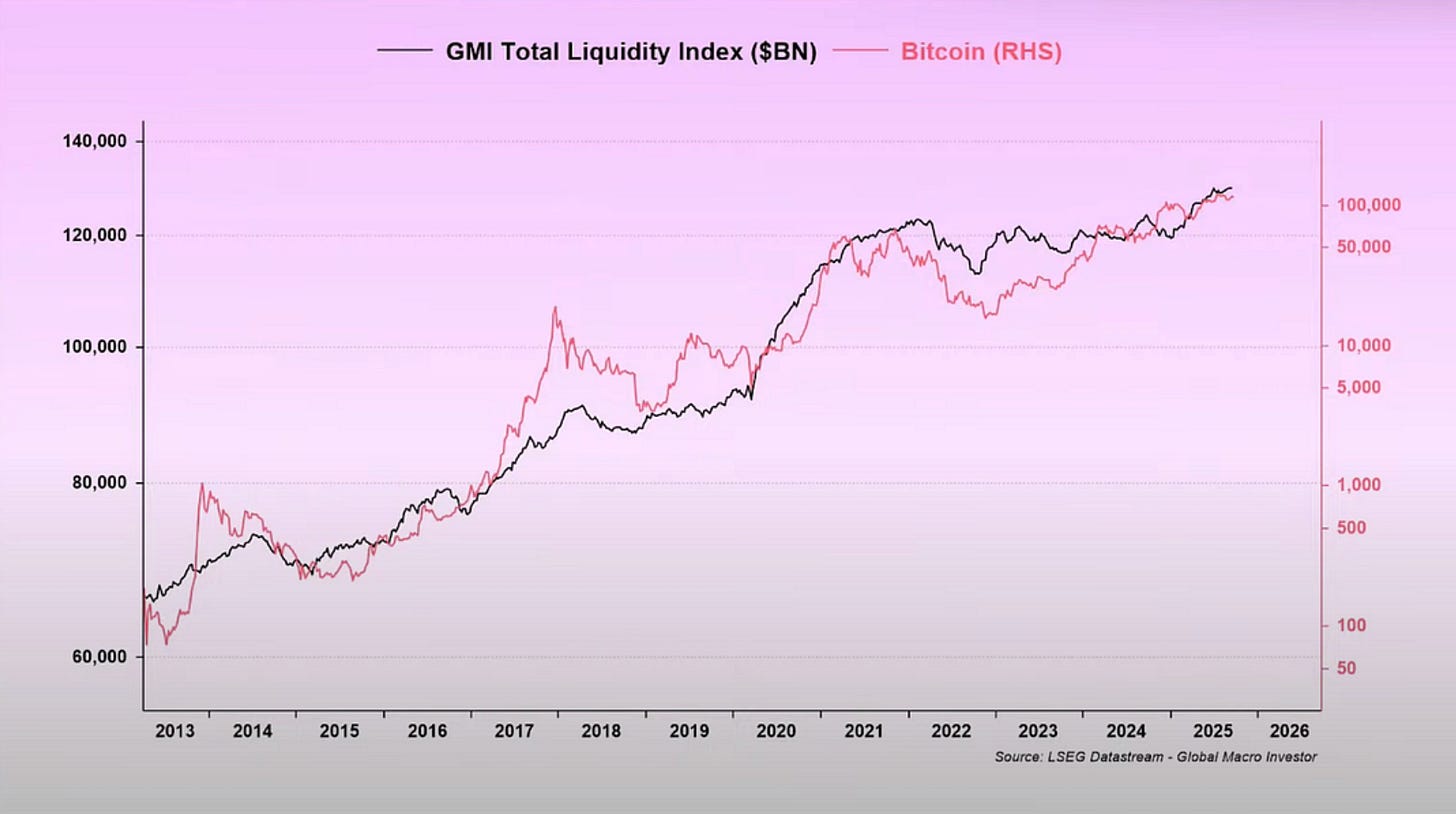

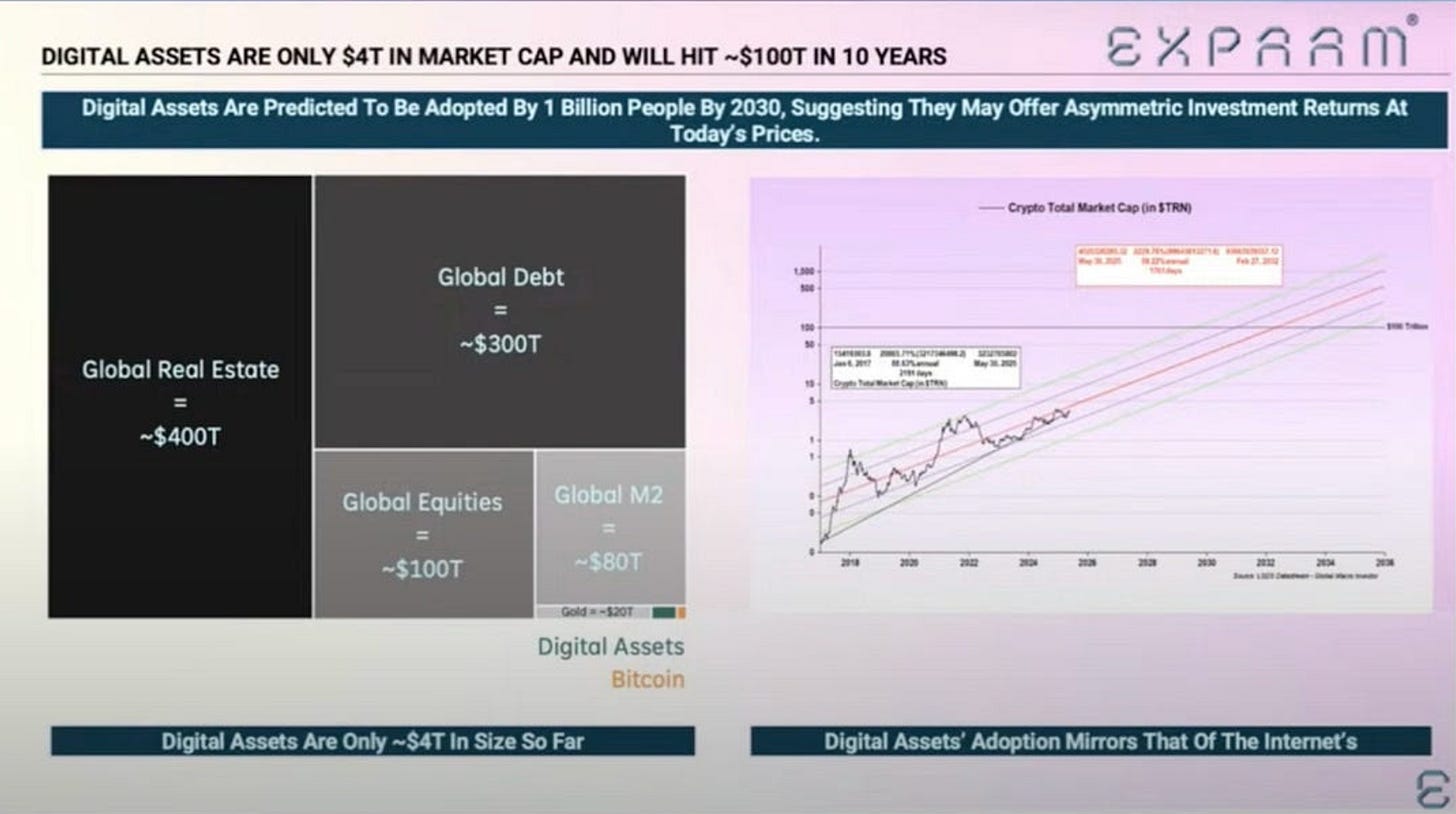

Asset inflation reflects currency depreciation rather than organic growth. When liquidity expands, long-duration assets (technology, AI, cryptocurrencies) perform well. When liquidity contracts, leverage and valuations are compressed.

Three major structural drivers:

- Currency depreciation: Repaying sovereign debt requires continuous balance sheet expansion.

- Demographics: An aging population reduces productivity, increasing reliance on liquidity.

- Liquidity pipeline: Global Total Liquidity (GTL)—the sum of central bank and banking system reserves—has correlated with 90% of risk asset performance since 2009.

3. Recession Risks: Lagging Data, Leading Signals

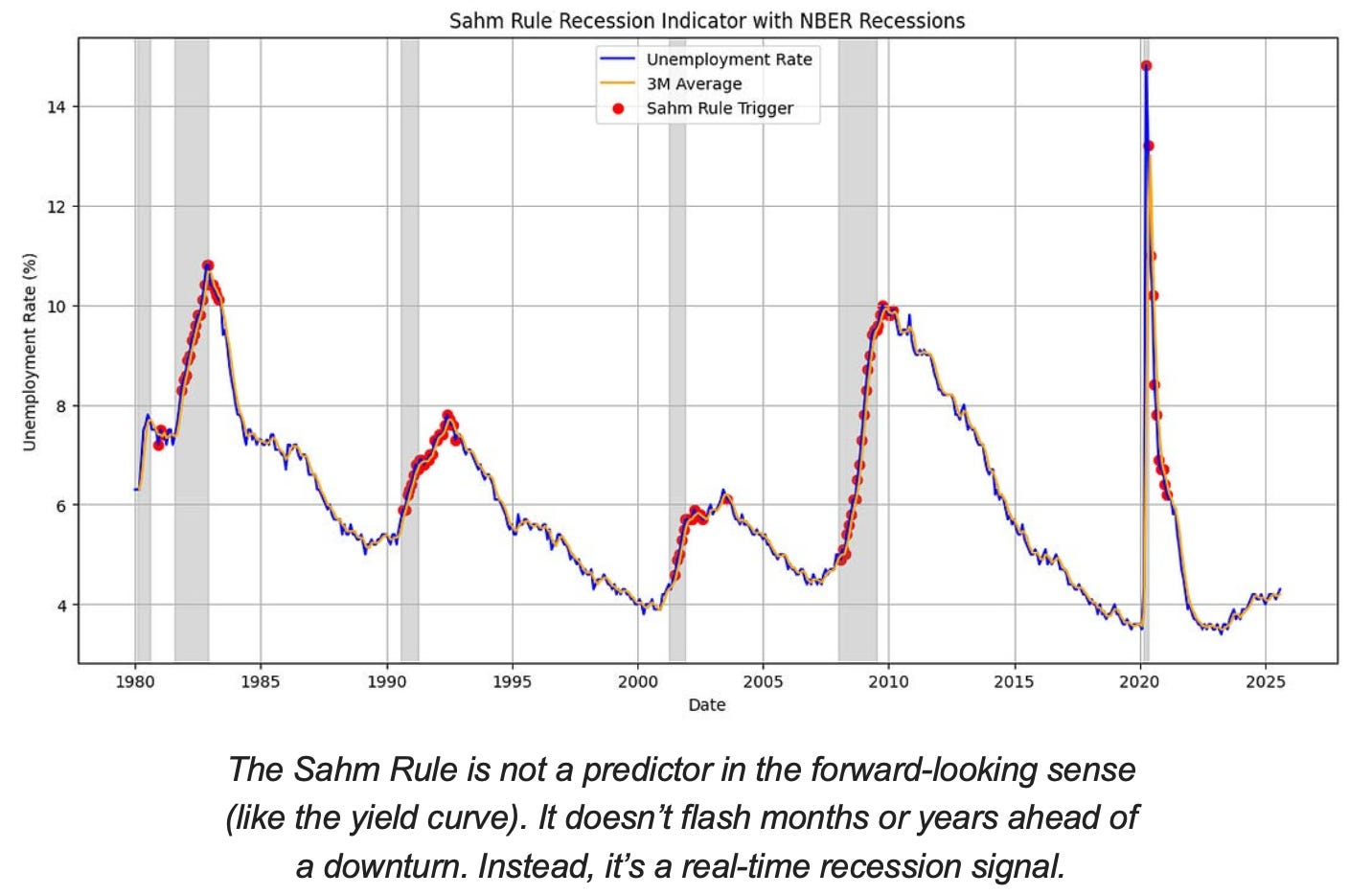

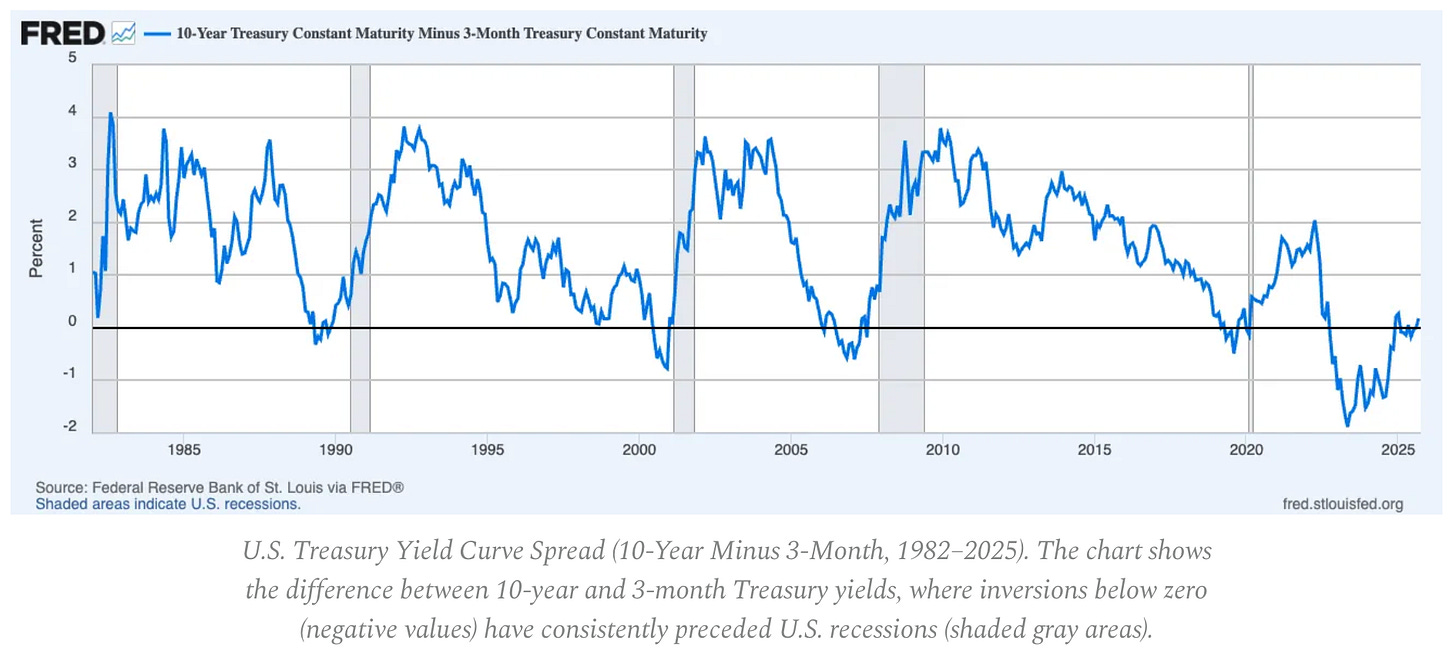

Mainstream recession indicators are retrospective. CPI, unemployment rates, and the Sahm Rule confirm a recession only after it has begun.

Interpretation: The U.S. is in the late cycle, not in a recession.

The probability of a soft landing remains higher than the risk of a hard landing, but timing of policy is a limiting factor.

Leading indicators:

- An inverted yield curve remains the clearest forward-looking signal.

- Credit spreads are under control, indicating no imminent systemic pressure.

- The labor market is gradually cooling; however, the job market remains in a cyclical tight state.

4. Inflation Dynamics: The Last Mile Problem

Commodity inflation has slowed; service inflation and wage stickiness currently anchor overall CPI around 3%. Since the 1980s, this "last mile" has been the most complex phase in the disinflation process.

- Commodity deflation currently offsets some inflation in the CPI basket.

- Nearly 4% wage growth keeps service inflation elevated.

- Housing inflation is lagging in measurement; real market rents have cooled.

Policy implications:

- The Federal Reserve faces a trade-off between credibility and growth.

- Premature rate cuts risk accelerating inflation again; maintaining high rates for too long risks excessive tightening.

- The ultimate equilibrium outcome is that the new inflation floor will be around 3%, not 2%.

5. Macro Structure

Three major long-term inflation anchors remain:

- De-globalization: Diversification of supply chains has raised transformation costs.

- Energy transition: The capital-intensive decarbonization process has increased short-term input costs.

- Demographics: Structural labor shortages have caused persistent wage rigidity.

These factors limit the Federal Reserve's ability to normalize policy without higher nominal growth or higher equilibrium inflation levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。