Written by: FinTax

1. The Profit Margin Crisis in Crypto Mining

In November 2025, Marathon Digital Holdings (MARA) revealed a strategic shift in its third-quarter financial report, announcing that "from now on, it will sell a portion of newly mined Bitcoin to support operational funding needs." This move highlights the pressing reality that the crypto mining industry is facing continuously shrinking profit margins.

Similarly, another mining giant, Riot Platforms (RIOT), reported in its October 2025 production and operations update that it produced a total of 437 Bitcoins that month, a decrease of 2% month-over-month and 14% year-over-year, while selling 400 Bitcoins. In April 2025, RIOT also sold 475 Bitcoins—this was the first time RIOT had sold self-mined Bitcoin since January 2024.

RIOT had long adhered to a "HODL" strategy, preferring to hold most of its Bitcoin in anticipation of price increases. However, in the new cycle following the halving of block rewards, RIOT has begun to adopt a more flexible funding strategy. The company's CEO explained that this selling can reduce the need for equity financing, thereby limiting dilution for existing shareholders. This indicates that even leading mining companies that stick to holding strategies must sell portions of their Bitcoin output as needed to maintain financial health in response to market and operational demands.

From the perspective of Bitcoin prices and hash rate data, mining profits are being increasingly squeezed. By the end of 2025, network hash rate climbed to a record 1.1 ZH/s. Meanwhile, Bitcoin prices fell to around $81,000, with hash rate prices dropping below $35 per PH/s, while the median hash rate cost reached $44.8 per PH/s—indicating intensified market competition and compressed profit margins. Even the most efficient mining companies are barely reaching breakeven points.

Mining companies are experiencing reduced marginal returns while fixed electricity and financing costs remain high. In this context, although some mining companies have accelerated their transition to AI and high-performance computing (HPC), they still face varying degrees of financial strain and survival pressure. At this time, effective tax planning is a key strategy to alleviate financial pressure and support long-term operations. Next, we will discuss whether tax planning can effectively reduce the overall operational pressure on mining companies, using the United States as an example.

2. The Tax Burden on Crypto Mining Companies: A U.S. Perspective

2.1 Corporate Tax Framework

In the United States, companies can be categorized into pass-through entities and C Corporations. Under U.S. tax law, pass-through entities directly pass profits to shareholders, who then pay taxes at individual rates, resulting in single-layer taxation; whereas C Corporations first pay taxes at the corporate level at a fixed rate of 21%, and then dividends are taxed at the individual level, resulting in double-layer taxation.

Specifically, sole proprietorships, partnerships, S Corporations, and most limited liability companies (LLCs) fall under the category of pass-through entities and do not pay federal corporate income tax. The income of pass-through entities is treated as ordinary income for individuals and is reported at ordinary income tax rates, which can be as high as 37%.

Table 1: 2025 U.S. Federal Ordinary Income Tax Rates and Brackets

As cryptocurrency is treated as property, the taxable nature of mining income and sale proceeds remains unchanged, but actual tax burdens may differ due to the different tax entities involved:

(1) If a crypto mining company is a pass-through entity, it does not need to pay federal income tax, but shareholders must report personal income tax on their share of profits. The taxes involved in acquiring and trading cryptocurrencies include ordinary income tax and capital gains tax. First, cryptocurrencies obtained through mining, staking, airdrops, etc., require shareholders to report taxes at the individual level as ordinary income (tax rates range from 10% to 37%). Second, when a pass-through entity sells, exchanges, or consumes cryptocurrencies, shareholders must also pay capital gains tax. If the holding period is one year or less, the gains are treated as short-term capital gains and taxed at ordinary income tax rates, ranging from 10% to 37%; if the holding period exceeds one year, the gains are treated as long-term capital gains and enjoy preferential tax rates of 0%, 15%, or 20%, depending on taxable income.

Table 2: U.S. Long-Term Capital Gains Tax Rates and Brackets

(2) If a crypto mining company is a C Corporation, it will be subject to a 21% unified federal corporate income tax and must also pay state taxes. Cryptocurrencies obtained through mining, staking, airdrops, etc., will be recorded at their fair value as corporate revenue, and capital gains from selling, exchanging, or consuming cryptocurrencies (regardless of short or long term) will also be included in corporate revenue. The profits formed after deducting costs and related expenses will be taxed at the 21% federal corporate income tax rate, while state taxes will be paid according to state standards. If a C Corporation chooses to distribute dividends to shareholders, it will trigger taxation at the dividend level, resulting in double-layer taxation.

2.2 The Challenge of Multiple Tax Burdens

Within the U.S. jurisdiction, large, publicly funded, or publicly listed mining companies, such as MARA, RIOT, and Core Scientific, almost universally operate as C Corporations; while small or startup mining companies tend to prefer pass-through entity structures.

Different companies have varying financing needs, cash retention strategies, and tax considerations, leading to different choices in corporate structure. The crypto mining industry is capital-intensive, with a strong demand for retained earnings during expansion periods. The C Corporation structure is advantageous for retaining profits, as it does not immediately pass tax burdens to owners, reducing cash outflow pressure caused by taxes on undistributed profits. Most LLCs adopt a pass-through entity structure, which provides early tax flexibility (can be taxed as a partnership or S Corporation to reduce tax burdens) and can choose to reorganize as a C Corporation once they reach a certain scale, which is why many startup mining companies initially use LLC structures and gradually transition to C Corporations as their scale and financing needs grow.

Even with different corporate structures, crypto mining companies face multiple tax burdens. The operating income of pass-through entities "passes through" to the owners, and miners are considered to have received taxable income, requiring subsequent disposal to generate capital gains that must also be reported, resulting in owners bearing tax burdens at two stages. In contrast, C Corporations account for income generated from mining or related activities at the corporate level, with the company calculating profits and paying corporate income tax. If the company distributes profits to shareholders, it triggers taxation at the dividend level again. However, through appropriate tax planning, mining companies can legally and reasonably reduce tax liabilities, transforming the original tax burden into competitive advantages under compressed mining profits.

3. The Possibility of Tax Optimization for Crypto Mining Companies

Using the United States as an example, crypto mining companies can plan various tax optimization paths to achieve tax savings.

3.1 Utilizing Mining Equipment Depreciation to Optimize Current Tax Burden

This year, the U.S. introduced the "One Big Beautiful Bill Act," which restored the 100% accelerated depreciation policy under Section 168(k) of the tax code. The "accelerated depreciation" policy allows taxpayers to deduct the full cost of purchasing mining machines or servers and other fixed assets in the year of purchase, thereby reducing taxable income. Originally, this favorable depreciation rate was set at 100% from 2018 to 2022, but starting in 2023, it will gradually decrease and is planned to drop to 0% by 2027. The "One Big Beautiful Bill Act" aims to restore and extend this benefit, stipulating that qualifying assets purchased and put into use after January 19, 2025, and before January 1, 2030, will restore 100% accelerated depreciation. Additionally, the act raises the depreciation limit under Section 179 of the tax code, increasing the maximum amount of equipment expenditures that can be fully deducted from $1 million to $2.5 million. This is significant for mining companies, as purchased mining machines, power infrastructure, cooling systems, and other fixed assets can be expensed in the first year, directly reducing taxable income for that year and significantly enhancing current cash flow. Besides tax savings, the "accelerated depreciation method" also helps improve the present value of funds.

It is important to note that using the accelerated depreciation method still requires consideration of the cost situation for the year to avoid profit loss and subsequent carryover losses. For example, if a U.S. mining company earns $400,000 in 2024 and invests $500,000 in purchasing mining machines, if the company deducts the $500,000 cost in one go, it will result in a book loss of $100,000 (NOL, Net Operating Loss) due to its low income. Although the current profit is negative and no income tax is owed, this also means that even if there is still cash flow on the books, the company cannot extract or distribute profits. In tax treatment, the NOL carried over to the next year can only offset 80% of the taxable income for that year. Therefore, blindly using accelerated depreciation in low-profit years is not a wise move.

3.2 Reasonable Planning of Cross-Border Structures to Optimize Capital Gains

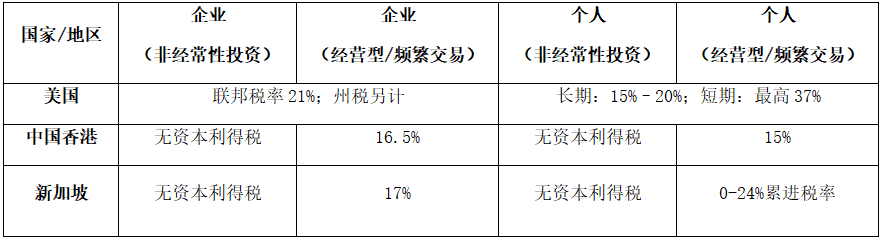

Different jurisdictions have varying tax policies for cryptocurrencies. In the U.S., whether selling coins occasionally for cash or engaging in frequent trading or business, as long as taxable transactions occur and profits are made, taxes must be reported. This uniform "tax on all profits" design places significant tax pressure on domestic crypto miners. In contrast, the crypto tax policies in Singapore and Hong Kong are more favorable. Currently, both regions do not tax individuals or companies on capital gains from non-recurring investments in cryptocurrencies, as long as the relevant transactions are deemed non-recurring investment income, allowing investors to avoid taxes on asset appreciation, thus enjoying a zero tax rate for long-term holdings. Of course, frequent traders or businesses still need to pay corporate or personal income taxes on their profits. The corporate income tax in Singapore is about 17%; Hong Kong's corporate tax rate is 16.5%. Although frequent traders still need to pay taxes, the rates in Hong Kong and Singapore are undoubtedly more competitive compared to the 21% federal corporate tax in the U.S.

Table 3: Comparison of Tax Rates in the U.S., Hong Kong, and Singapore

Based on the differences in tax systems across various jurisdictions, U.S. crypto mining companies can legally reduce their crypto tax burdens by planning cross-border structures. For example, a U.S. Bitcoin mining company could establish a subsidiary in Singapore, initially selling the Bitcoin mined daily at market fair value to this affiliated subsidiary, which would then sell it to the global market. Through this "internal first, external later" transaction arrangement, the U.S. parent company only needs to pay corporate income tax on the initial mining income, while the appreciation profits from the Bitcoin held by the Singapore subsidiary may qualify for Singapore's capital gains tax exemption policy when conditions are met, thus avoiding capital gains tax. The tax-saving effect of this cross-border structure design is evident, with its core being the legal transfer of the appreciation of crypto assets from high-tax jurisdictions to tax-exempt or low-tax jurisdictions, maximizing retained earnings.

3.3 Utilizing Mining Machine Hosting - Leasing Structure to Reasonably Plan Economic Substance and Tax Burden

Mining machine hosting - leasing structures are widely present in the crypto mining industry, with the business logic being the separation of asset ownership from mining operations to improve the efficiency of capital and resource allocation. This model creates profit distribution under natural business arrangements, allowing different entities to recognize income based on their roles in the transaction. For instance, an overseas entity located in a low-tax jurisdiction is responsible for purchasing, holding, and leasing out mining machines, while the domestic U.S. entity focuses on mining operations and pays rent or hosting fees to the overseas entity. In this case, the equipment income received by the low-tax jurisdiction entity has the opportunity to apply a lower tax rate. Although the mining machine hosting - leasing structure is not created for tax purposes, it has a genuine business background, providing some room for cross-border tax planning.

Of course, using this structure within the same entity must also meet certain compliance prerequisites. For example, the overseas leasing entity must have economic substance and genuinely hold the mining machine assets, and the rent must be priced based on independent transaction principles, meaning the rent should be within a reasonable market level.

4. Conclusion

Mining profits continue to decline under multiple influencing factors, and the global crypto mining industry is quietly entering a new industry cycle. At this turning point, tax planning is no longer just an optional tool at the financial level but is expected to become a breakthrough path for mining companies to maintain capital health and enhance their competitiveness. Mining companies can combine their business characteristics, profit structures, and capital investment situations to conduct systematic tax planning, ensuring that all arrangements comply with regulatory and tax law requirements, transforming tax burdens into competitive advantages and laying the foundation for long-term stable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。