Recently, the BRC20 assets in the BTC ecosystem have quietly risen, and the discussion in the community has reached a peak — this rebound is not coincidental; it is the result of funds that have been accumulating for several days. However, to be honest, I haven't seen any major projects that can "create wealth" yet, so everyone should hold off on rushing in and let me break it down slowly.

First, let's talk about the small changes in the BTC ecosystem: I previously mentioned the Spark protocol and the inscription protocol. Now, BRC2.0 is worth paying attention to; I've heard that some foreigners are currently developing technology, so there might be new gameplay coming.

However, I haven't been active lately and am still holding onto my old assets, mainly waiting for signals. By the way, I saw an important piece of news last night: the OP_RETURN restriction has officially been lifted. @bitcoincoreorg just released version 30.0, which not only relaxes the multiple data outputs but also lowers the minimum forwarding fee to 0.1 sat/vB, and even re-supports external signing on Windows — tech enthusiasts should understand that this essentially opens up more "interfaces" for the BTC ecosystem, and new gameplay might emerge later.

I also want to share a judgment: BTC has been hovering around $110,000 for so long that I think it won't drop any further. Funds from the financial sector are still pouring in; after all, during a rate-cutting cycle, such hard assets are very attractive. In the long run, BTC and ETH are no longer "toys for a small circle"; more and more traditional financial players are entering the market, and the gameplay will become more standardized, which is actually good for us newcomers, as it reduces the chances of falling into traps.

1. Binance USDE Decoupling Incident: Remember These Lessons Behind the $19.1 Billion Liquidation!

Speaking of falling into traps, do you all remember the USDE decoupling incident from a while back? That day, I opened the market in the early morning and was stunned — USDE dropped to $0.65, losing 34% in a day; BNSOL fared worse, plummeting from a high of $34, effectively halving and then halving again (an 83% drop); WBETH was even more outrageous, dropping to $430, losing 91% of its market value!

There was a lucky person in the group who exchanged $500 for 110 SOL, like picking up money, but more people were buried by this "panic sell-off" — the entire crypto market saw over $19.1 billion in liquidations, affecting over 1.6 million users. Upon reviewing, the root cause was "circular loan liquidation": some people used high leverage for circular loans, and once one was liquidated, it triggered a chain reaction, causing USDE to drop and dragging down BNSOL and WBETH, like a domino effect.

I want to highlight the platform Hyperliquid: data shows that only 2.6% of wallets were affected, yet they accounted for nearly 20% of the outstanding amount — in simple terms, it was a case of a few high-leverage players being "taken out all at once." Even more frightening is that 205 wallets with losses exceeding one million dollars only accounted for 3.3%, yet they dominated the liquidity shock.

Let me emphasize: The risk is not in the bulls or bears, but in "concentrated leverage"! Next time the market moves unexpectedly, the system may not collapse, but high leverage will definitely be the first to go. Moreover, I've noticed a pattern: before every major flash crash, there are "insiders" placing orders on Hyperliquid, but the accounts are always different. We ordinary players should avoid chasing these "insider orders," as it’s easy to become the bag holder.

By the way, for those focused on the secondary market, I recommend you follow "Ember" and "AI Aunt," as they specifically track whale movements. Following their signals will at least keep you on the right track. Also, did you participate in Aster, which Cz previously promoted? The results of the S2 points have come out, and everyone is getting a refund! Those who chose "refund fees" generally lost 20%-29%; those who chose "receive tokens," based on the current price of $1.58, directly lost 40%-55% — this kind of "volume-filling airdrop" gameplay has already hit a bottleneck, so don’t be a victim anymore!

2. Binance Alpha: Earn $150 per account monthly, Meme Rush has 4x points but be cautious!

Now let's talk about our "old friend" Binance Alpha.

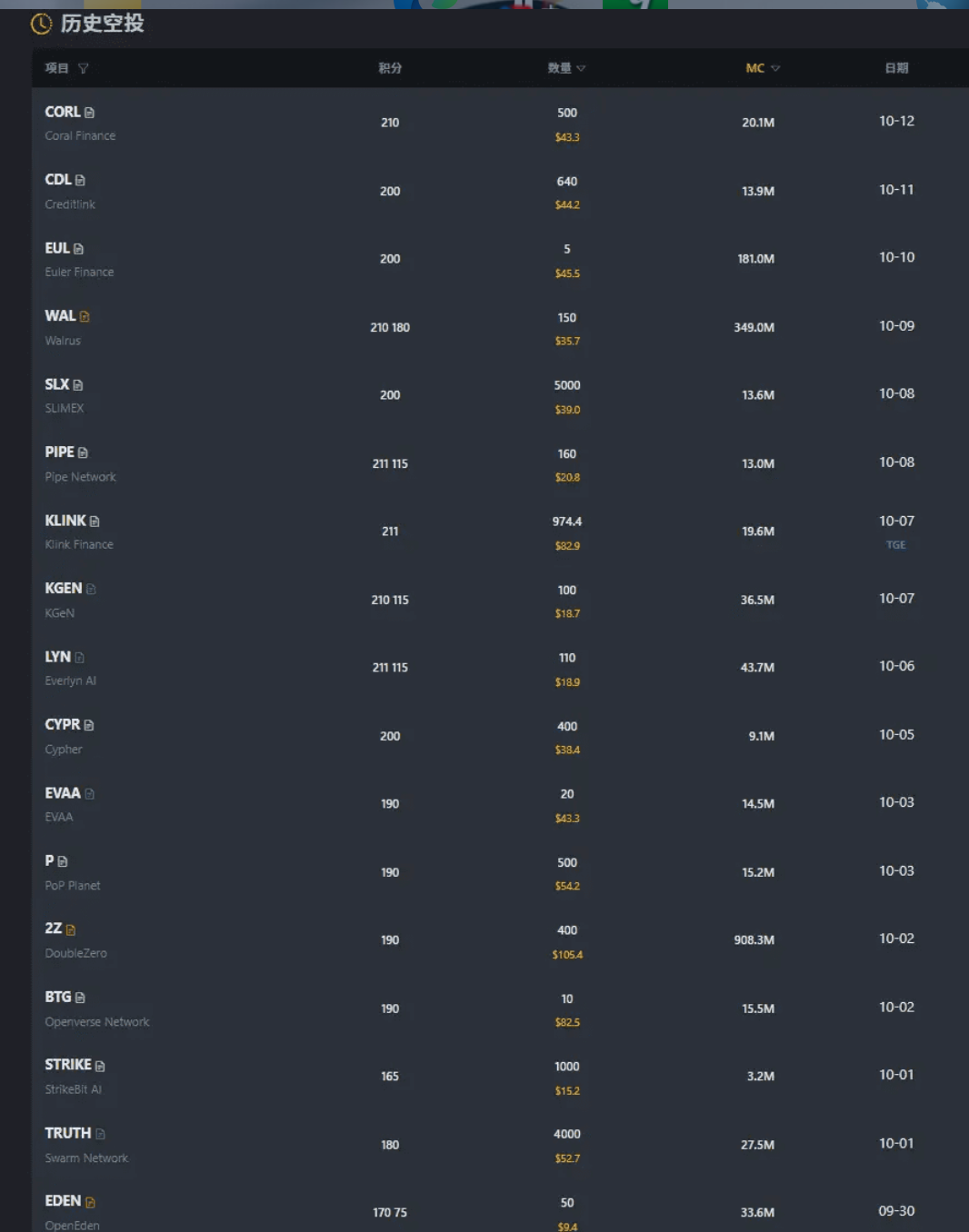

In these few days of October, you can earn about $150 by claiming rewards three times per account. Although this is a bit less than before and the enthusiasm has cooled down, it’s normal not to have major projects coming out; after all, new projects are about "waiting for the wind." I've been using Alpha for almost a week now, and my points have been stable at 10-15 per day, with gameplay similar to everyone else: mainly focusing on KOGE assets, with a bit of Meme Rush mixed in.

Why play Meme Rush? Firstly, there’s a 4x trading volume bonus recently, and secondly, I want to try something new. But I must remind everyone: the risks are much higher than regular new projects! I know someone who can earn over $500 in a month, but there are also those who lose half their investment right after entering, so don’t be greedy.

Additionally, I suspect Binance will invest resources in Meme Rush soon, especially since OKX is competing for market share. We should maintain a "claim + earn" rhythm; from the end of the month to the New Year, there will definitely be opportunities. By the way, the recent TGE of YB is worth participating in, as it has a multiplier bonus, and the cost is lower than the last project, with potentially higher returns. Those interested can keep a close watch.

3. OKX Boost Finally Recovers! Earn $160 with a $40 account cost, studios are bulk registering accounts

Previously criticized for "reverse refunds," OKX Boost has finally picked up! Let me explain to new friends: OKX Boost earns points based on "15-day average trading volume + wallet balance." The higher the points, the more quota you get for the subsequent X Launch (similar to Binance Alpha). The previous rounds were indeed disappointing, with earnings of just a few dozen dollars not even covering the fees, but this time is different.

The cost per account is less than $40, and you can earn over $160 in AVNT trading competition rewards + KGEN subsidies, which is similar to Binance Alpha, earning "hard-earned money." Now studios are bulk registering accounts, starting with 15 accounts, using family or friends for KYC. Even more outrageous, some factory owners directly ask employees to clock in and earn points — it’s quite something.

Here’s a little strategy for you: don’t just bet on one side between OKX and Binance; spread your positions a bit. Start with around $1,000 in the early stages. In terms of returns, Binance is currently hotter; in terms of safety, Xu Mingxing is more conservative than CZ, and OKX's risk control is steadier. Choose based on your own risk preference — if you like being aggressive, go for more Binance; if you want to be stable, put more into OKX.

4. BSC Opportunities: Meme projects that CZ watches at 4 AM, double your money and don’t be greedy!

Finally, onto the "main course" — the PVP gameplay in BSC. There haven’t been any new projects in the past two weeks, so I tried with $100 and surprisingly turned it into $700. Today, I’ll share the process with you.

First, you need to catch the right timing: CZ and He Yi are often active in the early morning (due to time zone differences), so we should check the Meme Rush section around 4 AM, where new coins will be listed. To decide whether to rush in, look at two points: first, the highest trading volume, and second, the internal market cap should meet the "0x444" emotional market standard. Then check the wallets that bought in earlier; most of them are large orders above $600. Once the market cap reaches around $80k, they will start to sell — this kind of market is basically "in and out quickly," so double your money and run; don’t think about holding long-term unless CZ or He Yi calls it out; otherwise, once it hits a $2 million market cap, pull out quickly.

Another little trick: for assets ending in 4444, first search for the CA address on Twitter to see which big accounts are calling it out, then check the narrative logic to facilitate finding someone to take over later (we only do "first-hand," not take over!). I participated just because it was something new and had 4x points; just a taste is enough.

Key Announcement: The next opportunity is on Binance's first Chinese asset!

Finally, let me say it three times, write it down: The next new project opportunity is on Binance's first Chinese asset! The first Chinese asset! The first! Recently, there have been rumors that Binance will launch a project with a Chinese narrative, so everyone should keep a close eye; I will announce any new developments in the group as soon as possible.

New projects are all about "finding opportunities + exiting early," so don’t be greedy; just earn what you can. By the way, if you haven’t joined the new project group yet, ask Yingying to note "new project group," and we can look for opportunities together. Also, don’t have biases against new chain ecosystems and new protocols; the returns from new narrative new projects are still decent, and the next major project might just be here!

Oh, and for those anxious about the secondary market, I recommend a tool: our app's little A assistant, which can be found in "Group Chat - Lower Left Corner Little A Analysis." It’s specifically designed for short-term traders, providing data references that are much more reliable than "going by feeling." If you need it, you can give it a try!

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice for anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。