After securing a $2 billion investment, Polymarket is valued at $9 billion, making it one of the highest funding amounts for projects in the Crypto space in recent years.

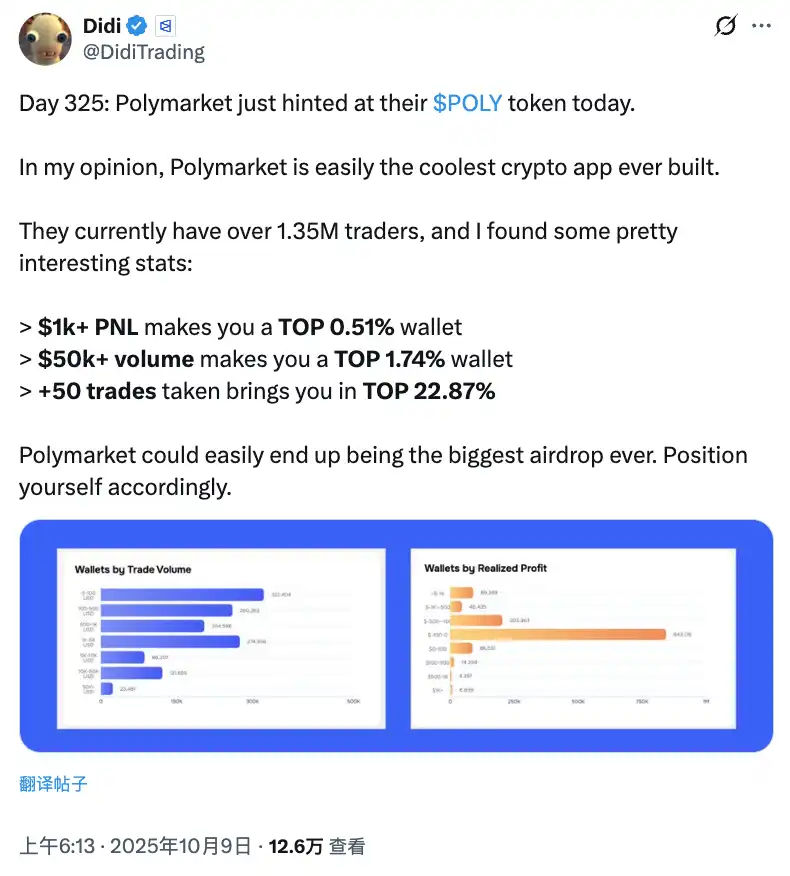

Against the backdrop of increasing rumors about IPOs, IDOs, and airdrops, let's first look at an interesting set of data: If your PNL exceeds $1,000, you enter the top 0.51% of wallets; if your trading volume exceeds $50,000, you rank among the top 1.74% of large holders; if you complete more than 50 trades, you surpass 77% of users.

This data also implies that in the fertile ground of Polymarket, there are actually not many who have been consistently cultivating and reaping rewards over the years.

With ICE's strategic investment taking effect, Polymarket's liquidity, user base, and market depth are rapidly increasing. More funds flowing in means more trading opportunities; more retail participation means more market imbalances; more market types mean more arbitrage space.

For those who know how to truly make money on Polymarket, this is a golden age. Most people treat Polymarket as a casino, while smart money sees it as an arbitrage tool. In the following lengthy article, Rhythm BlockBeats interviewed three seasoned Polymarket players to dissect their money-making strategies.

Sweeping the Tail as a New Financial Tool

"About 90% of large orders over $10,000 on Polymarket are executed at prices above 0.95," seasoned player fish stated directly.

In the prediction market of Polymarket, a strategy known as "sweeping the tail" is very popular.

The strategy is simple: when the outcome of an event is basically settled, and the market price soars above 0.95, even approaching 0.99, you buy at that price and patiently wait for the event to officially settle, capturing the last few points of "certainty" profit.

The core logic of sweeping the tail can be summarized in four words: time for certainty.

When an event has already occurred, such as a clear result in an election or the conclusion of a sports event, but the market has not officially settled, the price often hovers close to 1 but not quite at 1. Entering at this point, theoretically, as long as you wait for the settlement, you can steadily capture those last few points of profit.

"Many retail investors can't wait for the settlement," fish explained to Rhythm BlockBeats, "They are eager to cash out to place their next bet, so they sell directly at prices between 0.997 and 0.999, leaving arbitrage space for large holders. Although each trade only earns 0.1% profit, if the capital is large enough and the frequency is high, it can accumulate into a considerable income."

But just like all investments carry risks, sweeping the tail is not a "no-brainer" investment without risks.

"The biggest enemy of this strategy," fish shifted the conversation, "is not market volatility, but black swan events and manipulation by large holders."

The risk of black swans is something tail sweepers must always be vigilant about. What is a black swan? It refers to those seemingly certain events that suddenly experience unexpected reversals. For example, a game that seems to be over but is later ruled invalid by the referee; a political event that appears settled but suddenly erupts in scandal leading to a reversal of results. Once these low-probability events occur, your chips bought at 0.99 instantly become worthless.

"The so-called black swan events that can reverse are basically manipulated by large holders," fish continued to explain, "The typical strategy of large holders is as follows: when the price approaches 0.99, they suddenly use large orders to crash the price to 0.9, creating panic; they then stir the narrative in the comments section and on social media, spreading information that could lead to a reversal, amplifying retail investors' panic; after retail investors panic-sell, they buy back the chips at the lower price; after the event officially settles, these large holders not only profit from the price difference between 0.9 and 1.00 but also pocket the profits that retail investors should have made."

This is the complete closed loop of large holder manipulation.

Another seasoned player, Luke (@DeFiGuyLuke), added an interesting detail to this closed loop: "The comment section on Polymarket is particularly readable. I find this phenomenon quite special; it's hard to see this in other products."

People write a lot of evidence to support their views, and many know that you can align with everyone else. So manipulating public opinion becomes very easy on Polymarket.

This also became the opportunity for Luke's current startup: "When I was using Polymarket, I noticed an interesting phenomenon—people don't want to see content on Twitter, right? It's all nonsense and not real. Most people don't talk much. But the comment section on Polymarket is really fun; even if someone bets just a few dollars or a hundred dollars, they write long essays."

"You'll find this content particularly interesting. So at that time, I thought the readability of the Polymarket comment section was really high." Based on this observation, Luke started a product called Buzzing: allowing anyone to create markets on any topic. After betting, everyone can comment, and these comments will form a feed stream, distributing content to the market.

Now, back to the point: since sweeping the tail has the risk of manipulation by black swans, does that mean it shouldn't be played?

"Not necessarily. The key lies in risk control and position management. For example, I only allocate a maximum of 1/10 of my position in each market," fish added, "Don't put all your funds on one bet, even if that bet looks 99.9% likely to win. Prioritize those markets that are about to settle (within a few hours) and have prices above 0.997, as this shortens the time window for black swans."

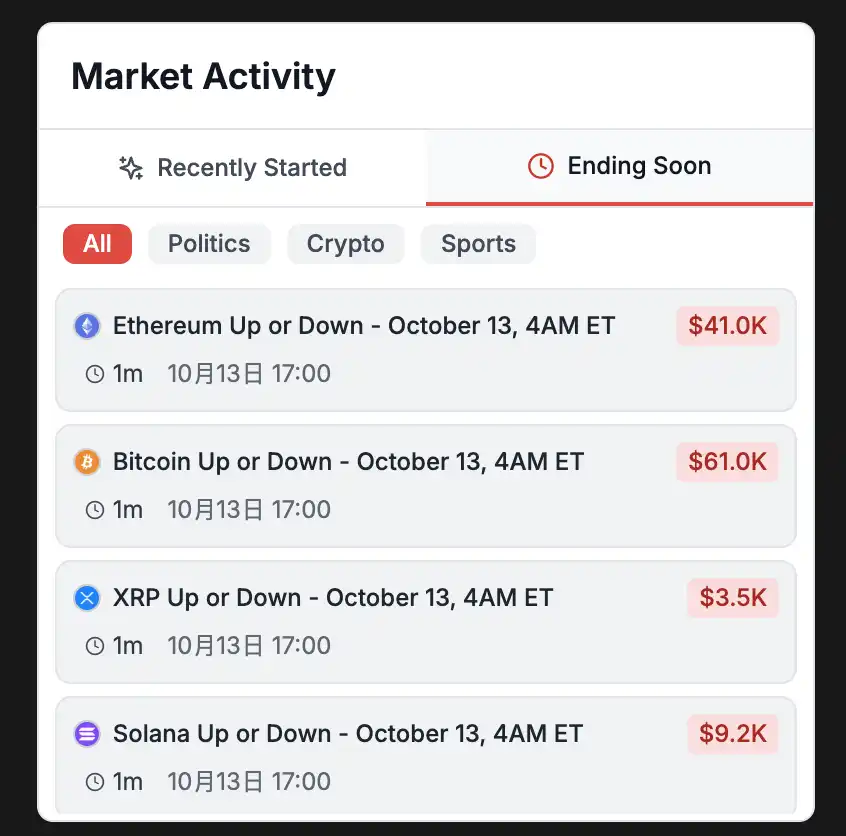

Markets about to end as shown on polymarketanalytics

Arbitrage Opportunities with a Total Less Than 100%

On Polymarket, there is an address that turned $10,000 into $100,000 in six months, participating in over 10,000 markets.

Not through betting on outcomes or insider information, but through a seemingly simple yet technically demanding arbitrage strategy—capturing opportunities in multi-option markets where the "total is less than 100%."

The core logic of this strategy is elegantly astonishing: in a multi-option market where only one option will win (Only 1 Winner), if the total price of all options adds up to less than $1, then by buying one of each option, you are guaranteed to receive $1 upon settlement. The difference between the cost and the return is your risk-free profit.

It may sound a bit hard to understand. Let's illustrate with a specific example. Suppose there is a market about "Will the Fed cut rates in July?" with four trading options:

Cut by more than 50 basis points: price $0.001 (0.1%);

Cut by more than 25 basis points: price $0.008 (0.8%);

Remain unchanged: price $0.985 (98.5%);

Raise by more than 25 basis points: price $0.001 (0.1%).

Adding these four prices together: 0.001 + 0.008 + 0.985 + 0.001 = $0.995. What does this mean? You spend $0.995 to buy one of each option, and upon settlement, one of the options will win, and you will receive $1. The profit is $0.005, with a return of 0.5%.

"Don't underestimate this 0.5%. If you invest $10,000, you can earn $50, making dozens of trades a day, leading to astonishing annual returns. Moreover, this is risk-free arbitrage; as long as the market settles normally, you will definitely profit," Fish said.

Why do such arbitrage opportunities arise?

In multi-option markets, the order books for each option are independent of each other. This leads to an interesting phenomenon:

Most of the time, the total probability of all options is greater than or equal to 1 (this is the normal state, as market makers need to earn the bid-ask spread). However, when retail investors trade a single option, it only affects the price of that option, and the prices of other options do not adjust simultaneously. This creates a temporary market imbalance—where the total probability of all options is less than 1.

This time window may only last a few seconds or even shorter. But for arbitrageurs running monitoring scripts, this is a golden opportunity.

"Our bot continuously monitors all multi-option markets' order books 24/7," fish explained, "Once it detects that the total probability is less than 1, it immediately places orders to buy all options, locking in profits. Once the bot system is established, it can monitor thousands of markets simultaneously."

"This strategy is somewhat similar to MEV (Miner Extractable Value) atomic arbitrage in cryptocurrency," fish continued, "both utilize temporary market imbalances, using speed and technology to complete arbitrage before others and then allowing the market to rebalance."

Unfortunately, this strategy seems to have been monopolized by several bots, making it difficult for ordinary people to make significant profits from it. Theoretically, risk-free arbitrage that anyone can do has, in practice, turned into a war among a few professional bots.

"The competition will become increasingly fierce," fish said, "depending on whose server is closer to the Polygon node, whose code execution efficiency is higher, who can monitor price changes faster, and who can submit transactions and confirm them on-chain more quickly."

Essentially, this is also the role of market makers

At this point, many may have realized that the arbitrage strategies discussed earlier essentially also play the role of market makers.

The job of a market maker is simply to deposit USDC into a specific market pool, equivalent to simultaneously placing buy orders for Yes and No, providing counterparties for all buyers and sellers. The deposited USDC will be converted into corresponding contract shares based on the current Yes/No ratio. For example, at a 50:50 price, depositing 100 USDC will be split into 50 shares of Yes + 50 shares of No. As the market fluctuates, your Yes/No inventory ratio will deviate from the optimal state (e.g., 50:50). Excellent market makers will continuously rebalance their positions through proactive trading or adjusting funds to lock in arbitrage opportunities.

From this perspective, these arbitrage bots are essentially acting as market makers—they continuously rebalance the market through arbitrage activities, making prices more reasonable and improving liquidity. This is beneficial for the entire Polymarket ecosystem. Therefore, Polymarket not only does not charge transaction fees but also provides rewards to makers (those placing orders).

"From this angle, Polymarket is actually very friendly to market makers," Fish said.

"From the data, market makers on Polymarket should have earned at least $20 million in the past year." This was the figure Luke revealed to Rhythm BlockBeats two months ago. "We haven't compiled the data for the past few months, but it must be more."

"Specifically regarding the revenue model, based on market experience, a relatively robust expectation is: 0.2% of the trading volume." Luke continued.

Assuming you provide liquidity in a certain market with a trading volume of $1 million in a month (including both buy and sell orders you execute), your expected profit would be: $1 million × 0.2% = $2,000.

This return rate may not seem high, but the key is that it is a relatively stable income, unlike speculative trading which can fluctuate wildly; moreover, if you scale up to increase returns, then 10 markets would yield $20,000, and 100 markets would yield $200,000. If you also factor in the platform's LP rewards and annualized holdings, the actual returns would be even higher. "But the main income still comes from the spread in market making and the rewards given by Polymarket; these two components."

Interestingly, compared to other arbitrage strategies that have been maximized by bots, Luke believes that the competition in market making is not very intense right now.

"Competition in token trading is definitely fierce, leading to competition over hardware and such. But the market competition on Polymarket is not very intense. So the current competition is still focused on strategy rather than speed."

This means that for players with certain technical skills and capital, market making may be an underestimated opportunity. As Polymarket achieves a $9 billion valuation and liquidity continues to grow, the profit potential for market makers will only increase. Entering now may not be too late.

Arbitrage in the 2028 Election

During the conversation with Rhythm BlockBeats, both Luke and Tim mentioned the potential opportunities for market making arbitrage, especially in the 2028 U.S. election market where Polymarket has introduced a 4% financial yield.

With three years until the 2028 election, Polymarket has already begun to position itself, offering a 4% annual yield to capture market share and attract early liquidity.

"Many might think that at first glance, a 4% annual yield is quite low in the crypto space, where platforms like AAVE offer higher APYs."

"But I think Polymarket is doing this to compete with Kalshi," Luke explained. "Kalshi has long provided U.S. Treasury yields on account balances, which is quite common in traditional financial products. For example, with Interactive Brokers, even if you don't actively buy bonds or stocks, your money earns a yield. These are common features in traditional financial products."

"And since Kalshi is a Web2 product, it's easy to implement," Luke continued. "But Polymarket has not done this because all its funds are in the protocol, making it more challenging to implement. So in terms of this financial feature, Polymarket was previously a bit behind Kalshi."

This drawback becomes even more apparent in a long-cycle market like the 2028 election. "You think about it, if you put money in now, you have to wait three years for settlement, and during those three years, your money is idle, which can be a bit uncomfortable, right? So they introduced this annual reward to level the playing field with competitors, which should be subsidized by themselves," Luke said.

"However, I believe the goal of market makers is definitely not just this 4% annual yield; this yield is mainly aimed at ordinary users." Through this subsidy, users' trading costs are reduced, which is very beneficial for those who are long-term traders on Polymarket, as studios are very sensitive to cost and revenue calculations.

Tim's research in this area is also very in-depth. "If you study the details of this mechanism closely, you'll find that there is a much larger arbitrage space hidden within for market makers."

"The rewards given by Polymarket are details that many people have not noticed; each option provides an additional $300 daily LP reward." Tim elaborated: In addition to the 4% annualized holding, Polymarket also gives market makers extra rewards. If you provide liquidity in this market—meaning placing both buy and sell orders to help maintain market depth—you can share in this daily $300 LP reward pool.

Tim did a quick calculation. Assuming the market "Who will be the president in the 2028 election?" has 10 popular options, with each option receiving a $300 LP reward daily, the total LP reward pool would be $3,000 per day. If you hold 10% of the liquidity share, you would receive $300 daily, which amounts to $109,500 over a year.

"This is just the LP reward. If you add the profit from the buy-sell spread in market making, plus the 4% annualized compounding, the combined returns can easily exceed 10%, even 20% or more."

"If you ask me whether market making for the 2028 election is worth it, my answer is: if you have the skills, capital, and patience, this is a severely underestimated opportunity. But to be honest, this strategy is not suitable for everyone."

Tim said: "It is suitable for those with a certain amount of capital (at least tens of thousands of dollars) who are conservative players; suitable for those with programming skills who can build automated market-making systems; suitable for long-termists who do not seek to get rich quickly and are willing to trade time for stable returns; and also suitable for players who have a certain understanding of U.S. politics and can judge market trends.

But it is not suitable for players with too little capital (a few thousand dollars); not suitable for speculators who seek short-term wealth and cannot be patient for four years; not suitable for complete novices who do not understand U.S. politics and cannot judge market rationality; and also not suitable for players who need liquidity and may need to use their funds at any time."

News Trading on Polymarket

In-depth research of Polymarket's market data led Luke and his team to discover a counterintuitive phenomenon.

"People used to say that Polymarket users are very smart and have foresight, right? They predict outcomes through trading even before events have results," Luke said, "but in fact, it's quite the opposite."

"Most users on Polymarket are actually 'dumb money,' quite inexperienced," Luke laughed, "In most cases, people misjudge the events. Then they wait for the event to have results or news before many rush in to arbitrage, pushing the prices to expected levels, either Yes or No. But before the news breaks, many times people have misjudged."

"From the data," Luke continued to explain, "the entire Polymarket market actually sees users' bets and price feedback lag behind real events. It often happens that the real event has already occurred, but people's bets are wrong, leading to significant reversals."

Luke provided a vivid example: "For instance, in the papal election, the first elected pope was an American. Before the Vatican announced this result, the winning probability of that American pope candidate was still just a few thousandths, very, very low. But once the Vatican announced it, boom, the price skyrocketed."

"So you can see that users in these markets often bet incorrectly," Luke summarized, "If you have relevant news sources and can act quickly, it feels profitable. I think this is still a viable strategy."

However, the barrier to entry for this path remains high.

"I think this requires a high level of development," Luke admitted, "You need to access news sources in a timely manner, somewhat like doing something akin to MEV. You need to capture news with certainty, layer it well, and then perform natural language understanding to trade quickly. But there are definitely opportunities."

In the $9 billion valuation battlefield of Polymarket, we see various money-making strategies, but regardless of the strategy, it seems that many low-profile players who make money on Polymarket treat it more as an arbitrage machine rather than a casino.

From our interviews, it is clear that the arbitrage ecosystem of Polymarket is rapidly maturing, and the space for newcomers is shrinking. But this does not mean that ordinary players have no opportunities.

Returning to the set of data at the beginning of the article: If your PNL exceeds $1,000, you can enter the top 0.51%; if your trading volume exceeds $50,000, you are in the top 1.74%; and if you complete more than 50 trades, you surpass 77% of users.

So even if you start trading frequently from now on, by the time the airdrop arrives, as one of the largest fundraising projects in recent years, Polymarket may still surprise ordinary players.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。