Bitcoin managed to squeeze out a small pop on Sunday after U.S. President Donald Trump walked back some of his fiery rhetoric on a trade war with China. By Monday afternoon, the cryptocurrency had reclaimed roughly 46% of its losses from Friday, hovering just above $115K at the time of writing.

“Don’t worry about China, it will all be fine!” Trump wrote. “Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I.”

But perhaps the U.S. president is the one who “had a bad moment.” Just three days ago, Trump warned China of “a massive increase of tariffs” after the country expanded export controls on rare earth minerals last week Thursday. Trump’s threat triggered an unprecedented market sell-off that saw an estimated $2 trillion in value evaporate from the stock market. Crypto saw $410 billion vanish, and bitcoin nosedived 11%.

But Trump’s words, good or bad, tend to have impact, and even his half-hearted apology from Sunday was enough to establish a market bottom and begin the long road to recovery. “The U.S.A. wants to help China, not hurt it!!! President DJT,” Trump said. The S&P 500, Nasdaq, and Dow all jumped 1.53%, 2.11%, and 1.27% respectively, and bitcoin was up nearly 6% from Friday’s low.

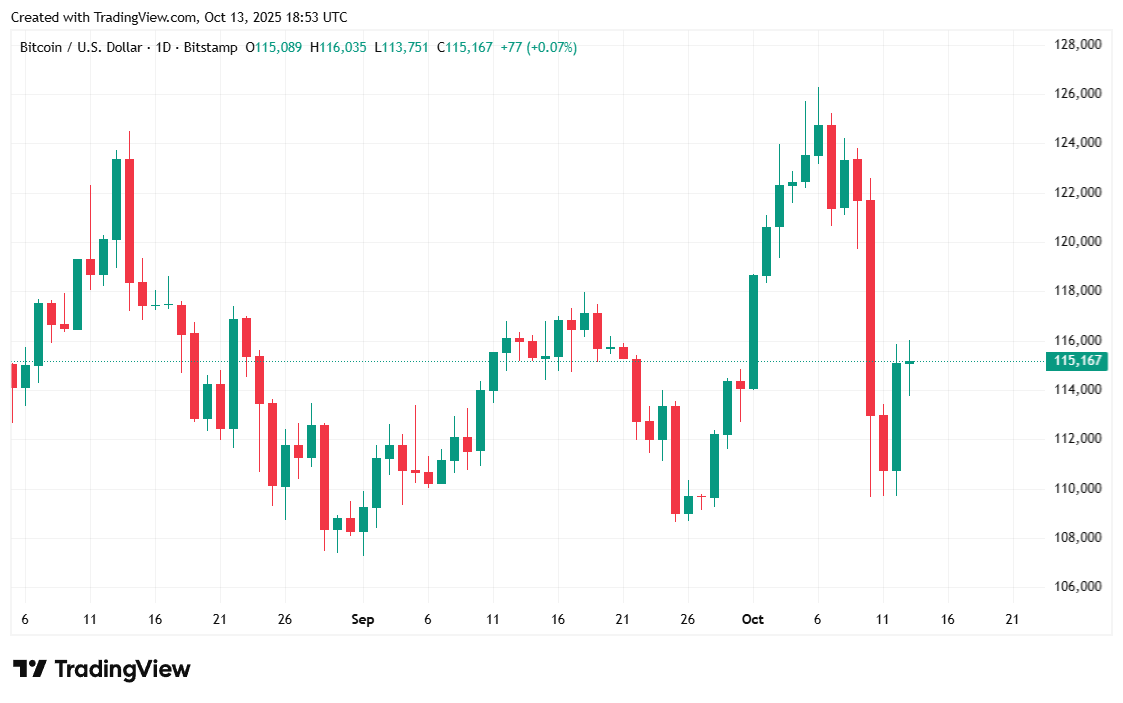

Bitcoin rose 1.03% over 24 hours and was trading at $115,272.74 at the time of writing, according to Coinmarketcap data. But the digital asset was still down 8.06% for the week. BTC’s price fluctuated between $113,673.06 and $115,955.33 since Sunday.

( BTC price / Trading View)

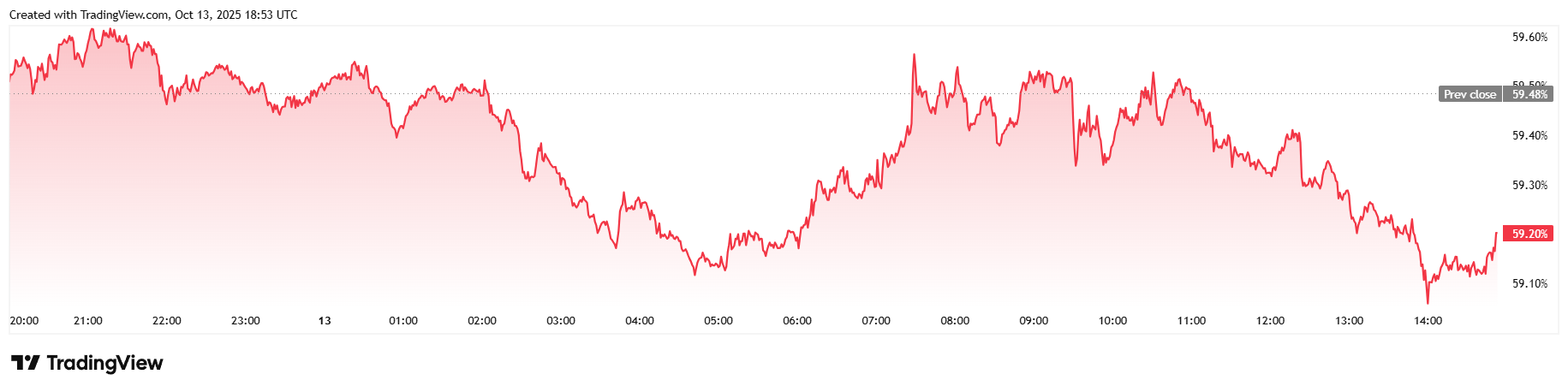

Twenty-four-hour trading volume fell 7.95% to $82.13 billion, defying the expected post-weekend volume pop typically seen on Mondays. Market capitalization increased by 1% to $2.29 trillion, in line with the 24-hour price increase. But bitcoin dominance dropped 0.54% to 59.20% at the time of reporting.

( BTC dominance / Trading View)

The total number of open futures contracts climbed 1.84% to $74.93 billion according to Coinglass. After topping $5 billion over the weekend during the Trump-linked sell-off, bitcoin liquidations returned to normal, totaling $78.94 million on Monday. Most of that grand total consisted of shorts, which came up to $45.11 million. Long investors appeared somewhat gun-shy (and rightfully so), with long liquidations accounting for a smaller $33.82 million in wiped out margin.

- Why did bitcoin rebound after Trump’s China remarks?

Bitcoin rose as traders interpreted Trump’s softer tone on China as a sign of easing trade tensions. - How much has bitcoin recovered?

The cryptocurrency regained about 46% of its losses, climbing back above $115,000. - What triggered last week’s sell-off?

Markets plunged after Trump threatened major tariffs following China’s rare-earth export controls. - Are broader markets reacting too?

Yes. U.S. stock indexes jumped over 1% as optimism returned across equities and crypto alike.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。