Author | Haseeb

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

_Editor's Note: Due to the black swan flash crash on October 11, the market capitalization of the stablecoin USDe issued by Ethena Labs has dropped to around $12.5 billion, a decrease of over $2 billion from about $14.82 billion seven days ago. The reason is that USDe severely depegged from the US dollar during this cryptocurrency market crash, falling as low as $0.62 on some decentralized exchanges, a depeg of up to 38%. Although the price has now recovered to the $1 range, the incident has significantly impacted user confidence. In response to widespread concerns about the USDe depeg rumors, Dragonfly managing partner _Haseeb_ has spoken out (Dragonfly is an investor in Ethena)._

The following is the original content:

Has Ethena really depegged?

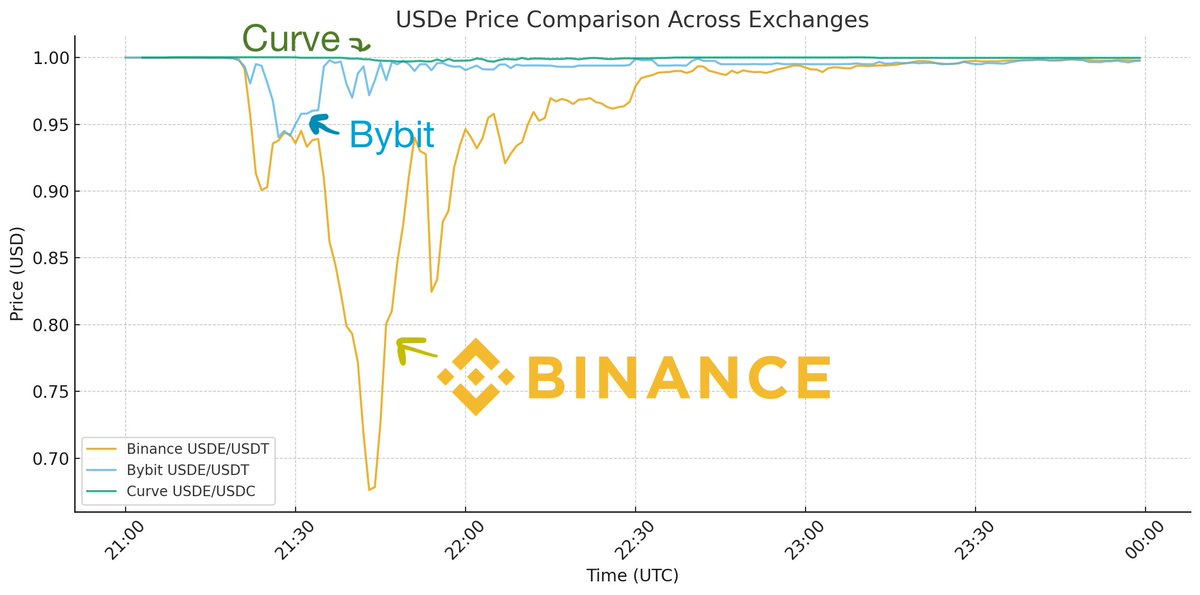

I saw many people discussing the "depeg" of Ethena's USDe when the market crashed this weekend. Rumors said USDe once dropped to about $0.68 before recovering. Here is the price chart from Binance that everyone is quoting:

However, after a thorough analysis of the data over the past few days and discussions with various parties, it can now be confirmed: this statement is incorrect. USDe has not actually depegged.

First, it is important to understand that the main liquidity venue for USDe is not centralized exchanges (CEX), but Curve.

On Curve, USDe has hundreds of millions of dollars in deep liquidity; whereas on major exchanges including Binance, liquidity is only in the tens of millions of dollars.

So, if you only look at the price chart on Binance, you might think USDe has depegged.

But if you overlay the prices from other major trading venues like Curve, the picture looks completely different:

You can see that while USDe experienced momentary drops on various CEXs, they were not consistent.

Bybit briefly dropped to $0.95 before quickly recovering, while Binance's drop was exceptionally large and took a long time to recover.

Meanwhile, USDe on Curve only dropped by 0.3%.

So why is there such a discrepancy?

Remember, the entire market was under extreme pressure that day—this was the largest liquidation event in crypto history.

Binance was unusually unstable during this period, and market makers (MM) could not adjust their positions on the platform because the API interfaces frequently failed, and the deposit and withdrawal channels were almost paralyzed.

The result was that no one could enter the market to arbitrage. It was like Binance was on fire, but all the channels were blocked, and firefighters couldn't get in. As a result, the fire spread internally on Binance, while elsewhere, due to cross-platform liquidity bridging, the fire was quickly extinguished.

(As Guy pointed out in the article, USDC also briefly "depegged" by a few cents on Binance at that time for the same reason—not an asset issue, but a liquidity issue.)

Therefore, when the exchange's API is unstable, it is not surprising that there are significant price discrepancies between exchanges—because no one can replenish inventory.

But the question is: why was Binance's price deviation more severe than Bybit's?

The answer has two aspects:

- Binance does not have a primary dealer relationship with Ethena, so it cannot directly mint or redeem USDe on the platform. Exchanges like Bybit have this integrated mechanism, allowing market makers to engage in pegging arbitrage even while remaining on the exchange. On Binance, market makers must transfer funds out of Binance, go on-chain to arbitrage Ethena, and then transfer back. At the moment when the API failed and the market crashed, no one would take that risk.

- Binance's oracle implementation has flaws, leading to erroneous liquidations. A sound liquidation mechanism should not trigger due to momentary flash crashes, but Binance only referenced its own order book prices, not the real prices from mainstream venues (like Curve). As a result, Binance calculated USDe as being worth $0.80 or even lower, triggering a chain of liquidations. This is also why Binance is now compensating some users who were liquidated on USDe—other exchanges did not experience this issue. Their mistake was: they only looked at their own prices and did not consider the real external prices.

Thus, this was actually a Binance-specific flash crash event, not a depeg of USDe itself.

On the mainstream trading venue Curve, USDe maintained a tight pegged price throughout the day.

This is completely different from a "depeg."

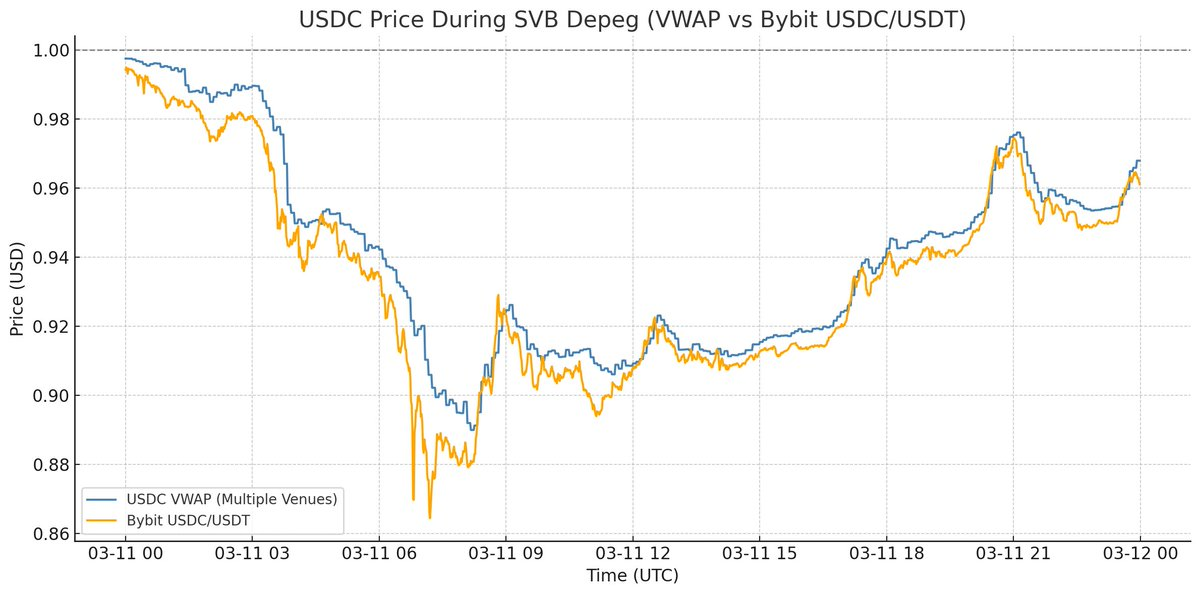

Do you remember the true depeg of USDC during the banking crisis in 2023?

At that time, USDC fell below $1 on all trading venues, and there was nowhere to buy USDC for $1.

The redemption mechanism was completely suspended, and the real market price was $0.87.

That is the definition of "depeg."

This time was merely a localized price dislocation on Binance.

This is an important lesson for market infrastructure, but if you want to derive the mechanism performance of USDe from this event, you must understand the subtle differences involved.

In fact, USDe remained fully collateralized throughout the entire event, with prices on the main trading venues consistently around $1.

In fact, due to price fluctuations, the total amount of collateral assets even increased over the weekend.

In other words, this turmoil provided valuable industry experience.

As Guy summarized in the article, any exchange (including Binance) can avoid similar issues by improving infrastructure.

Summary

USDe has not depegged; it is Binance that has depegged.

Based on this, Ethena Labs subsequently released an emergency reserve proof report in response to the severe market fluctuations over the past 24 hours.

The report was jointly verified by independent institutions such as Chaos Labs, Chainlink, Llama Risk, and Harris & Trotter, confirming that USDe currently maintains approximately $66 million in excess collateral, with overall asset conditions being robust.

Meanwhile, Binance also responded to this incident, stating that some users experienced erroneous liquidations due to holding USDe, BNSOL, and WBETH as collateral. Binance has acknowledged system responsibility and will fully compensate affected users, with compensation being distributed in two batches, totaling approximately $283 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。