Highlights of This Issue

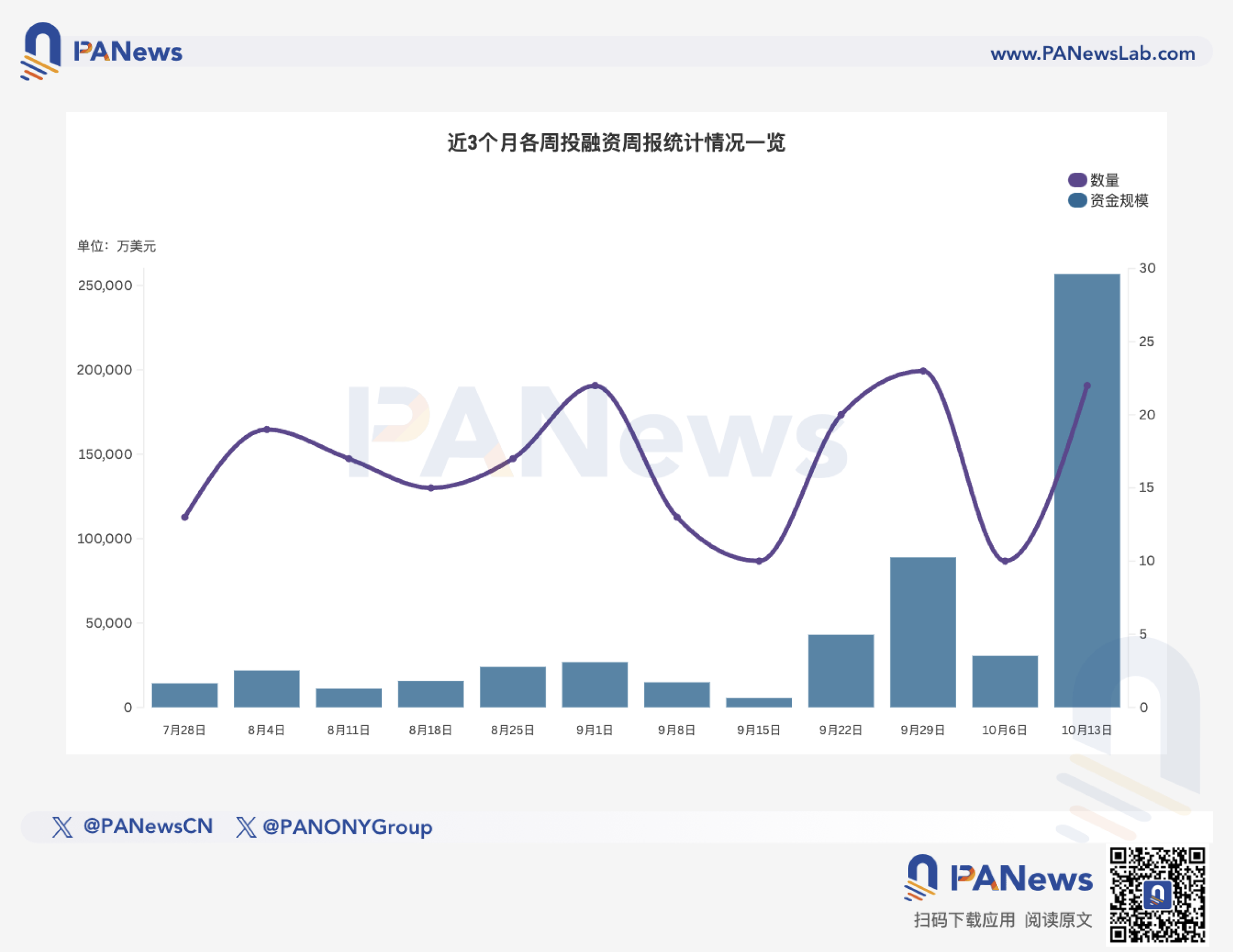

According to incomplete statistics from PANews, there were 22 investment and financing events in the global blockchain sector last week (10.6-10.12), with a total funding scale exceeding $2.568 billion. Additionally, the total financing amount for listed companies' crypto asset reserves exceeded $650 million. The overview is as follows:

- DeFi reported 3 investment and financing events, with Block Street announcing the completion of $11.5 million in strategic financing led by Hack VC;

- The Web3+AI sector reported 4 investment and financing events, including decentralized AI studio Yuma launching an asset management department and receiving a $10 million investment from DCG;

- The Infrastructure & Tools sector reported 5 investment and financing events, with stablecoin startup Coinflow announcing the completion of $25 million in Series A financing, with participation from Pantera and others;

- The Centralized Finance sector reported 5 investment and financing events, with Kraken completing $500 million in financing, reaching a valuation of $15 billion;

- The Other Web3 applications sector reported 4 investment and financing events, with Kalshi raising over $300 million in a new round of financing, valuing the company at $5 billion;

- Additionally, 4 listed companies completed financing to establish crypto treasuries, including Nasdaq-listed Predictive Oncology, which completed a $343.5 million PIPE financing to purchase ATH tokens in the public market;

- The DePIN sector reported 1 investment and financing event, with DePIN infrastructure service provider Bee Maps (formerly Hivemapper) securing $32 million in funding, with participation from Pantera Capital and others.

DeFi

Tokenized stock infrastructure Block Street completes $11.5 million financing, led by Hack VC

Block Street announced the completion of $11.5 million in strategic financing, led by Hack VC, with participation from Generative Venture, DWF Labs, StudioB, Bridge34, and others. Block Street focuses on building the execution and lending layer for tokenized stocks, with a tech stack that includes Aqua (RFQ intent) and Everst (hybrid clearing). The project plans to launch on the L1 project Monad in the fourth quarter of this year, with subsequent expansions to Ethereum, BNB Chain, and Base. Team members come from well-known institutions such as Citadel, Point72, and Google, and they plan to launch a transparent dashboard to enhance user experience.

Multi-chain trading infrastructure LAB announced the completion of $5 million in financing, with participation from Selini Capital, Re7 Capital, Cypher Capital, RedBeard VC, Lemniscap, TVM Ventures, OKX Ventures, Mirana, KuCoin Ventures, Gate Ventures, GSR, Animoca Brands, Presto Labs, MEXC Ventures, Amber Group, and others. The project will conduct a token generation event (TGE) on October 14.

Base ecosystem options trading platform BaseVol completes $3 million seed round financing

Base ecosystem options trading platform BaseVol announced the completion of $3 million in seed round financing, led by Neoclassic Capital, with participation from Virtuals Ventures, Baboon VC, and Woori Technology Investment. BaseVol is an options trading platform based on the Base blockchain, offering a range of trades from simple 0DTE (zero-day-to-expiration) trades to complex structured vault strategies. BaseVol plans to launch Onchain Vault in October, which will be managed by AI—this is a new model co-developed with Virtuals Protocol. These agents will automate vault management, connecting manual trading strategies with on-chain autonomous execution.

AI

Yuma, a decentralized artificial intelligence (deAI) network developed by Bittensor, founded by DCG's Barry Silbert, has launched its asset management department, Yuma Asset Management, providing institutional and qualified investors with convenient access to the deAI ecosystem.

Yuma Asset Management has secured a $10 million anchor investment from DCG and launched two fund strategies for investment subnet tokens. DCG stated that the Yuma subnet composite fund aims to provide market-weighted risk exposure across all active subnets, similar to a "Nasdaq Composite Index" for subnet tokens. The Yuma large-cap subnet fund is akin to a "Dow Jones Industrial Average" for subnet tokens, aiming to provide targeted risk exposure to the largest subnet by market capitalization.

AI trading signal platform NebX receives $6 million investment from M2M Capital

M2M Capital announced on the X platform that it has invested $6 million in NebX. NebX is a fintech company that uses AI to provide trading signals, identifying popular tokens before they gain widespread market attention through real-time sentiment analysis on social media platforms like X, Telegram, and Discord. The company has announced that NebX 2.0 testing is now open.

Crunch Lab completes $5 million strategic round financing, led by Galaxy Ventures and Road Capital

Crunch Lab announced the completion of $5 million in strategic round financing, led by Galaxy Ventures and Road Capital, with participation from VanEck and Multicoin. To date, the company's total financing has reached $10 million, and the new funds will be used to support the construction of a decentralized AI intelligence layer that can support asset price prediction, optimize energy demand, and more.

EPHYRA secures $2 million in strategic financing, co-led by Castrum Istanbul and TBV

EPHYRA has secured $2 million in strategic financing, with a FDV of $100 million. This round was co-led by Castrum Istanbul and TBV. EPHYRA is positioned as an AI-driven entertainment ecosystem that transforms static NPCs into emotionally autonomous AI Agents, targeting Web3 gaming and social scenarios. The official announcement states that the existing community exceeds 300,000, with 6,000 internal testers and 3,000 NFT PASS holders, and plans to advance to TGE.

Infrastructure & Tools

Stablecoin startup Coinflow announced the completion of $25 million in Series A financing, with participation from Pantera, Coinbase Ventures, Reciprocal Ventures, and Jump Capital. The company helps businesses shorten customer card payment times by using stablecoins as an intermediary layer, assisting merchants in processing payment transactions that support stablecoins.

Blockchain digital identity platform TransCrypts announced the completion of $15 million in seed round financing, led by Pantera Capital, with participation from Lightspeed Faction, Alpha Edison, Motley Fool Ventures, California Innovation Fund, and a group of angel investors. The new funds will support the optimization of building a blockchain platform for digital identity and credential verification, preventing AI fraud and deepfake technology from eroding online trust.

Cryptocurrency compliance startup CipherOwl announced the completion of $15 million in seed round financing, co-led by General Catalyst and Flourish Ventures, with participation from Coinbase Ventures and Enlight Capital. The company, co-founded by former Coinbase engineers, focuses on using artificial intelligence technology to provide on-chain transaction monitoring and compliance analysis services for financial institutions. Its clients include several cryptocurrency exchanges and law enforcement agencies, primarily generating suspicious activity analysis reports automatically through AI systems to enhance review efficiency.

Solana smart network 375ai completes $5 million new round of financing, led by Delphi Ventures

Solana smart network 375ai announced that it has completed a new round of financing of $5 million, led by Delphi Ventures, Strobe Capital, and HackVC, with participation from 6MV, ARCA, EV3, Peaq, and Heartcore. To date, the company's total financing has reached $10 million. The project provides blockchain-based decentralized edge data intelligent network nodes and mobile applications for real-time data collection. Users can participate in the network by deploying nodes, using applications, or staking tokens, while earning rewards. A token TGE is planned to launch at the end of October.

On-chain infrastructure layer Rhuna completes $2 million seed round financing, led by Aptos Labs

On-chain infrastructure layer Rhuna announced the completion of $2 million in seed round financing, led by Aptos Labs, with participation from Acc Ventures, X Ventures, NewTribe Capital, Keyrock, CoinMarketCap Labs, FunFair, Lémanique, and others. Rhuna is described as a universal entertainment pass supported by stablecoin settlement and on-chain identity. It provides operators with a single programmable layer for wallet-native checkout and POS systems, ticketing and access control, membership and identity verification, as well as real-time stablecoin settlement.

Others

Prediction Markets:

Prediction market Polymarket confirmed on the X platform that the NYSE parent company ICE has made a $2 billion strategic investment at a post-money valuation of $9 billion.

Additionally, Polymarket CEO discloses two previously undisclosed financing transactions totaling over $200 million. The first occurred last year, with Blockchain Capital leading a $55 million investment at a valuation of $350 million, with participation from Founders Fund, 1789, 1 confirmation, Abstract, Coinbase, Dragonfly, ParaFi, SV Angel; the second occurred earlier this year, with Founders Fund leading a $150 million investment at a valuation of $1.2 billion, with participation from Ribbit, Valor, Point 72 Ventures, Blockchain Capital, and others.

Prediction market Kalshi plans to announce on Friday that it has raised over $300 million in a new round of financing, valuing the company at $5 billion. The company also plans to disclose that it will begin allowing customers from over 140 countries to place bets on its website. Kalshi's rapid expansion has attracted the attention of venture capital firms, including Sequoia Capital, which first invested in the company in 2020, as well as new investor Andreessen Horowitz. Other investors in this round of financing include Paradigm, CapitalG, and Coinbase Ventures. Despite Kalshi just finishing its previous round of financing in June, it initiated negotiations for a new round of financing in August, doubling the company's valuation.

Collectibles Trading:

Web3 collectibles platform Fanable (developed by Ethernal Labs) has secured $11.5 million in support, with investors including Fanatics under Michael Rubin, Ripple, Steel Perlot, Polygon, Borderless, Morningstar, and others. Fanable claims to have completed over 20,000 transactions, with a monthly growth rate of 100%, which will be used for platform iteration and global expansion. It has partnered with Collect Foundation to launch $COLLECT token mining, which will be used for community rewards, trading incentives, and governance. Fanable has collaborated with Brinks to support global trading of Pokémon cards using cryptocurrencies and fiat currencies, covering iOS, Android, and web versions.

Data Analysis:

Crypto risk analysis company Agio Ratings completes $6 million financing, led by AlbionVC

Crypto risk analysis company Agio Ratings announced the completion of $6 million in financing, led by AlbionVC, with participation from Portage Ventures and MS&AD. To date, the company's total financing has reached $11 million. The company primarily assesses and quantifies the risks of exchanges, custodians, and lending institutions in the cryptocurrency industry. The new funds will be used to expand the scope of risk ratings and provide support for traditional financial institutions such as banks.

DAT

(These transactions are not included in this financing weekly report statistics)

Predictive Oncology completes $343.5 million PIPE financing to support ATH token treasury strategy

Nasdaq-listed Predictive Oncology announced that it has completed $343.5 million in PIPE financing, which the company will use to purchase ATH tokens in the public market to support its ATH token treasury strategy. (Note: ATH is the native utility token of the Aethir ecosystem)

Prestige Wealth Inc. (Nasdaq stock code: PWM; AURE) announced that it has participated in and completed a series of synergistic transactions to launch Nasdaq's first Tether Gold (XAUT) treasury. These transactions include approximately $100 million in private equity investment (PIPE) from Antalpha Platform Holding Company, as well as other accredited investors, including Tether and Kiara Capital, and a three-year, $50 million preferred debt financing. The company intends to use most of the net proceeds to purchase Tether Gold (XAUT) as a reserve asset. Upon obtaining the relevant approvals, the company expects to rename itself "Aurelion Inc." and trade under the new stock code (AURE) starting October 13, 2025.

NYSE-listed DDC Enterprise Limited has completed $124 million in equity financing, led by PAG Pegasus Fund, OKG Financial Services Limited (a subsidiary of OKG Technology Holdings Limited), and Mulana Investment Management. DDC founder, chairman, and CEO Zhu Jiaying personally invested $3 million. It is reported that almost all capital participating in this round of financing (including the founder's investment) has committed to lock up their shares for 180 days from the completion of the transaction to support the execution of DDC's Bitcoin treasury strategy.

Dutch Amdax's AMBTS has raised €30 million, intended for Bitcoin purchases

Dutch cryptocurrency company Amdax announced on Tuesday that it plans to launch a Bitcoin reserve company named AMBTS on the Dutch exchange, having raised €30 million (approximately $35 million) in funding. Amdax stated that the completion of the first round of financing for AMBTS means the company is ready to initiate its Bitcoin purchasing plan.

Centralized Finance

Meanwhile, a life insurance company based on BTC pricing, announced the completion of $82 million in financing, co-led by Haun Ventures and Bain Capital Crypto, with participation from Pantera Capital, Apollo, Northwestern Mutual Future Ventures, and Stillmark.

Cryptocurrency life insurance company Anthea announced that it has completed $22 million in Series A financing, led by Yunfeng Financial, with a group of strategic investors from the insurance, asset management, and fintech sectors participating. The new funds will be used to support the launch of ETH-priced life insurance products while continuing business operations and accelerating product development and innovation.

Falcon Finance secures $10 million strategic investment from M2 Capital and Cypher Capital

General collateral infrastructure Falcon Finance announced a $10 million strategic investment from UAE venture capital firm M2 Capital. Additionally, Cypher Capital also participated in this round of financing. With the investment from M2 Capital, Falcon will accelerate its global roadmap, focusing on expanding fiat currency channels, deepening ecosystem partnerships, and enhancing the resilience of its general collateral model.

Stablecoin infrastructure company BVNK receives investment from Citi Ventures

Citi Ventures has invested in stablecoin infrastructure startup BVNK, with the amount undisclosed. BVNK provides a stablecoin payment track that supports two-way settlement between fiat and crypto assets; co-founder Chris Harmse stated that the company's valuation exceeds the previously disclosed $750 million. Its fastest-growing market is the U.S., driven by the U.S. stablecoin regulatory bill GENIUS Act. Citi is evaluating the issuance of its own stablecoin and expanding crypto custody. In the past 12 months, stablecoin trading volume has approached $9 trillion (Visa), with a total market cap exceeding $300 billion (CoinMarketCap). BVNK is also supported by Coinbase and Tiger Global.

U.S. Treasury platform Jiko receives strategic investment from Coinbase and Blockstream

The U.S. Treasury-based platform Jiko has received strategic support from Coinbase and Blockstream Capital Partners. In addition to this investment, Jiko has established new strategic partnerships with Crypto.com, Blockstream Capital Partners, Bitso, and Coinbase. These strategic partners will work with other institutions that adopt Jiko as a banking partner to utilize its U.S. Treasury bond-based model for storage, settlement, and payments.

(This round of financing is not included in this financing weekly report statistics)

DePIN

DePIN infrastructure service provider Bee Maps (formerly Hivemapper, Inc., now rebranded) has secured $32 million in funding, with the specific financing round not disclosed. Pantera Capital, LDA Capital, Borderless Capital, and Ajna Capital participated. It is reported that Bee Maps has launched a new subscription-based "Bee Membership" program to lower the participation threshold for contributors.

Venture Capital Funds

YZi Labs announces the establishment of a $1 billion builder fund to support BNB ecosystem founders

YZi Labs announced the establishment of a $1 billion builder fund to double down on supporting the BNB ecosystem, particularly founders on the BNB chain. By leveraging the high-performance, low-cost infrastructure of BNBChain, builders can now access enhanced tools, funding, integration, and a user ecosystem of over 460 million to drive real-world impact. The upcoming October EASY Residency Season 2: the final recruitment dedicated to the most valuable builders (MVB) focused on BNB-based innovations (trading, RWA, AI, DeSci, DeFi, payments, wallets). EASY Residency Season 2 will expand its operations to New York, San Francisco, Dubai, and Singapore, aiming to create a highly engaged, immersive product delivery environment for builders.

Bitrise Capital establishes a $10 million BNB ecosystem special fund, supported by Nano Labs

Bitrise Capital announced the formal establishment of a $10 million BNB ecosystem special fund aimed at supporting high-quality projects and infrastructure built on the BNB Chain. The fund has received intention subscriptions and strategic support from Nasdaq-listed company Nano Labs (NASDAQ: NA).

Bitrise Capital was founded in 2017 and focuses on investments in the cryptocurrency and blockchain sectors, primarily engaged in primary and secondary market investments and project incubation, currently managing over $500 million in funds. Nano Labs is a leading global Web3 infrastructure company and the world's first publicly listed company with a BNB strategic reserve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。