Author: Lacie

10/10 23:47 About an hour after Trump accused China's rare earth export controls of being "hostile" on Truth Social, the market briefly stabilized. I was watching the spike of $WLFI and felt there was an opportunity for a rebound after the overselling, so I opened a 3x full position long at 0.14 and also transferred some funds into contracts as margin;

10/11 03:57 After taking melatonin to sleep, I woke up inexplicably and checked my account. Hmm… a 45% profit seemed to be holding steady. After some hesitation, I set a take-profit at 0.165 and then fell back into a deep sleep;

10/11 05:20 After Trump threatened to impose a 100% tariff on China, the market plummeted in panic, with many altcoins down over 80%. Unfortunately, the alarm did not wake me up;

10/11 07:34 I woke up very early today. Since I opened my phone still on the original contract account interface, when I saw my position was gone, I foolishly hoped it might have triggered a take-profit. It wasn't until I switched to the total assets interface and saw the meager remaining balance that I realized what had happened. After a few seconds of blankness, I bitterly smiled; this was my first real liquidation due to a lack of position management and risk control experience;

10/11 09:13 Friends in the group gradually woke up, and there were wails everywhere in various groups. The media also began to push reports on this black swan event. Having just graduated three months ago and entered the industry, I witnessed the largest liquidation event in cryptocurrency history, nearly 10 times the scale of the March 2020 COVID-19 crash. Over 1.66 million people across the network shared the same unfortunate experience, and I seemed to understand what everyone often says about "surviving";

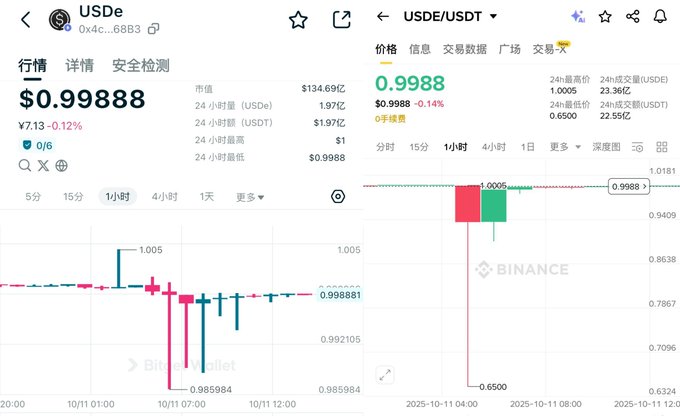

10/11 11:50 After the liquidation, I gloomily scrolled through Twitter, where many experts were discussing the outrageous spikes and USDe decoupling on CEX. Out of curiosity, I compared CEX with on-chain: CEX had extreme spikes, and many people wanted to buy the dip but couldn't due to outages; meanwhile, the price fluctuations on-chain were not as exaggerated, and trading could be completed relatively smoothly.

CEX's Spikes and Outages: The Fragility of a Single Point Liquidity Black Hole

My position was not only blown up by extreme market conditions but also by the inherent fragility of CEX itself:

Order book failure and limited MM funds: The main liquidity on CEX is provided by market makers (MM). Under normal conditions, market makers allocate limited funds based on the importance of projects, with Tier 0/Tier 1 large coins receiving the most support, while Tier 2/3 small coins receive very little order depth. In extreme conditions, market makers face funding constraints and can only prioritize ensuring that large coins like BTC and ETH do not encounter issues, even reallocating liquidity originally provided to small coins to "put out fires" for major assets, leaving little to hedge against tail risks. As a result, when a massive sell order hits the market, there are not enough counterparties on the order book to absorb it, causing prices to plummet to extreme lows.

API outages and insufficient risk control measures: CEX relies on a single technology stack to handle all transactions, making it prone to single points of failure under high concurrent requests. In extreme conditions, the influx of trading and liquidation requests leads to numerous API errors, order delays, and brief outages on CEX, preventing users from placing buy orders or canceling stop-loss orders, leaving them helpless as prices plummet. This not only exacerbates panic but also means that buy orders that could have absorbed the price at a certain level cannot appear in time, making the spike even more severe.

High leverage and cross-margin chain reactions: The leverage and cross-margin mechanisms provided by CEX amplify the cascading liquidations in extreme conditions. When USDe is used as margin on CEX, the price once plummeted 35% to $0.65, significantly reducing the actual margin value in accounts. Insufficient margin triggered a series of forced liquidations, with the system automatically selling off the assets held in those accounts to repay debts, effectively flooding the market with massive sell orders. Due to the concentration of sell orders and lack of buy support, the price of USDe further plummeted, leading to more users holding USDe as collateral or positions being liquidated, creating a domino effect that transmitted risks through circular loans and leveraged accounts.

On-Chain Comparison Experiment: The Resilience of Decentralized Liquidity

In the same extreme conditions, the on-chain environment demonstrated greater resilience:

AMM mechanism and continuous liquidity curve: Unlike CEX, which relies on order book depth, DEXs generally adopt the AMM model, with pricing based on a constant product formula (x*y=k). This mechanism ensures that there is continuous liquidity across any price range, meaning that even under extreme selling pressure, price changes are gradual rather than a sudden drop. Therefore, while prices may fall significantly, "zeroing out" spikes are less likely to occur. USDe was smashed down to $0.65 on CEX, while on-chain it maintained a minimum of $0.9859, reflecting the smooth liquidity provided by AMM.

Arbitrage mechanism and market self-repair: The on-chain trading environment is inherently open and composable, allowing any participant (including arbitrage bots) to engage in cross-market trading when price discrepancies are discovered. When the price of an asset on-chain diverges significantly from CEX or other markets, arbitrageurs quickly buy low and sell high, bringing prices back to reasonable ranges. This mechanism effectively limits the extent of price deviations during extreme conditions and accelerates market equilibrium adjustments. As a result, while on-chain price fluctuations can also be quite volatile, they did not experience the same level of decoupling or spikes as CEX.

Continuity of trading in decentralized network structures: Blockchain networks themselves possess redundancy and resilience, unlike centralized servers that may crash under high concurrency. As long as the blockchain is producing blocks, transactions can be packaged and confirmed. In extreme conditions, there may be spikes in Gas fees on-chain, but this only makes transactions more expensive, not impossible. Users can still "buy and sell," ensuring a degree of market continuity and user autonomy.

Conclusion: The Answer of Decentralization in Extreme Moments

Bosses have been saying that @BitgetWallet needs to continue to reach deeper and broader to provide better liquidity for cross-chain/same-chain swaps. For a recent graduate like me, this phrase was originally just a strategic goal and product direction, but after experiencing this black swan event, I truly understand its significance.

The single-point fragility of CEX is not just a technical issue but a structural flaw; while the continuous smooth liquidity, transparent settlement, and resilient network on-chain are the infrastructures that can be validated in extreme conditions.

There will be countless black swan events in the future, but as this incident has revealed, on-chain and decentralization are not idealistic concepts but rather the certain safe havens we can find in the storm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。