Traders Rush Back In—US-China Trade Tensions Cool Overnight!

Markets swung wildly after President Trump threatened 100% tariffs on China , then posted a calming message. Crypto and stocks bounced back fast—traders watch for follow-through and possible insider probes. The US-China Trade Tensions are taking another curve way.

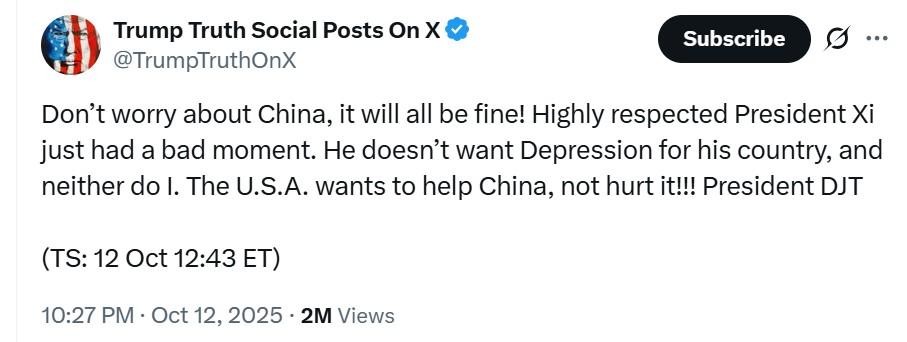

Trump’s Social Post Flips Market Sentiment

The Trump post that flipped sentiment o n Sunday, President Trump posted a reassuring message on social platforms telling markets “Don’t worry about China, it will all be fine,” and praised President Xi in measured terms. Traders treated that as a signal that the worst might be avoided, sparking a relief rally into the open. Still, the tariff threat remains on the calendar for November 1, so uncertainty is not fully gone.

Source : X

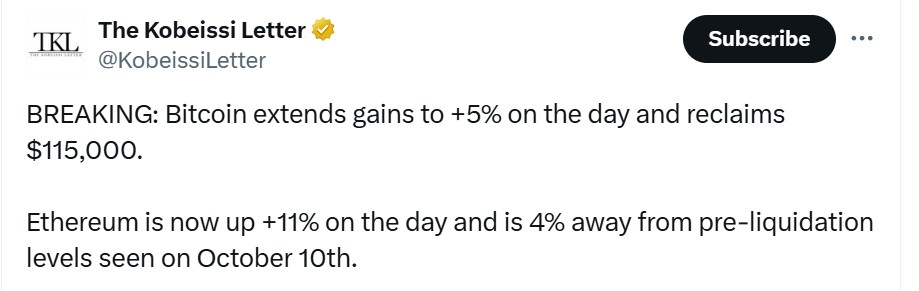

Stocks and Crypto Stage a Strong Comeback

Stocks and crypto fell hard on Friday after news of a proposed 100% tariff on Chinese imports. The Kobeissi Letter reports that by Sunday night, futures had recovered: Dow futures rose roughly 0.8-0.9%, S&P futures jumped about 1-1.2% and Nasdaq futures climbed around 1.3-1.6% as investors parsed weekend comments. Bitcoin recovered to about $115,500 and Ethereum traded near $4,130, reversing much of the earlier damage. Bitcoin gained around 5%-6% and Ethereum surged around 11% in the past 24hrs.

Source : The Kobeissi Letter

Data trackers report a historic liquidation event : about $19–19.5 billion in leveraged crypto positions were wiped out and roughly 1.6 million traders were liquidated during the initial shock. That forced heavy selling across exchanges and amplified price moves. When the weekend cool-off arrived, Bitcoin and Ethereum staged a strong rebound as buyers stepped in at lower prices.

Trade Fears Ripple Across Global Supply Chains

US-China Trade Tensions sums up the risk now driving prices. Tariffs and rare-earth export limits threaten chip, EV, and defense supply chains. That fear feeds fast selling when headlines flare and quick buying when calm returns. Markets are now extremely sensitive to brief diplomatic signals.

Beijing’s answer and geopolitical risk

China pushed back, warning it would respond if tariffs go ahead. Beijing’s commerce ministry called the steps provocative while leaving room for negotiation. That mix — strong words but not immediate escalation — is what traders call a “high-volatility” backdrop . Watch statements from both sides closely this week

What traders should watch next

-

Any formal tariff notices or changes to the Nov.1 timeline.

-

Treasury or administration comments that confirm or soften the threat.

-

Further liquidation alerts or large whale moves in crypto.

-

Any scheduled or surprise dialog between U.S. and Chinese officials.

Final Thoughts

US-China Trade Tensions remain the central risk. Headlines will move markets fast — both up and down. For crypto holders and equity traders, that means preparing for quick volatility: size positions carefully, use stops, and consider hedges if you are sensitive to headline risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。