Original Title: DeFi's next milestone: What it'll take for agentic finance to work

Original Author: @Lemniscap

Original Translation: Ismay, BlockBeats

Editor's Note: When the world of DeFi becomes so complex that even professional users struggle to navigate it, how can we return agency to ordinary people?

This article from Lemniscap systematically outlines the rise and real challenges of "Agentic Finance." From &milo, Meridian to SendAI, The Hive, these early products demonstrate how AI can become a new interface for on-chain interactions, while also exposing significant gaps in execution reliability, permission security, and verification mechanisms. The author points out that for DeFi to move to the next stage, the key is not smarter models, but a more trustworthy underlying structure—ensuring that every action taken by agents is verifiable, traceable, and trustworthy.

This is not only a turning point in technological evolution but also an experiment in reconstructing trust. As stated in the article: DeFi's next milestone is not greater scale, but trust in automation.

By 2025, DeFi will be completely different from its early days.

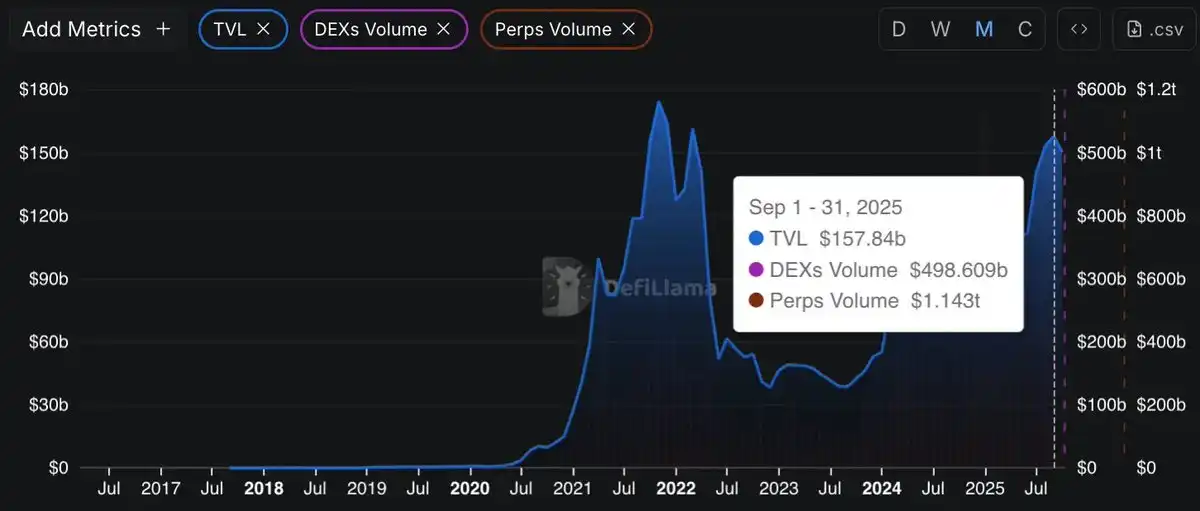

The data speaks for itself: institutional funds flowing in exceed $10 billion in a single quarter, with the number of active protocols across dozens of chains surpassing 3,000. The total locked value of DeFi protocols across the network will reach $160 billion in 2025, a year-on-year increase of 41%; the cumulative trading volume of DEX and Perps will be measured in "trillions."

As DeFi grows larger, the possibilities expand, but the complexity also rises sharply. Most people cannot keep up with everything happening on-chain. If we want more people to seize these new opportunities, we must build tools that make it easier for users to make the right decisions—this is the direction for future development.

At the same time, AI has gradually integrated into daily life, and people are beginning to develop new habits around automation. This trend has given rise to "Agentic Finance"—where intelligent agents handle the navigation and execution of financial operations.

Even simple browser-based agents like Comet demonstrate the rapid evolution of such tools. When you execute a DeFi operation through a browser agent (as shown in an example shared by SendAI founder Yash), you can see the potential of agentic finance.

This vision is quite intuitive: you no longer need to sift through various dashboards or long posts on X; you just tell the AI your goals, and it can automatically help you complete the subsequent steps.

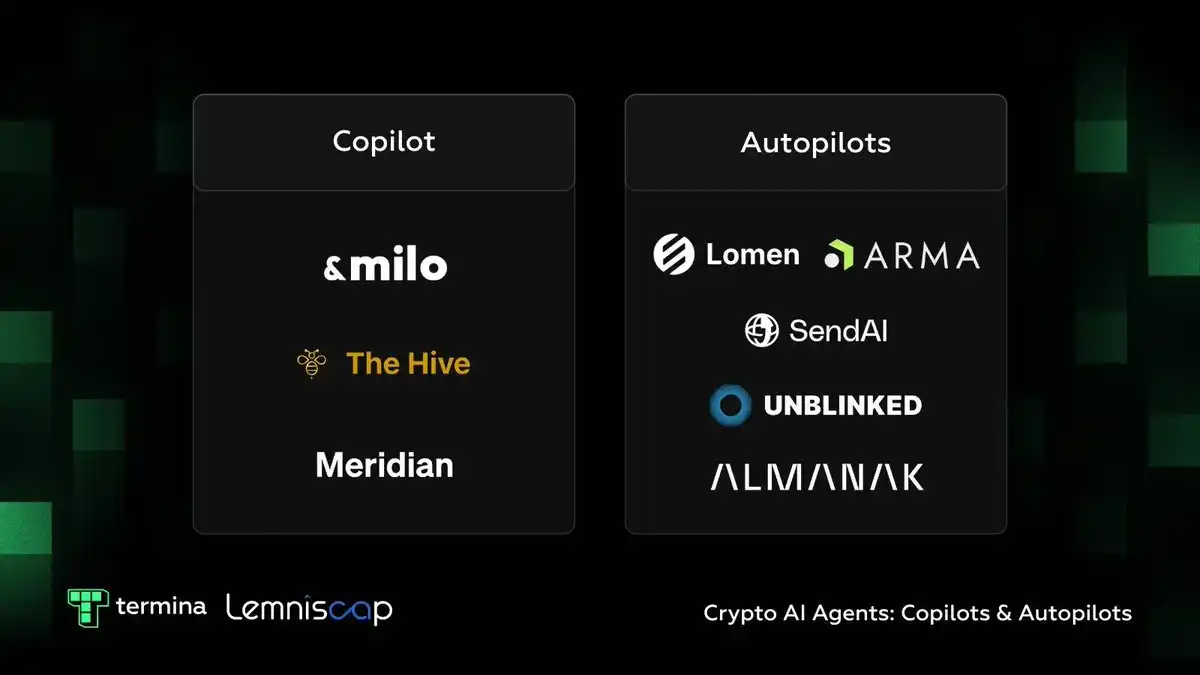

Currently, two types of intelligent agents are emerging:

One type is Copilots, which guide users in making decisions throughout the DeFi world; the other type is Quant Agents, which are more focused on executing professional automated strategies, akin to "Autopilots."

Both are still in their early stages and have flaws, but they point towards a new direction—a completely different, AI-driven way of interacting with DeFi.

Intelligent Agents as "Co-Pilots"

You can think of these intelligent agents as your personal assistants. You no longer need to flip through charts or jump between different protocols; you just ask questions in natural language, such as, "What are the hottest tokens right now?" or "Where are the highest yields?" The agent can respond directly and provide next-step suggestions—like a knowledgeable friend who is always available.

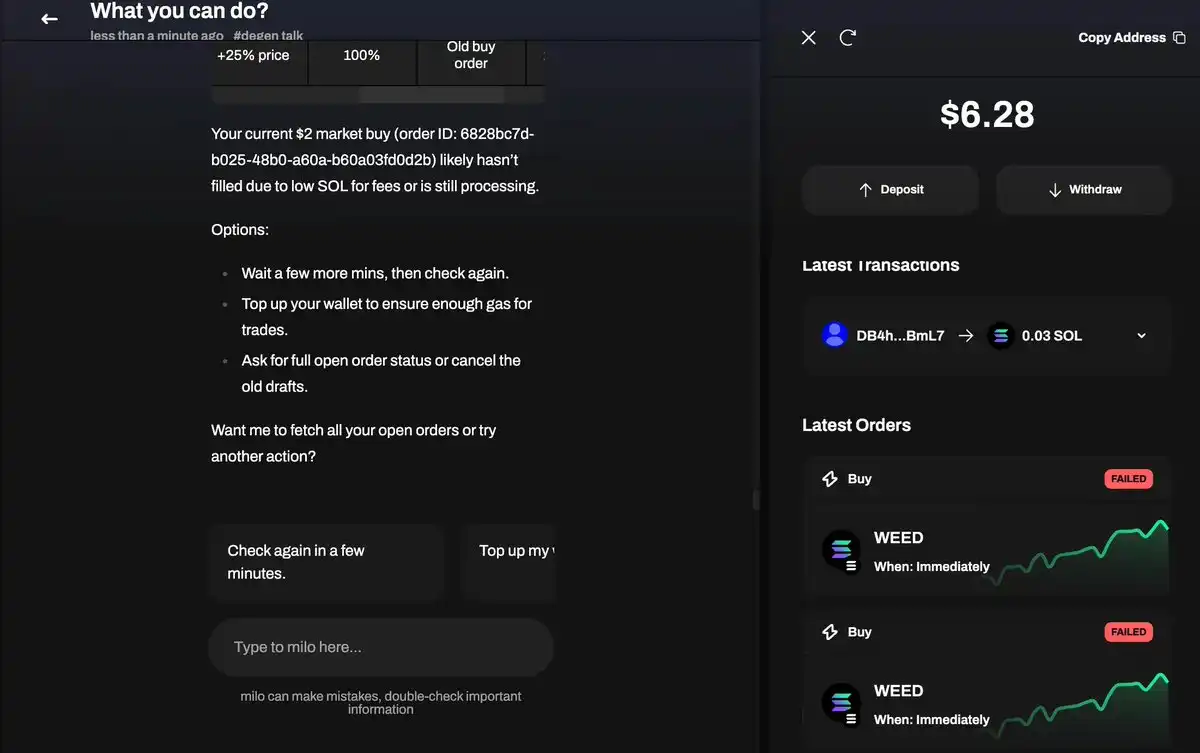

For example, &milo's co-pilot mode can assist you in making investment decisions, rebalancing assets, and gaining insights into your portfolio—allowing you to maintain control while saving you from cumbersome operations.

With natural language explanations and intelligent prompts, &milo helps users understand positions and compare yield opportunities without having to sift through data on various dashboards. It showcases the evolution of co-pilot agents from simple chat assistants to fully functional DeFi guides.

To observe how these agents perform in real operations, we tested several newly released products to experience their ability to handle real DeFi tasks.

The results showed that these agents still have limitations. For instance, they can successfully identify popular tokens but struggle to execute buy operations; there were also two failed transactions with the system indicating "insufficient balance," even though there was actually enough SOL in the account to cover the transaction fees.

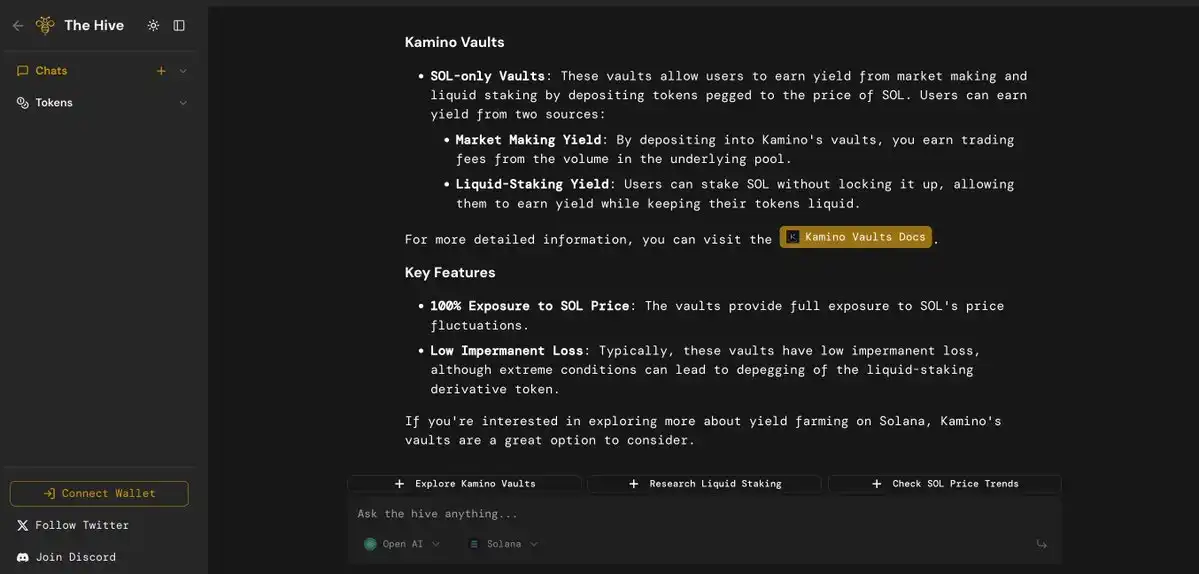

A similar platform, The Hive, took a different approach—it combines multiple DeFi agents into a "swarm" that can collaboratively complete complex tasks such as cross-chain operations, yield strategies, and liquidation defenses, all coordinated through a simple chat interface. This network of dedicated agents can perform multi-step on-chain operations using natural language commands.

We tested the same buy command with The Hive. The system did identify the popular token WEED, but returned an incorrect contract address when executing the purchase.

Overall, Milo demonstrated how to integrate portfolio management tools into a smooth process, while The Hive explored how to enable multiple specialized agents to work together. As the capabilities of intelligent agents improve, more distinct divisions of labor are beginning to emerge.

For example, Meridian focuses on a different user group—helping beginners take their first steps into DeFi. It employs a mobile-first design with clear prompts, making basic operations like swapping tokens, staking, or checking yields easier to grasp.

Meridian performs smoothly and executes quickly on these core tasks, and importantly, it is very clear about its boundaries. When users request it to perform operations beyond its scope, it explains the reasons rather than blindly attempting—this "honesty" makes it a reliable starting point for newcomers exploring the on-chain world.

Meridian founder Benedict explained:

"Meridian allows users to conduct safe research and operations using natural language. We have made the research capabilities of the agent publicly available for free at meridian.app. Users who register for the Meridian mobile app can use the agent's swap, multi-swap, and portfolio purchase features. Currently, accounts are still in a closed testing phase, and interested users can contact @bqbrady on Twitter to apply for access."

Through our testing, we found that most AI agents focused on DeFi navigation still primarily serve as "teachers" or "assistants," mainly helping users complete the most basic operations (like swapping tokens).

To enable them to reliably handle more complex processes—such as providing liquidity or managing leveraged positions—further improvements are still needed.

As Rishin Sharma, AI lead at the Solana Foundation, pointed out:

"Large language models (LLMs) can easily hallucinate when handling broad tasks and struggle to execute deterministic operations. Function calling mechanisms like MCP may be more suitable for translating 'action plans' into actual execution. While LLMs perform well in conceptualization and guidance, they still fall short in precise execution. To make agentic finance truly reliable, we must go beyond LLMs and develop specific function calling mechanisms, clear execution strategies, verifiability, and secure permission systems. In other words, today's intelligent agent execution layer is still underdeveloped—the AI 'brain' is smart enough, but it still lacks a 'body' that can act robustly."

Intelligent Agents as "Autopilots"

If "co-pilot" agents are more like mentors, then "quant" agents are more like autonomous driving systems. They can not only build strategies but also truly execute them—monitoring the market in real-time, testing trades, and automatically acting at machine speed, allowing complex DeFi strategies to enter "fully automated operation" mode.

A typical case that is taking shape comes from SendAI. It is not a quant agent itself but a toolkit that enables others to create these agents. Its "Agent Kit," designed for Solana, supports over 60 autonomous operations, including token swaps, new asset issuance, and lending management, and can directly interact with mainstream protocols like Jupiter, Metaplex, and Raydium.

In other words, it provides developers with a "track system" that allows them to directly connect decision models to on-chain execution.

SendAI founder Yash clearly summarized their vision:

"We believe that every AI agent will have its own wallet in the future. SendAI is building the tools and economic layers needed for this system, enabling these agents to perform any operation on Solana. We are creating a platform that gives these agents contextual awareness and supports long-running, persistent, and asynchronous complex task execution."

Meanwhile, other teams are trying to make this capability more accessible. Lomen curates selected strategies and allows users to "deploy with one click," lowering the barrier for enjoying quantitative automation without needing to write code.

For "advanced players" who prefer custom systems, Unblinked offers an AI-driven strategy experimentation environment. It is like a Cursor for the trading field: users can outline their strategy ideas, run and optimize them in a safe sandbox environment, and then decide whether to invest real money.

Some platforms choose to call upon multiple agents simultaneously to collaborate on tasks.

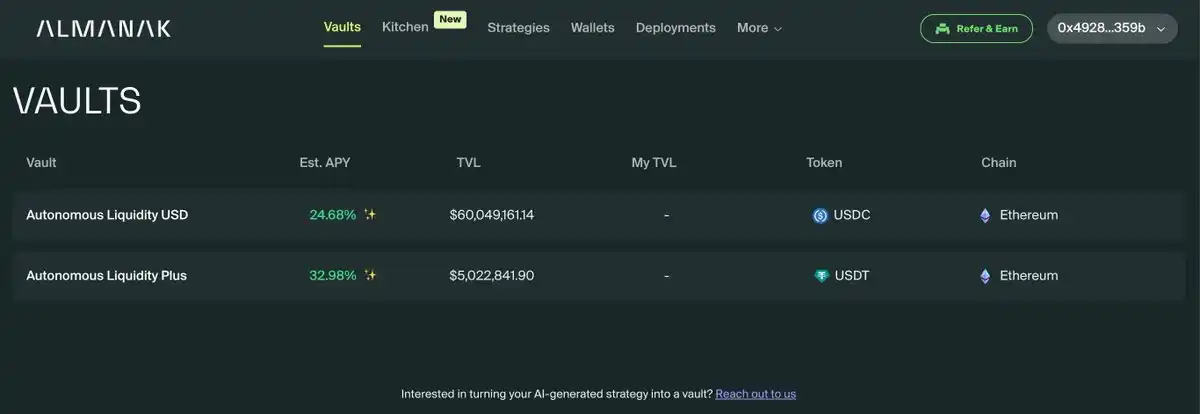

For example, Almanak combines "programming agents" with "backtesting agents": users describe strategies in natural language, and the AI automatically generates production-level code, backtesting it with over 10,000 Monte Carlo simulations, ultimately producing a "ready-to-go" strategy outcome.

Finally, some teams are focusing on real-time market advantages.

Giza's ARMA agent actively reallocates funds between various lending protocols to maximize stablecoin yields. Instead of letting funds sit in a single pool, ARMA continuously monitors interest rates, liquidity, and gas costs, dynamically moving assets. Its flagship agent has managed over $17 million in funds, claiming yields that are 83% higher than static holdings.

Overall, these quant agents significantly reduce time costs and allow ordinary users to access complex strategies that were previously reserved for professional quant teams. However, they also reveal the vulnerabilities of automation: when data is delayed, protocols are paused, or the market experiences severe fluctuations, agents can still "trip."

In other words, they can indeed make you faster, but they are far from "invincible."

Their Challenges

After spending some time with current intelligent agents, you will notice some common issues: they sometimes suggest executing operations that no longer exist, such as a liquidity pool that has already been closed; the data they rely on is often lagging behind the real on-chain state; and if a multi-step plan encounters an error midway, they do not self-adjust but repeatedly attempt the same action.

Permission management is also quite clumsy—users must either grant full access to the entire wallet or manually approve every minor operation. The testing phase is similarly superficial, as simulated environments struggle to accurately replicate "real-world chaos" such as sudden liquidity changes or governance parameter adjustments.

One of the most serious issues is that these agents operate almost like "black boxes."

Users cannot know what inputs they read, how they weigh options, whether they check real-time status, or why they choose to execute a specific transaction. Without signed verification of operation records, it is impossible to verify the consistency between "promised results" and "actual execution."

Users can only use the agents while "watching over" the automation process—this is not only inefficient but also makes performance difficult to assess.

Without a mechanism to verify decisions and prove that actions indeed adhere to established strategies, users will never be able to distinguish between a "reliable system" and "well-packaged marketing."

For larger-scale capital, DeFi platforms must shift from "trust us" to "please verify." This is also a key turning point in establishing a "verifiable, governable, and trustworthy" intelligent agent finance infrastructure.

Infrastructure Gaps

The core issue is that the current systems lack the foundational tools to keep agents trustworthy, consistent, and secure in large-scale scenarios. To address this, we need infrastructure that can verify agent behavior, confirm execution results, and adhere to unified rules across all environments. Only then will people feel comfortable entrusting real money to them.

However, most users do not actually care about the agents' "thought processes"; they just want to confirm that the output results are correct, verified, and within safe boundaries. In building trust, "verifiable reliability" is more important than "visibility."

This is the significance of "Verifiable Reliability." Agents do not need to record every internal operation step, but they should operate under clear strategies and reasonable checks: setting spending limits, execution time windows, and confirmation nodes before key operations.

At the foundational level, these rules can be ensured through Trusted Execution Environments (TEEs) or similar systems—without exposing all details, they can still prove that agents indeed adhere to boundaries. The result is outputs that can be audited when needed, and operations that ordinary users can trust immediately.

This verification layer does not have to be "one-size-fits-all." Everyday scenarios can adopt lightweight security protections and standardized metrics; while high-risk or institutional-level scenarios can require stronger proofs and formal verifications. The key is that each layer of infrastructure should provide measurable reliability that matches its risk level.

Preparing Protocols for Agents

The next step is to make protocols "agent-friendly."

Currently, most DeFi protocols are not designed for intelligent agents. They need to provide more stable and secure execution interfaces: allowing for operation previews, safe retries, and execution based on consistent data structures. Permission design should also "limit scope" rather than "grant full access," allowing agents to operate within clear boundaries instead of controlling the entire wallet.

In the absence of these foundational elements, even the smartest agent frameworks can be tripped up by weak underlying systems. Once these foundations are improved, users will no longer need to manually monitor automation processes; development teams can reduce debugging time and focus on innovation; and the execution results of different service providers can become comparable due to shared benchmarks—no longer just marketing slogans.

Parts That Must Change

The solution is not complicated: make agents verifiable (Provable) and prepare protocols for agents (Agent-ready). Introduce a strategy layer between agents and wallets, requiring all execution processes to be traceable and verifiable, rather than operating as "black boxes."

For example, Termina's SVM engine is built on this concept—it provides AI agents with a true Solana runtime environment, allowing agents to model, decide, and learn based on on-chain data. Meanwhile, protocol parties should open operation interfaces that can be "dry-run," with clear error codes, safe retry mechanisms, consistency of core data structures (positions, fees, health), and session-based permission controls.

When these features are implemented, users will be able to shed the burden of "watching over" agents; teams can reduce system failures; and institutional investors will finally obtain the safety barriers and verifiable proofs they need.

Realistic Timeline

In the next six months, the "co-pilot" agents are expected to improve the fastest. More robust data pipelines will enhance their reliability in everyday usage scenarios.

Within a year, as testing standards strengthen, agents will be able to coordinate execution across protocols, requiring human approval only for key steps. Looking further ahead, as infrastructure matures, intelligent agents may gradually blur into the default interaction layer of DeFi—not just standalone "tools," but becoming the primary way people interact with financial systems in their daily lives.

Conclusion

"Agentic Finance" is lowering the barriers to participation, making automation no longer just an exclusive tool for experts. But to truly operate on a large scale, it needs a better "foundation": real-time data, more secure permission mechanisms, stronger testing systems, and more transparent execution results.

Relying solely on smarter AI will not solve these problems. Real progress will come from improving the underlying structure.

DeFi's next milestone is not just growth in scale, but trust in automation. And that day will only truly arrive when AI agents are no longer just "concept demonstrations" but become genuinely reliable executors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。